Get the free City of Baltimore 401(a) Retirement Savings Plan and 457(b ...

Get, Create, Make and Sign city of baltimore 401a

Editing city of baltimore 401a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out city of baltimore 401a

How to fill out city of baltimore 401a

Who needs city of baltimore 401a?

City of Baltimore 401A Form - How-to Guide

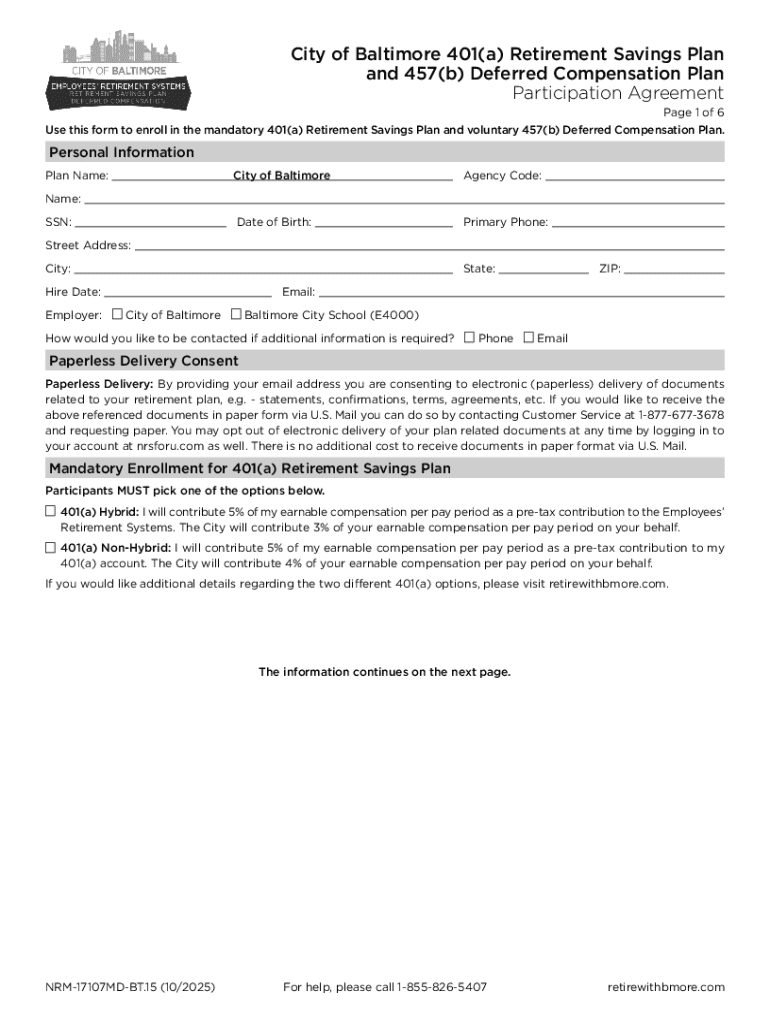

Understanding the City of Baltimore 401A Form

The City of Baltimore 401A Form is a key document for city employees participating in the 401A retirement plan. This plan offers employees the opportunity to save a portion of their salary toward retirement on a pre-tax basis, aiding in the future financial planning process. The 401A Form specifically allows for contributions to be made by the employee or the employer, supporting a more enriching retirement experience.

Employers and employees alike benefit from clear financial planning through this form, as it sets the groundwork for contributions, investment choices, and securing a stable economic future. When used correctly, the 401A Form can significantly influence one's retirement strategy and payout structure.

Key features of the Baltimore 401A Form

The Baltimore 401A Form consists of essential sections that provide the necessary information for proper retirement plan management. Key features include personal, employment, and contribution details that must be accurately recorded to ensure seamless processing and compliance with city regulations.

Some common sections of the form include:

Additional documents may be required, such as identification verification or previous tax information, to aid in establishing contribution eligibility.

Preparing to fill out the 401A Form

Before diving into the completion of the City of Baltimore 401A Form, it's crucial to gather all necessary information. This preparation not only saves time but also ensures accuracy in entering details.

Essential documents you may need include:

Accurate data entry is paramount. Mistakes in your form can cause significant delays in processing, potentially impacting your contribution limits and retirement payout expectations.

Step-by-step instructions for filling out the 401A Form

Filling out the City of Baltimore 401A Form can be straightforward if you follow these steps meticulously:

pdfFiller offers interactive tools that enhance the form-filling experience. Using its auto-fill features can significantly save time and help avoid errors, allowing you to submit precise information.

Editing and customizing your form

Utilizing pdfFiller, you have the ability to edit the 401A Form effortlessly. The platform enables you to make real-time changes to ensure that all entries reflect accurate and current information.

You can add notes, comments, or highlights to emphasize specific areas of the form that may need further attention. This feature is particularly useful if multiple team members are involved in completing the document.

Collaboration is simple with the platform, allowing you to work alongside others, so everyone has the most up-to-date information before finalizing the submission.

Signing the 401A Form

Once completed, the next step is to sign the City of Baltimore 401A Form. Electronic signatures have gained wide acceptance and are legally binding, making the eSigning process straightforward.

To eSign with pdfFiller:

Understanding the legal validity of your eSignature is crucial for peace of mind when managing sensitive retirement options.

Submitting the 401A Form

After completing and signing the form, you must submit the City of Baltimore 401A Form to the appropriate city department. Submission methods vary, offering flexibility based on your preference.

Here are the common submission methods:

Be sure to be aware of deadlines and important dates related to retirement contributions, as these can greatly impact your retirement planning.

Troubleshooting common issues

Should you encounter issues while filling out or submitting the City of Baltimore 401A Form, having a reliable set of resources is indispensable. Frequently asked questions cover areas from eligibility criteria to specific instructions for tricky sections of the form.

Common errors can include incorrect Social Security numbers, miscalculated contribution percentages, or failing to attach necessary documentation. Here are tips to help you navigate these issues:

Staying organized and proactive in addressing these potential problems can greatly smooth your experience with the 401A Form.

Useful information and resources related to the 401A Form

Being equipped with the right resources is vital for anyone involved with the City of Baltimore 401A Form. There are several links to forms or related documentation available through city and government websites, ensuring all requirements are met.

Helpful resources may include:

Utilizing these resources helps keep you informed and ensures you're making sound financial decisions regarding your retirement.

Benefits of using pdfFiller for your 401A form needs

Using pdfFiller simplifies the entire process of managing your City of Baltimore 401A Form, from editing and signing to collaborative workflows. The cloud-based platform allows for easy access from any device, ensuring that you can handle your documents on your own schedule.

Some advantages of utilizing pdfFiller include:

With pdfFiller, the journey from form completion to submission becomes seamless, granting you the freedom to focus on your retirement planning and goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send city of baltimore 401a to be eSigned by others?

How do I edit city of baltimore 401a straight from my smartphone?

How do I complete city of baltimore 401a on an Android device?

What is city of baltimore 401a?

Who is required to file city of baltimore 401a?

How to fill out city of baltimore 401a?

What is the purpose of city of baltimore 401a?

What information must be reported on city of baltimore 401a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.