Get the free vf-notice-to-shareholders-change-to-definition-of-dealing- ...

Get, Create, Make and Sign vf-notice-to-shareholders-change-to-definition-of-dealing

How to edit vf-notice-to-shareholders-change-to-definition-of-dealing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vf-notice-to-shareholders-change-to-definition-of-dealing

How to fill out vf-notice-to-shareholders-change-to-definition-of-dealing

Who needs vf-notice-to-shareholders-change-to-definition-of-dealing?

Understanding the vf-notice-to-shareholders change to definition of dealing form

Understanding the vf-notice-to-shareholders

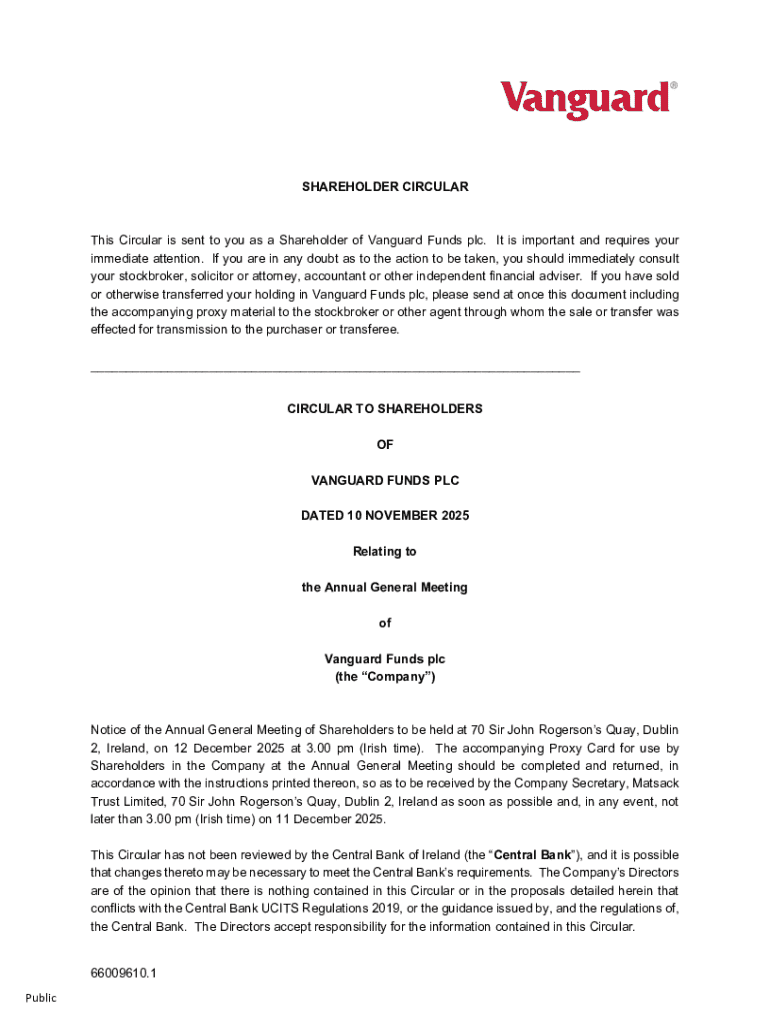

The vf-notice-to-shareholders is a critical document in corporate governance, ensuring that shareholders are kept informed about significant changes within a company. This form serves as a communication tool that allows for transparency in the relationship between the board of directors and shareholders, providing essential details about actions that may affect shareholdings, company policies, or overall governance.

The importance of the vf-notice-to-shareholders cannot be overstated. It supports shareholders' rights to be informed, encouraging participation and ensuring they have necessary disclosures to make knowledgeable decisions regarding their investments. This document aligns with corporate governance principles, reflecting a commitment to ethical standards and accountability.

Legal implications surrounding the vf-notice-to-shareholders arise from various laws and regulations mandating timely and accurate communication to shareholders. Improper handling of this notice can lead to significant consequences for a company, including legal penalties, negative shareholder sentiment, and reputational damage.

Overview of changes to the definition of dealing

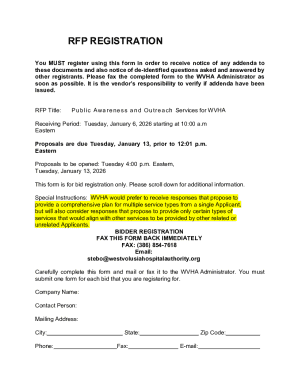

Historically, the definition of dealing in the context of shareholder notices has evolved, reflecting changes in market dynamics and regulations. This evolution aims to clarify what constitutes dealing activities, which can impact how shareholders engage with their shares and the decisions made by corporate entities.

The recent amendments were largely driven by the need for precision in language that relates to shareholder transactions. The key changes in the definition of dealing include a more comprehensive outline of activities that fall under this category, effectively broadening the scope to include various trading and transaction behaviors.

For instance, new definitions may encapsulate digital trading platforms as well as traditional buying and selling of shares. This change is particularly relevant in today's digital economy, where platforms like mobile apps are common in share trading. These shifts significantly affect both shareholders, who need to understand their rights and responsibilities, and corporations, which must adapt their communications accordingly.

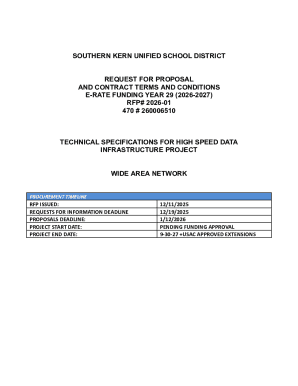

Filling out the vf-notice-to-shareholders change form

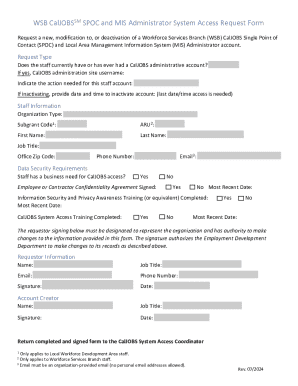

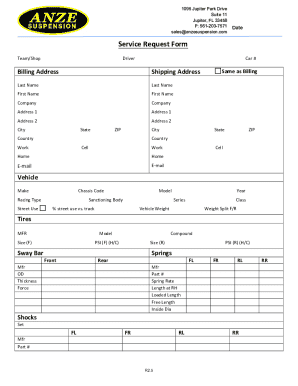

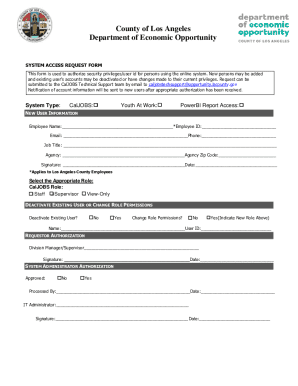

Filling out the vf-notice-to-shareholders change form accurately is crucial for compliance and clarity. Before starting, ensure you have all required documents and information on hand. Common documents include identification, current share certificates, and any relevant board resolutions.

To assist you further, here's a step-by-step walkthrough of the form sections:

Avoid common mistakes such as leaving sections blank or misrepresenting information, which can lead to complications or delays in processing your notice.

Editing and customizing the vf-notice-to-shareholders change form

Utilizing platforms like pdfFiller for managing your vf-notice-to-shareholders change form can significantly enhance efficiency. This cloud-based platform offers a variety of tools to edit PDF documents seamlessly, allowing for modifications without compromising the document's integrity.

Some benefits of using pdfFiller include:

For effective customization, finalize details that reflect the newly established definitions clearly, guaranteeing full compliance with updated regulations.

eSigning the vf-notice-to-shareholders change form

Electronic signatures provide an efficient and secure method for submitting documents like the vf-notice-to-shareholders change form. The legal validity of eSignatures offers added protection when managing documentation processes.

The streamlining of the approval process is another significant advantage of using eSignatures. To complete the eSignature process through pdfFiller:

This process enhances the experience for shareholders, allowing them to engage in corporate governance more effectively.

Collaborating on the vf-notice-to-shareholders change form

Collaboration is essential when filling out the vf-notice-to-shareholders change form to ensure accuracy and collective agreement. With tools like pdfFiller, you can invite team members to provide feedback and make edits collaboratively, streamlining communication.

Some features of pdfFiller that aid collaboration include:

Best practices for effective collaboration include maintaining clear lines of communication among team members and ensuring that all changes and inputs are agreed upon prior to submission, which can help avoid misunderstandings or future disputes.

Frequently asked questions

Common queries concerning the vf-notice-to-shareholders change form can arise, particularly around accuracy and changes. For instance, if information within the changed form is incorrect, it’s imperative to submit corrections promptly, along with any necessary supporting documentation.

Regarding disputes around the changes, it's advisable to initiate dialogue directly with the relevant corporate governance bodies to address concerns and establish clarity.

Additionally, misunderstandings around the definition of dealing can lead to complications. Providing clear explanations about the new definitions helps dispel myths and ensures shareholders are correctly informed about their rights and obligations.

Managing your documentation

Effective document management is paramount for keeping track of submitted forms like the vf-notice-to-shareholders change form. Organizing documentation ensures that all changes are easily accessible and retained for future reference, thereby fostering compliance and governance.

Features of pdfFiller that support robust document management include:

By taking advantage of these features, companies can ensure that their documentation practices remain compliant and efficient.

Case studies: real-world applications

Real-world implementations of the vf-notice-to-shareholders change form can provide valuable insights into best practices. For example, a well-known corporation recently adapted to changes in the definition of dealing by updating their communication strategies, thus enhancing shareholder engagement and information dissemination.

Feedback from shareholders highlighted that being clearly informed about changes allowed them to align their investment strategies accordingly. The transition process, handled efficiently, reinforced their trust in the company’s governance principles.

Lessons learned include the importance of timely communication, consistent updates, and involving shareholders throughout transition processes to minimize confusion and maximize compliance across the board.

Conclusion of the vf-notice-to-shareholders change process

Compliance with the vf-notice-to-shareholders change process is essential for safeguarding corporate governance standards. Staying updated with the latest definitions and ensuring that all shareholder documents reflect these accurately is a responsibility that cannot be overlooked.

Utilizing resources available at pdfFiller is encouraged to streamline the process, ensuring that all related documentation is managed effectively. These tools empower users to complete the vf-notice-to-shareholders change form efficiently, thus enhancing overall shareholder experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send vf-notice-to-shareholders-change-to-definition-of-dealing to be eSigned by others?

How do I complete vf-notice-to-shareholders-change-to-definition-of-dealing online?

Can I edit vf-notice-to-shareholders-change-to-definition-of-dealing on an Android device?

What is vf-notice-to-shareholders-change-to-definition-of-dealing?

Who is required to file vf-notice-to-shareholders-change-to-definition-of-dealing?

How to fill out vf-notice-to-shareholders-change-to-definition-of-dealing?

What is the purpose of vf-notice-to-shareholders-change-to-definition-of-dealing?

What information must be reported on vf-notice-to-shareholders-change-to-definition-of-dealing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.