Get the free Form 1 (MD)

Get, Create, Make and Sign form 1 md

Editing form 1 md online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1 md

How to fill out form 1 md

Who needs form 1 md?

Comprehensive Guide to Form 1 Form: Completing Your Submission with Confidence

Overview of Form 1

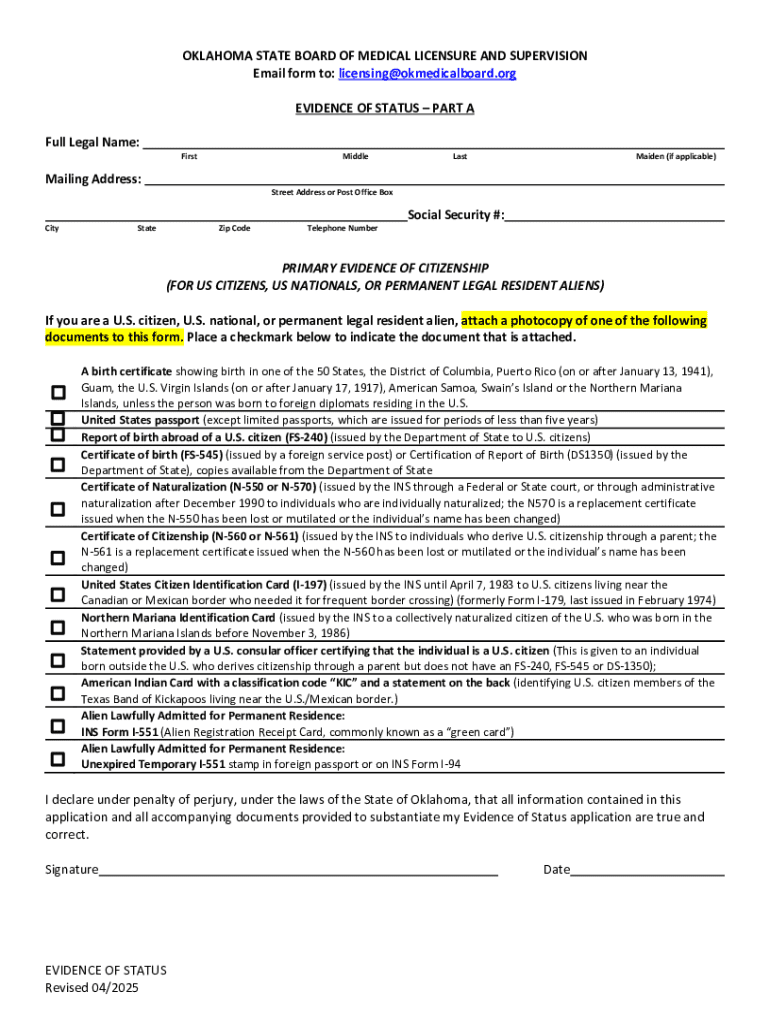

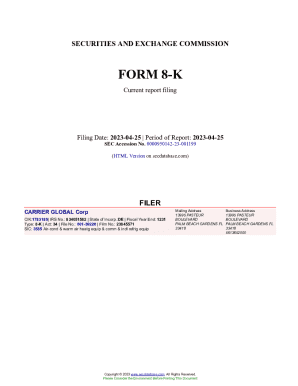

Form 1 MD serves as a critical document in the state of Maryland, primarily utilized for reporting information related to individual and business activities. The purpose of this form extends beyond mere compliance, playing a significant role in ensuring that both individuals and businesses maintain transparent and accurate records with the Maryland State Department of Assessments and Taxation. Whether you're an individual filing personal information or a business entity detailing operational metrics, Form 1 is essential for compliance and keeping your records current.

The significance of Form 1 cannot be overstated, as it directly impacts your tax obligations and business standing within the state. Accurate completion and timely submission are essential to avoid potential penalties and ensure that your information is updated in state databases. For those who wish to remain compliant with Maryland law, understanding this form is paramount.

Preparing to complete Form 1

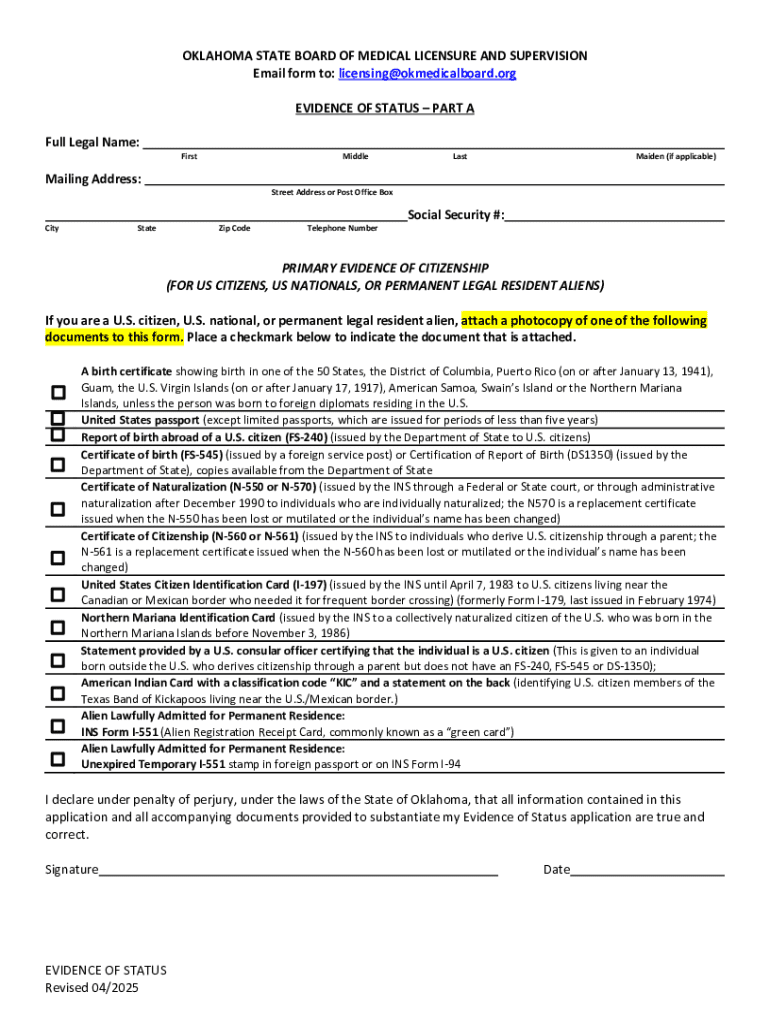

Before diving into the specifics of filling out Form 1 MD, proper preparation is crucial. Gathering all necessary information and documentation can streamline your completion process and minimize errors. Start by assembling your personal information, including your name, address, and Social Security number. If you're completing the form on behalf of a business, you will also need the entity's name, state of registration, and federal Employer Identification Number (EIN).

In addition to personal and business details, relevant financial data, such as your income, expenses, and any applicable deductions, should be organized. For optimal efficiency, create a checklist of required documents and information to make the process smoother. Tips for organizing your information effectively include using digital tools or applications to track and store documents, ensuring you're ready to fill out Form 1 without unnecessary delays.

Step-by-step instructions for filling out Form 1

Filling out Form 1 MD is a straightforward process when you break it down into manageable sections. Let’s go through the form, section by section, to ensure comprehensive understanding.

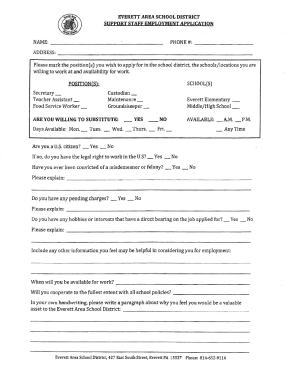

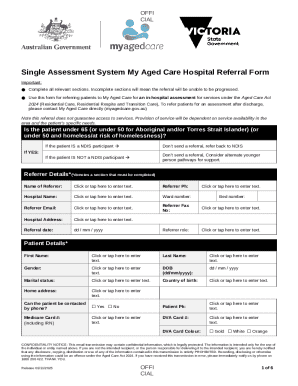

Section 1: Applicant information

In this section, you’ll input your personal details. Common required fields include your full name, residential phone number, email address, and physical address. Make sure to double-check the accuracy of your information, as small typographical errors can lead to significant issues down the line. One common mistake is the improper formatting of phone numbers or mistakenly inputting the wrong middle initial. Always verify that the information reflects your current status.

Section 2: Business information (if applicable)

If you are filing on behalf of a business, you will need to fill out this section accurately. Include the legal name of the business, the trade name if applicable, the type of business structure, and your Employer Identification Number. Be cautious when selecting a business structure, as there are various types (e.g., LLC, Corporation, Sole Proprietorship). Understanding which classification applies to your situation is vital for both taxation and legal matters.

Section 3: Financial information

This section requires a detailed report of your financial activities. Necessary data includes total earnings, business expenses, and any deductions you may qualify for. Guidelines for accurately reporting these figures should include consulting tax records or financial statements to ensure accuracy. It may also be beneficial to keep a record of any receipts or invoices that support your reported figures. This preparation will not only aid in filling out Form 1 but will also be advantageous for future reference.

Section 4: Signatures and authorization

The final section of Form 1 requires signatures to authenticate the information provided. Be aware that all parties involved—whether it’s an individual or representatives of a business—must sign off on the form. If you choose to e-sign, ensure you understand the implications of doing so, as electronic signatures hold the same weight as handwritten ones in Maryland.

Editing and reviewing your form

Proofreading your Form 1 is an integral part of the completion process that should never be overlooked. Errors can lead to complications during processing, potentially delaying your submission. Effective proofreading strategies include reading the form out loud, which can help catch mistakes that you may overlook when reading silently. Additionally, having a trusted colleague or friend review your form can provide an extra set of eyes to catch potential errors.

Utilizing pdfFiller’s editing tools can significantly enhance your review process. With features that allow for easy corrections and adjustments, you can rectify mistakes with confidence and clarity.

Submitting Form 1

Once your Form 1 is complete and reviewed, the next step is submission. Maryland offers multiple methods for submission, ensuring flexibility and convenience for users.

Submission methods

1. **Online submission**: Utilizing Maryland's e-Services portal allows you to submit your Form 1 quickly and securely. Ensure you have all required credentials on hand before starting the online process.

2. **Mailing**: If you prefer traditional methods, you can print your completed form and mail it to the designated state address. Confirm the mailing address on the Maryland state website to avoid delays.

Additionally, be mindful of deadlines related to Form 1 submissions. Each year, specific dates are set, and filing late can result in penalties that could impact your standing either as an individual or a business.

Finally, review any fees associated with the submission to avoid unexpected charges upon filing.

Managing your form after submission

After submitting your Form 1, it’s important to know how to manage it effectively. Keeping track of your submission status can provide peace of mind and ensure that you’re aware of any follow-up actions. Maryland’s e-Services portal often allows users to check the status of submitted forms, providing real-time updates on progress.

Upon submission, expect communication from state entities, which may include confirmation emails targeting your filing status. However, if there are issues or if your form is rejected, familiarize yourself with the procedures for addressing these concerns promptly to avoid future complications.

Frequently asked questions (FAQs)

1. **What to do if you make a mistake on your Form 1?** If you realize there’s an error after submission, you will typically need to file an amendment. The specific process for amending Form 1 may be specified on Maryland’s taxation website.

2. **Can you amend Form 1 once submitted?** Yes, amendments can be made, but it's crucial to follow the appropriate channels to ensure your updated information reflects correctly in state records.

3. **How does Form 1 impact your tax status or obligations?** Accurate completion and submission of Form 1 directly affect your tax status with the state. Inaccuracies may lead to audits or reassessments of your tax obligations.

Interactive tools for easy form management

pdfFiller offers a suite of interactive tools designed to simplify form management, particularly for Form 1 MD. Users can take advantage of document collaboration tools to work together on form preparation seamlessly.

E-signature capabilities allow users to sign forms digitally, enhancing convenience while ensuring compliance. With real-time collaborative editing features, multiple team members can contribute to the form simultaneously, ensuring accuracy and expedience in completion. Moreover, secure storage solutions offered by pdfFiller keep your documents organized and accessible when needed.

Additional tips for success

Maintaining thorough documentation and staying informed about Maryland regulations is essential for anyone regularly submitting Form 1. Best practices for documentation include consistently saving all forms, receipts, and related documents in a structured digital filing system.

Staying updated on Maryland legislation is equally important, as regulations can evolve. Utilizing online resources and community forums can provide valuable insights and guidance, ensuring you're never caught unaware of changes that might affect your Form 1 filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 1 md online?

How do I fill out the form 1 md form on my smartphone?

Can I edit form 1 md on an Android device?

What is form 1 md?

Who is required to file form 1 md?

How to fill out form 1 md?

What is the purpose of form 1 md?

What information must be reported on form 1 md?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.