Get the free Clergy Housing AllowanceWespath Benefits & Investments

Get, Create, Make and Sign clergy housing allowancewespath benefits

How to edit clergy housing allowancewespath benefits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out clergy housing allowancewespath benefits

How to fill out clergy housing allowancewespath benefits

Who needs clergy housing allowancewespath benefits?

Clergy Housing Allowance Wespath Benefits Form: A Comprehensive Guide

Understanding clergy housing allowance

The clergy housing allowance is a tax-exempt benefit designed to support clergy members in managing their housing expenses. By offering this allowance, religious organizations provide crucial financial assistance that alleviates the burden of housing costs, allowing ministers to focus more on their spiritual duties. The allowance can cover rent, mortgage payments, property taxes, utility bills, and other housing-related expenses.

For clergy members, understanding and maximizing the benefits of the housing allowance is essential for effective financial planning. This allowance not only helps create a stable living situation but also significantly impacts tax obligations, making it a key focus area for budgeting and financial strategies.

Overview of Wespath benefits

Wespath Benefits and Investments is an organization dedicated to supporting the financial, health, and wellness needs of clergy and church employees. With extensive experience in managing clergy benefits, Wespath provides a multitude of services, including retirement planning, insurance options, and of course, the clergy housing allowance.

Among the key benefits Wespath offers, the housing allowance stands out for its tax advantages. By utilizing this allowance, clergy can minimize their taxable income, resulting in significant savings. Understanding the tax implications of the housing allowance is crucial, as it can afford ministers increased financial flexibility and stability.

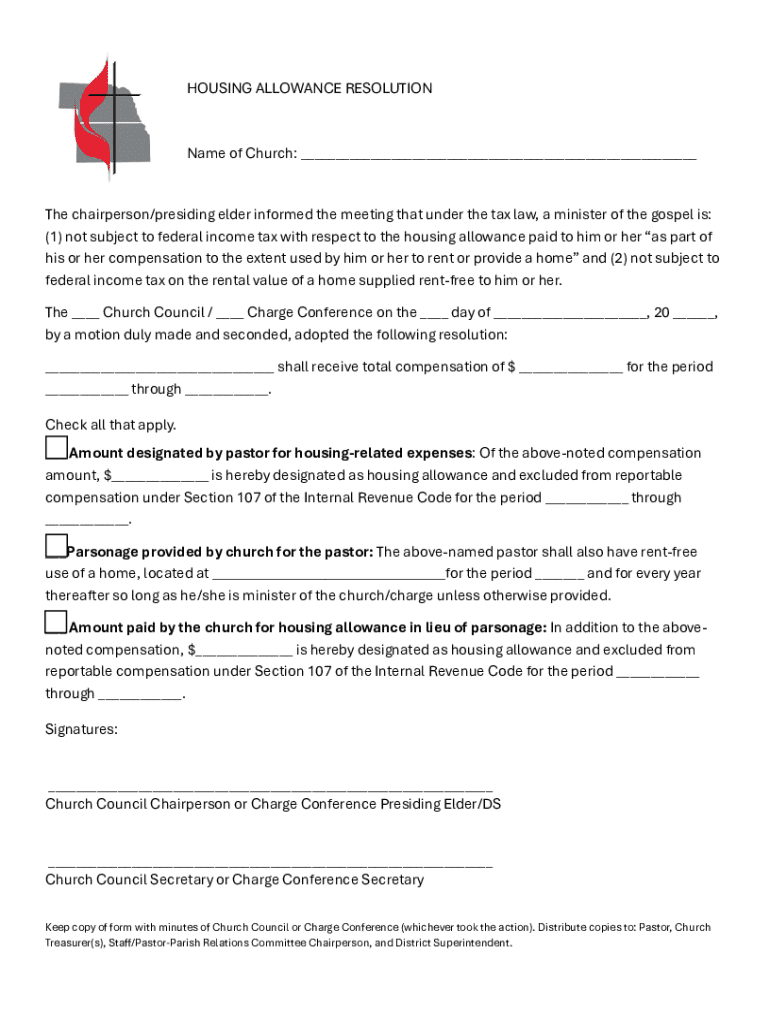

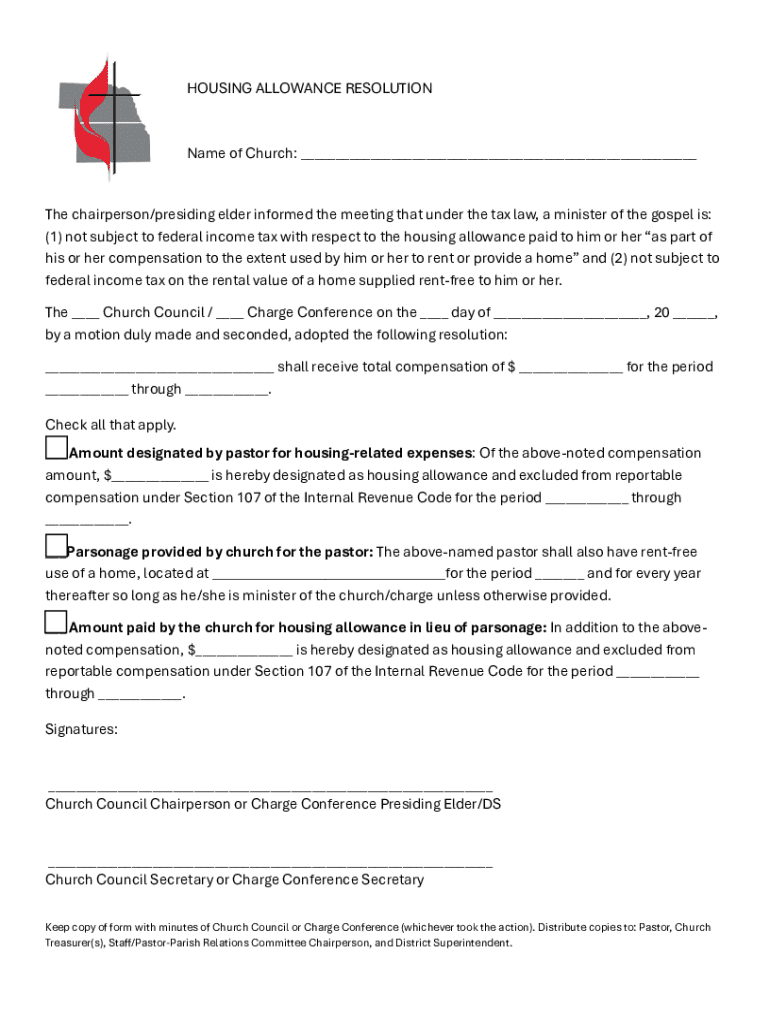

Navigating the housing allowance form

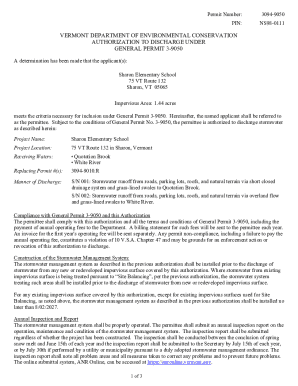

Filling out the clergy housing allowance form can seem daunting, but it is a straightforward process. The form serves as a critical document that verifies the eligibility and amount of the housing allowance. There are several forms associated with the clergy housing allowance, including the application form and annual reports.

To access the housing allowance form, visit Wespath's official website. Navigate to the resources designated for clergy benefits, where you can locate and download the form you need.

Filling out the clergy housing allowance form

When it comes to filling out the clergy housing allowance form, providing accurate information is paramount. The form consists of several sections aimed at gathering essential data about the applicant and their housing arrangements. Starting with personal information, ensure you include your full name, address, and contact details.

In the housing details section, you should specify the type of housing you reside in, whether it's owned, rented, or a parsonage provided by your congregation. Understanding the types of housing eligible for the allowance is key, as it encompasses various arrangements that can reduce tax liabilities.

Calculating your allowance accurately is crucial. To estimate your allowance, compile your housing expenses, including rent or mortgage payments, utilities, insurance, and property taxes. Ensuring this section is calculated correctly would help prevent issues later on.

Editing and managing your housing allowance form

Once you have filled out the clergy housing allowance form, you may need to make adjustments or collaborate with team members. Utilizing document editing software like pdfFiller is invaluable here. This platform enables users to easily edit, sign, and share documents, making the management process significantly smoother.

Collaboration is streamlined through features that allow team members to leave comments, request edits, and even fill out sections of the form where necessary. Storing completed forms in the cloud also ensures easy access and management, reducing the chances of losing important paperwork.

Submitting your housing allowance form

When you’re ready to submit your clergy housing allowance form, following best practices is critical. Make sure to submit the completed form before the stipulated deadline to ensure eligibility for the allowance. Deadlines may vary, so it’s essential to confirm the specific dates outlined on the Wespath website.

If you encounter difficulties while submitting or have questions about the process, don't hesitate to contact Wespath's support team for assistance. They are well-equipped to provide the guidance you need to navigate any challenges.

Resources for clergy on housing allowance

Having access to reliable resources can streamline the process of navigating the clergy housing allowance. Frequently asked questions about the housing allowance can be a valuable first step for clarification, ensuring everyone understands the requirements and implications of the allowance thoroughly.

Additionally, the Wespath website provides links to further resources, including guides, calculators, and budgeting tools specifically tailored for clergy members. Consider using these tools to strengthen your financial planning related to the housing allowance.

Testimonials and case studies

Real-life testimonials from clergy members who have successfully benefited from the housing allowance can offer insights and encouragement to others considering their options. Stories shared often highlight how the assurance of a housing allowance has brought financial stability and reduced stress in their personal lives.

These success stories can also demonstrate the tangible benefits of utilizing the housing allowance correctly, signaling how it can be a valuable asset in achieving long-term financial goals.

Staying informed: changes in benefits and policies

Remaining up-to-date with Wespath's changes regarding housing allowance policies is essential for clergy members. Regular communication from Wespath provides valuable updates and clarifications on eligibility, changes to the tax code, and other pertinent matters. Being proactive about annual reviews of your housing allowance is also advised, ensuring that you continue to meet the criteria and adjust your application as necessary.

Wespath may also host webinars or workshops aimed at educating clergy on the housing allowance and related financial literacy topics. Participating in these events can provide invaluable knowledge, keeping you well-informed.

Engaging with clergy housing resources

Social media channels can be an effective way to connect with fellow clergy and share experiences related to the housing allowance. Engaging in online directories or community forums can help create a support network, making it easier to navigate this complex process together.

In addition, local clergy housing support groups often host events or discussions focused on housing allowances and financial planning. By participating in these groups, clergy members can contribute to a sense of community and share valuable tips and advice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify clergy housing allowancewespath benefits without leaving Google Drive?

Where do I find clergy housing allowancewespath benefits?

How can I edit clergy housing allowancewespath benefits on a smartphone?

What is clergy housing allowancewespath benefits?

Who is required to file clergy housing allowancewespath benefits?

How to fill out clergy housing allowancewespath benefits?

What is the purpose of clergy housing allowancewespath benefits?

What information must be reported on clergy housing allowancewespath benefits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.