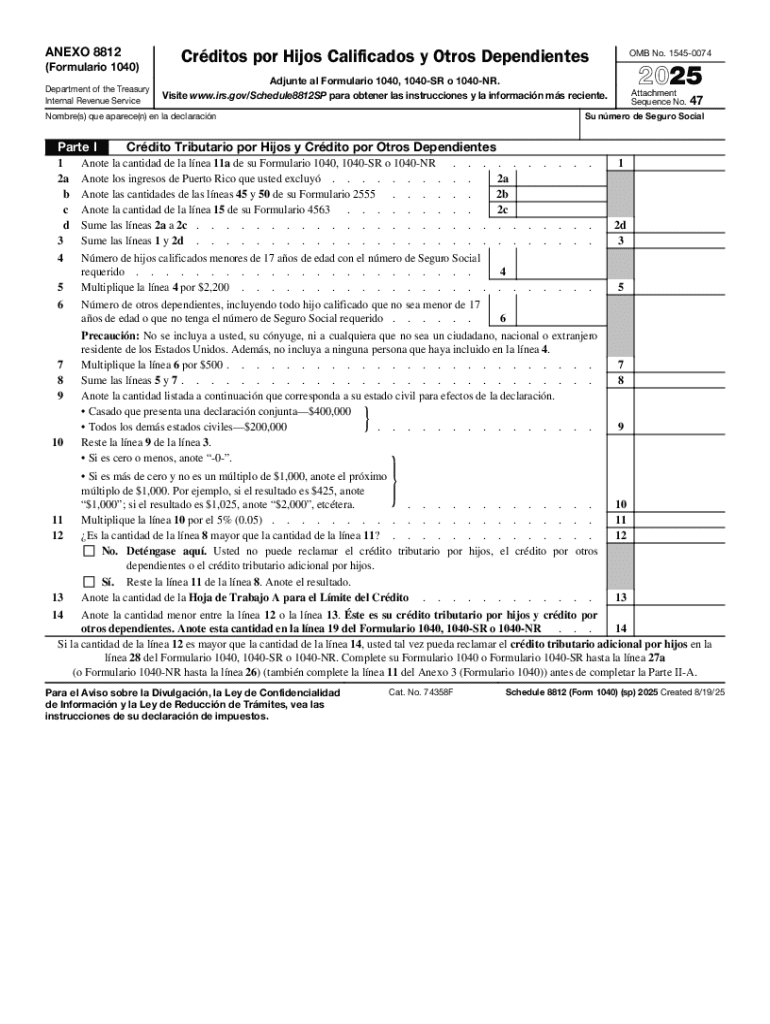

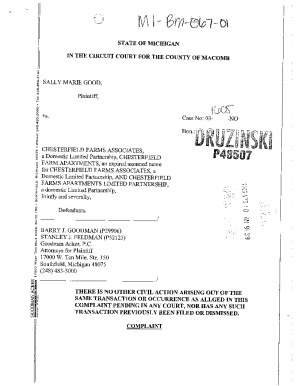

IRS 1040 - Schedule 8812 (SP) 2025-2026 free printable template

Get, Create, Make and Sign IRS 1040 - Schedule 8812 SP

Editing IRS 1040 - Schedule 8812 SP online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040 - Schedule 8812 (SP) Form Versions

How to fill out IRS 1040 - Schedule 8812 SP

How to fill out 2025 schedule 8812 form

Who needs 2025 schedule 8812 form?

2025 Schedule 8812 Form: Your Complete Guide to Claiming the Child Tax Credit

Understanding Form 8812: A comprehensive overview

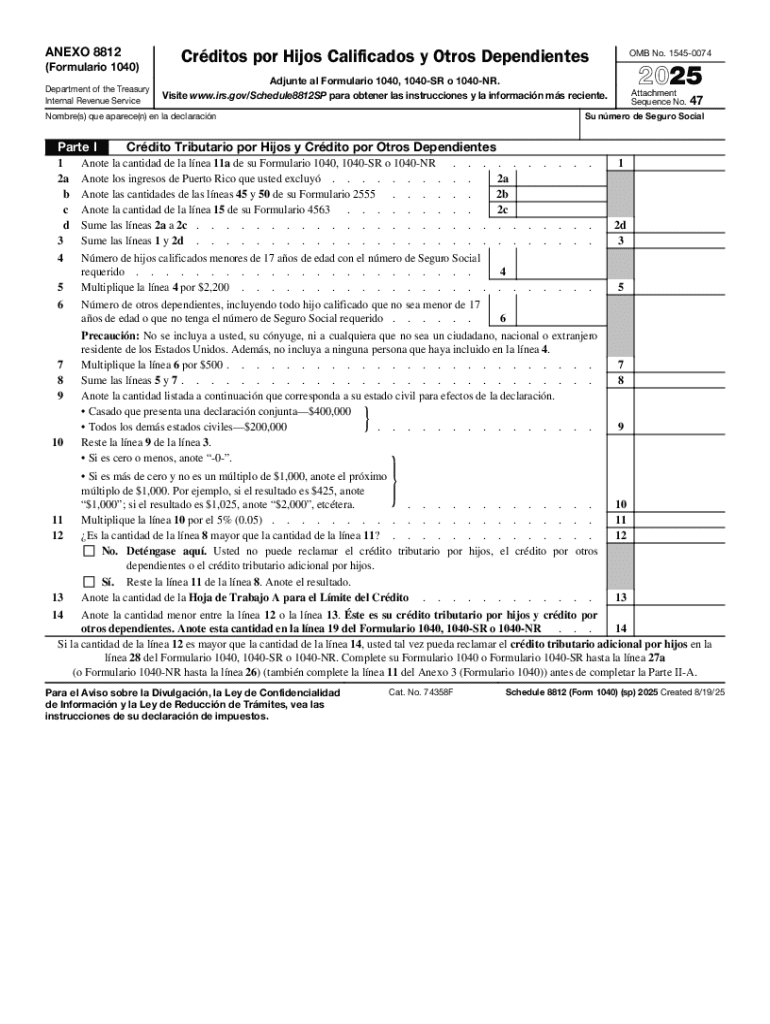

Form 8812, also known as the 'Additional Child Tax Credit,' is a key tax document that allows eligible taxpayers to claim additional benefits related to the Child Tax Credit (CTC). For the 2025 tax year, this form is crucial for ensuring that families receive the financial assistance intended to support children in need. The law stipulates that the CTC is a refundable credit, which means it can not only reduce a taxpayer's tax liability but also provide a refund when the credit exceeds that liability.

The relevance of the 2025 Schedule 8812 Form cannot be overstated, particularly as tax laws evolve and change annually. Taxpayers eligible for the Child Tax Credit will need to familiarize themselves with the specific criteria and legal requirements associated with this form in order to optimize financial benefits. Important changes in the tax law can often reshape eligibility and the amount of assistance available, and the 2025 updates are no exception.

The Child Tax Credit: Unlocking financial benefits

The Child Tax Credit is a significant tax relief measure designed to assist families with children under the age of 17. In 2025, taxpayers can expect further enhancements that expand eligibility and increase potential refund amounts. Understanding the intricacies of the Child Tax Credit for 2025 is essential for families seeking to improve their financial situation during tax season.

To qualify for the Child Tax Credit, families must meet certain income thresholds and filing status criteria. For 2025, the eligibility income thresholds may vary, which means that taxpayers should carefully assess their gross income relative to the requirements. The CTC can provide substantial savings that effectively lower a taxpayer's liability or yield significant refunds.

Qualifications for claiming Child Tax Credit using Schedule 8812

Qualifying for the Child Tax Credit using Schedule 8812 requires meeting several specific requirements, including dependent status, residency, and income levels. Taxpayers must have qualifying children, which includes both biological, adopted, and foster children meeting age, relationship, residency, and support requirements. It's crucial to scrutinize the fine print, as common myths surrounding the credit can lead to missed opportunities for many families.

Many taxpayers remain unaware that certain family structures, such as those involving single parents or divorced couples, can still claim the credit under specific conditions. Understanding these nuances ensures that everyone eligible knows how best to navigate the filing process. For instance, a single parent filing on their own may have different considerations compared to a married couple filing jointly.

Step-by-step guide to filling out the 2025 Schedule 8812 Form

Filling out the 2025 Schedule 8812 Form involves several distinct sections, each serving a specific purpose in the credit calculation process. Understanding how to properly fill each part can minimize errors and expedite your filing process. Here’s a breakdown of the key sections of the form that you need to complete.

Part I collects personal information about the taxpayer. This includes your name, Social Security number, and filing status. Moving to Part II, you’ll record information about each dependent child. The details required here are essential for determining your eligibility for the Child Tax Credit. Finally, Part III focuses on credit calculation, where taxpayers must determine the total amount of credit based on their income and number of qualifying children.

Filing Schedule 8812: Options and best practices

When it comes to filing your Schedule 8812, you have options – online or paper filing. Each method has its advantages and disadvantages; online filing is generally faster and provides instant confirmation of receipt, while paper filing may offer a more traditional approach but often takes longer to process. Utilizing tax software, such as that provided by pdfFiller, can streamline this process significantly, allowing users to file quickly and accurately.

Proper organization of your documents is also vital to a smooth filing experience. Gather all necessary documentation, including Social Security cards for dependents and relevant income information, before beginning your form. Reviewing your completed Schedule 8812 before submission ensures accuracy and can prevent unnecessary delays in processing your tax return.

Frequently asked questions about Form 8812

As taxpayers prepare to file using the 2025 Schedule 8812 Form, many questions may arise concerning eligibility, income variations, and documentation. One common question revolves around claiming credits when a dependent turns 17 during the tax year. Generally, the child must be under 17 at the end of the tax year to qualify. Additionally, if a taxpayer’s income fluctuates throughout the year, the final calculation should reflect their total income for the year, impacting potential credits.

Documentation is another area where taxpayers often seek clarification. Taxpayers typically do not need to attach additional documents to Form 8812 unless specifically requested by the IRS. If an error is discovered in filing, the IRS offers a process for making corrections. Knowing these details can significantly ease the anxiety surrounding tax season.

Interpreting your tax return: What happens after you submit

After submitting the 2025 Schedule 8812 Form, taxpayers often wonder about the status of their tax return and potential refund timeline. Generally, the IRS processes returns within 21 days for e-filed submissions. Taxpayers can track their refund via the IRS 'Where's My Refund?' tool, a helpful resource for staying informed about your return's status.

Occasionally, issues may arise during processing, such as discrepancies that require additional information. The IRS typically notifies taxpayers in these instances, informing them of any required actions. Being prepared for possible follow-up can save time and mitigate stress during tax season.

Leveraging pdfFiller's tools for document management

pdfFiller offers robust solutions for managing documents such as Schedule 8812. Features include the ability to edit, sign, and collaborate on PDFs seamlessly. Users can fill out the form within the platform’s intuitive interface, thus minimizing errors and ensuring all required fields are completed correctly. Moreover, the eSigning feature significantly expedites the submission process, allowing for faster engagement with federal tax requirements.

Collaboration tools enable teams to work together efficiently on document creation and submission. This helps ensure that relevant stakeholders are informed, reducing the chances of duplication or oversight. pdfFiller empowers users not only to manage individual documents but also to contribute to a cohesive team effort.

Getting in touch: Support for your 2025 Schedule 8812 inquiries

Navigating tax forms can be daunting, but help is available when needed. pdfFiller provides several customer support options to assist users with any queries related to the 2025 Schedule 8812 Form. From live chat assistance to detailed resources available on the pdfFiller platform, customers can find tailored help during their tax preparation journey.

For ongoing assistance, users can access a plethora of guides, FAQs, and tips on how to effectively manage tax documents. This comprehensive support structure helps ensure that individuals and teams feel confident and well-equipped to handle their documents.

About pdfFiller: Your partner in document creation

pdfFiller offers an array of services that empower individuals and teams to create and manage documents with ease. From tax forms to contracts, our platform provides a seamless document management experience geared toward efficiency and accuracy. Our commitment to enhancing user experiences ensures that navigating tax forms like the 2025 Schedule 8812 is straightforward and stress-free.

By leveraging cutting-edge technology and user-friendly interfaces, pdfFiller positions itself as a leader in helping you manage your documents from anywhere. Whether for personal use or in collaborative team settings, pdfFiller supports all aspects of document creation and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 1040 - Schedule 8812 SP without leaving Google Drive?

How do I edit IRS 1040 - Schedule 8812 SP on an iOS device?

How do I complete IRS 1040 - Schedule 8812 SP on an Android device?

What is 2025 schedule 8812 form?

Who is required to file 2025 schedule 8812 form?

How to fill out 2025 schedule 8812 form?

What is the purpose of 2025 schedule 8812 form?

What information must be reported on 2025 schedule 8812 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.