Get the free Financial Business and Consumer Solutions, Inc

Get, Create, Make and Sign financial business and consumer

Editing financial business and consumer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial business and consumer

How to fill out financial business and consumer

Who needs financial business and consumer?

Financial Business and Consumer Form: A Comprehensive How-to Guide

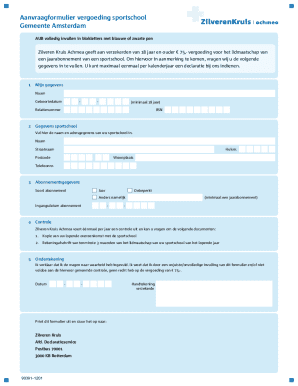

Understanding financial business and consumer forms

Financial business and consumer forms serve as foundational tools in any financial transaction, catering to both businesses and consumers alike. These forms outline necessary details that help facilitate loans, credit assessments, feedback mechanisms, and disclosures. A well-designed financial form can greatly streamline the process of acquiring services, receiving feedback, or reporting issues.

The importance of these forms cannot be understated; they not only ensure compliance with legal requirements but also foster transparency between parties. Collectively, they assist in tracking financial transactions, addressing grievances, and maintaining an organization's integrity.

Key features of a functional financial form

For any financial business and consumer form to be effective, certain key features must be incorporated. Clarity is paramount: forms should be easy to understand and navigate. This ensures that all parties can accurately provide and interpret the information included.

Accessibility is another critical component; forms should be available in various formats and platforms to accommodate users. Moreover, it is essential to include all required information relevant to the form’s purpose to avoid delays in processing.

Steps to fill out financial business and consumer forms

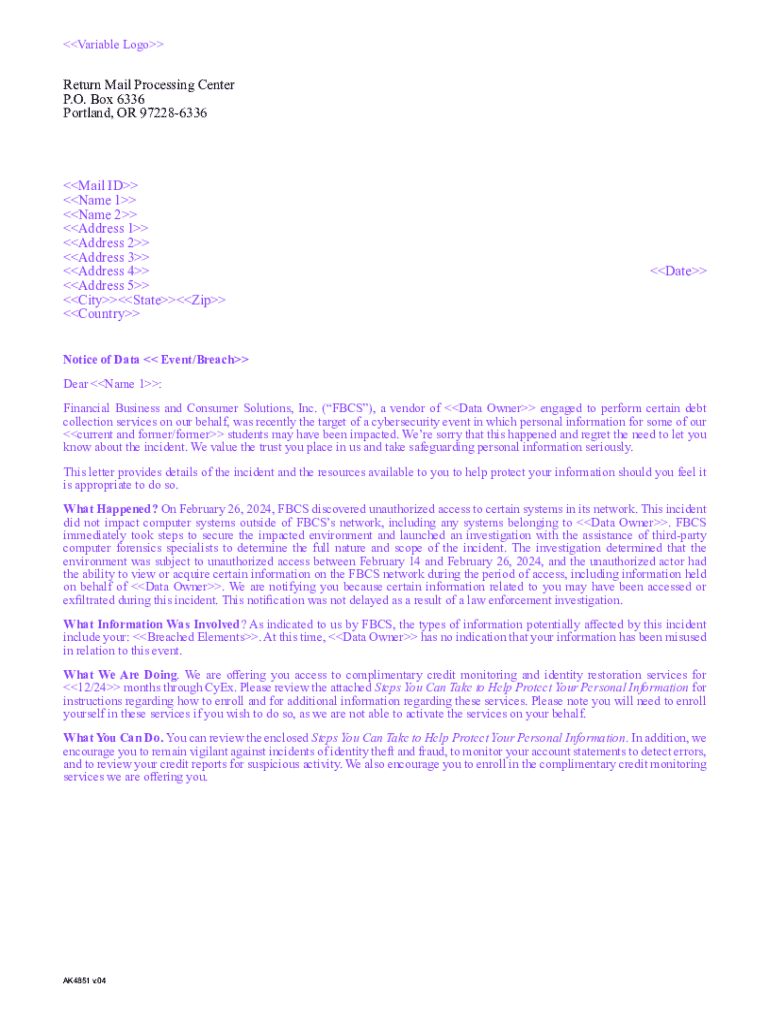

Filling out a financial business and consumer form requires careful preparation and attention to detail. Begin by gathering necessary information, starting with personal identification details, which can include your name, address, and Social Security number. Understanding the extent of your financial history and having recent financial statements on hand is also vital.

In addition to personal information, supporting documentation such as bank statements or proof of income may be required to substantiate your claims. From there, follow a step-by-step breakdown when completing the form to maximize accuracy.

Editing and customizing forms

To ensure that your financial business and consumer forms meet your specific needs, familiarity with PDF editing tools is essential. Using platforms like pdfFiller allows users to easily edit and customize forms, ensuring accuracy and compliance with legal requirements.

pdfFiller offers an array of features that allow for interactive editing options, enabling individuals and teams to make real-time adjustments to their forms. This can include adding or removing fields, adjusting layouts, and even collaborating with others to finalize the form.

Signing and submitting your financial forms

Once your financial business and consumer form is accurately filled out and customized, the signing and submission process begins. Electronic signatures are an increasingly popular and legally recognized method of signing documents in today's digital landscape, making it easier and quicker to finalize forms.

To ensure a smooth submission, follow best practices: understand where to send completed forms, whether to an agency, a bank, or a company, and track your submissions to confirm receipt. This keeps you informed and ensures no processing delays occur.

Managing your financial forms post-submission

After submission, it’s vital to manage your financial business and consumer forms efficiently. Archiving and storage are key components, as you may need to refer back to these forms in the future. Utilizing cloud services like pdfFiller makes it incredibly easier to secure these documents for long-term accessibility.

Furthermore, tracking deadlines and follow-ups is crucial to avoid missing important obligations or opportunities. Make use of calendar tools and reminders to stay organized and proactive.

Troubleshooting common issues

Occasionally, financial business and consumer forms may encounter issues, such as rejection, amendments, or processing delays. Understanding how to troubleshoot these problems is crucial. If a form is rejected, carefully review the reasons provided and make necessary corrections before resubmitting.

In instances where you need to make amendments, documents can typically be edited without significant hassle through editing platforms like pdfFiller, ensuring corrections are made promptly. Staying proactive about potential processing delays aids in anticipating challenges ahead.

Resources for consumers and businesses

Utilizing a range of resources can significantly enhance your experience with financial business and consumer forms. Frequently asked questions serve as a great starting point for understanding common concerns and clarifications, ensuring users grasp the required processes.

Those needing further assistance should consider contacting support through pdfFiller, offering additional guidance based on individual needs. Furthermore, exploring additional templates and tools can provide invaluable aid for completing your forms correctly.

Legal and ethical considerations

Engaging with financial business and consumer forms involves understanding both legal and ethical considerations. Users should familiarize themselves with their rights concerning these documents, as various consumer protection laws are designed to shield individuals from unfair practices.

In cases where violations occur, having a clear understanding of how to report issues becomes essential. Whether dealing with financial institutions, cable companies, or other entities, being informed is critical in advocating for oneself effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial business and consumer for eSignature?

Can I create an eSignature for the financial business and consumer in Gmail?

How do I complete financial business and consumer on an Android device?

What is financial business and consumer?

Who is required to file financial business and consumer?

How to fill out financial business and consumer?

What is the purpose of financial business and consumer?

What information must be reported on financial business and consumer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.