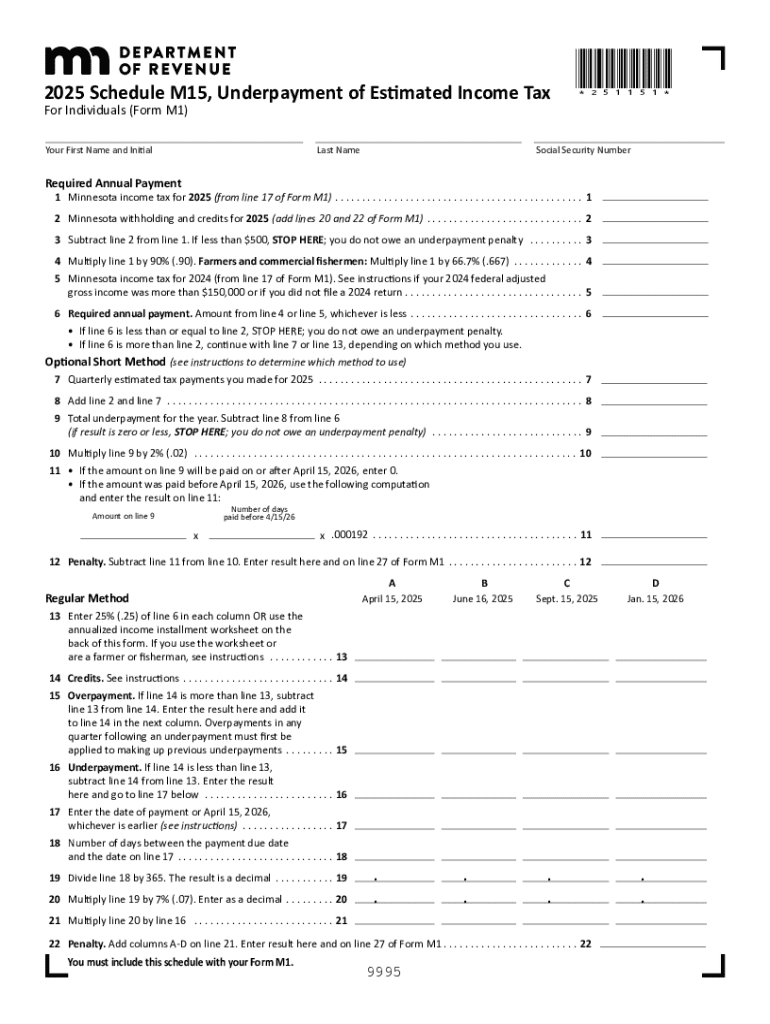

Get the free 2025 M15, Underpayment of Estimated Income Tax for Individuals. 2025 M15, Underpayme...

Get, Create, Make and Sign 2025 m15 underpayment of

Editing 2025 m15 underpayment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 m15 underpayment of

How to fill out 2025 m15 underpayment of

Who needs 2025 m15 underpayment of?

Understanding the 2025 M15 Underpayment of Form and How to Navigate It

Understanding the M15 form

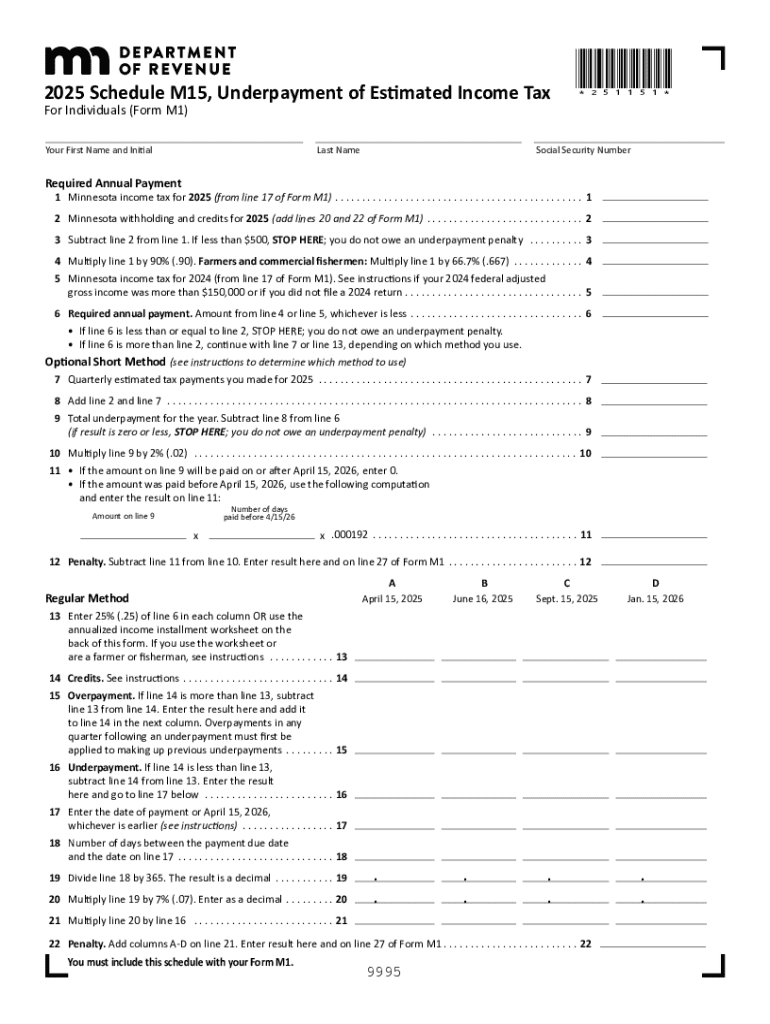

The M15 Form, officially known as the 'Income Tax Underpayment and Overpayment Form', plays a crucial role for taxpayers who have failed to pay the adequate amount of estimated tax throughout the year. Designed to help individuals and businesses report any discrepancies related to underpayment, the M15 form streamlines the process of settling tax debts properly. Primarily targeted at those who earn income subject to taxation yet haven't withheld enough tax during the pertinent year, completing the M15 form is necessary for adequate compliance and record-keeping.

In 2025, various elements affecting who needs to use the M15 form are in flux, reflecting ongoing changes in tax regulations and economic conditions. Taxpayers earning income from businesses, investments, or freelance work, and who fail to meet the minimum required tax payments, will need to complete this form to avoid incurring further penalties and interest.

Importance of the M15 form in 2025

The significance of the M15 form in 2025 cannot be overstated due to key changes in tax regulations and economic conditions. Each tax year, adjustments and updates are made to the tax code, and 2025 will have its own set of reforms impacting how underpayments are calculated and reported. This year may see an increase in the income threshold that differentiates between underpayment and full payment, prompting taxpayers to reevaluate their tax strategy to ensure compliance.

Consequently, failing to address an underpayment can result in financial strain from accumulating penalties and interests. Hence, it's paramount for taxpayers to be proactive—understanding what underpayments entail under the revised guidelines, and utilizing the M15 form effectively can prevent larger financial repercussions down the road.

Underpayment penalties

Penalties for underpayment can vary significantly based on the total amount owed and the timeframe of the delay in payment. Generally, the Internal Revenue Service (IRS) assesses an interest rate on any unpaid tax amount, which accrues daily until the total due is paid. Moreover, there can be additional fixed penalties if the underpayment threshold is not met—a fixed percentage of the unpaid tax will increase the obligation further.

Different types of penalties applicable to M15 filers include:

Understanding these penalties is crucial for M15 form filers as they directly influence the cost of delay in tax payments. A clear awareness of each type of penalty can empower taxpayers to address their tax situations more effectively.

Calculating your underpayment penalty

Calculating underpayment penalties is essential for knowing how much you may owe. The process begins by determining if you owe additional tax: If the sum of your withholdings and estimated payments is less than 90% of your total tax liability or less than 100% of your last year's tax obligation, an underpayment exists. The next step involves applying the appropriate penalty percentage based on your income bracket to the resulting underpayment.

Here is a basic step-by-step process to determine if you have an underpayment:

How interest applies for individuals

Interest accrual on underpayment is another key factor taxpayers must consider. The interest begins accruing on the due date of the tax to the date it is paid. For 2025, the IRS has set the quarterly interest rates that will be applicable for late payments, which are contingent on the federal short-term rate plus specific adjustments.

Factors influencing interest rates in 2025 include:

By understanding how interest operates within the context of an underpayment, taxpayers can devise timely strategies to minimize additional charges and manage their debt more effectively.

Avoiding interest penalties

To mitigate the risk of accumulating interest penalties, taxpayers should adopt specific best practices. For one, making estimated payments throughout the year can significantly reduce the amount owed by the end of the tax season. Ensuring you make timely payments, whether they are estimated or for previous tax years, is critical. Additionally, reviewing tax obligations quarterly can help you stay on top of your financial responsibilities.

Here are practical tips to further manage payment schedules effectively:

Implementing these practices can lead to better management of tax obligations, with fewer surprises during tax season.

Steps to file the M15 form accurately

Filing the M15 form accurately is essential to avoid delays and ensure compliance with tax regulations. The initial step in this process is gathering all necessary documentation. Potential paperwork includes your past tax returns, income statements, and records of estimated payments made throughout the year. Having these documents organized not only simplifies the form completion process but also provides you with a clear view of your financial circumstance.

A comprehensive list of documents required for filing includes:

Once all documentation is gathered, focus on accurately filling out the M15 form. Follow these detailed step-by-step instructions for completing each section:

Common mistakes to avoid during completion

When filling out the M15 form, several common mistakes can lead to unintentional penalties or processing delays. These errors often stem from simple oversights, for example: failing to double-check figures, using incorrect Social Security numbers, or neglecting to account for all income sources. It's beneficial to have another individual review the completed form to catch any potential errors prior to submission.

Ensuring accuracy and completeness in submission instills confidence that your tax obligations will be correctly assessed, significantly reducing the chance of receiving a notice of disagreement from the department of revenue due to discrepancies.

Using pdfFiller for M15 form management

pdfFiller offers a seamless solution for managing the M15 form and other essential documents. Features of pdfFiller simplify the process of filling out the M15 form, with user-friendly tools that allow for easy editing, signing, and even collaborating on forms with others if necessary. With a cloud-based architecture, users can access their documents from anywhere, facilitating the ability to review, modify, and sign forms securely.

You can benefit from additional capabilities such as:

By using pdfFiller, managing the M15 form becomes a more efficient process, freeing taxpayers to focus on their financial planning without getting bogged down by paperwork.

Frequently asked questions (FAQ)

Many taxpayers seeking clarity around the M15 underpayment process often have similar inquiries. Addressing the most common questions can pave the way for a better understanding.

Some typical inquiries include:

Resources for assistance

When tax season arrives, the need for professional assistance can become apparent, especially concerning complex situations such as those surrounding the M15 form. Finding the right help is crucial not just for confidence in processing but also for peace of mind.

Options for finding professional advice concerning M15-related queries include:

Additionally, ensure you have easy access to IRS resources, such as their official website, which can guide you on IRS forms and specific instructions required for the M15 underpayment situation.

Additional tools and templates from pdfFiller

For taxpayers navigating through tax documentation complexities, pdfFiller has made available a variety of tools and templates that can prove indispensable. Not only do these resources simplify the filing process but they also enhance your overall tax management experience. Users have access to templates for various tax forms beyond the M15, enabling streamlined record-keeping.

Some resources available include:

Related content

For those interested in a wider exploration of tax responsibilities and the nuances of the M15 form, further reading can provide valuable insights. Keeping yourself informed about not just penalties, but entire tax legislation, benefits you during the filing process.

Consider exploring these linked articles for comprehensive information:

Automatic translation disclaimer

For non-English speakers or those needing assistance in different languages, pdfFiller offers automatic translation services. While these services aim to provide a comprehensive understanding of forms and docs, it’s important to note that the accuracy can vary. Users should cross-reference translations when necessary, especially concerning complex legal or tax-related jargon.

Recommended best practices when utilizing translation services include always reviewing the original English version and consulting with bilingual tax professionals if you encounter discrepancies or misunderstandings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2025 m15 underpayment of directly from Gmail?

How do I edit 2025 m15 underpayment of on an iOS device?

How do I edit 2025 m15 underpayment of on an Android device?

What is 2025 m15 underpayment of?

Who is required to file 2025 m15 underpayment of?

How to fill out 2025 m15 underpayment of?

What is the purpose of 2025 m15 underpayment of?

What information must be reported on 2025 m15 underpayment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.