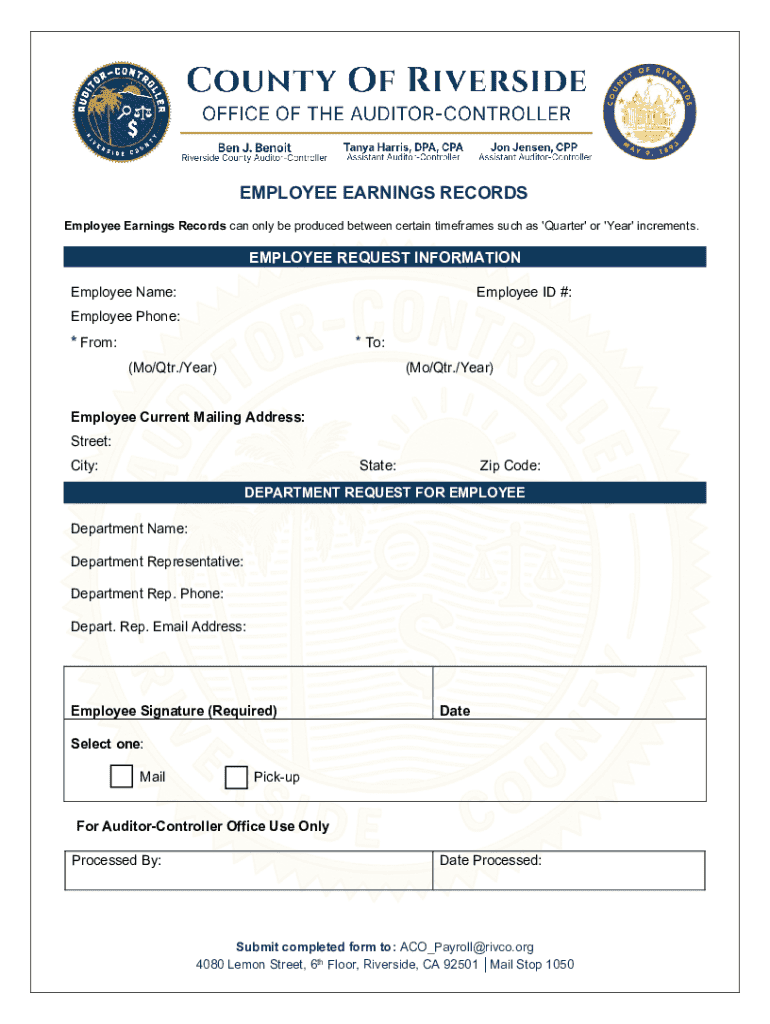

Get the free EMPLOYEE EARNINGS RECORDS

Get, Create, Make and Sign employee earnings records

How to edit employee earnings records online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee earnings records

How to fill out employee earnings records

Who needs employee earnings records?

Employee Earnings Records Form: A Comprehensive Guide

Understanding employee earnings records

An employee earnings record is an essential document that details an employee’s earnings and deductions throughout their term of employment. It's crucial for both employees and employers to maintain accurate payroll records to ensure proper compensation and compliance with labor laws.

Accurate payroll records are not just beneficial for tracking employee pay; they also serve as a safeguard against potential disputes over compensation. Having a comprehensive earnings record can be invaluable during tax season, performance reviews, or any audits conducted by regulatory bodies.

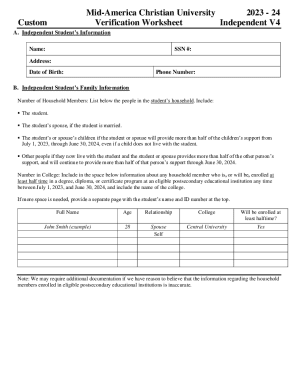

Key components of the employee earnings record

Understanding the components of the employee earnings record is vital for anyone handling payroll. The record typically includes the employee's personal information, earnings details, deductions, and year-end summaries that provide a snapshot of the employee's financial status.

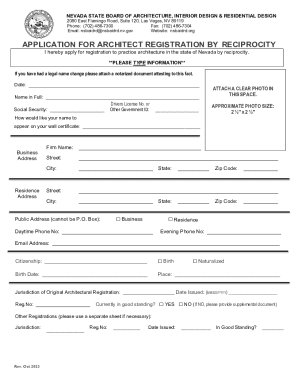

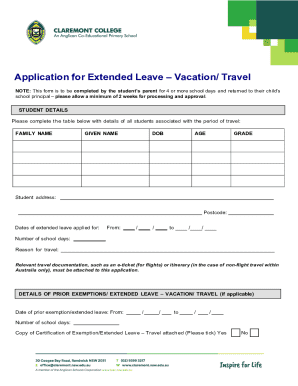

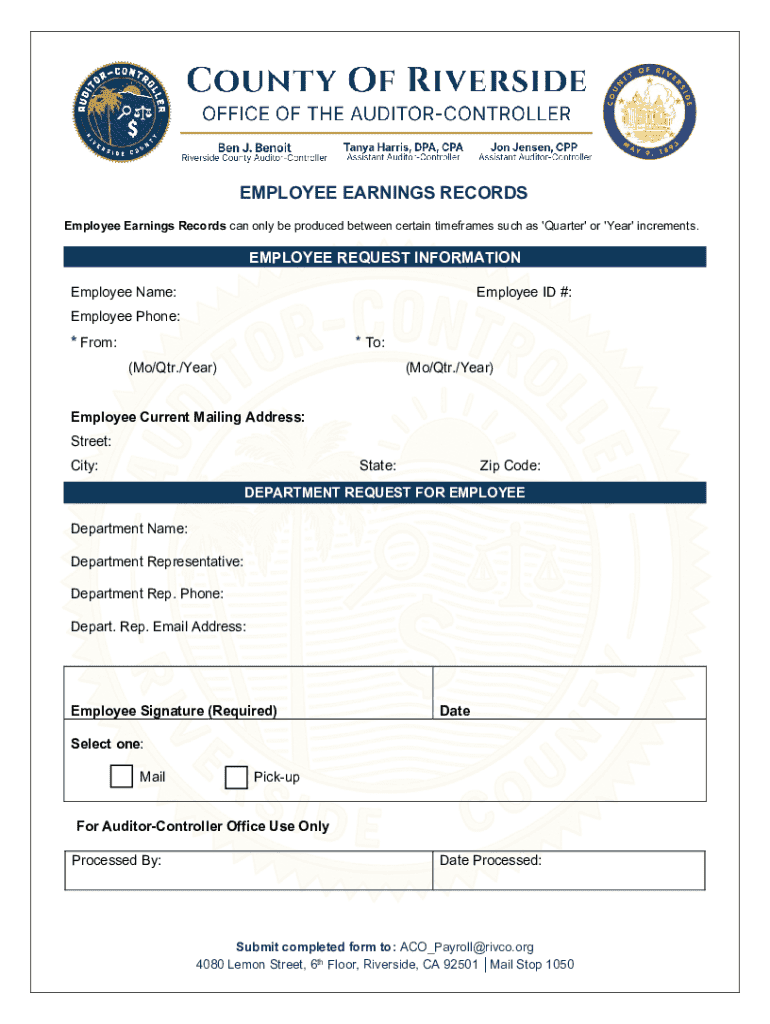

Navigating the employee earnings records form

The layout of the employee earnings records form may vary, but it typically consists of sections for personal details, earnings, deductions, and additional notes. Familiarizing yourself with the arrangement of the form will streamline the data entry process.

How to accurately fill out the employee earnings record

Filling out the employee earnings records form accurately is paramount. It not only ensures compliance with legal standards but also fosters trust between employees and employers. Here are steps to follow for completion:

Keeping a checklist of common errors can help to streamline the process. This ensures completeness and reduces the likelihood of discrepancies prior to filing.

Editing and modifying employee earnings records

Modifications to the employee earnings records form may become necessary due to errors or changes in employee status. It's essential to know when these edits should be made and how to go about making them efficiently. Common scenarios include correcting an incorrect salary figure or adjusting deductions after receiving updated tax information.

When editing a physical form, neatly cross out the incorrect information and replace it, clearly indicating that a change has been made. For digital forms, most software provides an edit feature that tracks changes for transparency. Keeping employee earnings records updated is crucial to maintain accuracy and uphold compliance.

Signing and approving employee earnings records

The process for signing the employee earnings records form involves both the employer and the employee. This document acts as a formal acknowledgment of the reported earnings and deductions, creating a critical legal understanding between both parties.

It’s crucial to understand that signing these records expresses agreement with the contents. Therefore, both parties should carefully review the document before signing to mitigate any future disputes.

Collaborating on employee earnings records

When more than one person is involved in managing employee earnings records, collaboration tools can facilitate teamwork while ensuring data integrity. Platforms like pdfFiller offer multi-user access, allowing team members to collaboratively edit, sign, and manage documents in real-time.

Additionally, employing practices that ensure secure data sharing is vital for protecting sensitive information within employee earnings records. Always use encrypted connections and set strict access protocols.

Managing and storing employee earnings records

Proper management and storage of employee earnings records are essential to maintain compliance and protect sensitive information. Choosing the right storage option, whether cloud-based systems or physical copies, greatly impacts the efficiency of retrieval and management.

Best practices include regular auditing of stored records to ensure compliance with regulatory requirements, as well as implementing robust backup systems to prevent data loss.

Troubleshooting common issues with employee earnings records

Disputes or discrepancies within employee earnings records can create complications. Addressing issues swiftly is critical for maintaining trust and compliance. Common problems include inaccuracies in reported earnings, misunderstandings regarding deductions, and failure to update records.

Implementing a proactive approach can significantly reduce the likelihood of disputes and ensure both parties remain informed throughout any necessary corrections.

Regulatory and compliance considerations

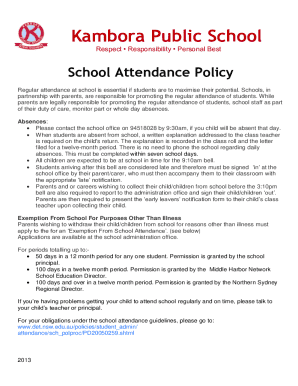

Staying compliant with federal and state regulations regarding employee earnings records is crucial for all employers. These regulations dictate not only what information must be recorded, but also how long those records must be retained. The potential consequences of non-compliance can include hefty fines and legal ramifications.

Continuous education regarding changes in legislation is vital for safeguarding businesses against compliance-related issues. Monitoring updates from trusted resources can help employers remain informed.

Conclusion: Importance of accurate employee earnings records

Accurate employee earnings records are the bedrock of successful payroll management. They not only protect the interests of both the employees and employers but also facilitate compliance with various regulations. As discussed, they encompass critical elements ranging from personal information to deductions and require meticulous attention to detail during preparation.

Investing time and resources into maintaining these records can lead to improved employee satisfaction and minimize discrepancies that can result in serious financial implications for the business.

Staying updated with employee earnings practices

The landscape of payroll management continues to evolve, making ongoing education crucial. Engaging with resources such as webinars or workshops can enhance understanding and effectiveness in managing employee earnings records.

Subscribing to regular updates from pdfFiller can ensure users are kept informed about best practices in document management, including tackling employee earnings records efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify employee earnings records without leaving Google Drive?

How do I complete employee earnings records online?

How do I fill out employee earnings records on an Android device?

What is employee earnings records?

Who is required to file employee earnings records?

How to fill out employee earnings records?

What is the purpose of employee earnings records?

What information must be reported on employee earnings records?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.