Get the free Tipp City Annual Reconciliation for Tax Year 2026 INFORMATION ...

Get, Create, Make and Sign tipp city annual reconciliation

Editing tipp city annual reconciliation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tipp city annual reconciliation

How to fill out tipp city annual reconciliation

Who needs tipp city annual reconciliation?

Tipp City Annual Reconciliation Form: Your Comprehensive Guide

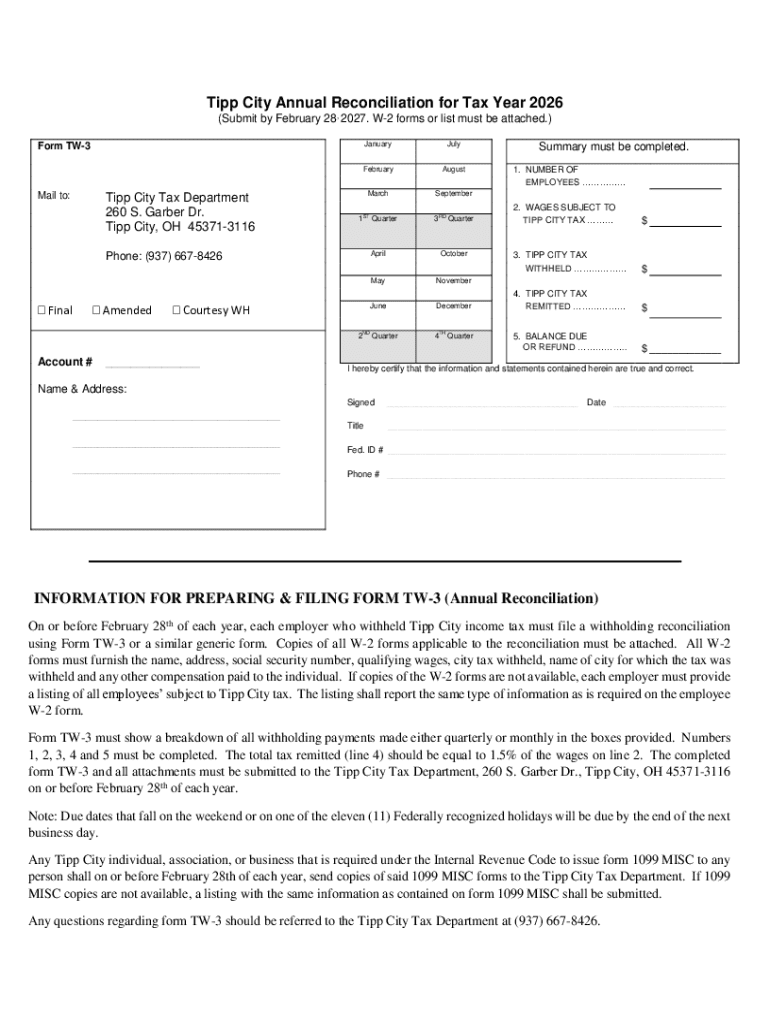

Overview of Tipp City Annual Reconciliation Form

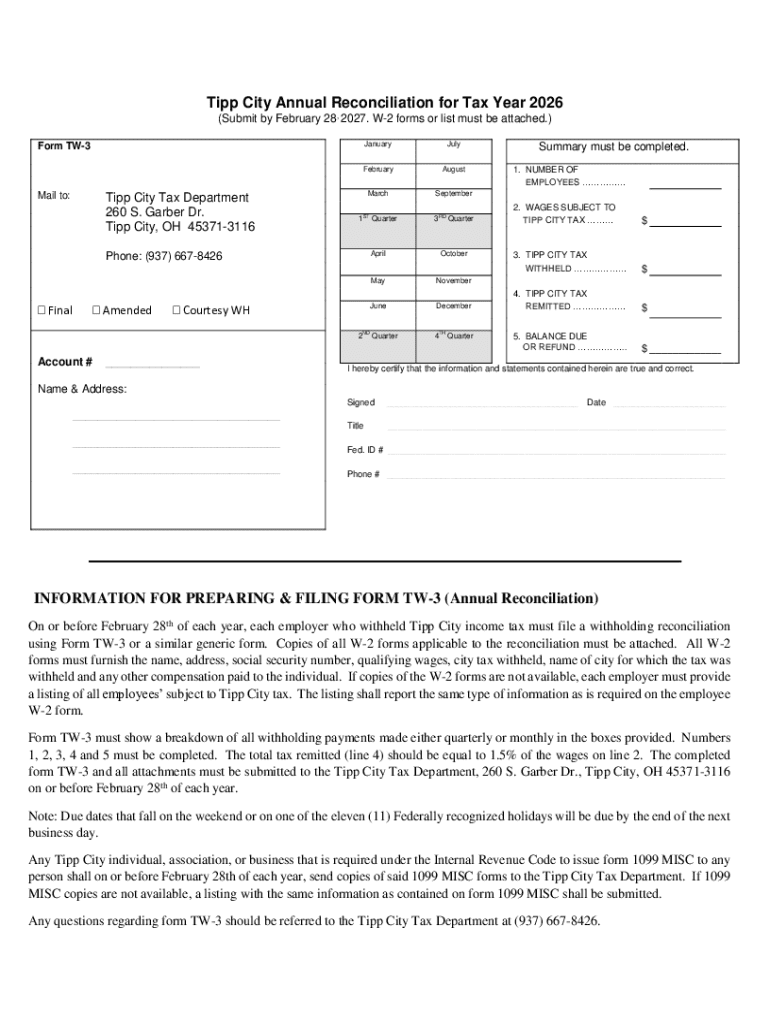

The Tipp City Annual Reconciliation Form is a crucial document for residents and businesses in Tipp City, Ohio, aimed at calculating income tax liabilities or any potential refunds due. This form serves to ensure that all taxable income is accurately reported and reconciled with the actual tax withholding during the year. Through this process, taxpayers can confirm compliance with local tax laws and contribute to the city’s revenue in a fair manner.

Annual reconciliation is especially important in Tipp City as it helps maintain transparency in the local tax system. Tax revenues are essential for funding community services such as education, infrastructure, and public safety. Filing the annual reconciliation form is not just a legal obligation but also a way to actively participate in community development. All taxpayers living or working in Tipp City are required to submit this form, making it a key component of the city's tax procedure.

Key components of the Tipp City Annual Reconciliation Form

Understanding the components of the Tipp City Annual Reconciliation Form is vital for accurate completion. Here’s a detailed breakdown of the key sections that the form entails:

Step-by-step instructions for completing the form

Completing the Tipp City Annual Reconciliation Form can seem daunting, but following a structured approach simplifies the process. Here’s a step-by-step guide to help you navigate through it:

Common mistakes to avoid when filing the Tipp City Annual Reconciliation Form

Filing taxes can be complex, and small mistakes can have significant consequences. Here are some common pitfalls to avoid when you’re filling out the Tipp City Annual Reconciliation Form:

Tips for managing the submission process

Choosing the right method for submitting your Tipp City Annual Reconciliation Form can make the process smoother. Here are some considerations to keep in mind:

Resources for additional assistance with the Tipp City Annual Reconciliation Form

If you find yourself needing help while completing the Tipp City Annual Reconciliation Form, several resources are available to aid you:

Frequently asked questions (FAQs)

Navigating the complexities of the Tipp City Annual Reconciliation Form can yield questions. Here are some frequently asked questions to guide you:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tipp city annual reconciliation?

How do I complete tipp city annual reconciliation on an iOS device?

How do I complete tipp city annual reconciliation on an Android device?

What is tipp city annual reconciliation?

Who is required to file tipp city annual reconciliation?

How to fill out tipp city annual reconciliation?

What is the purpose of tipp city annual reconciliation?

What information must be reported on tipp city annual reconciliation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.