Get the free TC-90cb, Renter Refund Application. Forms & Publications

Get, Create, Make and Sign tc-90cb renter refund application

Editing tc-90cb renter refund application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-90cb renter refund application

How to fill out tc-90cb renter refund application

Who needs tc-90cb renter refund application?

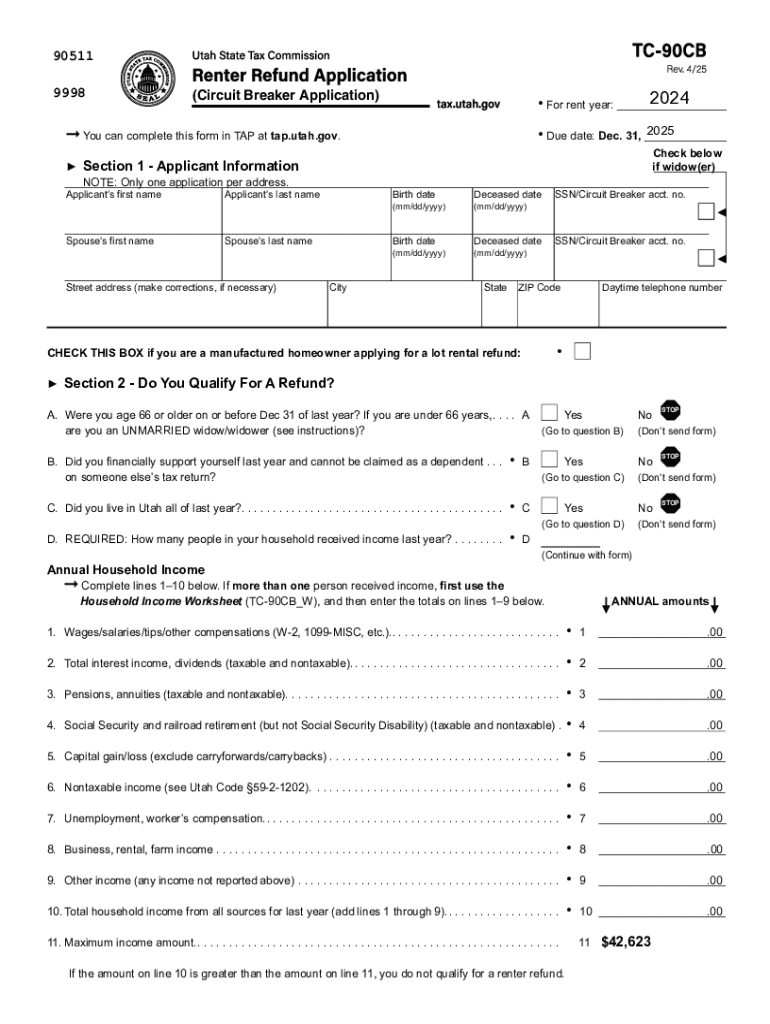

Complete Guide to the TC-90CB Renter Refund Application Form

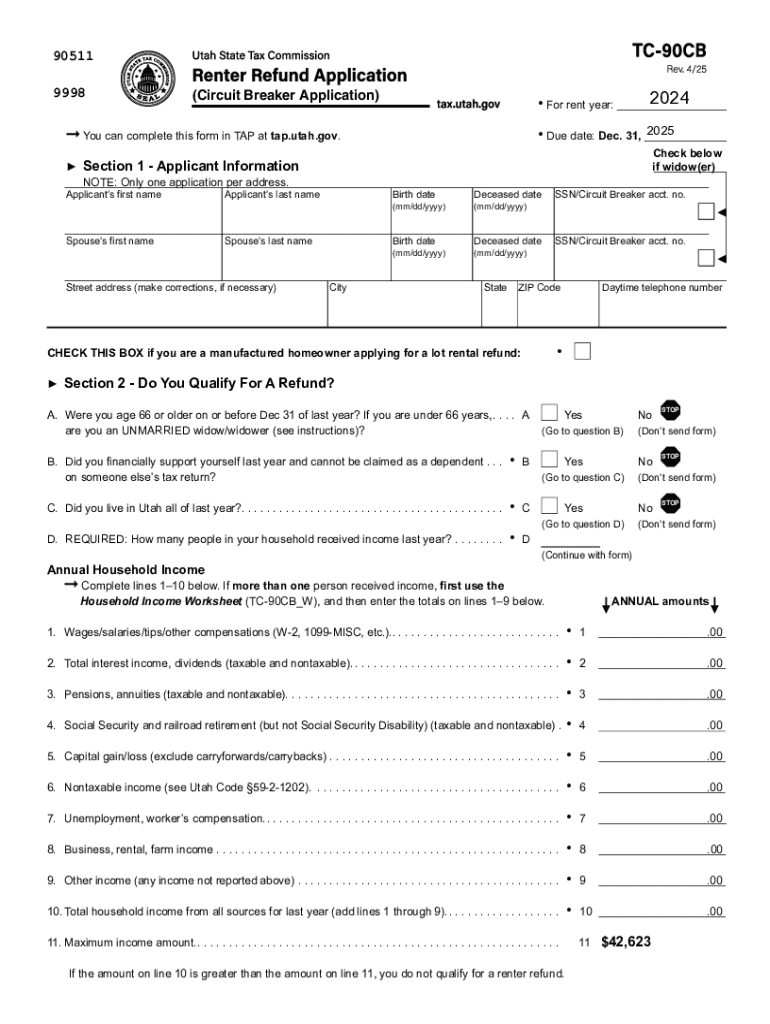

Overview of the TC-90CB renter refund application form

The TC-90CB form is a crucial document for renters seeking financial relief in the form of a renter refund. This application allows tenants to request a refund on a portion of the rent they have paid, providing essential financial support, particularly for low-income individuals and families. Understanding its significance is essential for anyone who meets the eligibility criteria. The form becomes a gateway to vital relief that can help alleviate the financial burden of housing costs.

The importance of submitting the TC-90CB form cannot be understated. It helps to reclaim funds that renters may have overpaid or simply to receive benefits they are entitled to under state laws. By accurately completing this form, renters can ensure their eligibility for refunds, which can significantly aid in financial planning and stability.

So, who should use this form? While primarily aimed at renters who pay property taxes indirectly through their rent, the TC-90CB application is especially beneficial for low-income households, seniors, and those who are facing economic challenges. If you fall into these categories, it’s vital to understand how to fill out this form correctly to receive the assistance you need.

Eligibility criteria for renter refunds

To apply for a renter refund using the TC-90CB form, potential applicants must meet specific eligibility criteria focused on income limits, residency requirements, and other factors. This ensures that the financial relief reaches those most in need. Generally, applicants must demonstrate that their income does not exceed a particular threshold, which varies by household size and county.

For residents applying, proof of residency is crucial. It is often required to show a valid lease agreement or other documentation proving you occupied the rented property during the tax year in question. Most importantly, common exemptions exist for certain groups, such as senior citizens or individuals with disabilities, which may allow them to bypass some income requirements.

Additionally, applicants must provide proof of rental payments made throughout the year. This documentation typically includes bank statements, rent receipts, or records from your landlord. Failing to provide satisfactory proof may lead to delays or denial of your application.

Step-by-step guide to filling out the TC-90CB form

Filling out the TC-90CB form may seem daunting, but breaking it down into manageable steps can simplify the process significantly. Preparation is essential, so start by gathering all required documents, which include your lease agreement, income statements, and any necessary identification.

Next, familiarize yourself with the layout of the TC-90CB form. It contains several sections that must be filled out accurately to prevent delays in processing. Each section has a designated purpose, from capturing your personal information to detailing your rental payments and income.

Make sure to pay close attention to each part of the application, particularly the following sections:

Digital submission of the TC-90CB application

One of the most significant advancements in recent years is the ability to submit the TC-90CB form digitally. Many states now offer options for online submission, making the process more efficient and accessible. Digital submission significantly streamlines the application process and allows for quicker processing times.

Using a platform like pdfFiller is an excellent option for filling out and submitting your TC-90CB form. This cloud-based platform not only allows you to complete and eSign the application but also offers various features to help manage your documents effectively. Don’t forget to follow these steps to ensure a seamless submission process:

Alternative submission methods

If you prefer not to submit your TC-90CB application digitally, there are alternative methods available. You can choose to mail your application or submit it in person at designated offices, depending on your locality and preference.

Submitting by mail

To mail your TC-90CB application, ensure that it is filled out completely and accurately. Include all necessary supporting documentation to avoid delays. Here’s a step-by-step guide for mailing your application:

Submitting in person

If you prefer a hands-on approach, submitting the TC-90CB application in person is a feasible option. Be sure to locate the nearest tax office where you can submit your form without complications. Here’s what to keep in mind when submitting in person:

Important deadlines and timeline for processing applications

Being aware of deadlines is critical in the application process for the TC-90CB form. Each tax year has specific deadlines for submission that vary based on county regulations. Missing these deadlines can result in an inability to receive your refund in a timely manner or, in some cases, forfeiting your right to a refund entirely.

Generally, applicants should aim to submit their TC-90CB applications as early as possible. Once submitted, the expected timeframe for processing applications can range from a few weeks to several months. Staying informed about your application’s status is essential in this period.

Should you approach the deadlines or face any challenges with your submissions, consider following up with local tax offices to ensure everything is on track and your application is being processed without issues.

Frequently asked questions (FAQs)

As applicants navigate the process of filling out the TC-90CB renter refund application form, several common queries arise, ranging from eligibility to submission details. Let’s address some frequently asked questions to clarify potential concerns.

Additional resources and support

Accessing ample resources when applying for the TC-90CB renter refund application can make a significant difference. Each state has official tax resources that provide detailed information about renter refunds, including application guidelines and eligibility requirements. Links to these resources can typically be found on state government websites.

For those who may need personal assistance, consider reaching out to local housing organizations or legal aid societies that often provide support for renters during tax season. Lastly, leveraging the tutorials and support available through pdfFiller can also aid in simplifying the application process and resolving issues that may arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tc-90cb renter refund application without leaving Google Drive?

How can I edit tc-90cb renter refund application on a smartphone?

How do I complete tc-90cb renter refund application on an iOS device?

What is tc-90cb renter refund application?

Who is required to file tc-90cb renter refund application?

How to fill out tc-90cb renter refund application?

What is the purpose of tc-90cb renter refund application?

What information must be reported on tc-90cb renter refund application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.