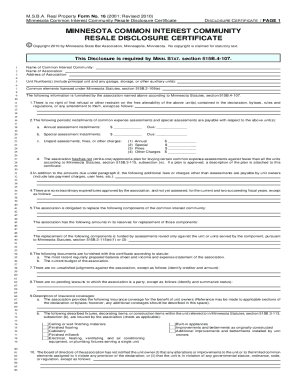

Get the free the msba real property form is crucial in the context the operations of community associations

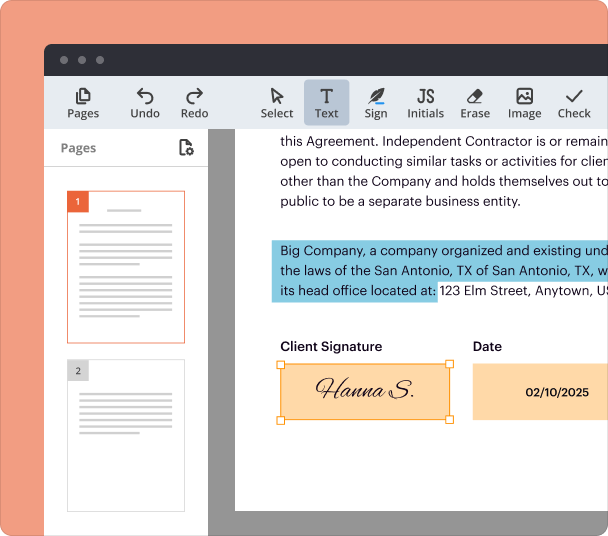

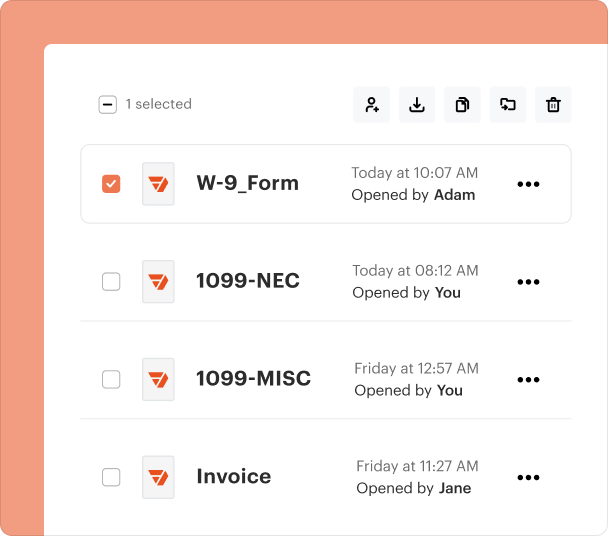

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

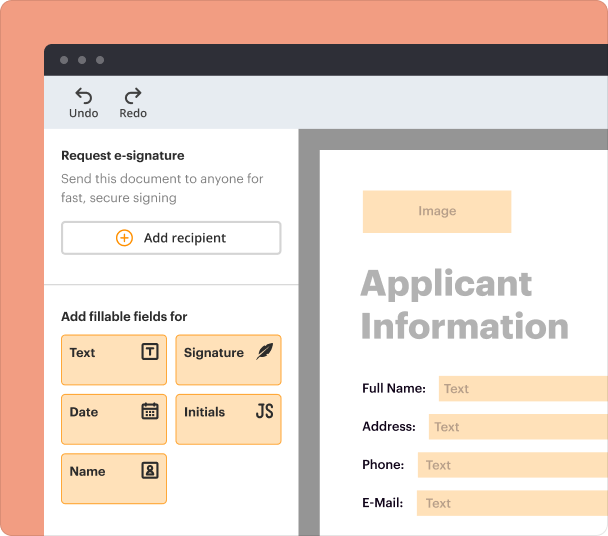

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out the MSBA real property form correctly

Understanding the MSBA real property form

The MSBA real property form is crucial in the context of real estate transactions in Minnesota. This form ensures homeowners and prospective buyers are aware of the rights and obligations associated with common interest communities. Its significance lies in providing transparency regarding financial obligations and community policies, ultimately aiding in informed decision-making.

-

The Minnesota Common Interest Community Resale Disclosure Certificate includes vital details such as community rules, obligations, and assessments.

-

The form fulfills legal obligations under MINN STAT section B, governing the operations of community associations.

Filling out the MSBA real property form correctly

When it comes to completing the MSBA real property form, precision is key. Understanding each section ensures that you convey the necessary information without omission. Below is a step-by-step guide.

-

This includes the Name of Common Interest Community, Name of Association, and Unit Numbers relevant to the property.

-

Provide accurate data for each required field to avoid any delays or potential issues in processing.

-

Double-check your entries for any mistakes before finalizing the form.

-

Ensure all financial obligations are disclosed to prevent misunderstandings later on.

How does document management with pdfFiller work?

pdfFiller makes managing the MSBA real property form hassle-free. Its platform allows users to edit, sign, and collaborate on forms seamlessly, adapting to the needs of busy professionals and teams.

-

Users can effortlessly edit the MSBA form and digitally sign it without needing to print or fax.

-

Teams can work together on the document in real-time, ensuring everyone is on the same page.

-

Track changes and manage different versions of the document easily.

What are common elements and financial obligations?

Common elements under Minnesota Statutes section B refer to shared facilities within a community that everyone has access to. Managing these elements requires understanding the associated financial responsibilities, which include annual assessments and the implications for non-payment.

-

These are regular fees collected to maintain common areas and services, necessary for community upkeep.

-

Failure to pay may lead to fines, or, in severe cases, legal action against the homeowner.

How do special assessment plans impact homeowners?

Special assessment plans are levied for significant repairs or improvements to common elements, according to Minnesota Statutes section B. It’s crucial to understand how these plans affect your financial obligations.

-

Associations must communicate if a special assessment plan has been approved and its financial implications.

-

Resources are available for associations to ensure homeowners are fully informed about special assessments.

What types of additional fees and charges might apply?

Additional fees may arise from various scenarios in property management, which unit owners should be ready for. Understanding these can save homeowners from unexpected financial burden.

-

These can include late payment charges, user fees for exclusive services, or violations of community rules.

-

Homeowners must be proactive in managing their accounts to avoid accruing additional charges.

-

Observing common fee structures in Minnesota can provide insights into expectations and norms.

What are the long-term obligations of the association?

Associations face ongoing fiscal responsibilities that impact both current and future community members. Understanding these obligations is vital for effective long-term planning.

-

Includes maintenance of common areas, upkeep of shared facilities, and management of community communications.

-

The association must prepare financially for upcoming projects such as replacing aging infrastructure.

How to manage real property documents effectively?

Beyond initial form completion, ongoing management of real property documents is vital. pdfFiller excels in offering tools that support this, reinforcing the importance of effective document management.

-

Users can generate templates for frequently used documents, enhancing efficiency in property management.

-

Leveraging cloud-based solutions provides easy access to documents anytime and anywhere.

Frequently Asked Questions about the minnesota common interest community the operations of community associations form

What is the MSBA Real Property Form?

The MSBA Real Property Form is a critical document used in Minnesota's common interest communities, detailing financial obligations and association policies for homeowners and buyers.

How do I fill out the MSBA Real Property Form?

To fill out the MSBA form, gather essential information about your common interest community and association, serve each section with accurate data, and ensure a thorough review before submission.

What happens if I don't pay my assessments?

If assessments are unpaid, homeowners may face penalties such as fines or legal actions. It is crucial for residents to understand the risk of losing their property rights.

What are special assessments?

Special assessments are additional fees levied for specific projects or improvements in the community, intended to fund necessary repairs not covered by regular assessments.

How does pdfFiller help with the MSBA Real Property Form?

pdfFiller streamlines the process of editing, signing, and managing your MSBA Real Property Form, enhancing collaboration and ensuring all documentation is readily accessible.

pdfFiller scores top ratings on review platforms