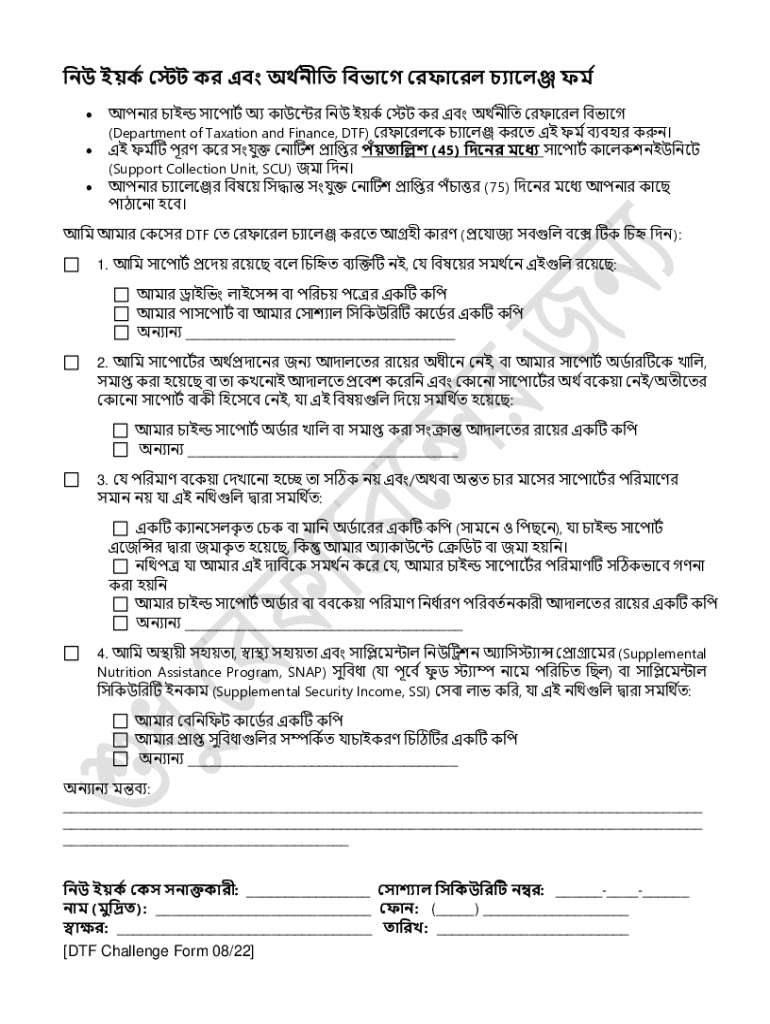

Get the free Dept. of Taxation and Finance Referall-BE. DTF Referral Form-BE - childsupport ny

Get, Create, Make and Sign dept of taxation and

Editing dept of taxation and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dept of taxation and

How to fill out dept of taxation and

Who needs dept of taxation and?

Dept of Taxation and Form: A Comprehensive How-to Guide

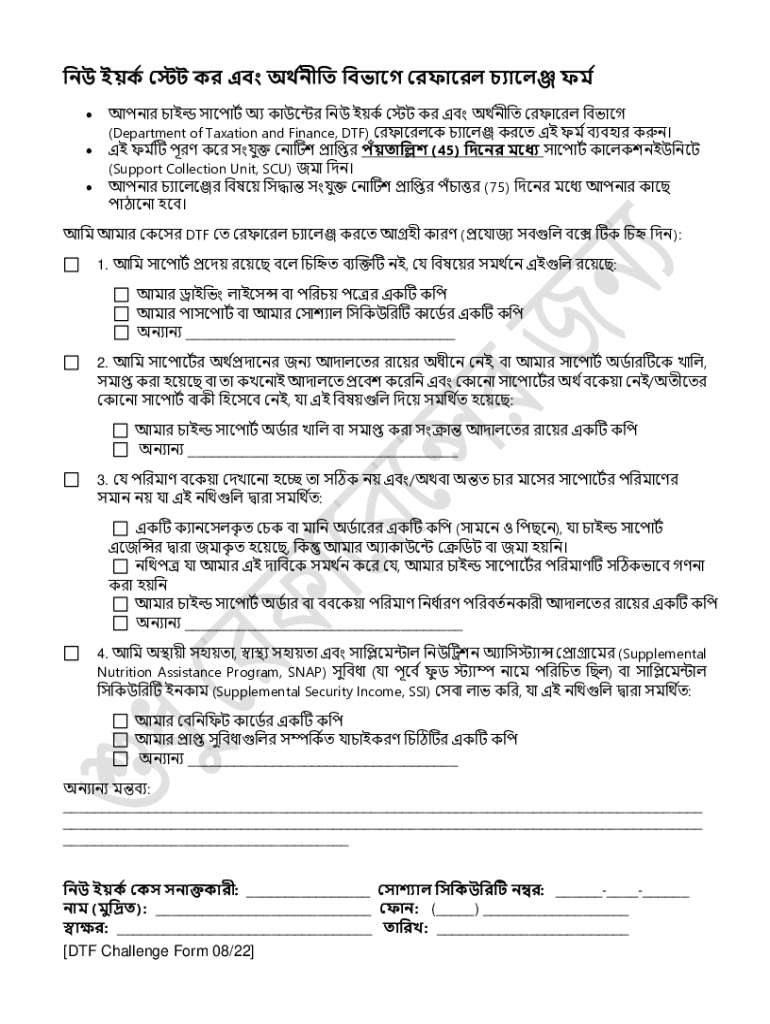

Understanding the dept of taxation

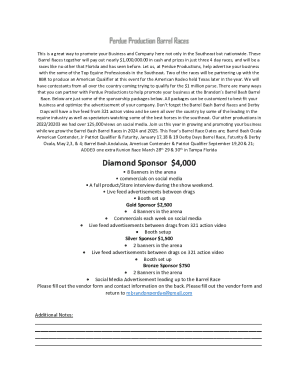

The Dept of Taxation plays a crucial role in managing tax policy and ensuring compliance with state and federal tax laws. It administers the collection of taxes, facilitates tax compliance, and oversees the enforcement of laws related to taxation. For individuals and businesses alike, understanding the functions and operations of the Dept of Taxation can significantly impact financial planning and filing procedures.

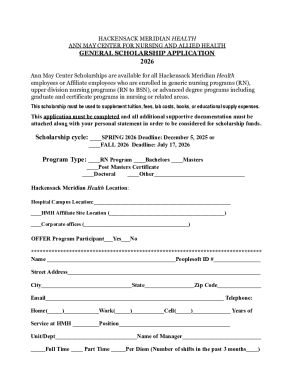

Taxation forms are essential documents used to report income, calculate taxes owed, and claim deductions or credits. These forms vary based on the type of tax, the taxpayer's status, and specific income streams involved. Familiarity with these forms can streamline the filing process and ensure accuracy, preventing issues with tax authorities.

Compliance with taxation requirements is not just a legal obligation; it is also a means of ensuring financial health for individuals and businesses. Failure to submit the correct forms can result in penalties, interest, and other legal ramifications. Thus, understanding the dept of taxation and the required forms is paramount for successful tax management.

Types of taxation forms

Taxation forms are categorized by the nature of the taxpayer and the specific type of taxes involved. Individual taxpayers typically encounter forms for personal income tax, whereas businesses deal primarily with corporate tax forms. Each category has distinct requirements and implications that taxpayers must navigate carefully.

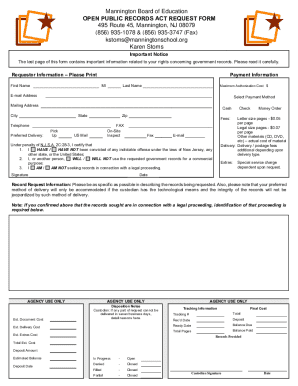

Navigating the department's online resources

With the growth of digital tools, the Department of Taxation provides online resources to help taxpayers access crucial information swiftly. The official taxation portal is an invaluable asset for finding necessary forms and instructions. Familiarizing yourself with the layout and features of this platform can save time and enhance the overall filing experience.

For efficient navigation, users should utilize search functionalities and filters available on the government website. This allows you to pinpoint specific forms or topics of interest quickly, reducing the frustration commonly associated with paperwork.

Filling out taxation forms: step-by-step instructions

Completing taxation forms accurately is crucial for successful filing. Start by gathering all necessary documents, such as W-2 forms, 1099s, and any relevant receipts for deductions. Familiarize yourself with common terms and phrases used within the forms to avoid confusion later on.

The actual process of filling out forms can be broken down into several steps. Firstly, enter your personal information, including name, address, and Social Security number. Next, report your income accurately, ensuring you include all applicable sources of income. Then, apply for deductions and credits you are eligible for, as they can reduce your tax burden significantly. Finally, remember to sign where required and double-check your entries for accuracy before submission.

Tips for editing and managing your tax forms

Editing and managing your tax forms can be simplified using tools such as pdfFiller. This cloud-based platform allows for seamless editing and collaboration, making tax document management a breeze. Utilize pdfFiller’s features to streamline the creation, modification, and storage of your taxation forms.

Using electronic signatures not only expedites the signing process but also enhances security. With pdfFiller, you can eSign documents securely, ensuring your approvals are legitimate and your private information stays protected.

Frequently asked questions (faqs)

Navigating the complexities of tax forms can lead to various questions and concerns. Here, we address some common queries that many taxpayers have, assisting you in resolving any confusion you may encounter.

Getting additional help

If additional help is needed, contacting the Department of Taxation can provide clarity and assistance for specific inquiries or issues. They often have dedicated support channels where taxpayers can receive guidance on form-related concerns.

Language assistance and accessibility options

Taxpayers can benefit from multilingual resources made available by the Department of Taxation. By providing instructions and forms in various languages, the department ensures that non-native speakers can also comply with tax regulations effectively.

Real-life case studies

Understanding the practical applications of tax forms through real-life scenarios can illuminate how the information applies. Consider various situations individuals and businesses face while filing forms, which can reveal insights into best practices and common pitfalls.

Feedback and continuous improvement

The process of filling out forms can always benefit from user feedback, which can help improve the experience for everyone. Taxpayers are encouraged to provide feedback on their experiences to enhance future offerings by the Department of Taxation and relevant platform providers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get dept of taxation and?

How do I edit dept of taxation and in Chrome?

How do I fill out dept of taxation and on an Android device?

What is dept of taxation and?

Who is required to file dept of taxation and?

How to fill out dept of taxation and?

What is the purpose of dept of taxation and?

What information must be reported on dept of taxation and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.