Get the free New Bookkeeping Client Intake Form - Fill Online, Printable ...

Get, Create, Make and Sign new bookkeeping client intake

How to edit new bookkeeping client intake online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new bookkeeping client intake

How to fill out new bookkeeping client intake

Who needs new bookkeeping client intake?

Comprehensive Guide to New Bookkeeping Client Intake Forms

Understanding the importance of a bookkeeping client intake form

A bookkeeping client intake form serves as a foundational tool in establishing productive relationships between accounting firms and their clients. It captures essential client information in a structured format, ultimately ensuring that bookkeeping services are tailored to meet specific client needs.

An intake form not only collects critical data but also reflects a firm's commitment to professionalism. By using a well-designed bookkeeping client intake form, firms can systematically gather and manage client information while fostering trust and transparency. This proactive approach helps in aligning the services offered with clients’ expectations.

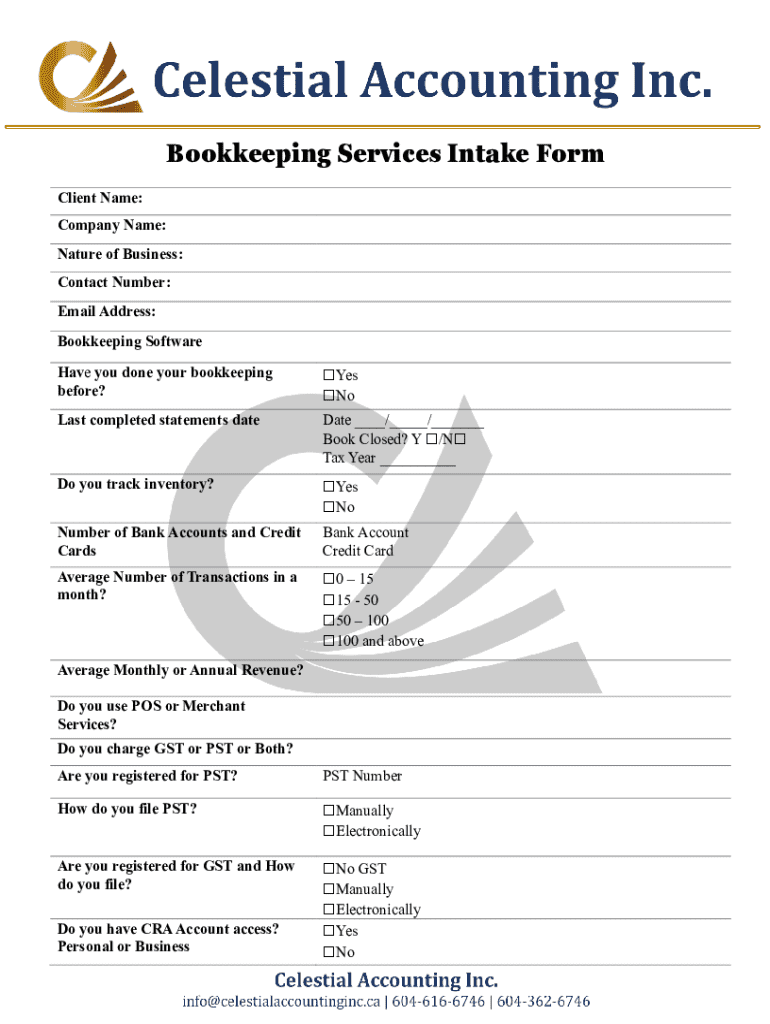

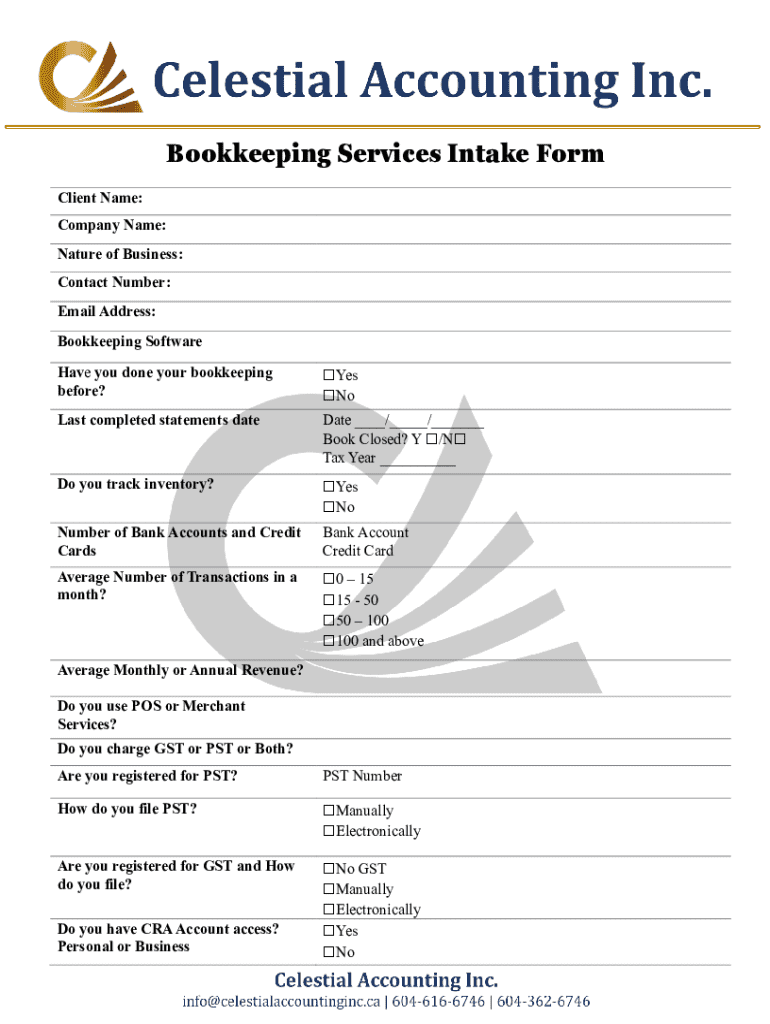

Key components of a comprehensive bookkeeping client intake form

A comprehensive bookkeeping client intake form should encompass a range of information crucial for effective service delivery. Basic client information, financial history, and nature of the business operations are all integral parts of the form.

The first section should cover basic client information such as names, contact details, and business names. Following this, understanding the client’s financial history and goals lays the groundwork for a tailor-made service approach. It’s vital to inquire about previous bookkeeping experiences and specific financial aspirations.

Crafting your own bookkeeping client intake form

Utilizing templates can significantly enhance the efficiency of creating a new bookkeeping client intake form. Pre-designed templates offer a solid foundation that can be customized to meet specific firm and client needs. Customization is essential, as it allows firms to integrate unique branding and address service-specific nuances.

When designing the form, ensure that it is user-friendly. Clear, concise language will facilitate understanding, while a logical flow encourages clients to complete the form without confusion. Leveraging platforms like pdfFiller can simplify this process, enabling firms to edit PDFs effortlessly, incorporate eSignatures, and enable client collaboration.

Essential questions to include in your client intake form

A well-rounded bookkeeping client intake form must include diverse questions that provide insight into client finances and expectations. It should not only capture personal and business information, but also touch on their financial operations, existing systems, and preferred modes of communication.

Questions pertaining to financial insights are particularly vital. For instance, inquiring about monthly revenue estimates and current bookkeeping systems in use helps to assess the client's situation accurately and develop an effective service strategy. Understanding client expectations will also pave the way for better service alignment.

Interactive tools for enhanced client engagement

In an increasingly digital environment, the choice of form format can have a significant impact on client engagement. Online fillable forms offer the convenience of accessibility from any device, while printable formats provide a physical copy that some clients may prefer.

With tools such as pdfFiller, firms can utilize real-time collaboration features that enhance the client experience. Whether it's incorporating live edits or comments, these features promote engagement and transparency throughout the process.

Tips for effective implementation of client intake forms

Executing a successful client intake form requires thorough planning and execution. Start with training your team to ensure consistent practices across the board. Best practices in onboarding staff can significantly improve the efficiency with which forms are completed.

Additionally, gathering feedback from clients about their intake experience will highlight areas for improvement. Regularly reviewing compliance with industry standards is also recommended to keep the process aligned with regulatory requirements.

Common mistakes to avoid when using a client intake form

Despite the numerous advantages of a bookkeeping client intake form, several common pitfalls can arise. One major mistake is a lack of clarity in the questions; this can confuse clients and lead to incomplete or inaccurate submissions.

Overloading the form with unnecessary information is another frequent error that can deter clients from completing it. Likewise, ignoring client feedback during and after the process can result in missed opportunities for improvement, damaging the overall client relationship.

Additional resources and tools for bookkeeping efficiency

For firms looking to streamline their bookkeeping processes further, leveraging software specifically designed for bookkeeping can yield significant benefits. Solutions that integrate document management and storage capabilities can enhance productivity, ensuring that all client information is easily accessible and secure.

Employing best practices in document management not only protects sensitive client data but also simplifies the retrieval process, which is essential during audits or reviews. Make valuable use of these additional resources to maintain a competitive edge.

Conclusion: Streamlining your bookkeeping process with a client intake form

Implementing a new bookkeeping client intake form is not just about gathering information; it's about optimizing the entire client service experience. Firms that recognize its benefits can establish stronger relationships, ensure accuracy in their operations, and vastly improve service delivery.

As you create your own new bookkeeping client intake form, remember the importance of clarity, relevance, and engagement. With the right strategies in place – especially utilizing innovative tools like pdfFiller – your firm will be well-positioned to provide exceptional bookkeeping services tailored to meet the needs of every client.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit new bookkeeping client intake online?

Can I create an eSignature for the new bookkeeping client intake in Gmail?

How do I edit new bookkeeping client intake straight from my smartphone?

What is new bookkeeping client intake?

Who is required to file new bookkeeping client intake?

How to fill out new bookkeeping client intake?

What is the purpose of new bookkeeping client intake?

What information must be reported on new bookkeeping client intake?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.