Get the free Gifts, Donations, & Transfers - The University of Tennessee ...

Get, Create, Make and Sign gifts donations amp transfers

Editing gifts donations amp transfers online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gifts donations amp transfers

How to fill out gifts donations amp transfers

Who needs gifts donations amp transfers?

Comprehensive Guide to Gifts Donations & Transfers Form

Understanding the gifts donations & transfers form

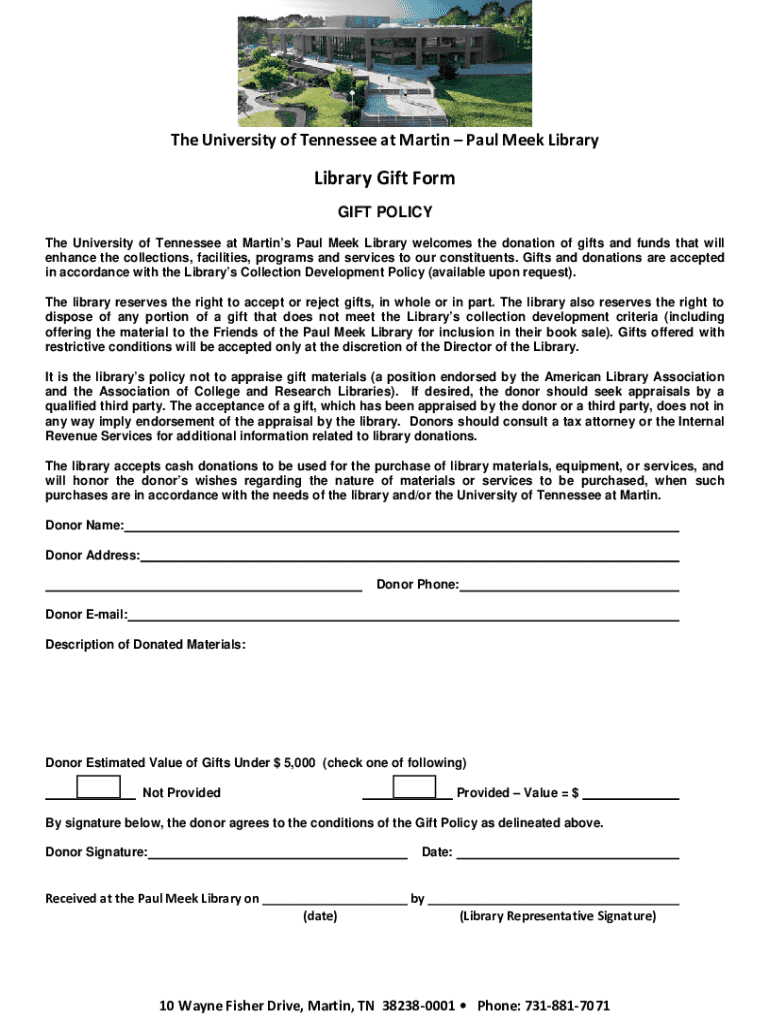

The Gifts Donations & Transfers Form is a crucial document used for recording various types of contributions and transfers, whether they be financial gifts to individuals or nonprofits, or asset transfers between parties. This form plays a pivotal role in ensuring transparency and accuracy in documenting these transactions. With non-profits, for instance, accurately tracking donations can influence tax deductions for donors and is key in maintaining their operational integrity.

The importance of this form extends beyond mere record-keeping; it enhances internal document management processes. For teams, having a standardized form allows every member to understand their contribution towards efficient record maintenance, ensuring that everyone is on the same page regarding donations and transfers.

Benefits of using the gifts donations & transfers form

Utilizing the Gifts Donations & Transfers Form significantly streamlines the process for creating and managing relevant documents. Instead of wrestling with multiple documents or tools, users can rely on a singular platform to gather all necessary information in one place. It allows for smoother tracking of financial contributions, providing an organized way to oversee funds moving between accounts, whether from a credit card account or checking account.

Moreover, modern cloud-based solutions, such as pdfFiller, ensure that this form is accessible from anywhere. This is especially beneficial for individuals and teams who may need to share and access this information on-the-go, making documentation much more flexible and dynamic.

Enhanced collaboration features allow teams to work together more effectively. Team members can edit, comment, and annotate the document in real time, ensuring all inputs are included and that nothing is overlooked. Additionally, compliance and legal assurance are integral benefits; using standardized forms means users are less likely to make mistakes that could lead to challenges down the line.

Getting started with the gifts donations & transfers form

To utilize the Gifts Donations & Transfers Form, start with accessing the pdfFiller platform. Navigate to the landing page where various template forms are available. Once you locate the Gifts Donations & Transfers Form, you can select it based on your specific needs, such as whether the transaction is for personal use or involves multiple parties.

Interactive tools on pdfFiller allow for a personalized experience, enabling users to tailor the form to their liking by adding specific information or additional fields as necessary.

Detailed walkthrough: Filling out the gifts donations & transfers form

Filling out the Gifts Donations & Transfers Form can initially seem daunting, but a section-by-section breakdown simplifies the process. Begin by entering your personal information, which is essential for identification purposes. Providing accurate contact and identification details ensures proper transfer of funds or assets.

Next, detail the donation or transfer. Specify the amounts and any pertinent conditions attached to this financial transaction. Ensure the reason for the transfer is clear, especially in cases where tax implications may arise. The last essential part of the form is collecting signatures and completing verification steps. Acquire signatures from all parties involved, as this validates the transaction and confirms consent from each participant.

One common mistake to avoid during completion is leaving out essential personal or financial details; this can lead to delays in processing the transfer or donation and create potential confusion later.

Editing options: Customizing your gifts donations & transfers form

After filling out the form, it is often necessary to review and make edits to ensure maximum accuracy before submission. pdfFiller provides various editing options, allowing users to modify their forms seamlessly. You can comment, annotate, or even highlight specific areas needing attention or clarification, which is particularly useful when collaborating on the form with a team.

For those needing to incorporate additional signatures or fields, pdfFiller’s user-friendly features enable easy adjustments. This adaptability ensures you can maintain transparency across teams, receive feedback, and make necessary changes before final submission of the Gifts Donations & Transfers Form.

eSigning the gifts donations & transfers form

Electronic signatures are becoming a standard practice in modern document management, and this is no different with the Gifts Donations & Transfers Form. They facilitate quick and efficient transactions while ensuring that all parties involved have agreed to the terms laid out in the document.

To eSign the form, start the signing process through pdfFiller. You can choose from various options for adding your signature, including drawing it, uploading an image, or using a mouse. Once you’ve incorporated the signature, save the document, and sharing it electronically is just a click away.

Managing your gifts donations & transfers form

Once you have completed the Gifts Donations & Transfers Form, effective management of your documents on pdfFiller becomes paramount. The platform allows users to store and organize forms systematically which facilitates quick retrieval when necessary. Consider naming conventions for easy searching later, especially if numerous forms are involved.

Document management best practices include maintaining version control—keeping track of changes will ensure that you always reference the most current and accurate information. Sharing your completed forms can be done easily through secure methods provided by pdfFiller, allowing you to collaborate with colleagues or donors without compromising security.

Real-life scenarios and success stories

Many individuals and organizations have successfully utilized pdfFiller through real-life scenarios involving the Gifts Donations & Transfers Form. For instance, a local charity organized a fundraising event and used the platform to streamline their donation process. Participants were able to complete forms on-site, directly relating their donations to their bank transfer records efficiently.

Additionally, testimonials from users highlight how pdfFiller has transformed their document management experience. One user noted that their staff’s planning and contribution tracking improved significantly since implementing the use of electronic forms. The hassle of disjointed paperwork was eliminated, leading to greater productivity and improved trust among volunteers and donors.

Troubleshooting common issues

Even with a highly efficient platform like pdfFiller, users may encounter challenges when filling out the Gifts Donations & Transfers Form. Commonly asked questions typically revolve around user access, editing capabilities, and submission processes. Resolving these issues typically involves checking your device settings or consulting pdfFiller’s help resources.

Solutions to common problems may include ensuring you're using a compatible web browser, verifying that all necessary fields have been filled out, and double-checking that opting for electronic signatures is well understood by all parties involved. For additional help and support, resources available through the pdfFiller website are particularly valuable. They guide you through troubleshooting steps to streamline your experience.

Conclusion: The future of document management with pdfFiller

Leveraging technology for efficient document processes, such as the Gifts Donations & Transfers Form, places users ahead in the ever-evolving landscape of document management software. Embracing digital solutions translates to enhanced efficiency in handling contributions and transfers, while fostering collaboration and compliance across teams.

As more users recognize the benefits of digitizing their paperwork, platforms like pdfFiller empower individuals and teams to work smarter by simplifying processes and ensuring compliance in an era where accurate record-keeping is vital. Transitioning to a comprehensive, cloud-based document creation solution can revolutionize how organizations manage gifts, donations, and transfers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gifts donations amp transfers for eSignature?

Where do I find gifts donations amp transfers?

How do I complete gifts donations amp transfers online?

What is gifts donations amp transfers?

Who is required to file gifts donations amp transfers?

How to fill out gifts donations amp transfers?

What is the purpose of gifts donations amp transfers?

What information must be reported on gifts donations amp transfers?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.