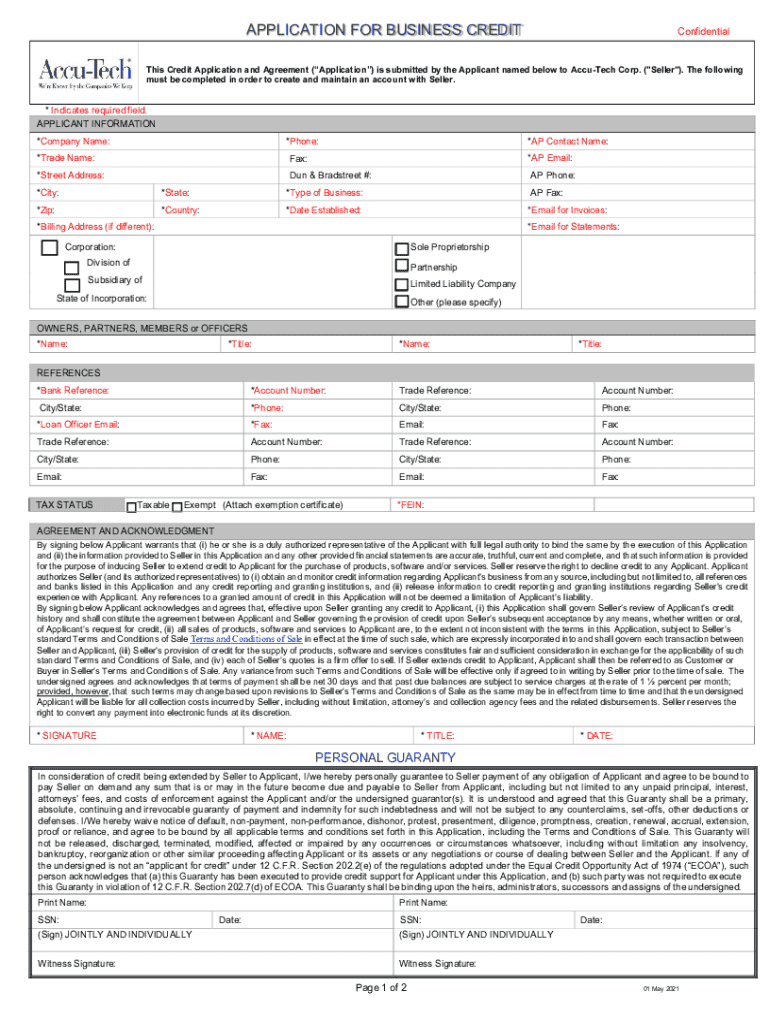

Get the free This Credit Application and Agreement (Application) is submitted by the Applicant na...

Get, Create, Make and Sign this credit application and

How to edit this credit application and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this credit application and

How to fill out this credit application and

Who needs this credit application and?

This Credit Application and Form: Your Comprehensive Guide

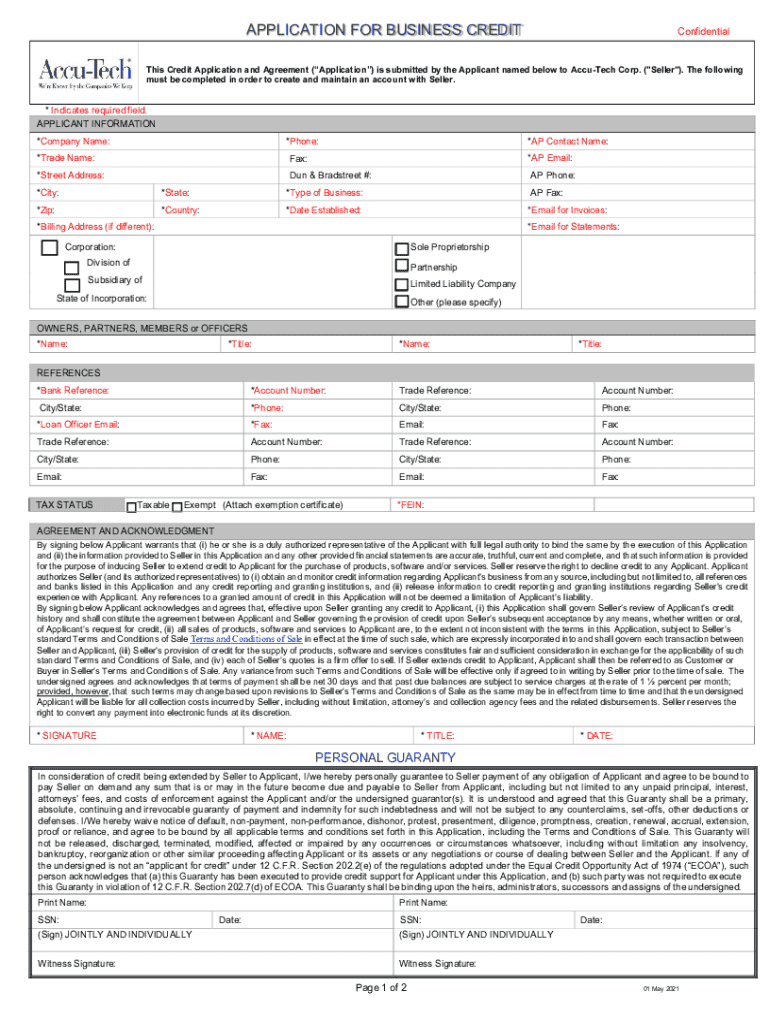

Understanding the credit application form

A credit application form serves as a formal request to a lender or financial institution for credit approval, fundamentally determining whether individuals or teams can secure loans. This application is a critical bridge between potential borrowers and lenders, as it collects essential data that helps in assessing creditworthiness. The importance of this credit application and form cannot be overstated, as it provides lenders insight into your financial stability and history.

Common uses for credit applications span a variety of scenarios, including personal loans, mortgages, and business financing. Each setting necessitates providing detailed information to help the lender evaluate the risk involved. Understanding how this credit application and form impacts loan approvals helps applicants prepare adequately and increases their chances of securing favorable terms.

Key components of a credit application

A complete credit application typically encompasses several sections, beginning with the personal information segment. This section includes typical details required such as your name, address, phone number, and email. Providing accurate information is crucial; any discrepancies might delay processing or lead to an application being rejected.

Following personal details, the financial information section demands transparency regarding income sources, employment history, and bank account details. For many lenders, understanding your financial situation is paramount. This part is often followed by a credit history summary, encompassing any credit inquiries you’ve made in the past which can impact your credit score. Lastly, applicants may need to provide additional information, such as details on co-applicants or guarantors, which can further strengthen or complicate your application.

Step-by-step guide to filling out a credit application

Filling out this credit application and form accurately is essential for a successful loan approval process. Start by gathering necessary documents, including identities like your social security card and driver’s license, financial documents like pay stubs and tax returns, and other relevant papers. This preparation will save you time and ensure that you're providing the correct information from the get-go.

Proceed to fill out your personal information accurately. Take your time to ensure that your name matches legal documents and check that your contact options are reachable. Next, provide detailed and accurate financial information, outlining income, expenses, and assets. When reflecting on your credit history, acknowledge any late payments or defaults while also highlighting positive credit behaviors. Finally, double-check your application to sidestep common mistakes like incorrect addresses or typos that could result in processing delays.

Editing and customizing your credit application

Once the credit application is filled, using tools available on pdfFiller can facilitate efficient edits. The platform’s document editing features allow you to amend sections easily, ensuring all details remain current and accurate. Collaborating with others is another advantageous feature, as it allows team members to review and provide input directly on the form, saving time and minimizing errors.

Additionally, saving templates for future applications can further streamline the process. If you frequently apply for credit, having a base template can cut down on input time significantly while ensuring consistency across applications. This approach allows individuals and teams to maintain organized records of their credit applications, keeping a clear overview of each submission.

Signing the credit application

The final step in the credit application process involves signing your document, and the modern solution lies in eSignatures. Understanding that eSigning is legally valid in most jurisdictions, it offers a convenient, secure way to authenticate your application without the need for physical paperwork. Using pdfFiller, you can swiftly add your signature using various input methods, regardless of the device you’re using.

To execute a signature on this credit application and form using pdfFiller, first, navigate to the signature section. Click on the option to eSign, choose your preferred method—such as drawing, typing your name, or uploading an image of your signature—and place it directly onto the document. With the application signed electronically, you can submit it with confidence that it meets both legal and institutional requirements for signatures.

Managing your credit application after submission

Keeping track of your handled credit application post-submission is crucial. Most lenders offer a way to check the status of your application, often through an online portal or customer service line. This transparency allows applicants to stay informed about any decisions made or pending information requests, keeping the process on track.

In some cases, lenders may require additional information after submission. If this occurs, respond promptly to any requests to not delay your application. Moreover, if you feel the need to reapply for better loan terms—perhaps due to an improved credit score or a change in financial status—understand the timing and conditions under which this would be most effective to enhance your chances of acceptance.

Common FAQs about credit applications

Individuals with a low credit score might worry about their acceptance chances. Those facing such a situation can work on improving their credit ratings prior to applying, paying down debts, or disputing any errors in credit reports to foster better financial health. Often, applying with a co-signer who has a robust credit history can also improve your chances and can be advantageous for both parties.

A critical question arises about excluding a co-signer—while it’s indeed possible to apply for credit independently, applications generally have a higher chance of approval when co-signers are present, especially in cases of lower scores. Lastly, potential applicants should be aware that approval times may vary. On average, processing ranges from a few days to a few weeks, influenced by the institution's policies and the thoroughness of your application.

Important considerations for individuals and teams

When completing this credit application and form, it's essential to be aware of the associated liabilities and risks. Signing a credit application can carry implications beyond just receiving a loan; the borrower takes on a legal obligation to repay the funds, which could impact personal finances and credit ratings. Teams applying may also face shared liabilities, where one member’s default can affect all involved.

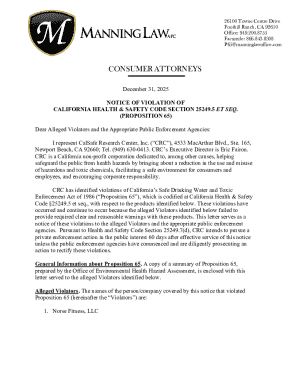

Understanding the compliance and legal aspects governing credit applications also plays a significant role. Regulations such as the Equal Credit Opportunity Act (ECOA) ensure lenders cannot discriminate against applicants based on race, color, religion, national origin, sex, marital status, or age, which secures fair treatment for all borrowers. Staying informed of these regulations helps applicants navigate the process confidently and assists in recognizing their rights within financial agreements.

Best practices for credit application management

Having a robust organizational strategy for managing credit applications makes the overall process smoother. Utilizing pdfFiller helps in maintaining an easily navigable document repository where forms are properly categorized and stored. This organization minimizes the chances of mix-ups and allows for quick access when needed.

Creating a workflow for applications enhances efficiency. For instance, establishing a checklist that includes preparing documents, filling out forms, eSigning, and following up on submissions can streamline the process significantly. By setting a routine and employing tools like pdfFiller, both individuals and teams can ensure a hassle-free experience while managing this credit application and form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send this credit application and for eSignature?

How do I edit this credit application and in Chrome?

How do I complete this credit application and on an iOS device?

What is this credit application?

Who is required to file this credit application?

How to fill out this credit application?

What is the purpose of this credit application?

What information must be reported on this credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.