Get the free SCHEDULE OC (FORM 40 OR 40NR) Other Available Credits ALABAMA 2014

Show details

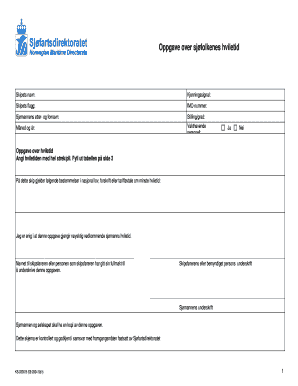

SCHEDULE OC (FORM 40 OR 40NR) *140009OC* Alabama Department of Revenue Other Available Credits ATTACH TO FORM 40 OR 40NR Name(s) as shown on Form 40 or 40NR PART A Credit For Taxes Paid To Other States

We are not affiliated with any brand or entity on this form

Instructions and Help about schedule oc form 40

How to edit schedule oc form 40

How to fill out schedule oc form 40

Instructions and Help about schedule oc form 40

How to edit schedule oc form 40

To edit the schedule oc form 40 efficiently, use pdfFiller to access a fully interactive PDF. This platform allows for easy text modifications, and you can fill in the necessary fields directly on the form. To start editing, upload the form to pdfFiller, make your changes, and save or download the updated version. Ensure you check all entries for accuracy before submission.

How to fill out schedule oc form 40

Filling out the schedule oc form 40 involves several clear steps. Begin by gathering all relevant financial information required for the form. Then, input the data into the designated fields in order, ensuring that you follow the instructions specific to each section. Review your entries thoroughly before submitting the form. You can use pdfFiller's tools to make the process smoother.

Latest updates to schedule oc form 40

Latest updates to schedule oc form 40

Stay informed about the latest updates to schedule oc form 40 by regularly checking the IRS official website or trusted tax resources. Updates can include changes in filing procedures, due dates, or eligibility criteria, and it's essential to have the most current information to ensure compliance.

All You Need to Know About schedule oc form 40

What is schedule oc form 40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedule oc form 40

What is schedule oc form 40?

Schedule oc form 40 is a specific IRS supplementary form required for certain taxpayers in the U.S. This form is used to report various tax-related activities in accordance with federal regulations. Understanding its details is crucial for accurate tax filing.

What is the purpose of this form?

The primary purpose of schedule oc form 40 is to provide the IRS with detailed information regarding specific tax obligations. It helps in tracking tax compliance and ensures that all appropriate taxes are reported and paid. Accurately completing this form is necessary to avoid penalties and maintain good standing with the IRS.

Who needs the form?

Taxpayers who must report certain income or deductions related to specific situations are required to fill out schedule oc form 40. Common filers include those who have specific types of income that must be declared separately from their standard tax returns. If you are unsure if you need the form, consult with a tax professional.

When am I exempt from filling out this form?

You may be exempt from filling out schedule oc form 40 if your income does not meet the thresholds established by the IRS or if you do not have the specific types of income the form addresses. Additionally, certain taxpayers may qualify for exemptions based on their filing status or other criteria. It's essential to verify your eligibility based on current IRS guidelines.

Components of the form

Schedule oc form 40 consists of various sections that require detailed financial information. Common components include fields for reporting income, deductions, and other relevant tax data. Familiarizing yourself with these components helps in accurate completion of the form.

Due date

The due date for schedule oc form 40 aligns with the standard tax filing deadline. It is typically due on April 15th each year unless an extension is filed. It’s crucial to keep track of this date to avoid late penalties.

What are the penalties for not issuing the form?

Failing to issue schedule oc form 40 when required can result in significant penalties imposed by the IRS. These penalties can vary based on the circumstances surrounding the omission. It’s advisable to thoroughly understand the requirements to avoid unnecessary financial repercussions.

What information do you need when you file the form?

When filing schedule oc form 40, you need detailed financial information that may include income details, deductions, and any other supporting documentation. Be prepared to provide accurate records to support the entries made on the form. This ensures compliance and reduces the likelihood of an audit.

Is the form accompanied by other forms?

In some cases, schedule oc form 40 must be submitted along with other tax forms that support your claims for deductions or income reporting. It is important to check IRS guidelines to determine if additional documentation is necessary for your specific situation.

Where do I send the form?

The destination for sending schedule oc form 40 depends on your filing status and location. Generally, it is sent to the address specified by the IRS for your corresponding tax category. Ensure to verify the correct submission address to prevent any delays in processing your form.

See what our users say