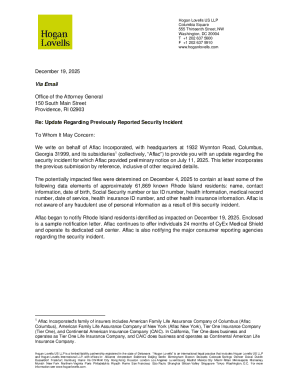

Get the free Form M-36 - Combined Claim For Refund Of Fuel Taxes ...

Get, Create, Make and Sign form m-36 - combined

How to edit form m-36 - combined online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form m-36 - combined

How to fill out form m-36 - combined

Who needs form m-36 - combined?

Form -36 - Combined Form: Your Comprehensive How-to Guide

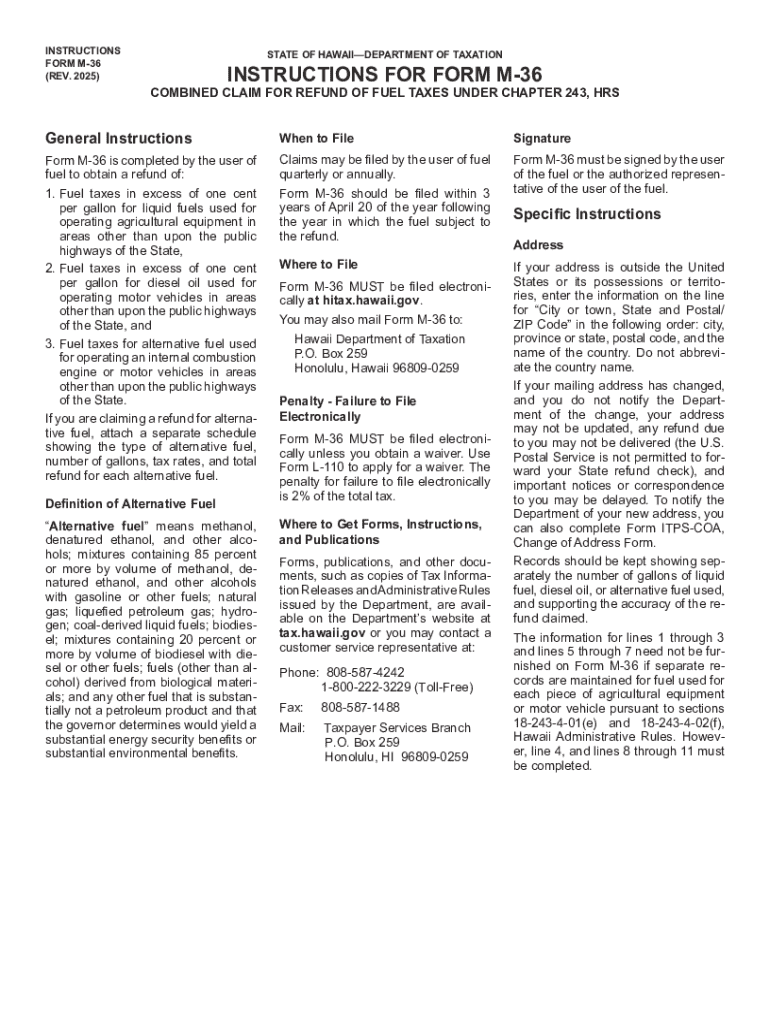

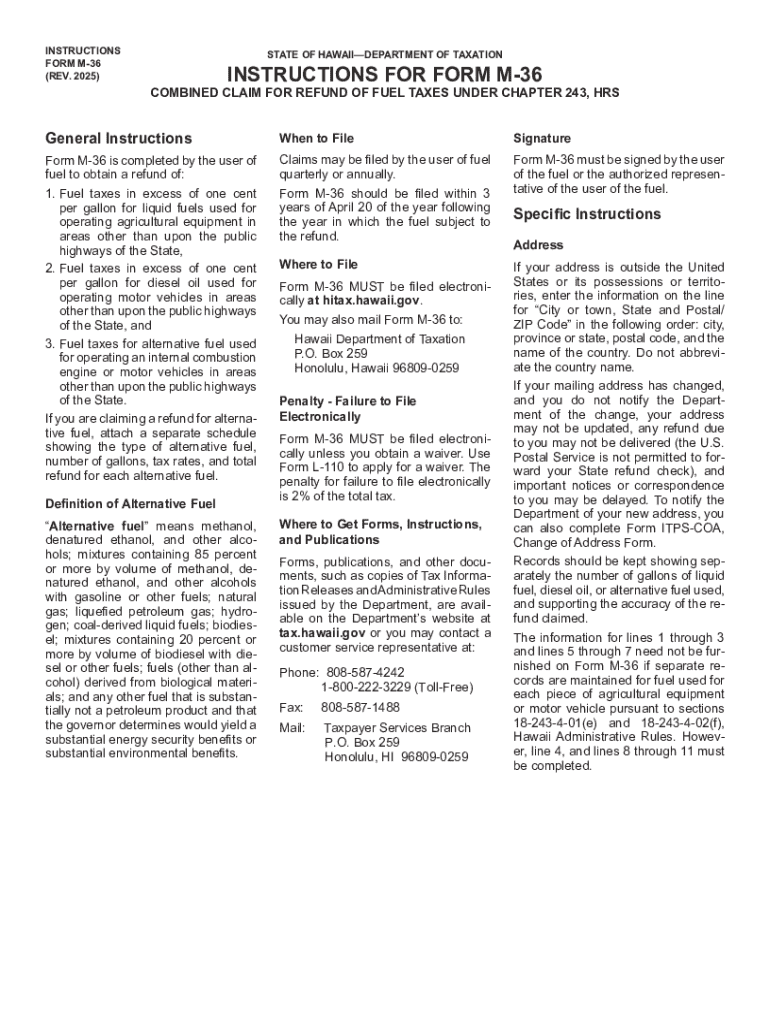

Overview of form -36

Form M-36 is a combined form designed to streamline various documentation processes, often required for tax and financial reporting. This form is essential for individuals and businesses alike, enabling them to provide comprehensive information in a consolidated format. The M-36 helps reduce redundancy, ensuring all relevant details are captured without overwhelming users with multiple forms.

The importance of the M-36 Combined Form lies in its ability to facilitate efficient document processing. It serves as a one-stop solution for submitting personal and financial data, making it significantly easier for both the filer and the receiving department. Utilizing this format can lead to quicker approvals and fewer errors due to its structured layout.

Understanding the components of form -36

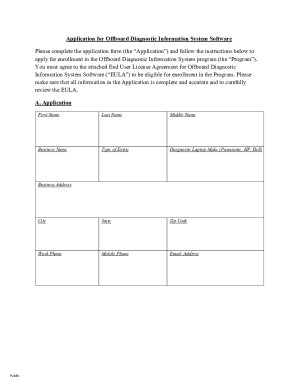

Form M-36 is divided into several sections, each carefully crafted to gather specific information from the user. First, the 'Personal Information' section requests basic data including name, address, and contact numbers. This information is pivotal for establishing the identity of the individual or entity filing the form.

Next is the 'Financial Details' section, where users must provide relevant financial figures, such as income, expenses, and other monetary details. Having precise financial data is crucial for accurate processing. Lastly, the 'Signatures and Authorizations' section ensures that the form is endorsed by the appropriate parties, confirming that the information provided is accurate and complete.

Understanding these components is vital for users, especially in terms of ensuring compliance and accuracy. Familiarity with common terms found in the form can further aid in the completion process.

Step-by-step instructions for filling out form -36

Filling out the M-36 form requires a systematic approach to ensure accuracy and completeness. The preparation phase involves gathering all necessary documents, such as previous tax returns, proof of income, and identification. Knowing what information is relevant will make the process more efficient.

Once you have gathered the necessary documents, begin filling out the form. Start with the 'Personal Information' section by including complete and accurate details. Double-check for typographical errors, as these can lead to complications later. Move on to the 'Financial Details' section, where you will input exact figures from your financial documents.

After filling in all required sections, review and confirm all entries for accuracy. It's crucial to ensure that all the information matches your documents to avoid any potential complications.

Finalizing the form involves a thorough double-check for any errors. Consider cross-referencing with your original documents and using validation tools available within platforms like pdfFiller.

Interactive tools for form -36

The digital landscape is continuously evolving, and tools for managing Form M-36 have also advanced significantly. Platforms like pdfFiller provide users with versatile digital avenues to create, fill out, and manage the M-36 form efficiently. One of the standout features is the editing options, enabling users to modify text and layout easily.

Additionally, eSigning functionalities offered by pdfFiller streamline the signing process, allowing for quick and secure electronic signatures. This not only boosts efficiency but also ensures that all parties can review documents collaboratively, making team submissions a breeze.

Editing and customizing your form -36

Sometimes, after filling out the M-36 form, users may find that changes are necessary. Knowing how to effectively edit the completed form is crucial. With pdfFiller, users can follow a few simple steps to make adjustments. Begin by opening the filled form and selecting what changes are needed, whether it’s correcting a typo or adjusting financial details.

Altering formats and structures, such as changing font styles or rearranging sections, is also straightforward. Users can save multiple versions of the M-36 form, making it easier to track changes over time. This flexibility is invaluable for ensuring that the final submission meets all standards.

Signing and submitting form -36

The signing and submission process of Form M-36 has also been greatly simplified with digital tools. Users can utilize eSigning options available via pdfFiller, allowing for secure and immediate signing. This feature eliminates the need for printing the form, signing it manually, and re-scanning — all of which can contribute to delays in submission.

When submitting electronically, ensure that all required documents are attached and that you have followed any specific submission guidelines dictated by your regulatory body. It's essential to adhere to key deadlines to avoid any penalties for late submissions.

Common errors and solutions when using the -36 combined form

Despite careful preparation, mistakes can still occur when filling out Form M-36. One of the most common errors is missing signatures; without proper authorization, the document may be considered invalid. Additionally, incorrect financial information can lead to significant complications. Users must ensure figures are verified against proper documentation.

To rectify such issues, users can utilize pdfFiller’s interactive features that allow for easy edits post-filling. Regularly reviewing the form during completion can help minimize mistakes, and utilizing validation tools can further enhance accuracy.

Tracking your form -36 after submission

Tracking the status of your Form M-36 submission is crucial, especially if the documents are critical to your financial standing or legal compliance. Utilizing pdfFiller’s tracking tools can help users monitor their submitted documents effortlessly. These tools can provide updates on whether the form has been received and if any further actions are necessary.

If a form is rejected or identified as requiring revisions, users can swiftly address any issues utilizing pdfFiller’s editing features. Quick response times can alleviate potential delays in processing.

FAQs about form -36

Many users have questions about the nuances of Form M-36, particularly regarding access and assistance. To access Form M-36, visit the relevant resources on pdfFiller’s website, where you can find both templates and guidance for completion. Should further assistance be necessary, reaching out to customer support can provide clarity and additional help.

Another common concern revolves around potential penalties arising from errors in submission. Understanding that many agencies offer grace periods for small mistakes can ease some of the anxiety associated with accuracy. It’s important to stay informed about the specifics related to your jurisdiction.

Related forms and templates

Form M-36 is just one of many forms that individuals and entities may require. There are several variants that serve specific purposes and demographics. Understanding how to transition between related documents can make the preparation process smoother. pdfFiller provides links and access to various other forms, making it a convenient one-stop resource for all documentation needs.

Having access to related templates allows users to efficiently manage their documentation without having to search multiple platforms. By conveniently accessing various forms on pdfFiller, you can ensure all paperwork is coherent and consistent.

Testimonials and user experiences with form -36

User experiences with the M-36 form often highlight the effectiveness of pdfFiller’s platform. Many users report improved accuracy and speed in completing their documentation, showcasing how easy the platform makes the submission process.

Real-life use cases demonstrate how pdfFiller’s features can positively impact users, both from individual filers and teams managing multiple submissions. Customer success stories paint a picture of enhanced efficiency, showcasing the benefits of adapting to digital forms in today's workflow.

Best practices for document management with pdfFiller

To maximize the benefits of using pdfFiller for managing Form M-36 and other documentation, users should adopt best practices for document management. Strategies for organizing forms effectively can greatly enhance workflow and efficiency. Consider creating a centralized filing system within pdfFiller, allowing easy access to all necessary documentation.

Collaborative environments benefit immensely from structured document management. Encourage team members to utilize shared folders, or comment functions for instant feedback. Ensuring the security and accessibility of documents is paramount, especially when handling sensitive information.

Preparing for future updates to form -36

Staying informed about changes to Form M-36 is crucial for ongoing compliance and effective document management. Regularly check for updates from your relevant authorities—this can include new requirements or revisions to existing processes. Being proactive in staying up to date ensures that your submissions will continue to meet all necessary standards.

It's also wise to adapt to new features offered by pdfFiller. The platform frequently introduces enhancements, and being aware of these updates can provide users with more tools for efficiency. Preparing ahead for upcoming deadlines or tax seasons can alleviate last-minute stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form m-36 - combined?

Can I edit form m-36 - combined on an iOS device?

Can I edit form m-36 - combined on an Android device?

What is form m-36 - combined?

Who is required to file form m-36 - combined?

How to fill out form m-36 - combined?

What is the purpose of form m-36 - combined?

What information must be reported on form m-36 - combined?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.