Get the free SEC Form 4: Ownership Changes ReportPDF

Get, Create, Make and Sign sec form 4 ownership

Editing sec form 4 ownership online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4 ownership

How to fill out sec form 4 ownership

Who needs sec form 4 ownership?

Understanding the SEC Form 4 Ownership Form: A Comprehensive Guide

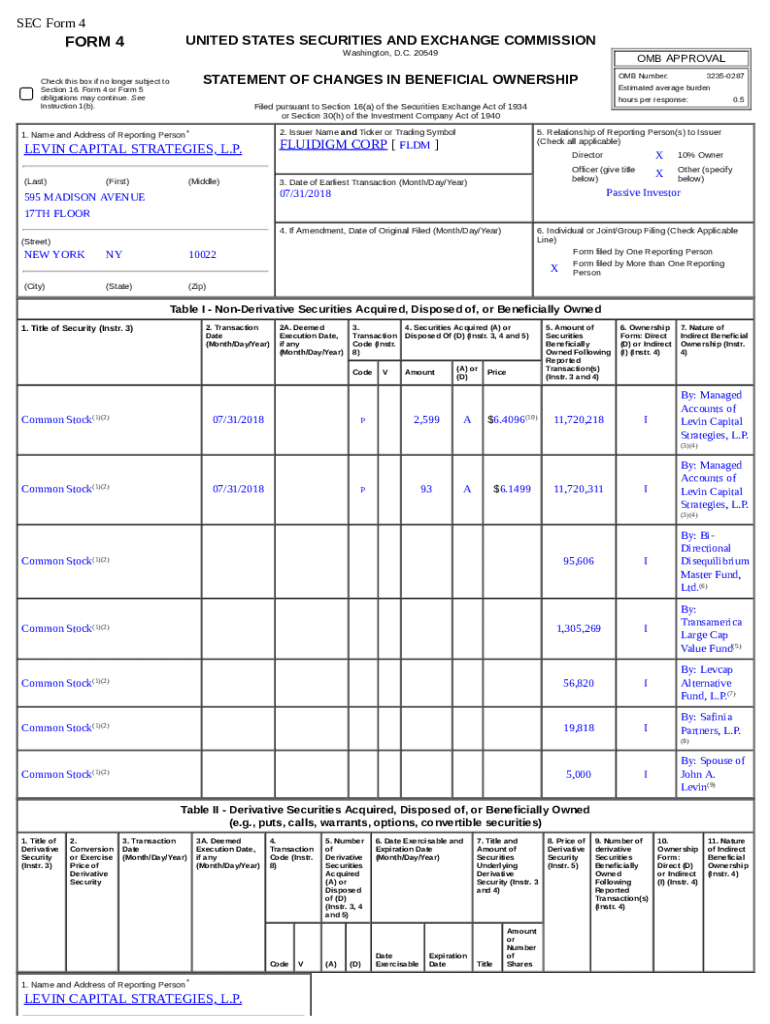

Overview of SEC Form 4 Ownership Form

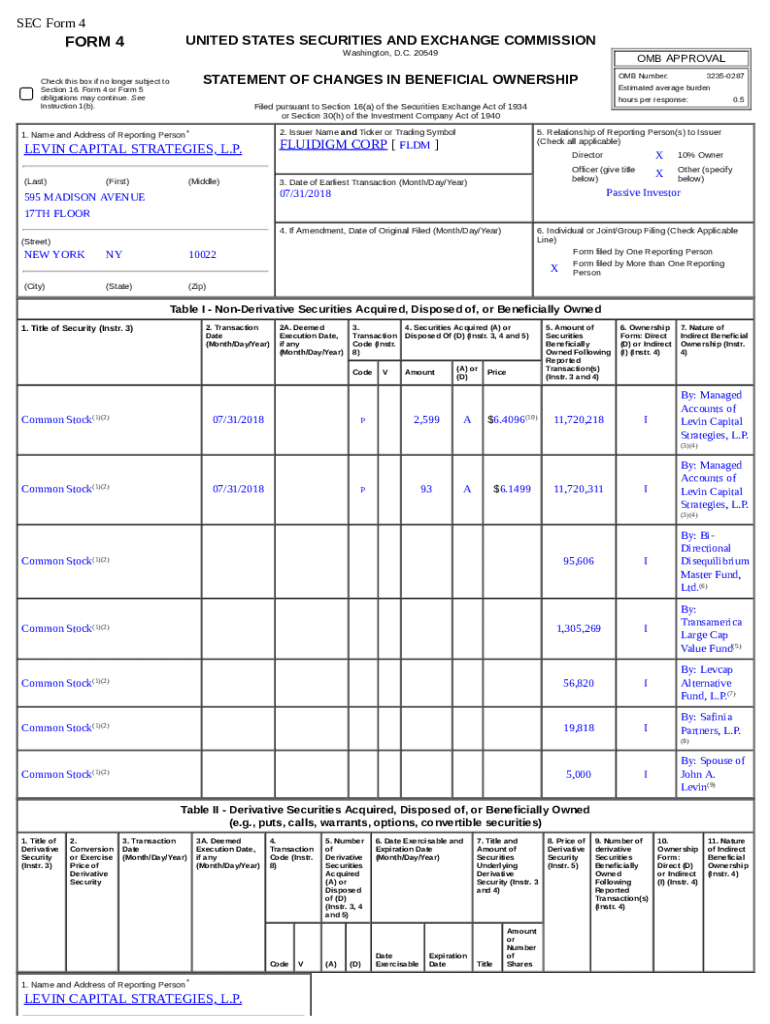

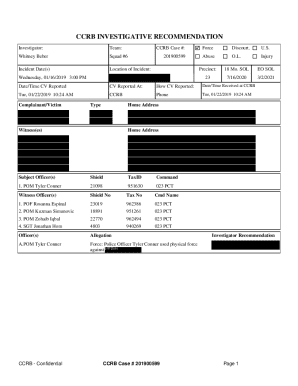

SEC Form 4 is a critical document in the securities industry, serving as a significant reporting tool for changes in ownership of a company's equity securities. This form is essential for transparency and accountability, allowing stakeholders to track ownership shifts by company executives, directors, and beneficial owners. The United States government mandates this filing to ensure that market participants have timely access to pertinent ownership information, thus promoting trust in the financial markets.

Those required to file Form 4 typically include company insiders such as executives, upper management, and any individuals who own a significant percentage of the company's securities. Failure to file this form on time can lead to serious legal repercussions, including penalties and a negative impact on a company's market perception. Investors often scrutinize the timely filing of this form, as it reflects the integrity and governance practices of the reporting issuer.

Key components of SEC Form 4

When filling out SEC Form 4, various critical sections must be meticulously completed. Item 1 requires the name of the reporting person, which is essential for identifying who is making the change in ownership. Subsequently, Item 2 focuses on the relationship of the reporting person to the issuer, clarifying the insider's role within the company.

Item 3 is dedicated to the date of the event requiring the statement, while Item 4 includes the issuer's name and ticker symbol for detailed identification. Item 5 delves into transaction details, specifying the ownership structure before and after the transaction, including types of ownership—direct or indirect. Finally, Item 6 focuses on the specifics of acquisitions or dispositions, outlining the nature of the transactions, such as purchases, sales, or gifts, which must be accurately reported to maintain compliance with SEC regulations.

Filing requirements and deadlines

Filing SEC Form 4 is crucial and must be completed electronically through the SEC's EDGAR system. The SEC mandates that filings occur within two business days of the transaction occurring, meaning failure to adhere to these deadlines can result in significant penalties. This prompt and efficient filing ensures that all market participants have access to updated ownership information, which is pivotal for maintaining market integrity.

Common filing mistakes often include overlooking required fields or misreporting the types of transactions or ownership changes. Attention to detail is paramount when filling out Form 4, as inaccuracies can lead to investigations or penalties from the SEC. Ensuring that each section is thoroughly reviewed before submission can safeguard against late penalties and maintain compliance with federal regulations.

The role of pdfFiller in completing SEC Form 4

pdfFiller offers a comprehensive platform for aiding users in the completion of SEC Form 4, ensuring a seamless document editing and signing experience. The platform allows users to input their data easily, collaborating with other team members to ensure accuracy. With interactive features, pdfFiller enables multiple stakeholders to provide their input on the document simultaneously, enhancing efficiency.

The cloud-based solution provided by pdfFiller ensures that users have access to their Form 4 documents anytime and anywhere. This is particularly valuable for busy executives who need to manage their filings on the move. pdfFiller's secure storage solutions and version control features allow users to keep track of any amendments, providing a clear audit trail should the need arise.

How to fill out SEC Form 4: Step-by-step guide

The process of filling out SEC Form 4 can be broken down into three fundamental steps. Step 1 involves gathering all the necessary information needed for accurate completion. This includes personal data about the reporting individual as well as details about the issuer and the nature of the transaction. Having this information organized and accessible will streamline the completion process.

In Step 2, you can utilize pdfFiller's tools to directly input the collected data into the form. The platform provides various templates specifically designed for SEC Form 4, which can significantly enhance the efficiency of filling out essential fields. Ensuring that no sections are left empty and that the correct types of transactions are reported is essential for compliance. Finally, in Step 3, you should review and validate all entries made on the form. Leveraging pdfFiller's built-in validation features allows for an additional layer of accuracy, ensuring that every piece of information is correct before the file is submitted.

Managing and storing SEC Form 4 copies

Once SEC Form 4 is filed, it is important to practice excellent document management. Utilizing cloud storage options provided by pdfFiller ensures secure document management, allowing for easy access and retrieval when needed. With cloud solutions, users can safeguard their documents against loss while maintaining compliance with regulatory requirements.

Version control is a key aspect of managing SEC Form 4 copies. This allows reporting individuals to track amendments made to their filings over time and helps keep a clear record of all ownership changes. When sharing these documents among stakeholders and regulatory bodies, you can employ secure sharing methods through pdfFiller, ensuring that all parties involved have access to the correct and most current documents.

Frequently asked questions (FAQs) about SEC Form 4

Common questions regarding SEC Form 4 often relate to ownership changes and the specific scenarios that trigger filing requirements. Investors and insiders alike inquire about how to interpret certain ownership changes, particularly concerning complex transactions. Moreover, there are concerns about the accessibility of the form, particularly regarding electronic filing systems, which can sometimes appear daunting to less tech-savvy individuals.

Understanding the regulations surrounding SEC Form 4 is critical, and many people seek clarification on the specific practices for compliance. It is advisable for those subject to these regulations to familiarize themselves with the filing requirements and utilize support tools like pdfFiller to manage and submit their forms with ease.

Additional resources and tools

For those interested in delving deeper into the intricacies of SEC Form 4, there are various resources available. The official SEC website provides detailed guidelines and FAQs regarding Form 4, ensuring that filers can navigate the regulations effectively. Also, tools are available for tracking filing status, which can assist insiders in staying informed about their reporting obligations and compliance.

Furthermore, understanding related forms and documentation for ownership reporting, such as Form 3 and Form 5, is beneficial for a comprehensive grasp of SEC regulations governing ownership disclosures. With these resources and tools, individuals can maintain a clear understanding of their responsibilities and remain compliant with federal regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sec form 4 ownership directly from Gmail?

How can I send sec form 4 ownership to be eSigned by others?

How do I execute sec form 4 ownership online?

What is sec form 4 ownership?

Who is required to file sec form 4 ownership?

How to fill out sec form 4 ownership?

What is the purpose of sec form 4 ownership?

What information must be reported on sec form 4 ownership?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.