Get the free Drake Tax - Form Availability and Tax Changes: Wisconsin

Get, Create, Make and Sign drake tax - form

How to edit drake tax - form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out drake tax - form

How to fill out drake tax - form

Who needs drake tax - form?

Drake Tax - Form: A Comprehensive Guide

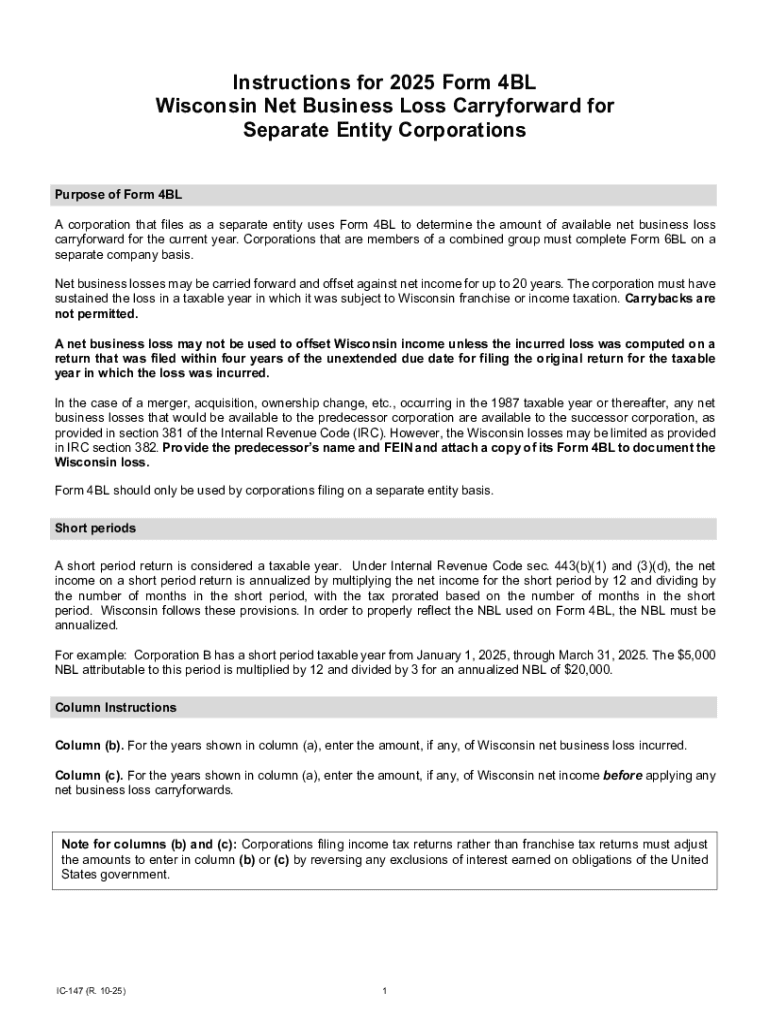

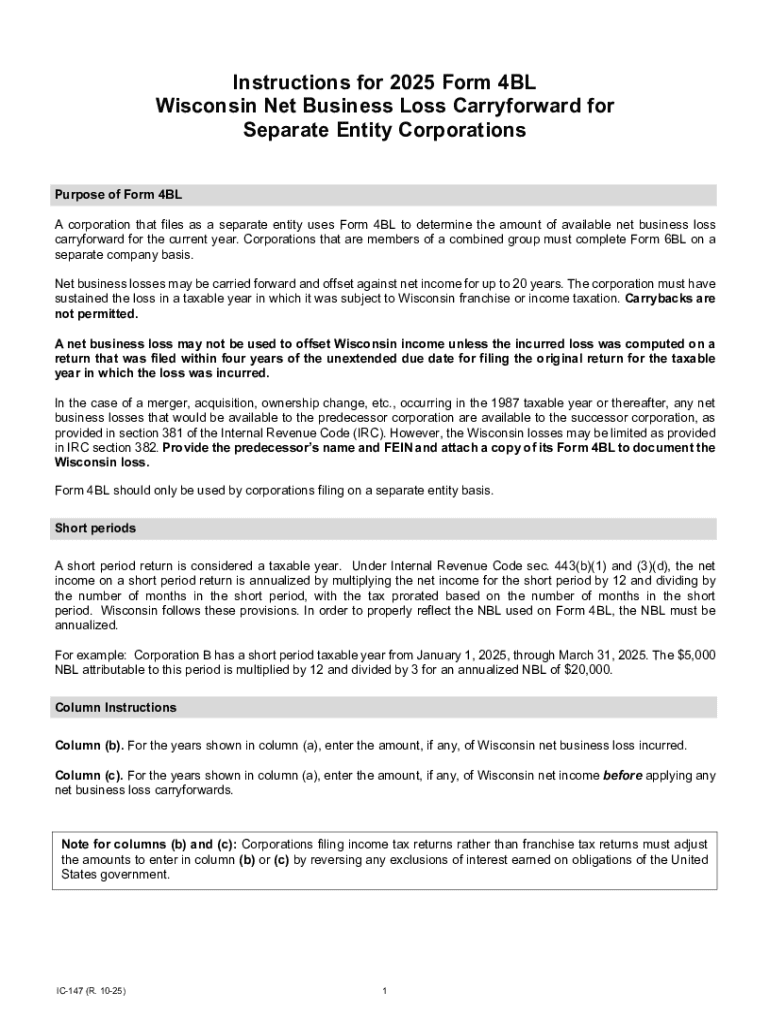

Overview of Drake Tax

Drake Tax is a robust tax preparation software designed for tax professionals, combining precision and user-friendly features for efficient tax filing. It offers a comprehensive suite of tools that cater to both individual filers and business entities, making it a go-to solution for many in the industry.

Key features of Drake Tax include support for all major forms required for various tax returns, like 1040, 1120, and 1065, ensuring compliance across states. The software also provides customizable templates, import functions from other software, and built-in error-checking capabilities.

Using Drake Tax for tax preparation delivers several benefits, such as streamlining the filing process, minimizing errors, and enhancing the overall workflow. With features like multi-state packages and electronic filing, it supports accountants and taxpayers in ensuring timely submissions and efficient management of returns.

Understanding tax forms in Drake Tax

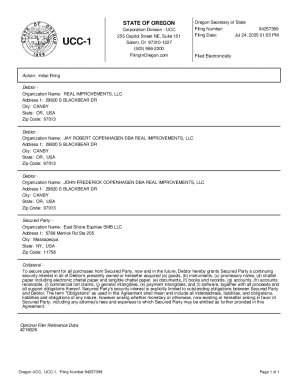

Drake Tax simplifies the daunting task of dealing with various tax forms by categorizing them into easy-to-navigate sections. Among the most commonly used forms for individual filers are the IRS Form 1040 for personal income tax returns and its accompanying schedules, while businesses frequently utilize forms like 1120 for corporations and 1065 for partnerships.

Electronic filing through Drake Tax is a streamlined process, allowing users to submit their returns directly to the IRS or respective state entities. This not only saves time but also increases accuracy—reducing the chances of errors associated with manual submissions.

Drake Tax also generates various reports, including summary reports of tax returns, client letters, and financial statements. This feature is invaluable for both individual preparers and professional firms managing multiple client accounts.

Detailed guide to filling out tax forms with Drake

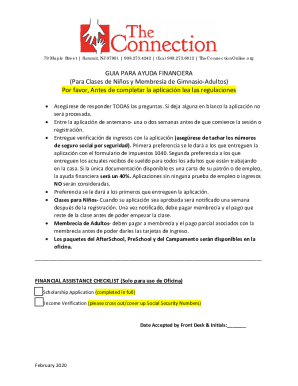

Filling out tax forms using Drake Tax is straightforward, thanks to its user-centric design. Start by selecting the appropriate form based on your financial situation, whether it's personal or business-related. Ensure that you have all necessary documents handy to make the process smoother.

Next, input your personal information, including name, address, and Social Security Number. This step is crucial for identifying your return properly. Then, enter your income details—this includes information from your W-2 forms, 1099s, and other income records. Pay particular attention to ensure that numbers are accurate to avoid discrepancies later.

Deductions and credits come next. Carefully review the available deductions for which you qualify, such as mortgage interest or educational expenses. Ensure to use the built-in calculators and tools within Drake Tax to aid in determining these amounts accurately.

After entering all relevant data, review your entries meticulously. Drake Tax provides features to highlight potential errors and suggests corrections, which can be invaluable to reducing filing mistakes. Finally, ensure you save your entries regularly to prevent data loss.

Common pitfalls to avoid include neglecting important forms, failing to update personal information, and rushing through the review process. Allocate ample time to ensure everything is correct before submission.

Editing and modifying forms in Drake Tax

Drake Tax comes equipped with a built-in editor that allows users to make changes to tax forms with ease. This editor is user-friendly and provides functionalities such as cut, copy, and paste options, ensuring that you can adjust your forms as necessary without hassle.

Saving and retrieving edited tax forms is straightforward. Drake Tax allows users to save multiple versions, enabling you to have backups of your work. It's recommended to save with unique naming conventions to easily differentiate between various iterations.

Managing multiple versions of your tax forms is crucial, especially if you have ongoing changes or updates. With Drake Tax, you can keep a clear record of different versions, ensuring that your final submission reflects all necessary adjustments.

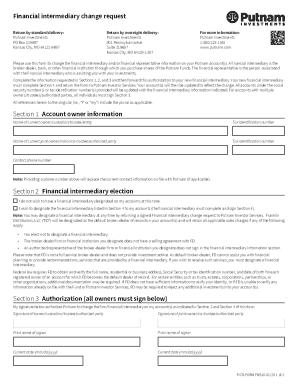

Signing and submitting forms

Drake Tax offers various options for electronic signatures, facilitating faster and more secure submissions. Users can opt for built-in eSign features that comply with IRS regulations, enabling quick finalization of documents without the need for physical signatures.

The submission process consists of several steps: review your completed forms, apply signatures, and then finalize the electronic submission. Each of these steps is designed to ensure that all necessary components are in place before you hit ‘submit’.

Tracking your submission status is easy within Drake Tax. Users can access a dashboard that provides real-time updates, allowing you to monitor whether the IRS or state authorities have accepted your forms or if there are issues that need to be addressed.

Collaboration features for teams

For teams working on tax returns, Drake Tax facilitates seamless collaboration. You can invite team members to collaboratively edit forms, ensuring everyone stays updated. This feature promotes efficiency, as team members can work simultaneously and contribute to a shared form.

Workflow management tools within Drake Tax allow you to assign tasks to different team members, track progress, and set deadlines. This organized approach helps prevent tasks from falling through the cracks and enhances team productivity.

Protecting sensitive information during collaboration is a priority for Drake Tax. It employs encryption and secure access controls to ensure that only authorized users can modify or view sensitive financial data, maintaining the confidentiality of your clients.

Frequently asked questions about Drake Tax forms

Post-submission discrepancies can occur, and knowing how to correct mistakes is crucial. Drake Tax allows you to make amendments to submitted returns. You'll need to file an amended return using the appropriate forms, which Drake Tax simplifies with guided prompts.

If you receive a query from the IRS, immediate action is advised. Follow the instructions provided in the correspondence, and if required, utilize Drake Tax's features to gather necessary documentation for your response.

One of the best practices for record-keeping with Drake Tax includes regularly backing up your data and maintaining a structured filing system. This ensures you have quick access to forms and supporting documents should the IRS or state require them in the future.

Additional features

Drake Tax offers integration with other financial management software, increasing its versatility. This alignment ensures that data entered in platforms like QuickBooks or Excel can be imported directly into Drake Tax, reducing repeated data entry and improving accuracy.

Expanding functionality with add-ons and upgrades enables users to tailor their Drake Tax experience further. For example, you might choose to integrate additional state packages for specific returns or upgrade to enhanced reporting features depending on your needs.

Mobile access is another advantageous feature of Drake Tax. Users can complete forms on the go from any location, which is particularly useful for tax professionals managing clients in various states or if assistance is needed while away from the office.

User testimonials and case studies

User feedback has shown that individuals and teams using Drake Tax experience significant improvements in efficiency and accuracy in filing. Testimonials highlight how the software has reduced filing time and allowed for seamless management of multi-state tax returns.

Case studies from firms using Drake Tax illustrate not only enhanced productivity but also increased client satisfaction due to timely and accurate filings. The impact of using Drake Tax has encouraged many to recommend it as a leading choice in the realm of tax preparation.

Interactive tools and resources

Drake Tax provides access to a wealth of tutorials and how-to videos designed to help users navigate the software effectively. These resources are invaluable for both new and experienced users seeking to familiarize themselves with the wide array of tools available.

Interactive checklists for tax preparation further assist users in ensuring their filing process is comprehensive. By following these lists, you can guarantee that no critical elements are overlooked in your return.

Connecting with customer support for additional help is also straightforward. Drake Tax offers various channels for assistance, including phone support and live chat, ensuring users can quickly resolve issues they may encounter while using the software.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find drake tax - form?

How do I edit drake tax - form in Chrome?

Can I create an electronic signature for the drake tax - form in Chrome?

What is drake tax - form?

Who is required to file drake tax - form?

How to fill out drake tax - form?

What is the purpose of drake tax - form?

What information must be reported on drake tax - form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.