Get the free CERTIFICATE OF INDIRECT COSTS This is to certify ...

Get, Create, Make and Sign certificate of indirect costs

How to edit certificate of indirect costs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of indirect costs

How to fill out certificate of indirect costs

Who needs certificate of indirect costs?

Certificate of Indirect Costs Form: A Comprehensive Guide

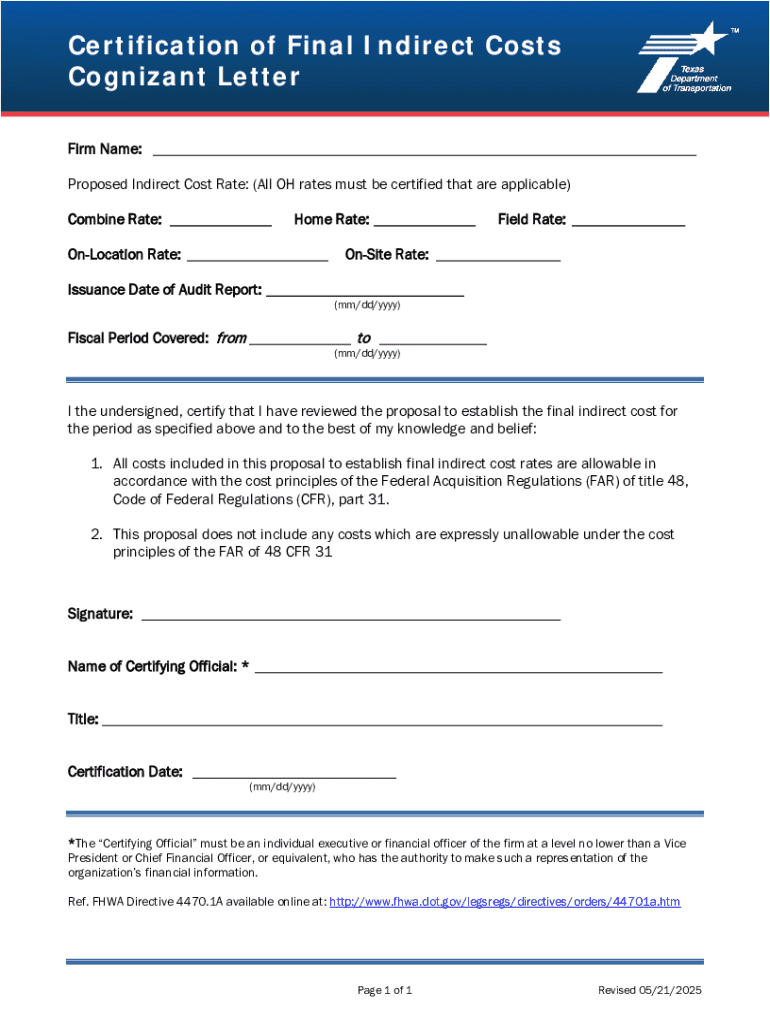

Understanding the Certificate of Indirect Costs Form

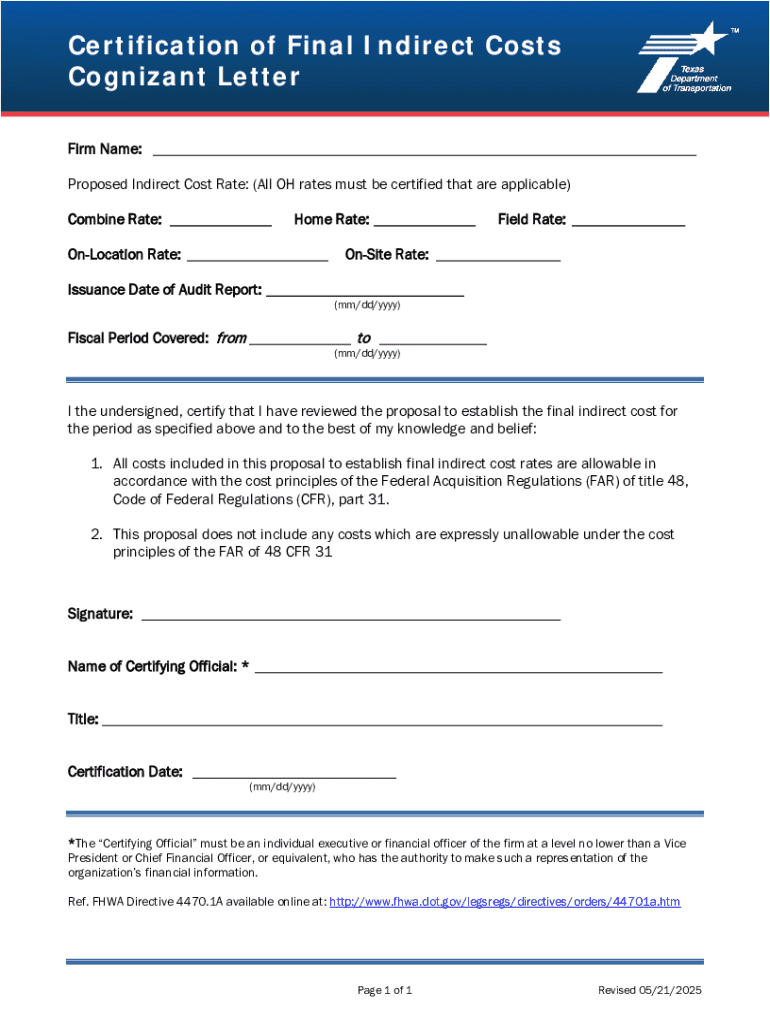

The Certificate of Indirect Costs Form is a crucial financial document used by organizations and businesses to detail the indirect costs associated with specific projects or programs. These forms are required by various funding agencies, particularly in the context of federal grants. Their primary purpose is to provide transparency in managing project budgets, ensuring that organizations can recover costs that are not directly attributable to a specific project but are necessary for operations.

Understanding the importance of this form is vital for effective financial management. It allows organizations to substantiate their indirect cost rates, which can significantly affect the allocation of funds for projects. With precise reporting, organizations can enhance their financial sustainability and ensure compliance with regulatory demands.

Key components of the form

The Certificate of Indirect Costs Form typically includes several sections that clarify how indirect costs are determined. One crucial component is the formula for calculating indirect costs, often expressed as a percentage of direct costs. Additionally, the form requires supporting documentation that includes prior financial statements and audit reports to justify the calculated rates.

Importance of accurate indirect cost reporting

Accurate indirect cost reporting is paramount for maintaining the financial health and integrity of any organization. Errors in reporting can lead to significant consequences, including the potential loss of funding or grants, which could jeopardize entire projects. Moreover, inaccuracies can deter stakeholders and funding agencies, leading to distrust and further scrutiny in future funding requests.

On the other hand, proper documentation of indirect costs allows for streamlined audits and financial reviews. This level of transparency can enhance the organization’s credibility, making it easier to secure funding and foster relationships with partners and donors. As such, ensuring that the Certificate of Indirect Costs Form is filled out correctly is beneficial not only for compliance but also for reinforcing trust with all stakeholders involved.

Step-by-step guide to filling out the Certificate of Indirect Costs Form

Before diving into filling out the Certificate of Indirect Costs Form, preparation is key. Gather all necessary documents, including financial statements, previous audits, and any pertinent records that showcase your organization's administrative expenditures. Organizing this data effectively will streamline the reporting process and minimize the risk of errors.

Detailed instructions by section

Once you've gathered all necessary documents, you can begin filling out the form section by section. Start with Section 1, which typically requires you to enter your direct costs. Direct costs should be broken down here, including specific line items like employee salaries, project materials, and equipment fees.

In Section 2, focus on calculating your indirect costs. Utilize the provided formula, often calculated as the ratio of total indirect costs to total direct costs, to determine your indirect cost rate. This calculation is critical as it informs funding requests and impacts budget planning.

Finally, Section 3 will require you to submit supporting documentation. It's essential to include only those documents that are compliant with the funding agency's guidelines, distinguishing between allowed and disallowed costs. This careful categorization will help prevent potential funding disputes.

Common pitfalls to avoid

When completing the Certificate of Indirect Costs Form, be vigilant of common pitfalls that can derail accuracy. Overreporting or underreporting expenses can lead to significant complications, including audits resulting in funding recovery or future funding restrictions. Additionally, be mindful of submission deadlines, as missing them could result in lost opportunities for financial support.

Tools and resources for managing your indirect costs form

Managing the Certificate of Indirect Costs Form can be simplified significantly through the use of interactive tools, such as those offered by pdfFiller. These features enhance user experience by allowing for easy editing and collaboration in real-time. Moreover, the platform supports a straightforward process for filling out forms online, eliminating the need for cumbersome paper trails.

Beyond just the Certificate of Indirect Costs, pdfFiller provides alternative templates and forms that may be beneficial for those involved in financial reporting. Users can find a plethora of document templates that cater to various organizational needs, ensuring compliance with both internal and external standards.

Collaborating on the Certificate of Indirect Costs Form

When working on the Certificate of Indirect Costs Form as a team, collaborating efficiently is essential. Best practices for collaborative editing include clearly defined roles among team members, allowing for streamlined contributions without overlap. Utilizing the comments and feedback features in pdfFiller can foster communication and ensure that everyone's input is considered during the editing process.

Implementing a workflow for review and approvals can significantly enhance the accuracy of the filed form. Each team member should understand their responsibilities, from data entry to final review, allowing for necessary compliance checks before the final submission. This preparatory effort can serve as an invaluable safeguard against erroneous filings.

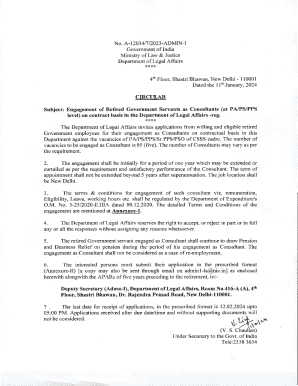

eSigning and finalizing your Certificate of Indirect Costs Form

eSigning the Certificate of Indirect Costs Form enhances both security and efficiency in the submission process. Electronic signatures carry the same legal validity as handwritten ones and streamline the finalization of documents, eliminating delays associated with physical signatures. This ensures that your organizations can move quickly while maintaining compliance with necessary regulations.

For final submission, consider recommended methods for safe document delivery. Utilizing electronic submission methods or secure file transfers can ensure that your completed form reaches the appropriate funding agency without risk of loss or unauthorized access. Lastly, confirm the receipt of submissions and set up follow-up processes to address any queries that may arise.

Keeping your Certificate of Indirect Costs up-to-date

To maintain an effective indirect cost reporting structure, it is critical to keep your records updated. Regular reviews and document organization help ensure that all data remains current and complies with current regulations. Establish a regimen for reviewing your Certificate of Indirect Costs, adjusting for any changes in your organization or regulations that impact your indirect cost rates.

Staying informed about regulatory changes is equally important. Subscribe to relevant newsletters or maintain communication with professionals in the field to ensure that your organization is always prepared to adapt to new requirements. This proactive approach not only mitigates risk associated with compliance failures but also reinforces your organization’s reputation for reliability and professionalism.

Frequently asked questions

The Certificate of Indirect Costs Form can raise several inquiries, particularly among first-time filers. Common questions often revolve around how to calculate the indirect cost rate accurately and the documentation required to support the claims made in the form. Many individuals believe that indirect costs are an afterthought in budgeting; however, they are integral to financial planning and must be treated as such.

Moreover, myths surrounding indirect cost reporting, such as the idea that indirect costs are not recoverable, can lead to underfunding important projects. It’s essential to clarify these points—funding agencies typically recognize and allow for reasonable indirect cost recovery, provided they are documented and justified adequately. Understanding these nuances is key to ensuring that organizations maximize their funding potential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the certificate of indirect costs electronically in Chrome?

How can I fill out certificate of indirect costs on an iOS device?

How do I edit certificate of indirect costs on an Android device?

What is certificate of indirect costs?

Who is required to file certificate of indirect costs?

How to fill out certificate of indirect costs?

What is the purpose of certificate of indirect costs?

What information must be reported on certificate of indirect costs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.