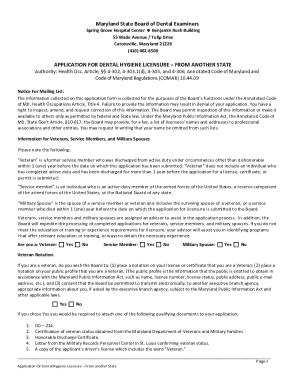

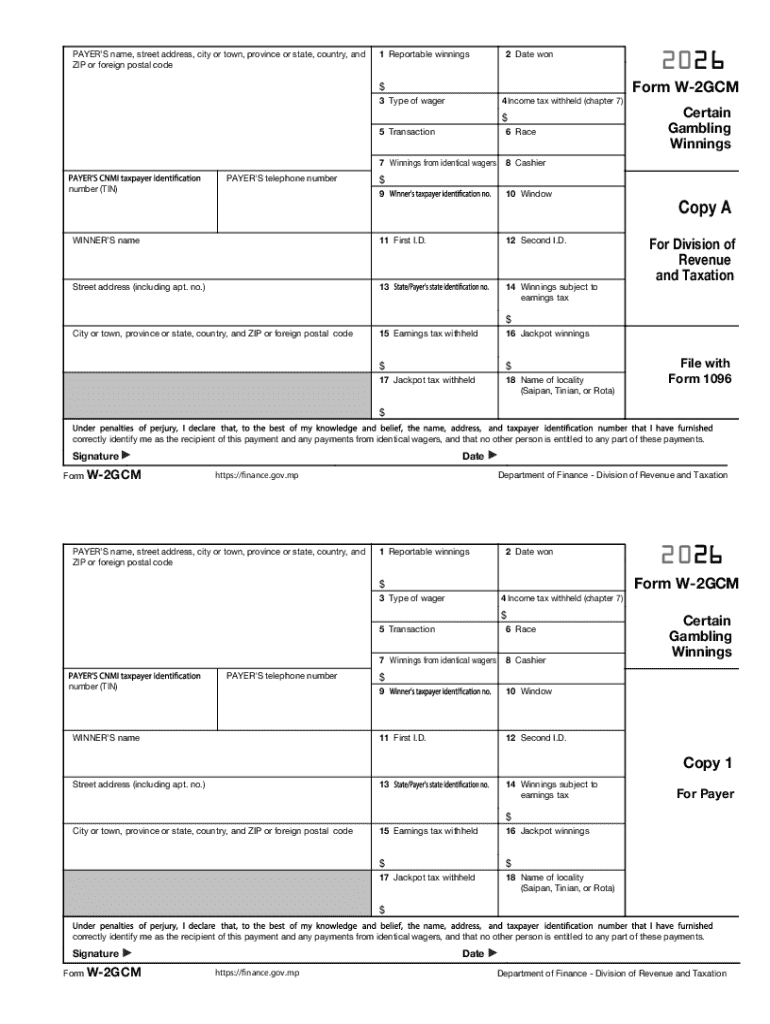

Get the free New York Department of Tax and Finance W-2G Tax Form

Get, Create, Make and Sign new york department of

Editing new york department of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new york department of

How to fill out new york department of

Who needs new york department of?

New York Department of Form: A Comprehensive How-to Guide

Understanding the New York Department of Form

The New York Department of Form plays a crucial role in managing a wide variety of administrative forms used across state and local government. This department ensures that the forms required for different administrative processes are accessible, streamlined, and compliant with New York state law. Importance of these forms cannot be overstated, as they are often pivotal in facilitating critical activities such as tax filings, business registrations, and licensing applications.

Forms handled by the department range from tax documents and business registration forms to various permit applications. These forms help ensure that individuals and businesses comply with regulations while also serving as a record of compliance with state law. Without the correct forms, navigating New York's administrative landscape can pose significant challenges for taxpayers and applicants.

Commonly used forms in New York

In New York, several forms are commonly utilized across various sectors. Understanding these forms can simplify many administrative processes. Here are three of the most widely used categories of forms:

Each form comes with its specific purpose and requirements, and understanding these requirements can significantly ease the application and submission processes.

Step-by-step guide to completing New York forms

Navigating the complexities of administrative forms can be daunting. Here’s a detailed guide on how to efficiently complete New York forms:

eSigning and submitting your form

With the increasing prevalence of digital applications, electronic signatures have gained significant importance. eSigning, or the use of electronic signatures, is a legally recognized way to sign documents in New York. This process not only saves time but also allows for quick and secure submissions.

Utilizing platforms like pdfFiller, you can easily apply eSignatures to your documents. Here’s a step-by-step guide on how to use pdfFiller for eSigning:

The benefits of using a cloud-based platform like pdfFiller include ease of document management, collaboration features, and immediate access from anywhere.

Interactive tools for form management

pdfFiller provides an array of interactive tools designed to enhance the document creation and management process. These tools are instrumental for both individuals and teams, facilitating efficient document collaboration.

Some of the features include:

Utilizing these interactive tools can significantly reduce the time spent managing forms while ensuring compliance with New York state law.

Instructions for specific form types

Specific categories of forms such as business formation forms, personal documents, and various license applications require detailed instructions for compliance. Here’s a breakdown:

Being systematic in gathering the required materials will help prevent any unnecessary delays in processing.

Getting help with your forms

Forms can be complex, and users often have questions and encounter issues during completion. pdfFiller offers several resources to assist users in navigating challenges.

Taking advantage of these resources can provide clarity and minimize confusion during the form completion process.

Updates and changes in form regulations

Staying informed about updates in New York's forms and regulations is vital for compliance and successful submissions. Recent changes may affect eligibility, documentation, or requirements for various forms.

To remain updated, users should subscribe to the New York Department of Form’s newsletters and regularly check their website for notices about regulatory changes. This proactive approach can help streamline the filing process and ensure that users are aware of necessary adjustments.

About pdfFiller

pdfFiller aims to empower users by offering efficient solutions for document management. With a focus on ease of use, their platform allows users to seamlessly edit PDFs, eSign, and manage documents all from a cloud-based interface.

Users have shared numerous success stories of how pdfFiller has simplified their document management needs, highlighting the platform's versatility and user-friendly features. With a commitment to supporting users, pdfFiller continues to evolve, meeting the changing demands of document creation and management.

Language assistance services

Understanding forms can be challenging, especially for non-English speakers. pdfFiller offers language assistance services that aim to make the process as seamless as possible.

These services include translated documents and resources, which help users understand their forms better and ensure compliance with state law. Access to these language support options is vital for ensuring inclusive access to essential services and documentation.

Connect with us

Staying connected with pdfFiller opens up avenues for users to get updates, tips, and community support. Engaging with the company through social media platforms provides users with valuable insights into new features and best practices for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new york department of for eSignature?

How do I edit new york department of online?

Can I sign the new york department of electronically in Chrome?

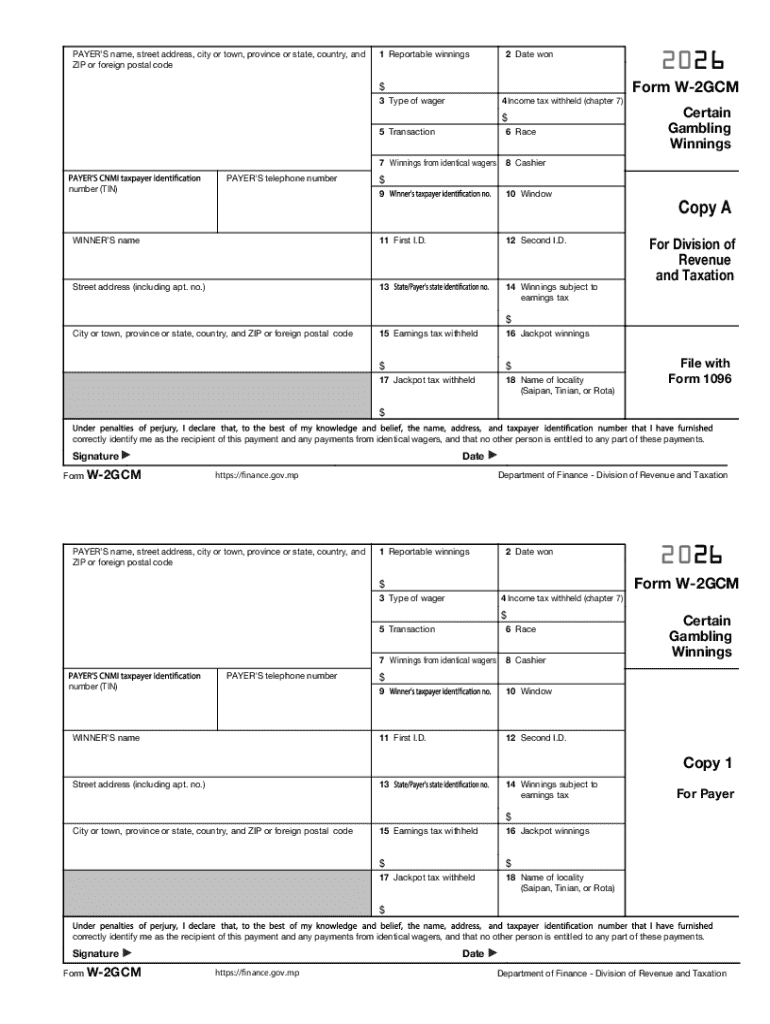

What is new york department of?

Who is required to file new york department of?

How to fill out new york department of?

What is the purpose of new york department of?

What information must be reported on new york department of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.