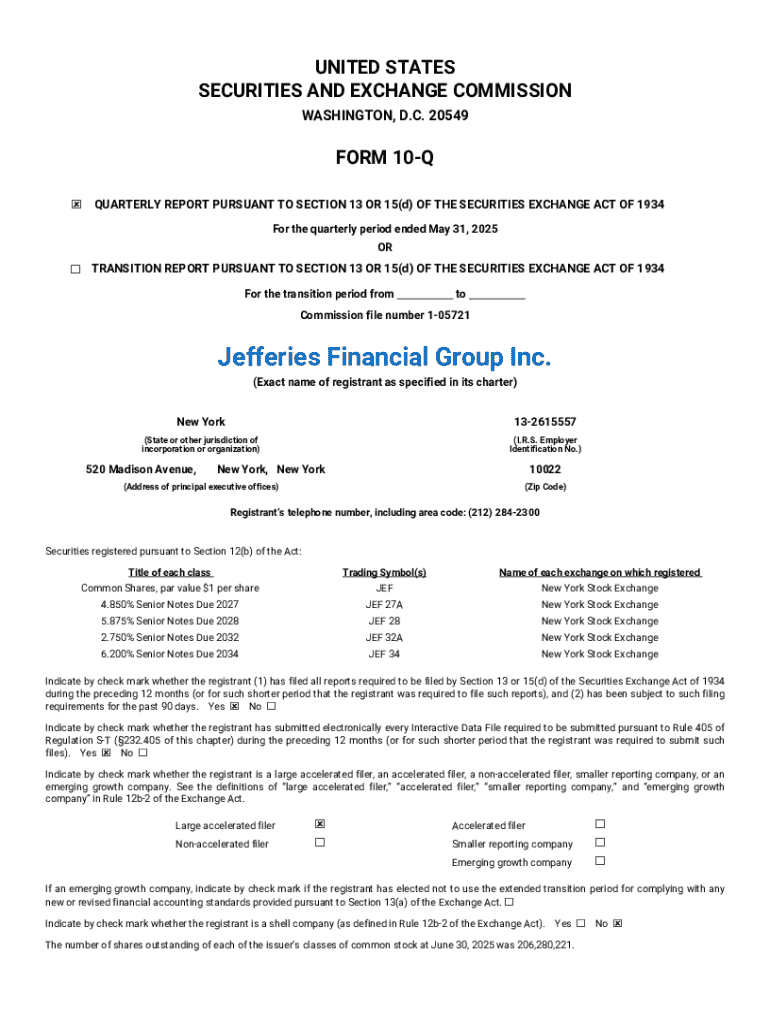

Get the free For the quarterly period ended May 31, 2025

Get, Create, Make and Sign for form quarterly period

How to edit for form quarterly period online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for form quarterly period

How to fill out for form quarterly period

Who needs for form quarterly period?

A comprehensive guide to filling out the form quarterly period form

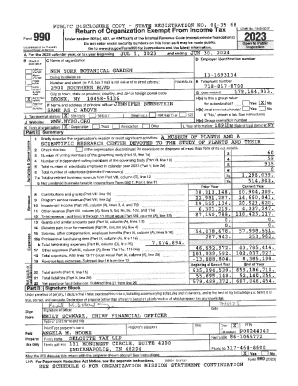

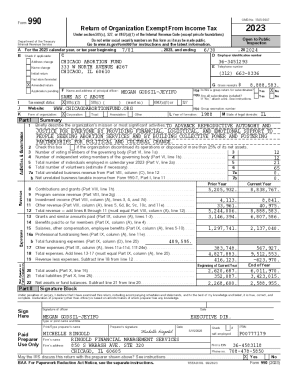

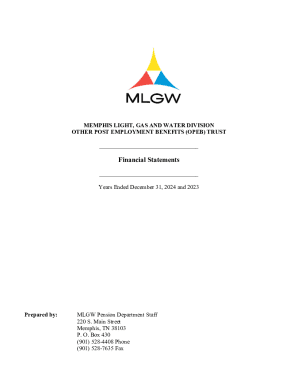

Understanding the quarterly period form

The quarterly period form is a critical document used by individuals and businesses to report financial data over a three-month period. This form serves various purposes, including tax reporting, compliance with financial regulations, and tracking income and expenses. By submitting these forms, users provide a snapshot of their financial situation, helping agencies and organizations monitor economic health effectively.

Correct and timely filing is crucial. For businesses, inaccuracies can lead to fines or audits, while individuals may face penalties that impact their personal finances. Accurate records not only simplify compliance but also support better financial planning and decision-making.

Key components of the quarterly period form typically include sections for income reporting, deduction details, and supplementary attachments. Each section plays a significant role in providing a complete and accurate picture necessary for appropriate tax obligations and financial assessments.

Preparing to fill out the quarterly period form

Before diving into completing the quarterly period form, gathering all necessary information is vital. This includes financial statements, tax identification numbers, and relevant documentation that support your income and deductions. Having a thorough set of data will streamline the process and ensure nothing essential is overlooked.

It's also important to choose the right tools for this task. pdfFiller is an excellent platform that provides intuitive options for form creation and editing. The application's advanced features enable users to convert documents into fillable forms, ensuring an efficient filling process. Whether you need to make corrections or add comments, pdfFiller offers the perfect solution.

Setting up your pdfFiller account is straightforward. Visit the pdfFiller website, select ‘Sign Up’, and follow the prompts to create your account. This will unlock access to all the tools necessary to complete your quarterly period form effectively.

Step-by-step instructions for completing the quarterly period form

1. Start with the basics: Begin by filling in your general information, which typically includes your name, address, and business identification. It's crucial to ensure this data is accurate as it sets the foundation for your submission.

2. Income reporting: Enter your income figures meticulously to avoid any discrepancies. This section is often scrutinized, so cross-reference with your financial statements to ensure figures align with your records.

3. Deduction details: Outline your deductions and credits accurately. Misreporting deductions can lead to underpayment or overpayment situations, which may affect your tax filing status.

4. Additional attachments: Review supplementary documents that must accompany your quarterly period form. These could include tax forms or any other relevant paperwork that substantiates your financial claims.

5. Reviewing your entries: Once filled, take the time to double-check all information. Implementing strategies like reviewing with a colleague or using pdfFiller's built-in helpful tips can ensure your form is error-free.

Editing and customizing the form in pdfFiller

pdfFiller’s editing tools are robust, allowing users to create highly customized forms. You can add text fields, checkboxes, and comments to enhance clarity. These features help communicate information effectively, which is especially important for complex financial data.

For teams, utilizing collaborative features is beneficial. You can invite colleagues to review and edit the form in real time. This collaborative environment not only speeds up the process but also brings multiple perspectives to ensure accuracy.

Managing versions of your form is another essential task. pdfFiller has features that help you save different versions and track changes, providing transparency during your quarterly submission process. This can be vital, especially if revisions are needed later.

Signing and submitting the quarterly period form

Electronic signing is a breeze with pdfFiller. The platform allows for easy eSigning features, ensuring that your signature is legally binding. This paperless approach is not only convenient but also speeds up the submission process.

For submission, you have several options: via email directly, mailing hard copies, or submitting through online portals, depending on the requirements of your local tax authority or organization. Always check the submission guidelines to ensure compliance.

After submitting your form, tracking its status is crucial. Utilize tracking features provided by pdfFiller to monitor your submission and ensure it is processed on time. This can help you stay ahead of any potential issues.

Managing and storing forms post-submission

Once you've submitted the quarterly period form, good document management practices come into play. Store your forms in a designated folder within pdfFiller to have easy access when needed. Organizing your documents effectively allows for quick retrieval and reduces the risk of errors in future filings.

pdfFiller offers extensive features for ongoing document management. You can continue to utilize the platform for future quarterly submissions and organize other critical documents, ensuring seamless management of all your forms.

It's also important to understand your responsibilities post-submission. If you need to amend a submission or respond to inquiries, knowing the proper procedures helps facilitate effective communication and compliance with regulations.

Troubleshooting common issues

Common errors while filling out the quarterly period form can include incorrect financial figures, missing signatures, or attachments. Identifying these pitfalls beforehand can save time and effort. Always refer to the specific guidelines provided by the regulatory body to avoid common mistakes.

To assist users, an FAQ section can address ongoing questions while completing the form. Questions may include details about deadlines, acceptable forms of payment, or clarification around what constitutes a qualifying deduction.

If users encounter issues, accessing support resources through pdfFiller can provide prompt assistance. The support team is available to help navigate specific queries, ensuring that filing the quarterly period form is a stress-free experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find for form quarterly period?

How do I execute for form quarterly period online?

How do I complete for form quarterly period on an Android device?

What is for form quarterly period?

Who is required to file for form quarterly period?

How to fill out for form quarterly period?

What is the purpose of for form quarterly period?

What information must be reported on for form quarterly period?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.