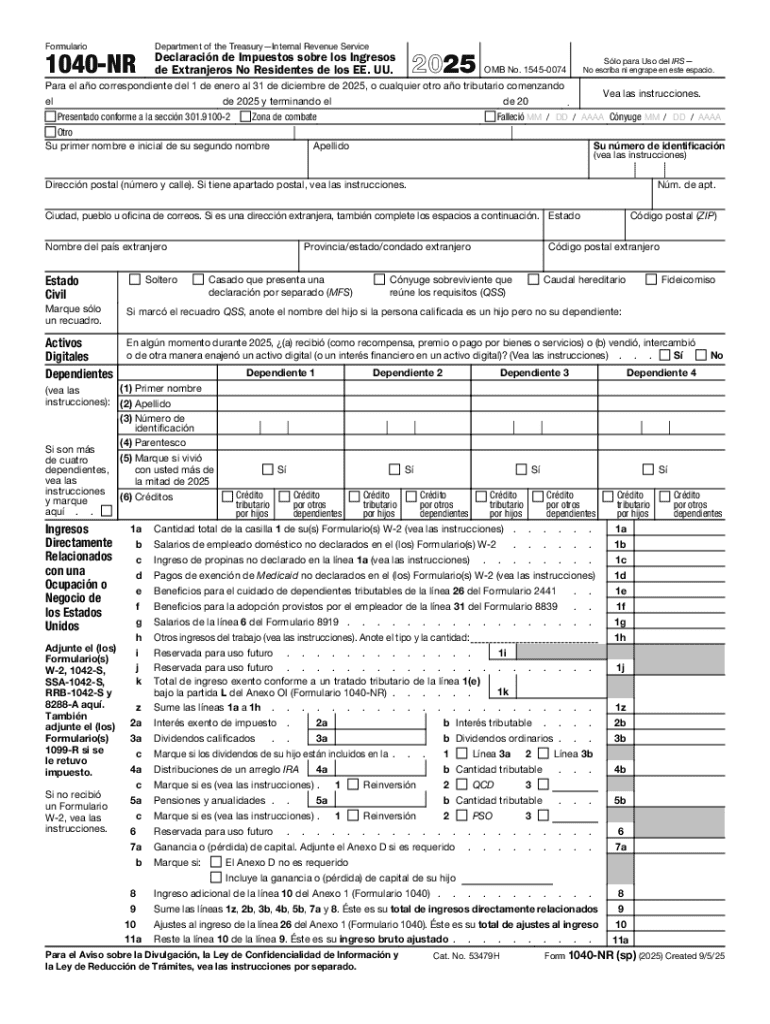

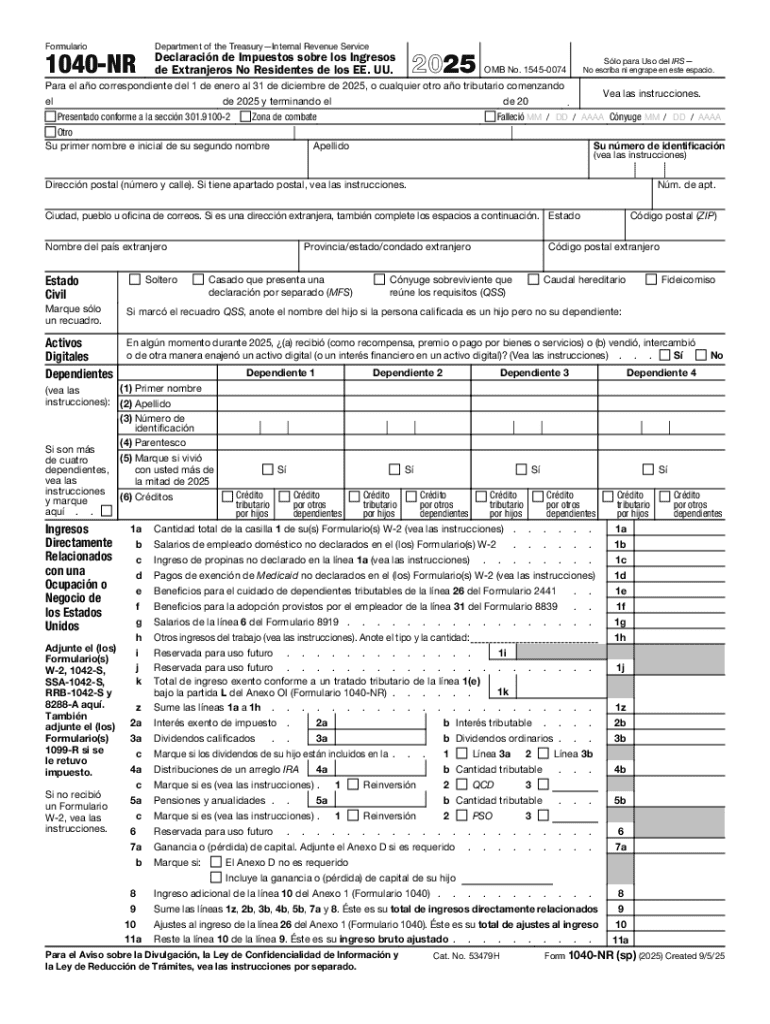

Get the free 2025 Form 1040-NR (sp). U.S. Nonresident Alien Income Tax Return (Spanish Version)

Get, Create, Make and Sign 2025 form 1040-nr sp

Editing 2025 form 1040-nr sp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 1040-nr sp

How to fill out 2025 form 1040-nr sp

Who needs 2025 form 1040-nr sp?

2025 Form 1040-NR SP: A Comprehensive How-to Guide

Overview of Form 1040-NR SP

Form 1040-NR SP is a specialized tax return form tailored for non-resident aliens in the United States, primarily filling it out for income earned in the country during the tax year. The form is essential for those who do not meet the residency criteria for filing as a resident but still have obligations or income sourced within the U.S. It streamlines the process of reporting income specifically for individuals unfamiliar with standard tax return procedures, making it particularly advantageous for non-resident students, employees on work visas, and foreign investors.

It is crucial to distinguish between Form 1040-NR and 1040-NR SP. While both are aimed at non-residents, Form 1040-NR SP is specifically designed in Spanish, accommodating Spanish-speaking taxpayers. Understanding which form applies to your situation ensures compliance and enhances clarity throughout the filing process.

Eligibility criteria for 2025 Form 1040-NR SP

To be eligible to file the 2025 Form 1040-NR SP, individuals must satisfy specific residency requirements set forth by the IRS. Generally, non-resident aliens are individuals who do not pass the Green Card test or the Substantial Presence Test during the tax year. It’s important to review your visa status and the duration of your stay to ensure you qualify as a non-resident.

Moreover, the types of income that need to be reported include wages, salaries, tips, interest, dividends, and other income generated within the United States. Certain exemptions and deductions may apply, particularly for students, business expenses, or dependent exemptions, which can significantly affect your tax obligation.

How to access the 2025 Form 1040-NR SP

Accessing the 2025 Form 1040-NR SP is straightforward. You can download the form directly from the IRS website, which provides the most current and official version. Ensure you always have the latest updates to avoid any discrepancies during filing.

For those who prefer a more interactive approach, pdfFiller offers tools that allow you to access and edit the PDF version of the form conveniently. This cloud-based platform streamlines the tax preparation experience, offering features that reduce stress and enhance productivity.

Step-by-step instructions for filling out 2025 Form 1040-NR SP

Filling out the 2025 Form 1040-NR SP effectively requires attention to detail. Start with the personal information section. Enter your name, address, and other identifying information. Be meticulous, as accurate information prevents unwanted delays in processing your return.

Next, accurately report all sources of income. Non-residents need to classify their income correctly to guarantee they pay the accurate amount of tax. Additionally, claim any eligible deductions and credits applicable to your activities during the year. This may include educational credits or expenses associated with U.S. employment. Lastly, remember to recognize and report taxable income, including any potential foreign tax credits.

To avoid common errors, double-check every entry before submission. Mistakes like incorrect social security numbers or income amounts can lead to processing delays or questions from the IRS.

Exploring key sections of the form

Understanding the critical sections in Form 1040-NR SP enhances clarity and accuracy in reporting. For instance, the section detailing wages, salaries, and tips directly links to your taxable income. It’s vital to ensure these figures are precise to avoid discrepancies.

The tax-exempt interest section is equally important, as it identifies income that isn't subject to U.S. taxation, thus potentially reducing your overall tax burden. Lastly, reporting any other income sources correctly, such as rental income or capital gains, is critical. Each section's accuracy affects the final tax liability and any refunds owed, emphasizing the importance of careful reporting.

Using pdfFiller for editing and eSigning the form

Utilizing pdfFiller provides significant advantages for managing your Form 1040-NR SP documentation. The cloud-based platform allows you to edit the PDF seamlessly, adding text, signatures, or notes. This accessibility empowers users, allowing for easier collaboration whether you’re working independently or with team members, such as tax professionals.

Following a straightforward step-by-step guide on pdfFiller ensures you maximize its functionalities. For instance, users can easily import their PDF documents, edit required fields, and electronically sign the final version. With built-in tools for tracking changes and version control, managing multiple drafts becomes effortless.

Filing your 2025 Form 1040-NR SP

When it comes to filing your 2025 Form 1040-NR SP, taxpayers have two primary options: e-filing or paper filing. E-filing tends to be faster and more efficient, allowing for quicker processing and potentially faster refunds. Conversely, if you opt for paper filing, ensure that you mail your completed form to the correct IRS address to avoid delays.

Adhering to deadlines is critical for smooth processing. The IRS typically sets the tax filing deadline for non-residents around June 15. Should you require more time, applying for an extension is possible, but ensure it is filed ahead of the deadline.

Common challenges and FAQs related to 2025 Form 1040-NR SP

Many taxpayers filing the 2025 Form 1040-NR SP often encounter challenges around error resolution. A common concern is, 'What if I make a mistake on my form?' In such cases, it’s vital to file an amended return with corrections. The IRS allows for corrections to ensure that your tax obligations are accurately reflected.

Tracking the status of your filed form is another frequent inquiry. Taxpayers can use the IRS's online tools to check their refund status or filing progress. As situations evolve, clarity on how to manage changes—such as income shifts or extended stays in the U.S.—is crucial. Taxpayers should consult the IRS or tax professionals for the correct course of action.

Contacting support for assistance with pdfFiller can also alleviate many procedural concerns, ensuring you complete each step with confidence.

Advanced tips for navigating non-resident taxation

Effective tax planning for non-residents is crucial to optimize your financial strategy. Utilize all available resources within pdfFiller to manage your documents efficiently from anywhere. Advanced features such as templates and saved forms can drastically reduce time spent completing repetitive forms, allowing for greater accuracy and compliance.

Additionally, staying updated on ongoing tax law changes that affect non-residents should receive significant attention. Monitoring IRS announcements and relevant news can provide insight into potential impacts on your tax obligations for the 2025 tax year. Knowledge of these changes can empower you to make informed decisions and potentially minimize your tax burdens.

Final checklist before filing your 2025 Form 1040-NR SP

Before submitting your 2025 Form 1040-NR SP, perform a final comprehensive checklist. Firstly, verify that all personal information is accurate, reducing the risk of processing delays. Next, review your income reporting to ensure that all wages and sources are correctly captured.

Confirm that all relevant documents and records are available, including W-2s and 1099s, as these will aid in accurate reporting and verification of amounts. Finally, take a moment for last-minute tips, examining every requirement to ensure that your filing process is as smooth as possible, securing the most favorable outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2025 form 1040-nr sp from Google Drive?

How do I complete 2025 form 1040-nr sp online?

Can I edit 2025 form 1040-nr sp on an Android device?

What is 2025 form 1040-nr sp?

Who is required to file 2025 form 1040-nr sp?

How to fill out 2025 form 1040-nr sp?

What is the purpose of 2025 form 1040-nr sp?

What information must be reported on 2025 form 1040-nr sp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.