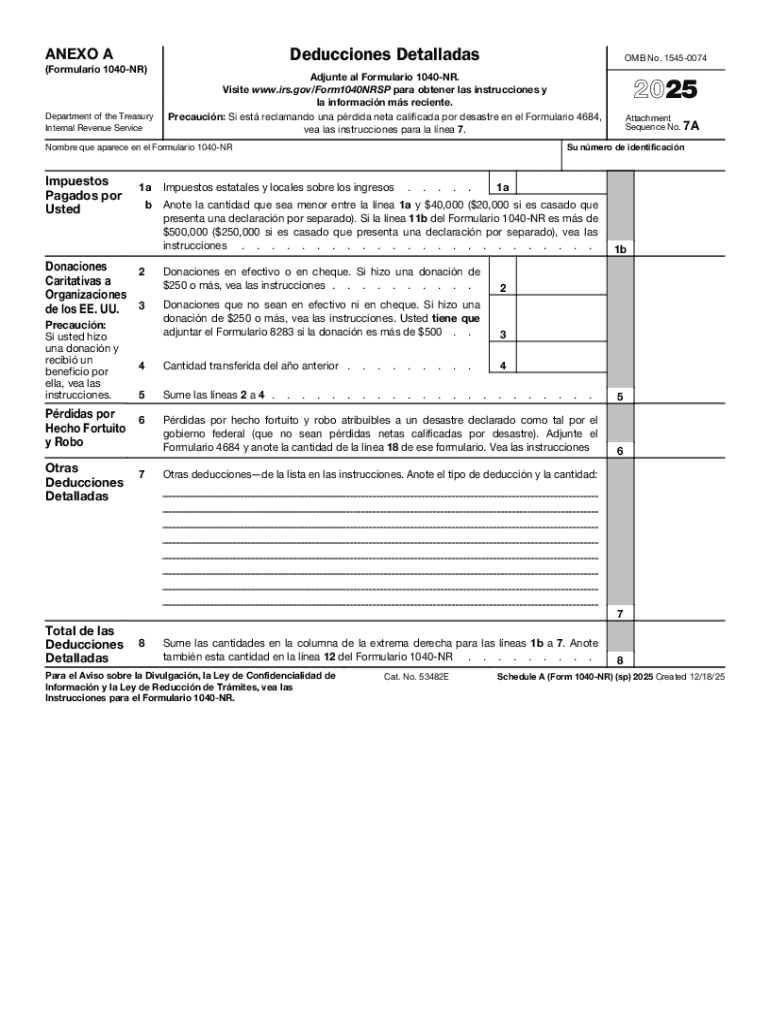

IRS 1040-NR - Schedule A (SP) 2025-2026 free printable template

Get, Create, Make and Sign IRS 1040-NR - Schedule A SP

How to edit IRS 1040-NR - Schedule A SP online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040-NR - Schedule A (SP) Form Versions

How to fill out IRS 1040-NR - Schedule A SP

How to fill out 2025 schedule a form

Who needs 2025 schedule a form?

2025 Schedule A Form: A Comprehensive How-to Guide

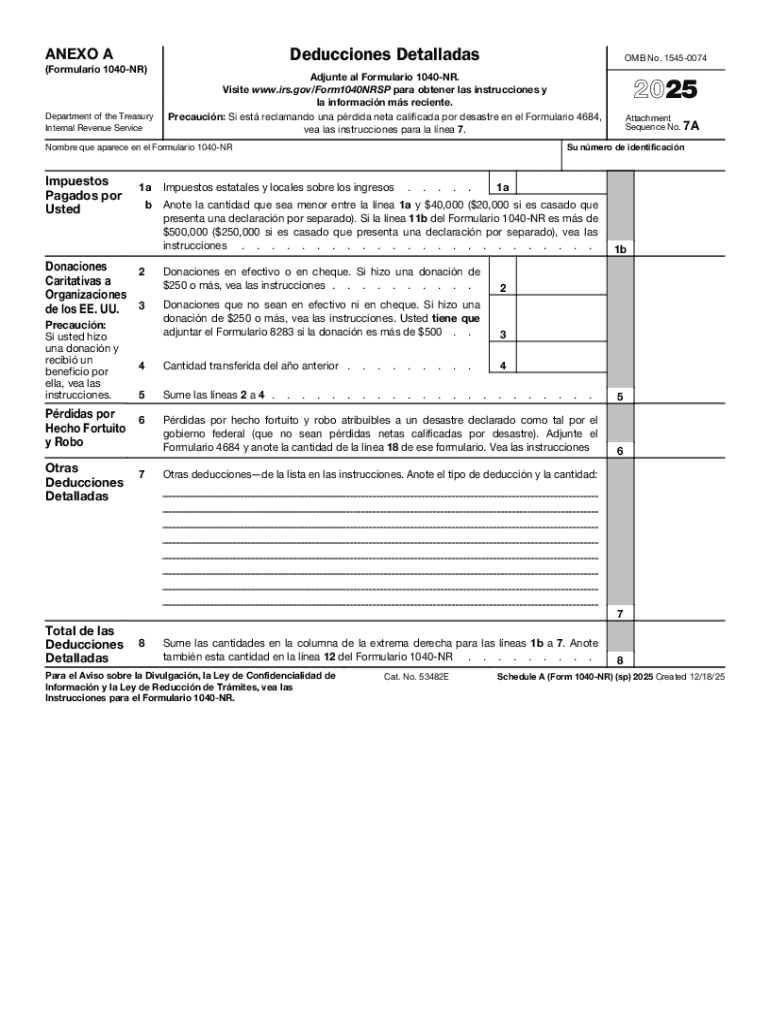

Understanding the 2025 Schedule A form

The 2025 Schedule A form is an essential document for taxpayers who wish to itemize their deductions instead of taking the standard deduction. This form allows individuals to detail their qualifying expenses, which can lead to significant tax savings. Understanding the intricacies of the Schedule A form can help you maximize your deductions and minimize the tax burden for the 2025 tax year.

The primary purpose of Schedule A is to itemize deductions related to your qualifying medical expenses, state and local taxes, mortgage interest, charitable donations, and other miscellaneous deductions. For the 2025 tax year, these deductions can significantly reduce your taxable income, making it essential for those with substantial deductible expenses to consider filing this form.

Eligibility and requirement for filing Schedule A

Not everyone needs or should fill out the 2025 Schedule A form. Individuals with substantial deductible expenses such as high medical costs, mortgage payments, or significant charitable contributions typically find value in itemizing. If your total itemized deductions exceed the standard deduction for your filing status, utilizing Schedule A can provide potential tax benefits.

Freelancers and small business owners may also benefit from Schedule A, especially if they can track specific deductible expenses such as business use of home or personal property loses from theft. For 2025, taxpayers must also consider income thresholds and filing requirements, which may change annually.

How to fill out the 2025 Schedule A form

Filling out the 2025 Schedule A form requires careful attention to detail. Start by gathering the necessary documentation, including receipts and statements for deductible expenses. The form is divided into sections that address different types of deductions, allowing you to itemize your write-offs effectively.

Here’s a section-by-section breakdown of how to complete the form:

While filling out Schedule A, be aware of common errors such as overstating deductions or forgetting to include necessary documents. Keeping detailed records throughout the year can enhance accuracy when you file your taxes.

Itemized deductions eligible under Schedule A for 2025

For the 2025 tax year, many common deductible expenses can be itemized on Schedule A. Medical expenses exceeding 7.5% of your AGI are included. However, it's crucial to understand the limitations and eligibility requirements surrounding them, particularly for high costs such as surgeries or long-term care.

Tax deductions primarily consist of property taxes, state and local income taxes, and potentially sales taxes. Also, contributions made to charitable organizations are fully deductible. Lesser-known deductions, such as unreimbursed employee expenses or certain business expenses for self-employed individuals, should not be overlooked and can significantly impact your overall tax obligation.

Strategies for maximizing your 2025 Schedule A deductions

Maximizing deductions on Schedule A starts with year-round planning. Keep track of your expenses using tools like spreadsheets or dedicated finance apps. Regular tracking can ensure no eligible deduction is missed at year-end.

Utilizing tax software can provide interactive tools that streamline the process of filling out Schedule A. These tools often guide you through the deductions applicable to your situation. Moreover, collaborating with a tax professional can be crucial, particularly in complex financial situations, to ensure all opportunities for deductions are explored.

Understanding how Schedule A works in the bigger picture of tax filing

Schedule A plays a pivotal role in your overall tax return, detailing all itemized deductions that can significantly impact your taxable income. Effectively managing and organizing your documentation throughout the year is crucial to simplifying the filing process and ensuring all claims are substantiated.

If you find that an error in deduction amounts or eligibility happens post-filing, amending your tax return may be necessary. Understanding how to navigate these adjustments can ensure that your tax filings are accurate and reflect your true financial situation.

Implications of the 2025 tax law changes on Schedule A users

Tax law changes can have significant implications for individuals using Schedule A. Staying informed about recent modifications to itemized deductions—including limits on mortgage interest and state and local tax deductions—is essential. These adjustments can impact your filing strategy and overall tax liability.

Anticipated trends suggest a continued focus on tax breaks for medical expenses and charitable contributions. It's wise to keep abreast of changes, as they can vary and shift from year to year. Familiarizing yourself with other relevant forms and schedules for 2025 will contribute to a well-rounded understanding of your filing requirements.

Best practices for document management and collaboration with pdfFiller

Using pdfFiller can simplify your document management process as you prepare to file the 2025 Schedule A form. This cloud-based tool offers seamless document editing, eSigning, and sharing capabilities, making it an excellent choice for tax filings. You can edit and finalize your Schedule A form from anywhere.

With pdfFiller, collaborating with tax professionals on your documentation becomes easier, allowing for smooth communication and efficient document gathering. Utilizing interactive tools available on the platform enhances the overall filing experience, guiding you step-by-step through the intricacies of itemized deductions.

Frequently asked questions about Schedule A in 2025

Filing Schedule A can raise several questions, particularly regarding procedural issues. For instance, what should you do if audited after submitting Schedule A? It's advisable to maintain all records corresponding to your deductions, which can serve as your defense during audits.

Can you claim expenses from previous years on 2025's Schedule A? Generally, you cannot, as this form only addresses deductions applicable to the current tax year. Keeping track of ongoing changes in tax laws affecting itemized deductions will ensure that you stay compliant and maximize your potential tax savings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 1040-NR - Schedule A SP for eSignature?

How do I complete IRS 1040-NR - Schedule A SP online?

Can I create an electronic signature for the IRS 1040-NR - Schedule A SP in Chrome?

What is 2025 schedule a form?

Who is required to file 2025 schedule a form?

How to fill out 2025 schedule a form?

What is the purpose of 2025 schedule a form?

What information must be reported on 2025 schedule a form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.