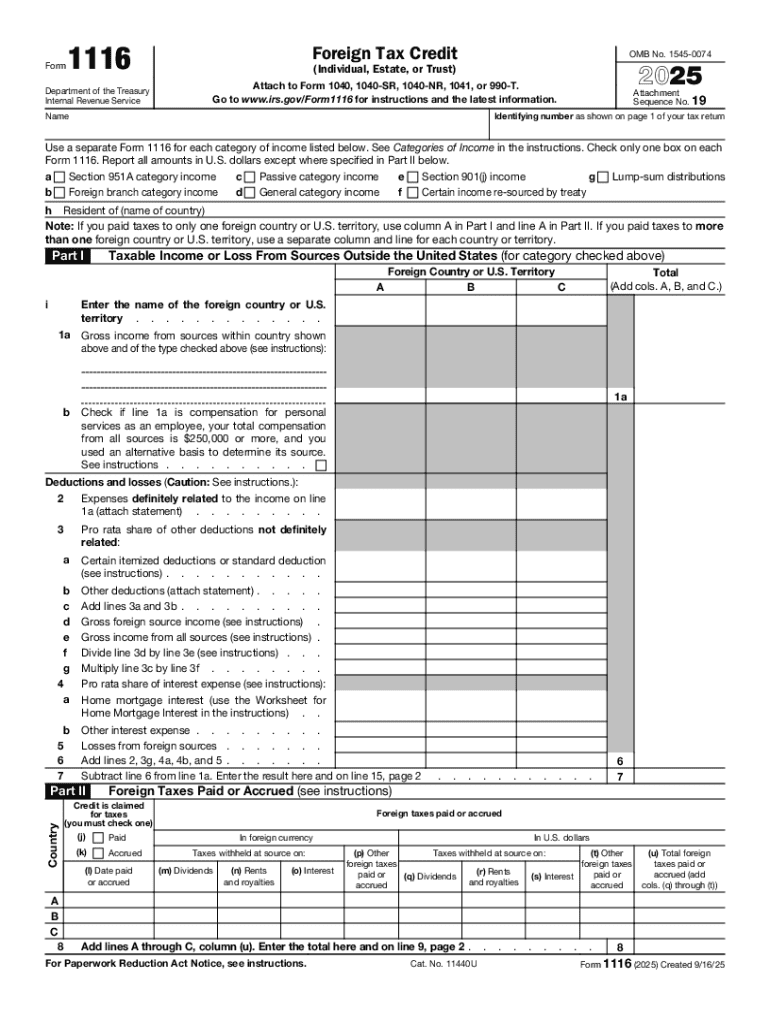

IRS 1116 2025-2026 free printable template

Get, Create, Make and Sign IRS 1116

How to edit IRS 1116 online

Uncompromising security for your PDF editing and eSignature needs

IRS 1116 Form Versions

How to fill out IRS 1116

How to fill out 2025 form 1116

Who needs 2025 form 1116?

Navigating the 2025 Form 1116 Form for Foreign Tax Credits

Overview of Form 1116 for 2025

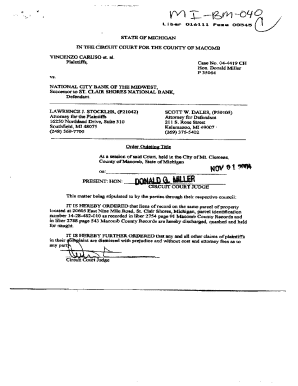

Form 1116 is a crucial document for U.S. taxpayers who have paid taxes to foreign countries or U.S. possessions. This form enables individuals to claim the Foreign Tax Credit, thereby preventing double taxation on income earned abroad. For the tax year 2025, it's essential to understand not only what this form entails but also its implications for your overall tax strategy, particularly amid potential changes in tax legislation.

The importance of Form 1116 lies in its role in helping U.S. taxpayers offset the income taxes they owe the United States by the amount of foreign taxes they have already paid. This can significantly reduce your tax bill, providing essential tax relief for expats and international investors. In 2025, updates to regulations and procedures regarding foreign tax credits may introduce nuances that taxpayers need to navigate, making a thorough understanding of the form imperative.

Who should use Form 1116?

Eligible taxpayers include U.S. citizens and resident aliens who have foreign income, foreign taxes paid, or are regarded as foreign tax residents. It's essential for individuals engaged in overseas employment or business activities to carefully assess their tax obligations in connection with foreign income. Form 1116 is used primarily by individuals, but businesses may also employ the form under specific conditions, particularly if they face taxation in multiple jurisdictions.

Situations that typically require the use of Form 1116 include but aren’t limited to: working abroad, owning rental properties in foreign countries, or receiving dividend income from foreign investments. Moreover, many may believe that filing Form 1116 is unnecessary if they have already paid foreign taxes; this is a common misconception. In fact, without accurately filing this form, taxpayers might miss out on substantial tax relief.

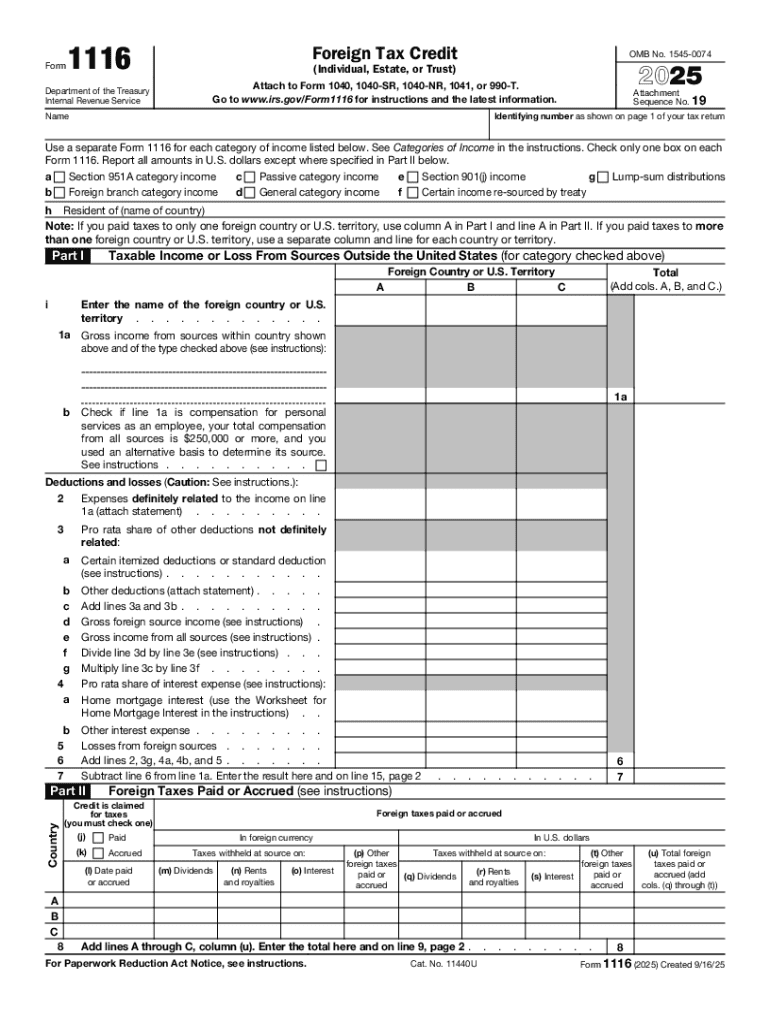

Key components of Form 1116

Form 1116 consists of several crucial sections that guide filers through the claim process for foreign tax credits. Firstly, taxpayer information includes personal identification details, such as your name, address, and Social Security number. Providing accurate data here helps to ensure that the IRS can correctly assess your tax return.

Income types are also a significant focus on the form. You will need to categorize your income as passive or general, with different rules applying to each. Passive income includes dividends, interests, and royalties, whereas general income typically covers wages or income from self-employment. Understanding the nature of your income is essential because it plays a pivotal role in calculating your allowable foreign tax credits.

The calculation of foreign tax credits involves a detailed breakdown that requires meticulous attention. Starting with the total foreign taxes paid, you will then determine your allowable taxes based on various calculations that factor in the amount of foreign income relative to your total global income to avoid discrepancies.

Completing your 2025 Form 1116: A step-by-step guide

Filling out Form 1116 correctly involves several detailed steps, each requiring careful consideration. Part I focuses on foreign tax paid or accrued, where you need to disclose the total amount of foreign taxes you have already settled. Provide all necessary details, including the type of income associated with these taxes, to avoid typical pitfalls experienced by filers.

Next, Part II entails the critical calculation of your foreign tax credit. This portion can be intricate and requires ensuring that your reported income aligns correctly with foreign taxes paid. Implementing tips such as double-checking your math and confirming currency conversions can safeguard against common errors that lead to rejected claims. Lastly, Part III summarizes the credits, reiterating the importance of having a clear overview of all credits claimed for transparent reporting.

Utilizing interactive tools, such as those available on pdfFiller, can help streamline this process. The platform's assistive features simplify document management, allowing you to edit, sign, and collaborate effectively while ensuring compliance with IRS regulations.

Common mistakes to avoid when filing Form 1116

Mistakes on Form 1116 can lead to significant complications, including delays in processing or outright rejection of your credit claims. One common issue is missing information, which can stem from overlooking specific income sources or foreign tax statements. Thoroughly reviewing each section of the form before submission is key to avoiding such oversights.

Miscalculating credits is another frequently encountered error. Be particularly diligent with currency conversions and totals, as these discrepancies can result in substantial impacts on your tax obligation. Additionally, ensure your Form 1116 remains consistent with other submitted tax documents to prevent the IRS from questioning your claims. These inaccuracies can often lead to audits, so attention to detail is paramount.

Understanding the consequences of inaccurate reporting further emphasizes the importance of diligence. Not only could it lead to penalties, but an audit could also disrupt your financial peace of mind.

Supporting documentation for Form 1116

The documentation accompanying your Form 1116 can make or break your foreign tax credit claims. Essential documents to include are foreign tax statements, which serve as proof of payment to the respective foreign authority, detailing the amount paid and the nature of the income. Additionally, any other proof of payment documentation you can provide, such as bank statements or receipts, adds credibility to your submission.

Best practices for safeguarding against potential audits include keeping organized records that substantiate your claims. Leveraging pdfFiller's tools can help in efficiently managing these documents, ensuring that everything is readily accessible should the IRS request further information. The platform's capabilities allow for easy document sharing and collaboration, which can be particularly beneficial if you engage tax professionals.

Using Form 1116 to amend previous claims

Understanding the circumstances under which you might need to amend previous claims is essential for maintaining compliance. If inaccuracies were discovered after submission, or if there are changes in your foreign tax circumstances, filing Form 1116 as an amendment becomes necessary. Assessing your records for any mistakes or missed credits is a smart step before timely submission of amendments.

Amending your claims includes a series of critical steps: first, gather and review all related documents thoroughly to identify discrepancies. Then, file Form 1116 with the revised information clearly indicated. Maintaining organized records of previous claims alongside amendments is vital; pdfFiller's tools can assist in ensuring you keep all files in precise order, reducing the likelihood of confusion.

FAQs about Form 1116 for 2025

One of the most frequently asked questions is whether individuals living abroad should file Form 1116 if they are subject to foreign taxes. Yes, if you have foreign income or are paying taxes in a foreign jurisdiction, filing Form 1116 helps ensure that you claim appropriate foreign tax credits. Additionally, expats often wonder what happens if their foreign tax paid exceeds the U.S. tax owed—typically, the excess credit can be carried back to previous tax years or carried forward to offset future tax liabilities.

Another common query involves checking the status of a Form 1116 submission. Taxpayers can monitor the progress of their claims through the IRS's online tools or by contacting the agency directly. Keeping records of your submissions is essential for reference during this process.

Advanced tips for maximizing foreign tax credits

To leverage the full potential of foreign tax credits, taxpayers should explore strategies that align with their specific financial situations, whether they are individuals or corporations. For individuals, maintaining accurate records and staying well-informed about current legislation can unveil opportunities for maximizing credits. Corporations, on the other hand, may benefit from tax strategies that utilize foreign investments while effectively managing tax liabilities.

Employing platforms like pdfFiller can enhance the management and collaboration of tax documents. The ability to share forms and track changes seamlessly can streamline interactions with tax professionals as well. Additionally, keeping abreast of changes in tax laws and IRS guidelines will enable taxpayers to take proactive measures regarding their tax claims.

People Also Ask about

What is the IRS residential energy credits for 2023?

What is the maximum credit for Form 5695?

How to fill out a 5695 form?

How do I claim solar tax credit on my taxes?

Why did I get a 15111 form?

What is the IRS form 5695 for 2023?

Who should fill out form 8863?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 1116 from Google Drive?

How do I make changes in IRS 1116?

How do I make edits in IRS 1116 without leaving Chrome?

What is 2025 form 1116?

Who is required to file 2025 form 1116?

How to fill out 2025 form 1116?

What is the purpose of 2025 form 1116?

What information must be reported on 2025 form 1116?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.