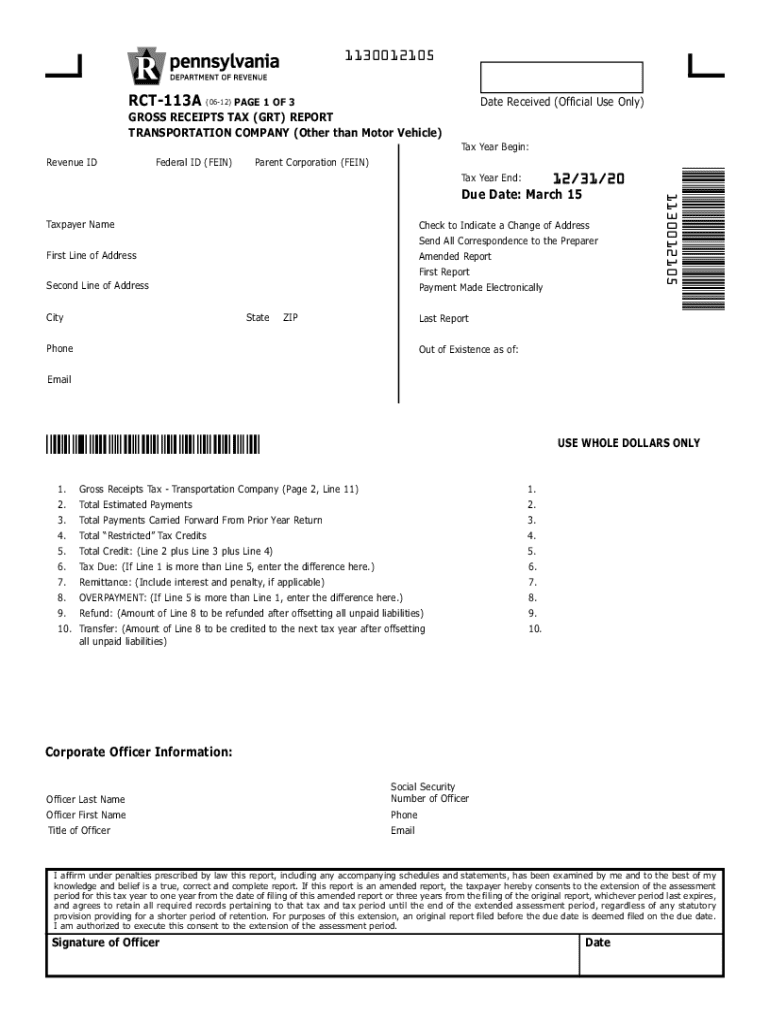

Get the free Gross Receipts Tax (GRT) Report -- Transportation Company (Other than Motor Vehicle)...

Get, Create, Make and Sign gross receipts tax grt

Editing gross receipts tax grt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gross receipts tax grt

How to fill out gross receipts tax grt

Who needs gross receipts tax grt?

Gross Receipts Tax (GRT) Form: A Comprehensive Guide

Understanding gross receipts tax (GRT)

Gross Receipts Tax (GRT) is a type of taxation imposed on the total revenue generated by a business, without deducting any associated costs or expenses. This tax serves as a significant revenue source for many state and local governments, impacting a wide range of businesses. Understanding GRT is crucial for compliance and financial planning.

Definition and purpose of GRT

The primary aim of GRT is to ensure tax equity by capturing a portion of the income generated by businesses directly. Since it applies to the gross revenue, it simplifies the tax process for certain sectors while also ensuring a stable revenue stream for public services. Many local jurisdictions favor GRT over traditional income taxes, as it is seen as more predictable.

Types of businesses affected by GRT

Various states such as New Mexico and Washington enforce GRT regulations, each having distinct rules and rates. Businesses operating in these areas must pay close attention to local laws to maintain compliance.

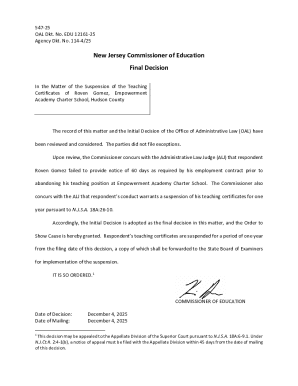

Overview of the gross receipts tax form

The Gross Receipts Tax Form is a pivotal document used by businesses to report their gross income and calculate the tax owed to the government. This form not only aids in compliance but also reflects the financial health of a business.

Importance of the GRT form

Properly completing the GRT form is vital to avoid legal penalties and ensure accurate tax payments. Neglecting this responsibility can lead to audits, fines, and other negative consequences for businesses. Beyond compliance, it allows for proper fiscal planning.

Key sections of the GRT form

Step-by-step guide to filling out the GRT form

Filling out the GRT form requires careful preparation and attention to detail. Begin this process by gathering all necessary financial documents that will provide the needed data.

Gathering necessary information

Understanding gross receipts is also essential; it generally includes all revenue collected before any deductions, although specific definitions may vary by jurisdiction.

Completing each section of the GRT form

As you fill out the form, ensure accuracy in each section. It’s crucial to double-check figures, particularly in the gross receipts and tax calculation sections. Mistakes can lead to fines, so be cautious.

Reviewing the completeness of your form

Before submission, it’s vital to review the form comprehensively for completeness and accuracy. Utilize a checklist to ensure that all necessary sections are filled out.

Tools to assist with GRT form management

Utilizing the right tools can streamline your GRT form management and significantly ease the filing process. pdfFiller provides features tailored to create, fill out, and manage various forms seamlessly.

Utilizing pdfFiller for GRT form creation

pdfFiller allows users to edit PDFs with ease. With features like e-signatures and document collaboration, teams can work effectively in real time on their GRT forms, enhancing productivity.

Interactive tools for calculating gross receipts

Filing the GRT form: options and best practices

Choosing the right method for submitting your GRT form can influence the efficiency of your filing process. Businesses typically have two options: online submission or paper filing.

Filing methods: online vs. paper submission

Opting for online filing often allows real-time status updates on your submission. The process typically involves creating an account on your respective state tax portal and following the instructions provided.

Best practices for timely submission

Common challenges and solutions

Filing the GRT form can come with challenges, such as misunderstanding what constitutes gross receipts or making erroneous calculations. Recognizing these common issues upfront can help mitigate problems.

Frequently encountered issues while filing GRT

To overcome these challenges, it’s crucial to leverage resources.

Solutions and resources for troubleshooting

Frequently asked questions about the GRT form

Addressing common queries surrounding the GRT form is essential for first-time filers. Understanding these frequently asked questions can ease anxiety and streamline the submission process.

What to do if you’ve made an error?

If you identify a mistake after submission, quickly file an amended return as instructed by your state’s tax authority to correct the issue.

How to amend a previously submitted GRT form?

Most jurisdictions provide a specific process for amending filed forms. Contact your local tax authority or refer to their guidelines for detailed steps.

Clarifying confusions about GRT regulations

Different states impose unique requirements for GRT forms. Consequently, ensure you refer to relevant state-specific resources to stay updated.

Support resources provided by pdfFiller

pdfFiller offers a wealth of information for users, including guides and customer support to ensure compliance with GRT filing.

Navigating post-submission processes

After the submission of your GRT form, you might wonder what happens next. Understanding the subsequent steps is vital for maintaining compliance and managing expectations.

What happens after you submit the GRT form?

Monitoring your submission can provide peace of mind and help you stay on top of any issues.

Keeping track of your GRT submissions

Utilizing pdfFiller's management features can keep your GRT submissions organized. Maintaining thorough records of submitted forms ensures you can address any follow-up queries efficiently.

Resources for continued learning about gross receipts tax

To stay informed regarding Gross Receipts Tax changes and best practices, continually seek out educational resources. State-specific tax departments often provide updated guidelines and informative materials.

Links to state-specific GRT resources

Be sure to bookmark official state tax websites, as these are the most authoritative sources for GRT regulations and updates.

Ongoing education and updates on GRT changes

Participating in financing workshops and webinars, offered by platforms like pdfFiller, allows you to stay updated on GRT practices and revisions. This proactive approach will empower you to handle tax obligations efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gross receipts tax grt for eSignature?

How can I get gross receipts tax grt?

How do I complete gross receipts tax grt online?

What is gross receipts tax grt?

Who is required to file gross receipts tax grt?

How to fill out gross receipts tax grt?

What is the purpose of gross receipts tax grt?

What information must be reported on gross receipts tax grt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.