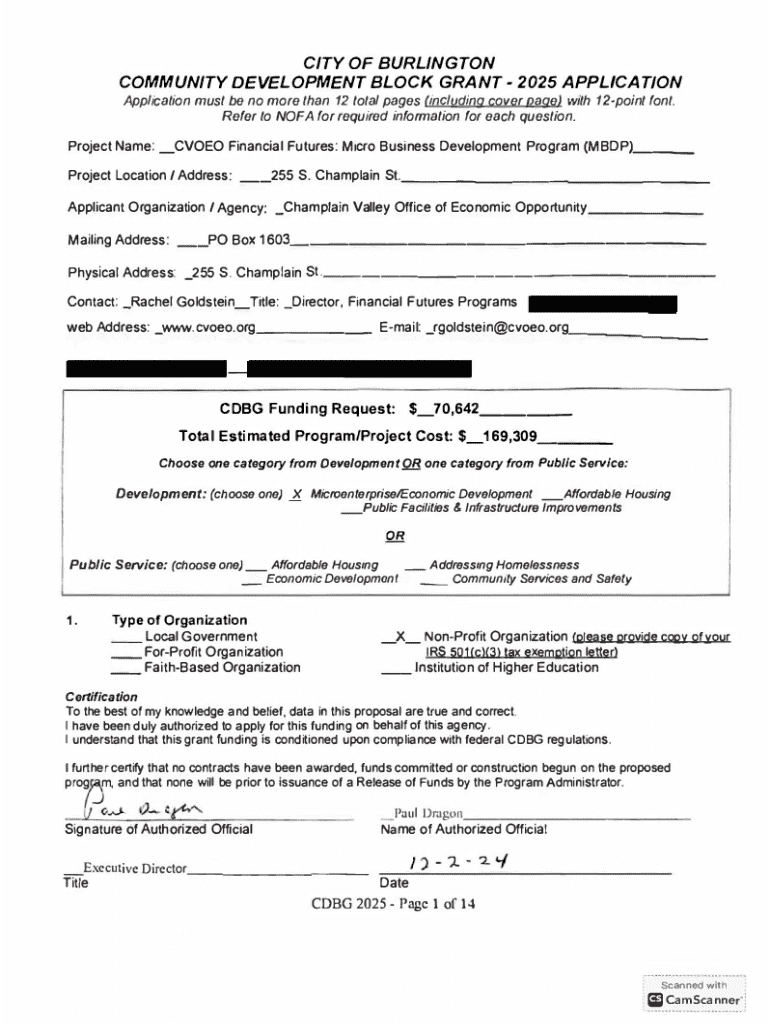

Get the free Financial Futures: Micro Business Development Program ...

Get, Create, Make and Sign financial futures micro business

How to edit financial futures micro business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial futures micro business

How to fill out financial futures micro business

Who needs financial futures micro business?

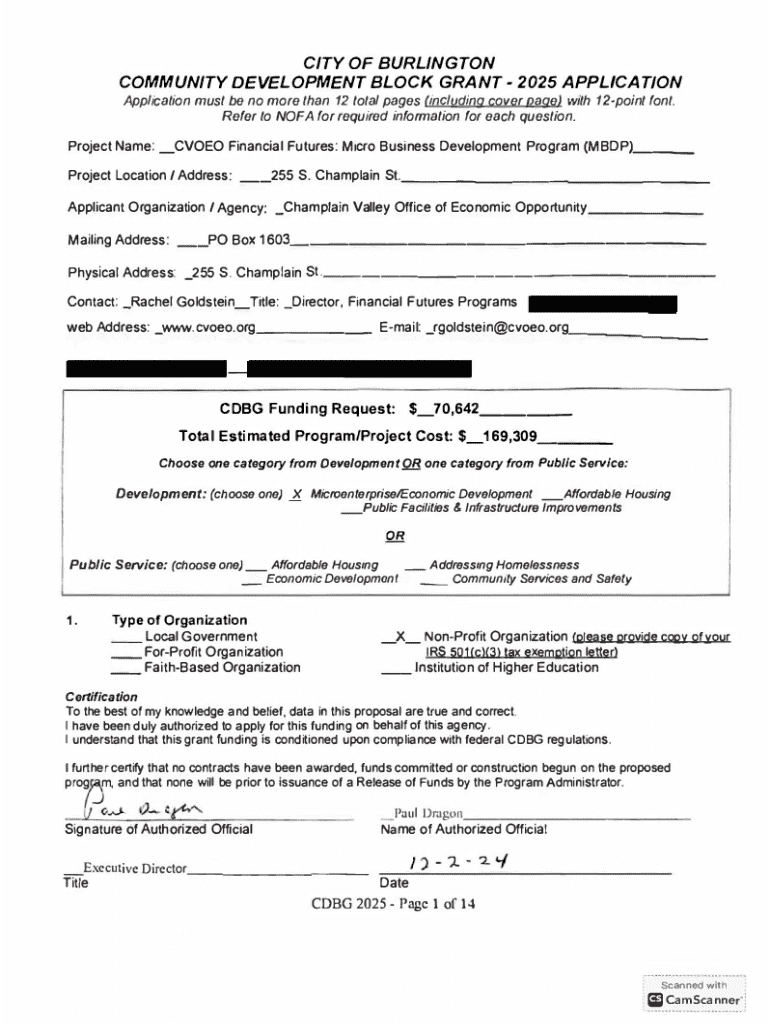

Understanding the Financial Futures Micro Business Form

Understanding financial futures

Financial futures offer businesses a mechanism for managing risk and planning for stability in a rapidly changing economic landscape. In a business context, financial futures are contracts that obligate the buyer to purchase an asset or the seller to sell an asset at a predetermined price at a specified date in the future. This function makes them critical tools for financial planning, especially for micro businesses that may lack the financial resilience larger corporations possess.

The importance of financial futures in business cannot be overstated, particularly as they provide a way to hedge against economic uncertainties. For micro business owners, understanding the key concepts of these instruments—such as leverage, margin requirements, and contract specifications—can empower them to make informed decisions that impact their operations and funding opportunities. When micro businesses utilize financial futures effectively, they can stabilize their finances and better predict cash flows, ultimately improving their chances of survival and growth.

The role of micro businesses in today's economy

Micro businesses, typically defined as enterprises with fewer than 10 employees or a small turnover, form the backbone of many local economies. Their contribution is significant, as they not only create jobs but also stimulate innovation and competition within various sectors. In the U.S., small businesses—including micro enterprises—account for approximately 44% of economic activity, highlighting their role in the overall financial ecosystem.

However, the challenges faced by micro businesses in leveraging financial futures are notable. Limited access to funding, lack of financial education, and varying levels of economic stability in different counties can hinder their ability to engage with complex financial products. Discrepancies in financial literacy among micro business owners can further exacerbate these challenges, often leading to missed opportunities for growth and sustainability.

The financial futures micro business form explained

The Financial Futures Micro Business Form is an essential document that helps micro business owners articulate their financial strategies regarding future investments and risks. This form serves a dual purpose—that of a financial planning tool and an application for potential funding opportunities. By detailing financial projections and strategies, this form can effectively position micro businesses for growth in a competitive landscape.

Step-by-step guide to completing the financial futures micro business form

Completing the Financial Futures Micro Business Form can seem daunting, but breaking it into manageable steps can simplify the process. Start by gathering all required information to provide a comprehensive overview of your business.

The next step involves filling out the form itself. It's crucial to provide detailed responses to each section, ensuring clarity and completeness.

Tips for effectively using the financial futures micro business form

Utilizing tools like pdfFiller can make editing and signing the Financial Futures Micro Business Form a breeze. This platform provides user-friendly features that enable seamless collaboration among team members. Collaboration is critical in ensuring all aspects of financial futures are adequately addressed, and pdfFiller permits real-time edits and electronic signatures from multiple users.

Navigating financial futures in your micro business strategy

Aligning financial futures with your micro business goals is essential for fostering long-term success. Understanding how to navigate the complexities of financial planning can create a solid foundation for future operations. Many successful micro businesses have integrated financial futures into their growth strategies, allowing for agility in response to market changes.

Case studies reveal that micro businesses utilizing financial futures have managed to stabilize their cash flow, prepare their household assets for unforeseen circumstances, and improve their credit standing. These successes demonstrate the importance of having well-informed financial planning that includes risk management strategies.

Interactive tools and resources

Engaging with interactive tools can significantly improve your ability to leverage financial futures effectively. Platforms like pdfFiller offer templates tailored for financial planning, including calculators that assess various scenarios for micro business viability.

Common questions and troubleshooting

When navigating the Financial Futures Micro Business Form, you may encounter common questions or issues. Addressing these can make the submission process smoother and help prevent delays in accessing necessary funding.

Embracing a cloud-based document management approach

The advent of cloud platforms like pdfFiller has transformed how businesses manage documents. Utilizing a cloud-based document management system offers significant advantages, especially for micro businesses operating within limited budgets.

Benefits include enhanced document security, easy accessibility from various devices, and seamless updates. Additionally, collaborating within cloud environments can enrich communication and streamline workflows, thereby improving overall efficiency—vital for ensuring scalability.

Future trends in financial futures for micro businesses

Emerging trends in financial planning indicate a shift toward greater emphasis on financial technology solutions that cater to micro businesses. As tools like artificial intelligence and big data analytics become increasingly integrated into finance, micro businesses can benefit by gaining insights that inform their financial futures more effectively.

The future of micro business financing will likely center on creating sustainable models that accommodate growing demands within the market while remaining resilient against economic fluctuations. Understanding these evolving trends will allow micro business owners to better position themselves for future challenges and opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find financial futures micro business?

Can I create an electronic signature for the financial futures micro business in Chrome?

Can I create an eSignature for the financial futures micro business in Gmail?

What is financial futures micro business?

Who is required to file financial futures micro business?

How to fill out financial futures micro business?

What is the purpose of financial futures micro business?

What information must be reported on financial futures micro business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.