Get the free Series LLCs in Business and Tax Planning

Get, Create, Make and Sign series llcs in business

Editing series llcs in business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out series llcs in business

How to fill out series llcs in business

Who needs series llcs in business?

Comprehensive Guide to Series LLCs in Business Form

Understanding Series LLCs

A Series LLC is a unique business structure that allows a single LLC to create multiple, distinct series, each with its own assets and liabilities. This structure differentiates itself from traditional LLCs, which are typically confined to a single entity with overlapping risks. For entrepreneurs and investors, the Series LLC offers flexibility and scalability, accommodating a range of assets or business ventures under one umbrella.

The key characteristics of Series LLCs include their ability to segregate liabilities among different series, meaning that a financial issue in one series does not impact the others. This can be particularly advantageous for individuals or organizations managing multiple investments, as it helps to isolate risks and protect assets effectively. Furthermore, this structure fosters organizational efficiency, allowing businesses to streamline management processes without the need to establish and maintain multiple LLCs.

Legal framework governing Series LLCs

The legal landscape for Series LLCs varies significantly across different states in the U.S. A handful of states, including Delaware, Nevada, and Illinois, have implemented laws that specifically accommodate Series LLCs. In these jurisdictions, the laws outline the formation, management, and limitations pertaining to Series LLCs, creating a favorable environment for businesses seeking this structure.

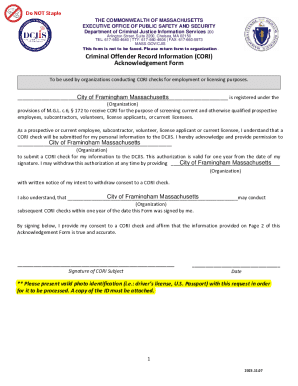

For example, Delaware's laws stipulate that a Series LLC can create separate series without needing to establish a separate LLC for each. However, companies opting for this structure must be diligent about adhering to compliance requirements, which may differ from state to state. This includes maintaining clear records and documentation for each series while fulfilling any ongoing reporting obligations to state authorities. Businesses should consult with legal experts familiar with local regulations to navigate these complexities successfully.

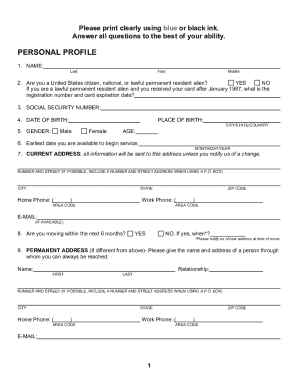

Formation process of a Series

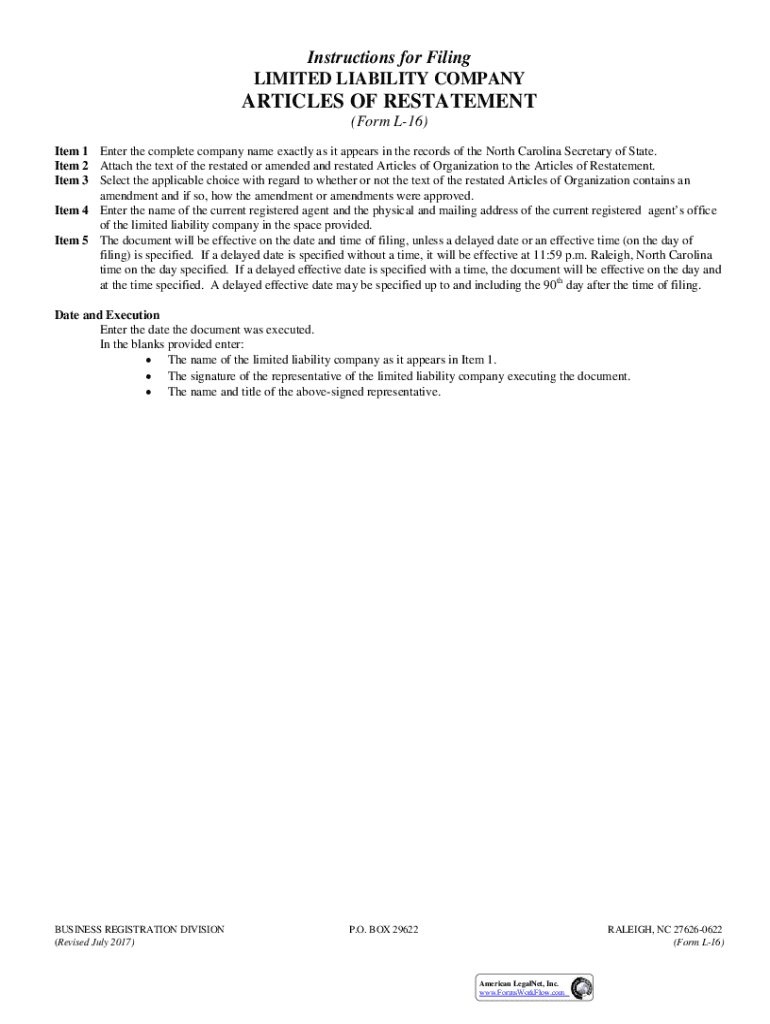

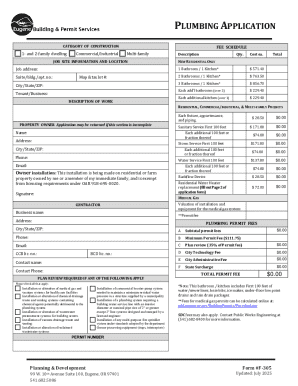

Establishing a Series LLC requires a series of structured steps that ensure compliance with state regulations. The first step is choosing a distinctive business name that complies with state naming requirements. After this, designating a registered agent is crucial as they are responsible for receiving legal documents on behalf of the LLC. The next step involves filing a Certificate of Formation with the state or designated authority, clearly stating the structure and intent to operate as a Series LLC.

Creating an Operating Agreement is equally important. This document outlines how each series will be managed and the rules governing the LLC as a whole. To establish a series within the LLC, additional documentation may be required, such as resolutions or specific series agreements that delineate how each series will operate independently yet still under the overarching LLC structure.

Strategic advantages of forming a Series

One of the primary strategic advantages of a Series LLC is its unparalleled risk mitigation capabilities. Since each series operates as a separate entity, it provides a distinct layer of asset protection, safeguarding individual series from liabilities incurred by others. For instance, an investment property held in one series cannot be pursued by creditors interested in financial issues stemming from a different series, protecting the value of those unique assets.

Moreover, the cost efficiency of a Series LLC is noteworthy. Establishing multiple LLCs can be a costly venture due to duplication of filing fees, compliance requirements, and accounting. With a Series LLC, businesses can significantly reduce these costs while still maintaining separate fiscal accountability. Businesses that leverage this structure often realize enhanced tax advantages as well, primarily through streamlined tax reporting processes that enable better management of financial responsibilities.

Considerations before forming a Series

Before forming a Series LLC, businesses should evaluate several critical factors. One of the foremost considerations is the overarching business goals; entrepreneurs must consider how a Series LLC fits into their long-term strategy. Industry-specific nuances also play a vital role. For instance, businesses operating in regulated sectors such as real estate or finance may encounter unique compliance challenges that influence the decision to adopt a Series LLC structure.

Additionally, potential risks must be scrutinized. Common misconceptions about Series LLCs include their perceived simplicity in liability protection or tax benefits. Entrepreneurs should be aware that each series must be maintained with separate accounting records and compliance practices to retain their protective features. Mismanagement or co-mingling of assets may inadvertently breach the liability protections the Series LLC claims to safeguard.

Management and maintenance of a Series

Effective governance of a Series LLC requires a comprehensive strategy to manage multiple series while ensuring adherence to compliance standards. It’s crucial to establish a clear organizational structure that delineates the responsibilities of each series' management. Regular communication and strategic planning meetings can facilitate better performance across the organization.

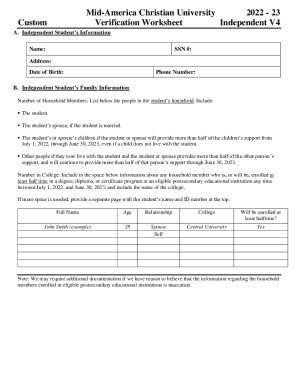

Proper accounting practices are essential for each series to maintain financial integrity and legal compliance. All series must have separate financial records, bank accounts, and operational documentation to safeguard the liability isolation benefits that the Series LLC entails. Additionally, staying updated on reporting requirements and operational policies ensures that all series flourish without interferences from administrative complexities.

Exploring related topics in Series LLCs

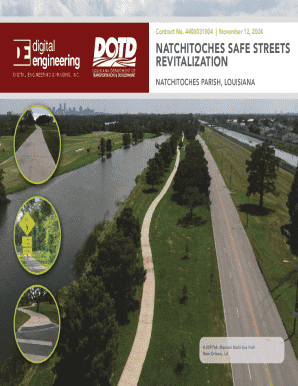

Series LLCs have found particular favor in industries such as real estate and franchising where asset segregation and liability protection are paramount. With the growing complexity of business requirements and regulations, Series LLCs provide a proactive solution for businesses managing multiple assets or divisions. The evolving legal landscape surrounding Series LLCs is worth observing; more states may begin to recognize and adopt this structure as businesses seek more versatile operational frameworks.

In tandem with these developments, emerging trends suggest a push from businesses towards embracing technology solutions that facilitate the management of Series LLCs. Performance management software and online document platforms, such as pdfFiller, can streamline the handling of compliance documentation, operational agreements, and financial records, producing a more efficient management environment for Series LLCs.

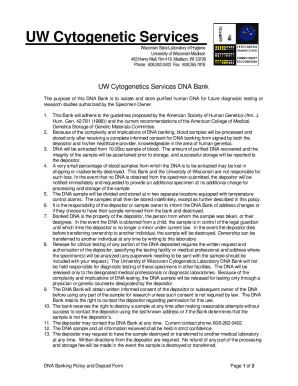

Tools and resources provided by pdfFiller

pdfFiller emerges as a powerful ally for businesses looking to navigate the complexities of Series LLCs efficiently. With its interactive document creation and editing capabilities, users can generate necessary agreements, operating documents, and compliance forms with ease. This cloud-based platform not only simplifies document management but also ensures that all edits and updates are conveniently accessible from anywhere, enhancing collaboration among teams.

Additional features like eSigning capabilities allow for streamlined approvals and real-time collaboration on key documents concerning Series LLCs. With a wealth of templates and user support specifically tailored for Series LLC formation and management, pdfFiller equips businesses with the tools they need for successful operation and compliance within this innovative business structure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit series llcs in business online?

Can I sign the series llcs in business electronically in Chrome?

How do I fill out the series llcs in business form on my smartphone?

What is series llcs in business?

Who is required to file series llcs in business?

How to fill out series llcs in business?

What is the purpose of series llcs in business?

What information must be reported on series llcs in business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.