IRS 8990 2025-2026 free printable template

Get, Create, Make and Sign IRS 8990

How to edit IRS 8990 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8990 Form Versions

How to fill out IRS 8990

How to fill out form 8990 rev december

Who needs form 8990 rev december?

Understanding Form 8990 Rev December Form: A Comprehensive Guide

Overview of Form 8990: Key Insights

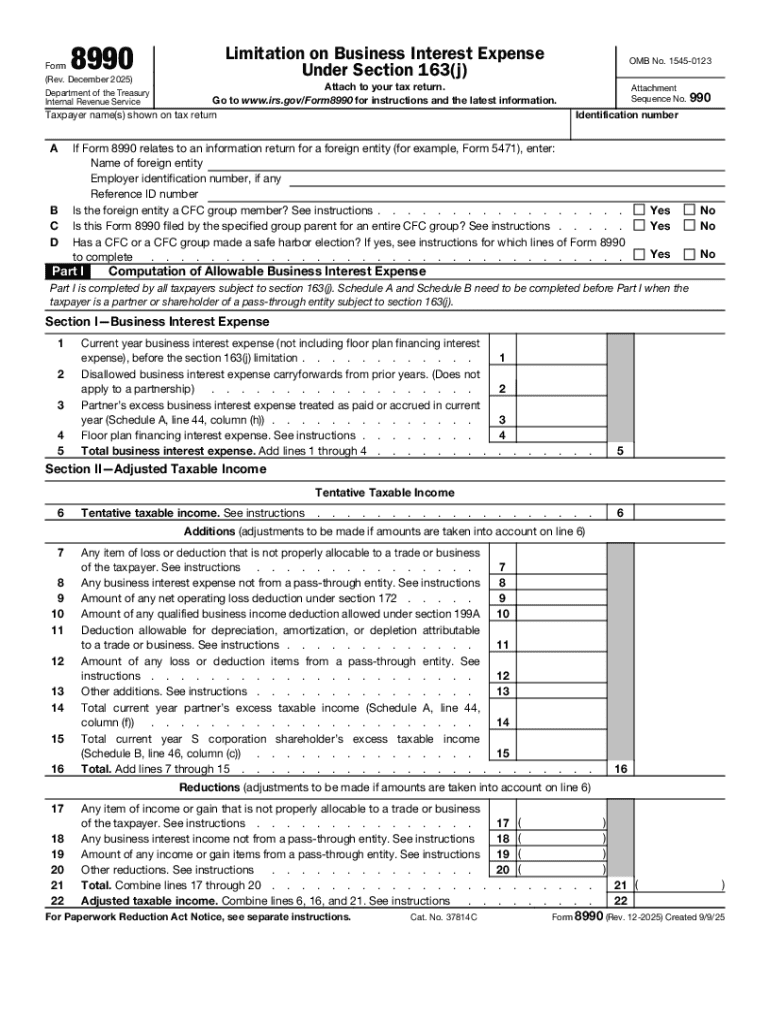

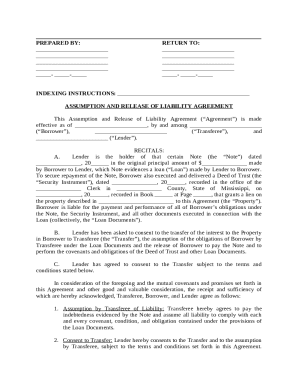

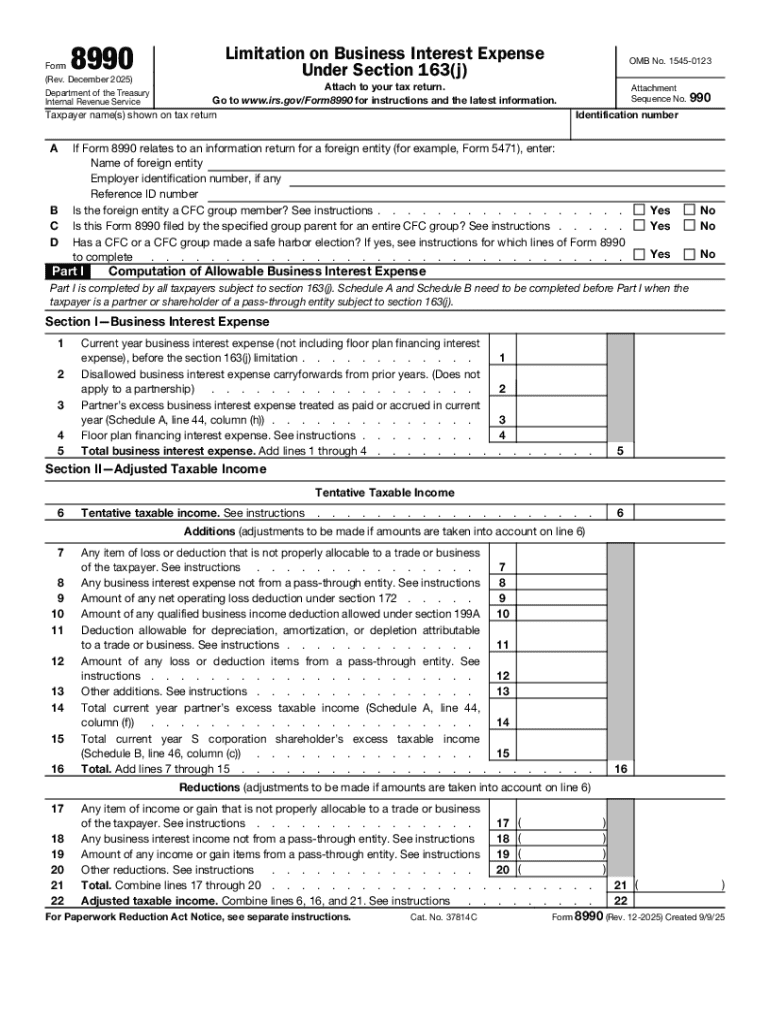

Form 8990 is a critical IRS document that helps businesses report their business interest expenses for tax purposes. The form is pivotal in ensuring compliance with the Tax Cuts and Jobs Act provisions regarding interest expense limitations. Utilizing the latest revision, the December edition of Form 8990, is essential as it incorporates the most up-to-date guidelines and regulations from the IRS, ensuring accurate reporting.

Form 8990 is commonly used by businesses that incur interest expenses, particularly those in sectors that require significant capital investment. This form serves not just as a reporting tool but also as a guide to understanding the nuances of interest expense limitations imposed by the IRS on a business level.

Understanding the purpose of Form 8990

Form 8990 is primarily used to calculate and report business interest expenses that businesses can deduct for federal income tax purposes. Depending on the business's structure, this form ensures that deductions are correctly calculated and reported, thereby adhering to capital limitation rules as set forth by IRS regulations.

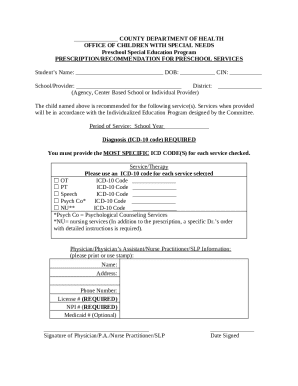

To successfully complete Form 8990, certain eligibility criteria must be met, typically indicating that the taxpayer is a partnership, corporation, or an S corporation with business interest expenses. It’s essential to evaluate your business operations to ascertain whether they fall under these criteria.

Detailed breakdown of Form 8990 sections

Section 1: Basic Information

This section requires identifying information such as the business name, employer identification number (EIN), and other pertinent details. Accurate data entry is crucial for a smooth filing process. Make sure to double-check all identifiers to avoid processing delays.

Section 2: Computation of Business Interest Expense

Here, businesses calculate their total interest expense, applying specific IRS prescribed methods. It is essential to follow the calculation methodologies provided in the instructions accompanying the form. For example, typical scenarios for deductions may range from loans taken for operating expenses to capital expenditures.

Section 3: Passive Activity Limitations

This section addresses the distinction between passive and active business activities. Understanding these definitions is critical to properly applying the limitations on business interest expense deductions. The IRS provides guidelines on how to evaluate your participation levels in each business activity.

Section 4: Summary of Adjustments

Lastly, Section 4 requires documentation of any adjustments made to the interest expense calculations. Ensuring accuracy in this section is vital since it directly affects the final tax reporting figures. Document your calculations thoroughly to prevent errors during audits.

Step-by-step instructions for completing Form 8990

Step 1: Gather required documentation

Before filling out Form 8990, gather all necessary documentation, including loan agreements, financial statements, and any prior IRS communications regarding interest expense deductions. This information will provide a solid foundation for accurate reporting.

Step 2: Fill out Form 8990 using the cloud-based platform

Utilize pdfFiller to access the latest template of Form 8990. With user-friendly PDF editing tools, you can fill out the form in the cloud seamlessly. The platform provides interactive tools to help check for errors proactively, thus reducing the risk of mistakes.

Step 3: Review and edit the form

Once completed, review the form carefully. Use pdfFiller’s collaboration features to allow team members to provide input and suggestions. It’s also important to check for common errors, such as incorrect EIN or omitted information, which could trigger processing delays.

Step 4: eSigning and submission

Upon final review, sign Form 8990 electronically through pdfFiller, which offers a secure way to eSign documents. After signing, familiarize yourself with the submission guidelines for the IRS to ensure it’s submitted correctly and on time.

Frequently asked questions (FAQs) about Form 8990

If you make a mistake on Form 8990, it's advisable to correct it as soon as possible, typically through an amended return. In case you don’t have all the required information, focus on gathering the most accurate data possible; partial forms are not ideal.

The IRS provides resources for additional support on complicated issues related to the form. If you're in a situation where you need help, don't hesitate to contact them via their customer service channels.

Updates and changes to Form 8990: what you need to know

The IRS regularly updates Form 8990 to reflect new tax codes and regulatory changes. Recent updates in the December revision have included clarifications on the calculation of non-deductible interest expense, making it crucial for users to review these modifications carefully to remain compliant.

Understanding these changes not only enhances accuracy in filings but also prepares businesses for possible future adjustments in tax regulations, enabling proactive financial planning.

Utilizing pdfFiller for Form 8990 management

pdfFiller stands out as an effective document management platform for handling Form 8990. With its array of interactive tools, users can edit directly on PDFs, eSign documents, and collaborate seamlessly with team members in real-time, creating a more streamlined filing experience.

The cloud-based platform is designed with the user in mind, offering features that enhance usability and simplify the management of the form. Customer testimonials reveal a high level of satisfaction regarding speed and efficiency when using pdfFiller.

Best practices for maintaining compliance with Form 8990

Timely filing of Form 8990 is crucial to avoid penalties and interest on business repayments. It’s essential to maintain organized records for all relevant documents, including loan documentation and any supporting financial statements. This organization not only helps with accurate reporting but is invaluable during audits.

To stay updated on IRS changes related to business interest, consider subscribing to tax bulletins or utilizing services like pdfFiller that keep users informed about evolving regulations. Enhancing knowledge in regulatory matters surrounding Form 8990 can save businesses from future complications.

Case studies: real-world application of Form 8990

Business Case #1 illustrates a company that successfully navigated the complexities of Form 8990 by utilizing pdfFiller. With organized documentation and a collaborative filing approach, they filed their form timely, resulting in seamless tax compliance.

In contrast, Business Case #2 highlights a scenario where lack of preparation resulted in errors during filing. The company missed out on significant deductions due to incorrect calculations, emphasizing the necessity of thorough understanding and accurate use of Form 8990.

Interactive tools for better document management

pdfFiller offers a comprehensive suite of tools for enhancing document management. Users can access editable templates, enable document sharing, and utilize interactive features that facilitate simple collaboration. All tools are designed to maximize efficiency during the preparation of Form 8990 and other documents.

Explore example templates directly on pdfFiller to see how the platform can elevate your document creation experience. The availability of tailored templates makes preparation of Form 8990 straightforward and intuitive.

People Also Ask about

Who is not subject to 163j?

What is the IRS limitation on business interest expense?

What is Form 8990 for?

Who is required to file a Form 8990?

What are the 3 conditions for Form 8990?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS 8990?

How do I make changes in IRS 8990?

Can I create an electronic signature for signing my IRS 8990 in Gmail?

What is form 8990 rev December?

Who is required to file form 8990 rev December?

How to fill out form 8990 rev December?

What is the purpose of form 8990 rev December?

What information must be reported on form 8990 rev December?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.