Get the free S 770 Filed

Get, Create, Make and Sign s 770 filed

How to edit s 770 filed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out s 770 filed

How to fill out s 770 filed

Who needs s 770 filed?

Understanding the S 770 filed form: A Comprehensive Guide

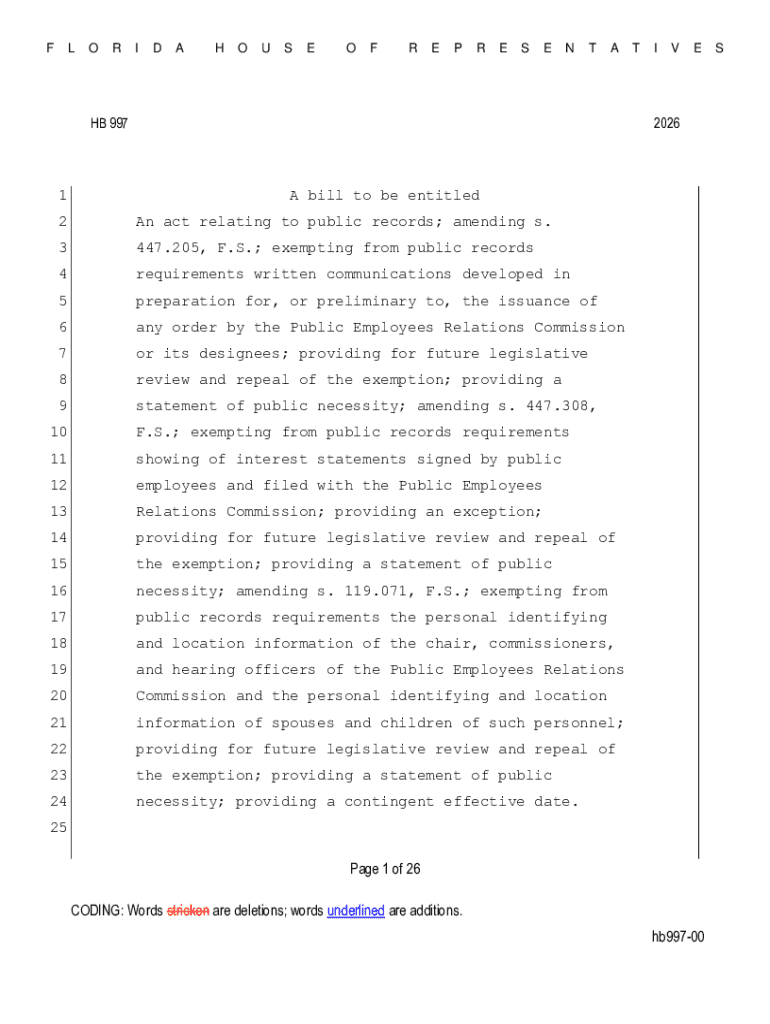

Overview of form S-770

The S-770 form, crucial for many individuals and organizations, serves a specific purpose within the realm of financial disclosures. It is primarily used to report various financial details to relevant authorities, ensuring transparency and compliance. Failing to file this form accurately can lead to significant legal consequences, making it paramount for filers to understand its requirements thoroughly.

Accurate filing of the S-770 form is vital for maintaining credibility with financial institutions and regulatory bodies. The form helps stakeholders understand an entity’s financial standing, facilitating informed decisions. Common scenarios that require the S-770 include applying for grants, loans, or when an organization is undergoing audits.

Who needs to file the S-770 form?

A diverse range of individuals and organizations may need to file the S-770 form. Typically, individuals seeking financial assistance, such as loans or grants from banks or governmental sources, will find themselves in need of this form. Businesses ranging from small startups to large corporations also routinely file the S-770 when engaging with stakeholders who require detailed financial insights.

Furthermore, specific professions—like non-profit organizations and educational institutions—often rely on the S-770 form to disclose financial aspects during funding applications. To be eligible for filing, entities must meet certain criteria, including operating within regulated industries, maintaining specific revenue thresholds, or having outstanding financial obligations that necessitate disclosure.

Detailed instructions for completing the S-770 form

Completing the S-770 form correctly is essential for transparent financial reporting. The process typically consists of three primary steps. The first step is to gather required information, which includes personal details like full name, address, social security number, and financial specifics such as income, assets, and liabilities that are vital for accurate disclosures.

The second step involves accurately filling out the form. The S-770 is typically divided into three sections: personal information, financial disclosures, and signature along with affidavit requirements. It’s crucial to report all the requested information truthfully and precisely, as inaccuracies can lead to penalties or rejection of your application.

Lastly, a thorough review of your filled form can significantly reduce errors. Checking for typos, inconsistent financial figures, or incomplete sections is essential. Seeking a peer review or consulting with an expert to evaluate your form can also provide an extra layer of assurance before submission.

Using pdfFiller for S-770 form management

Managing your S-770 form using pdfFiller simplifies the overall process. With pdfFiller’s intuitive interface, users can easily edit and manage their forms without hassle. The platform allows you to make amendments directly to the document, ensuring that your information is always up to date.

Moreover, pdfFiller offers interactive tools for editing the S-770 form, making it user-friendly for both individuals and teams. Features such as eSigning allow users to sign their forms electronically, boosting efficiency and convenience in file management. By leveraging pdfFiller, you can ensure that your documents are well-organized and compliant with filing requirements.

Submitting your S-770 form

Submitting the S-770 form can be done through several methods, providing flexibility to filers. Individuals can choose to submit online, via mail, or in person at designated locations. Each method has its advantages, with online submissions typically being the fastest way to ensure your application is received promptly.

Key deadlines for filing the S-770 form differ based on specific circumstances, such as the nature of the application or the funding source. After submission, you should expect to receive confirmation notifications indicating whether your form was accepted or if additional actions are required. Being aware of these timelines can help you manage your submission efficiently.

Common questions and troubleshooting

Many users often have questions regarding the S-770 form, reflecting common uncertainties in the filing process. One frequent inquiry is about the timeline for processing the form, which can vary widely based on the submission method and the specific requirements of the entity requiring the disclosures.

In case of errors or rejections, it’s critical to have contact information for support services readily available, whether from the regulatory body or your financial institution. Understanding protocols for addressing issues can save time and help filers stay on track, ensuring compliance and reducing unnecessary stress.

Resources for further assistance

For those seeking additional support related to the S-770 form, numerous resources are available. Government websites often provide essential guidance on filling out the form, including eligibility requirements and detailed instructions. Furthermore, pdfFiller features various articles and tutorials aimed at assisting users in mastering the necessary steps for efficient form management.

If you require professional advice, local tax assistance organizations or certified accountants can offer tailored services that ensure compliance and accuracy in filings. Taking advantage of these resources is an excellent way to minimize errors and get the most out of your documentation process.

Staying informed with updates

Being proactive about changes in requirements or filing procedures related to the S-770 form is crucial to maintaining compliance. Subscribing to updates from official sources ensures you are notified of any modifications impacting your filings. This knowledge is vital as it helps avoid potential fines or legal challenges that could arise from outdated practices.

By staying informed, you can adapt your filing strategies and ensure that all documentation is submitted in accordance with the latest regulations. This diligent approach not only reinforces your credibility but also safeguards your interests in an ever-evolving regulatory landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my s 770 filed in Gmail?

How can I modify s 770 filed without leaving Google Drive?

Can I sign the s 770 filed electronically in Chrome?

What is s 770 filed?

Who is required to file s 770 filed?

How to fill out s 770 filed?

What is the purpose of s 770 filed?

What information must be reported on s 770 filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.