Get the free TC-721, Utah Sales Tax Exemption Certificate copy

Get, Create, Make and Sign tc-721 utah sales tax

How to edit tc-721 utah sales tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-721 utah sales tax

How to fill out tc-721 utah sales tax

Who needs tc-721 utah sales tax?

Understanding the TC-721 Utah Sales Tax Form: A Comprehensive Guide

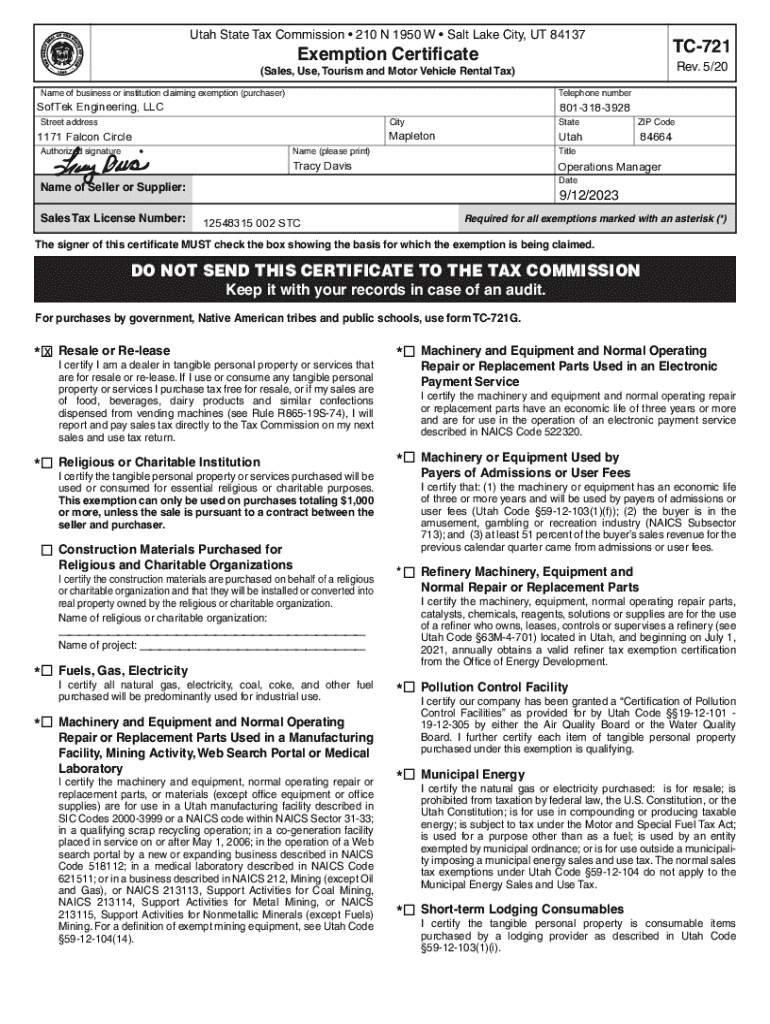

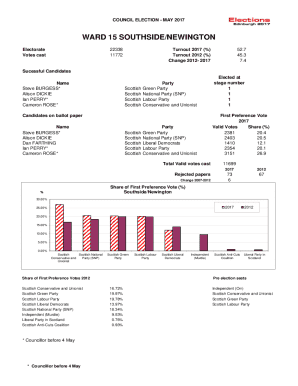

Overview of the TC-721 Utah sales tax form

The TC-721 Utah sales tax form plays a vital role in ensuring compliance for businesses operating within the state. This form is designed for reporting sales tax collected from customers, making it essential for accurate tax reporting and remittance.

The TC-721 provides a structured approach for documenting sales transactions, exemptions, and tax calculations. By filing the TC-721, businesses can effectively communicate their sales activity to the Utah State Tax Commission.

Target users for the TC-721 include retailers, service providers, and any business that charges sales tax during transactions. If your business sells goods or services that incur sales tax, you are required to file this form regularly.

Understanding sales tax in Utah

Sales tax in Utah is regulated at both state and local levels, making it crucial for businesses to be aware of the current regulations. The standard state sales tax rate is 4.85%, but when combined with local rates, some areas may have rates exceeding 8%. This variability means businesses must stay informed about local tax rates applicable to their specific location.

Compliance with sales tax regulations not only helps avoid penalties but also builds goodwill with customers who expect businesses to adhere to legal requirements. Understanding when and how to collect sales tax is essential for maintaining operational integrity and customer trust.

Recent changes to sales tax laws in Utah have included adjustments to taxation rules around online sales. These changes came to address the rise in eCommerce and ensure fair taxation practices across all sales channels.

Navigating the TC-721 form

Understanding the layout of the TC-721 form is crucial for effective completion. The form consists of multiple sections that require specific information regarding your business's sales activities.

Each section serves a distinct purpose, and knowing what to include can prevent mistakes and ensure timely submission.

Common mistakes to avoid include miscalculating the tax collected, failing to include all necessary sales data, and neglecting to sign and date the form. Each of these errors can lead to penalties or delays in processing.

Step-by-step instructions for filling out the TC-721

Filling out the TC-721 form doesn't have to be a daunting task. With a step-by-step approach, you can ensure that your form is accurate and complete.

Start by gathering all necessary information, including your business details and sales records.

Proceed with the following steps:

Editing and managing your TC-721 form

Managing your TC-721 form is made easier with tools like pdfFiller. Whether you need to edit an existing form or create a new one, pdfFiller has you covered.

Accessing the form on pdfFiller allows for smooth navigation through the editing process. You can upload existing TC-721 forms, and enhance your document management experience.

pdfFiller’s platform allows for enhanced collaboration, letting team members work together on the TC-721 form seamlessly. Utilizing digital tools like eSignatures ensures that every document is securely signed, maintaining compliance.

Submitting the TC-721

Once your TC-721 form is completed, it's time to submit it. You have multiple options for submission, depending on what works best for your business.

You can choose electronic submission through the Utah State Tax Commission's website or opt for traditional paper submission via mail. Understanding the advantages of each method can help you make an informed decision.

It’s essential to be aware of the important deadlines for filing, which generally coincide with the state’s quarterly reporting periods. Tracking the status of your submission is also critical; utilize the resources provided by the Utah State Tax Commission to ensure your form has been successfully processed.

Frequently asked questions (FAQs)

Mistakes regularly occur during the filing process. If you make a mistake on your TC-721, it’s important to correct it as soon as possible to avoid penalties. You may need to amend your form if significant errors were made.

Additional tools and resources on pdfFiller

pdfFiller is not just limited to the TC-721. It offers a suite of related tax forms that businesses can access easily. Exploring these tools can simplify the tax submission process and documentation requirements.

Utilizing pdfFiller’s document automation tools allows businesses to streamline their workflow when handling numerous forms. This can significantly reduce errors and improve overall efficiency.

Case studies: Successful usage of the TC-721 form

Several businesses have successfully navigated the TC-721 filing process and shared their experiences. Many found that utilizing digital tools like pdfFiller not only saved them time but also reduced stress related to tax compliance.

User testimonials often highlight how critical accurate filing has been for avoiding late fees and maintaining a good standing with tax authorities. Businesses learned that attention to detail when completing their TC-721 was key to a smooth filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tc-721 utah sales tax to be eSigned by others?

How do I complete tc-721 utah sales tax online?

How do I make changes in tc-721 utah sales tax?

What is tc-721 utah sales tax?

Who is required to file tc-721 utah sales tax?

How to fill out tc-721 utah sales tax?

What is the purpose of tc-721 utah sales tax?

What information must be reported on tc-721 utah sales tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.