Get the free Land Conservation Incentives Tax Credit Claim Form ...

Get, Create, Make and Sign land conservation incentives tax

How to edit land conservation incentives tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out land conservation incentives tax

How to fill out land conservation incentives tax

Who needs land conservation incentives tax?

Land Conservation Incentives Tax Form: A Comprehensive Guide

Understanding land conservation incentives

Land conservation refers to the strategic efforts and practices aimed at protecting and restoring natural landscapes, biodiversity, and ecosystems. It involves actions taken to manage land resources sustainably and preserve the natural environment for future generations.

The importance of land conservation is profound, extending beyond environmental protection to economic, social, and cultural benefits for individuals and communities. By conserving land, we not only protect wildlife habitats and enhance air and water quality but also ensure the sustainability of agriculture, forestry, and tourism industries that many communities rely on.

Various incentives exist to encourage landowners to engage in conservation practices, including state tax credits, grants, and donation programs directed at conservation easements and other conservation purposes.

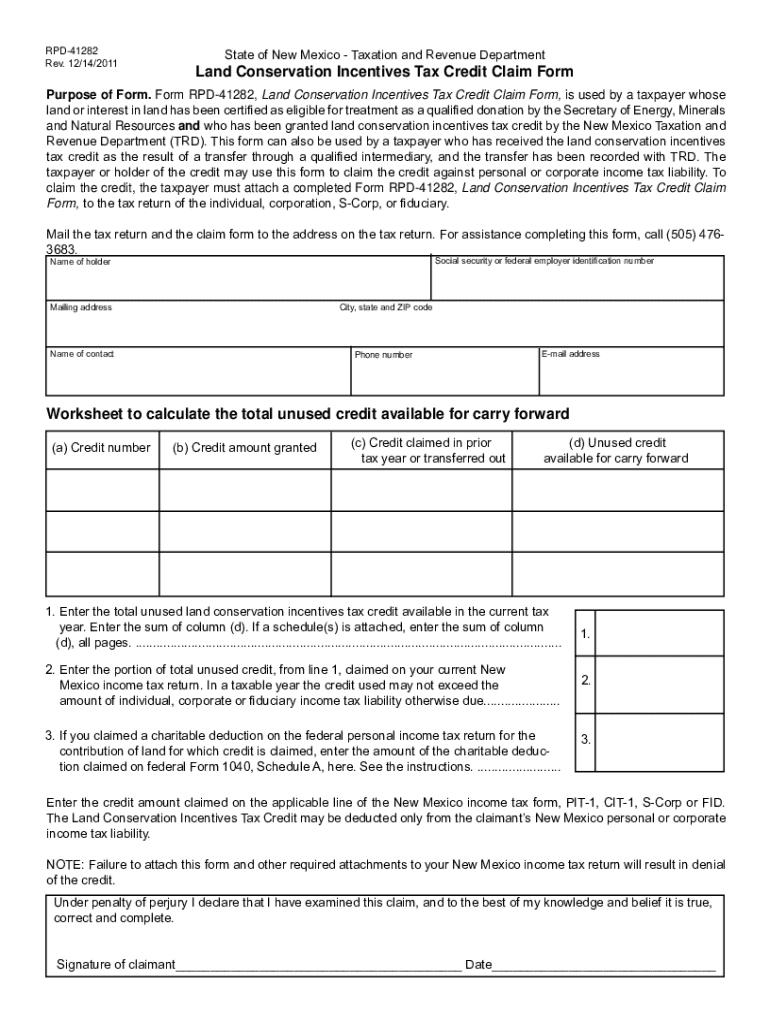

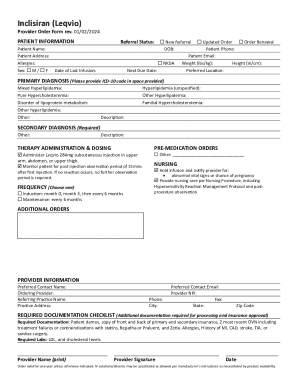

Overview of the land conservation incentives tax form

The land conservation incentives tax form is a crucial document designed to help landowners claim available tax benefits associated with land conservation efforts. This form typically assists individuals in documenting their conservation activities, enabling them to receive tax credits that mitigate their overall tax liability.

Anyone who has engaged in land conservation activities can benefit from this form. It is particularly beneficial for private landowners, non-profits, and other organizations that have made donations for land conservation or entered into conservation easements.

Eligibility criteria for land conservation incentives

To qualify for land conservation incentives, specific types of land are eligible, including agricultural land, forests, wetlands, and land adjacent to protected areas. Conservation easements are also a pivotal aspect of this eligibility, as they legally protect specific conservation values.

Applicants must also meet specific requirements, including demonstrating the conservation purposes of the land and providing adequate documentation of their conservation practices. These requirements vary by state, and understanding the local conservation laws is essential.

Unfortunately, many misconceptions surround eligibility. Some landowners mistakenly believe they need to dedicate an entire parcel for conservation or that minimal conservation efforts do not qualify. Understanding the local criteria is crucial in avoiding these pitfalls.

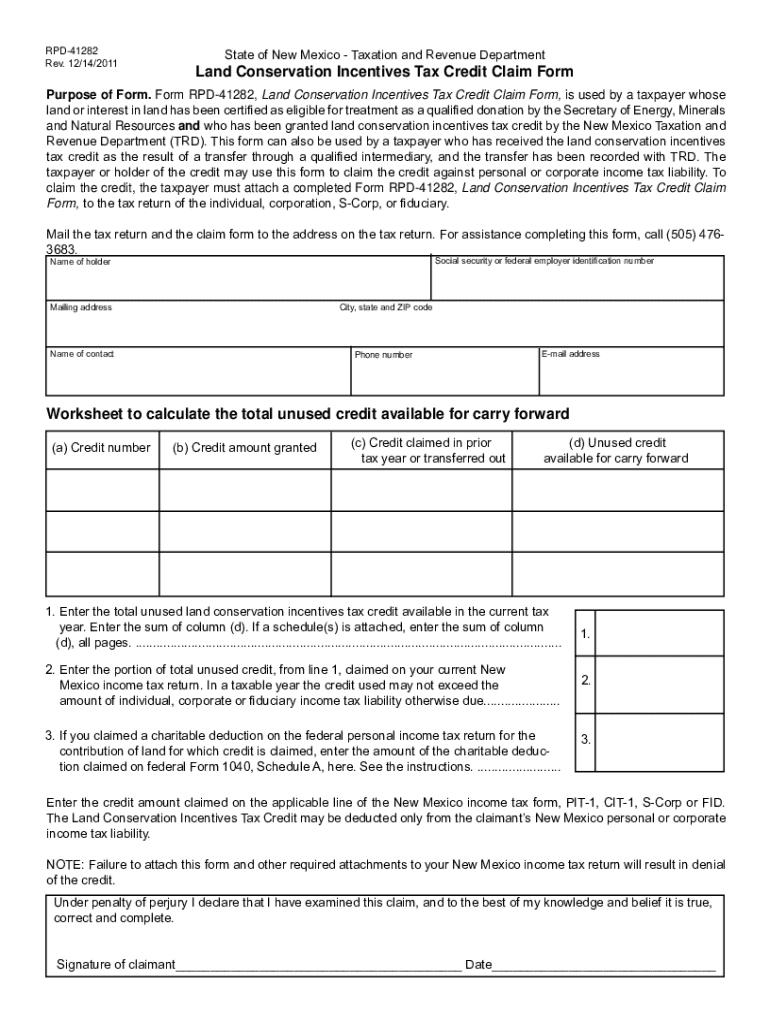

Step-by-step guide to filling out the land conservation incentives tax form

Preparing to fill out the land conservation incentives tax form requires some groundwork. Gathering necessary documentation and relevant information is crucial to streamline the process.

Preparation before starting the form

Once you have completed the preparation phase, the next step involves filling out the form.

Detailed walkthrough of each section of the form

Many individuals encounter common mistakes while filling out the land conservation incentives tax form. These include incorrect information entry, failing to attach required documents, or missing submission deadlines. Taking the time to double-check the form can save you from potential headaches later.

Interactive tools for the land conservation incentives tax form

With the rise of technology, digital tools are now available to improve the efficiency and accuracy of filling out the land conservation incentives tax form. Using resources like pdfFiller, users can transform the traditionally cumbersome paperwork process into a user-friendly online experience.

Managing your land conservation tax documentation

After successfully filing the land conservation incentives tax form, managing the documentation for future reference is essential. Adopting best practices for document control can save valuable time when tax season rolls around or when preparing for potential audits.

Maintaining organization in your conservation tax documentation prepares you for any eventualities, ensuring you're always compliant and informed.

Resources for further assistance

For individuals looking for guidance while navigating the intricacies of land conservation tax forms, reaching out to tax professionals can be beneficial. These experts understand the nuances of state tax credits and can provide tailored advice specific to individual situations.

Leveraging these resources can ease the process of filing and ensure you fully understand all benefits available under land conservation incentives.

Frequently asked questions (FAQs)

Innovations in land conservation incentives

The landscape for land conservation incentives continues to evolve, with new trends emerging in tax incentives designed to meet the pressing needs of environmental conservation. Recent innovations include enhanced credits for urban preservation and incentives for carbon offset practices.

Additionally, technology has accelerated conservation efforts, paving the way for better monitoring of land use changes, engagement with stakeholders, and efficient communication with conservation agencies. With an increasing focus on sustainability, future guidelines are expected to become more flexible, promoting greater participation in conservation efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the land conservation incentives tax electronically in Chrome?

Can I create an electronic signature for signing my land conservation incentives tax in Gmail?

Can I edit land conservation incentives tax on an Android device?

What is land conservation incentives tax?

Who is required to file land conservation incentives tax?

How to fill out land conservation incentives tax?

What is the purpose of land conservation incentives tax?

What information must be reported on land conservation incentives tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.