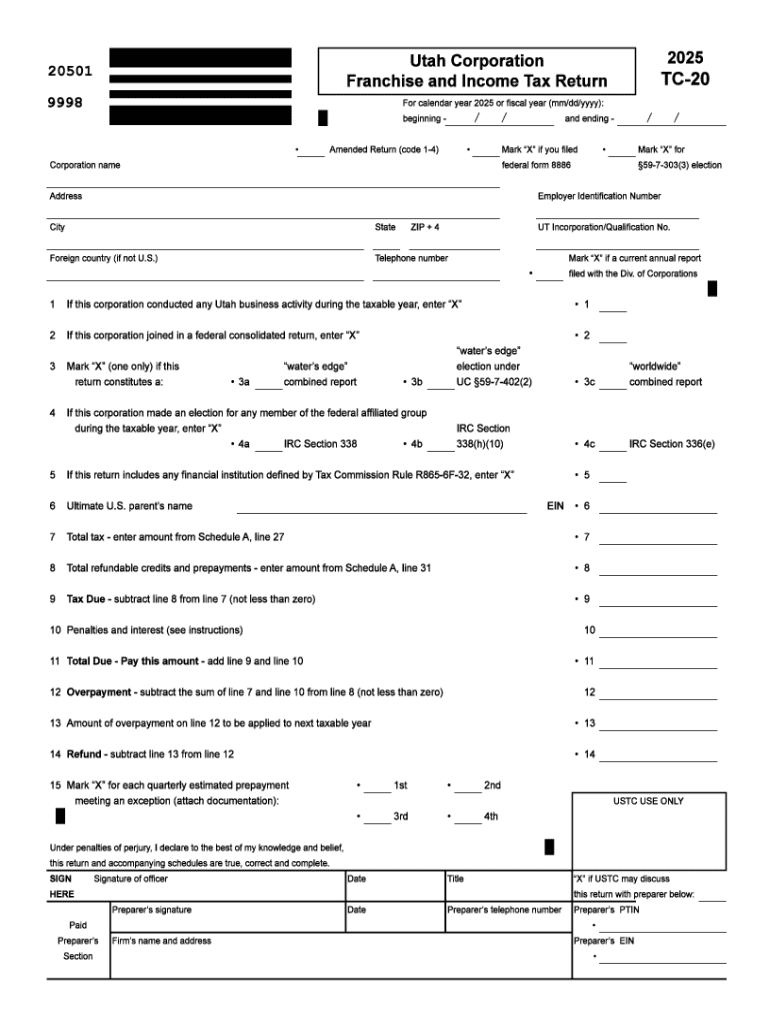

Get the free TC-20, Utah Corporation Franchise or Income Tax. Forms & Publications

Get, Create, Make and Sign tc-20 utah corporation franchise

How to edit tc-20 utah corporation franchise online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-20 utah corporation franchise

How to fill out tc-20 utah corporation franchise

Who needs tc-20 utah corporation franchise?

Navigating the TC-20 Utah Corporation Franchise Form

Understanding the TC-20 Utah Corporation Franchise Form

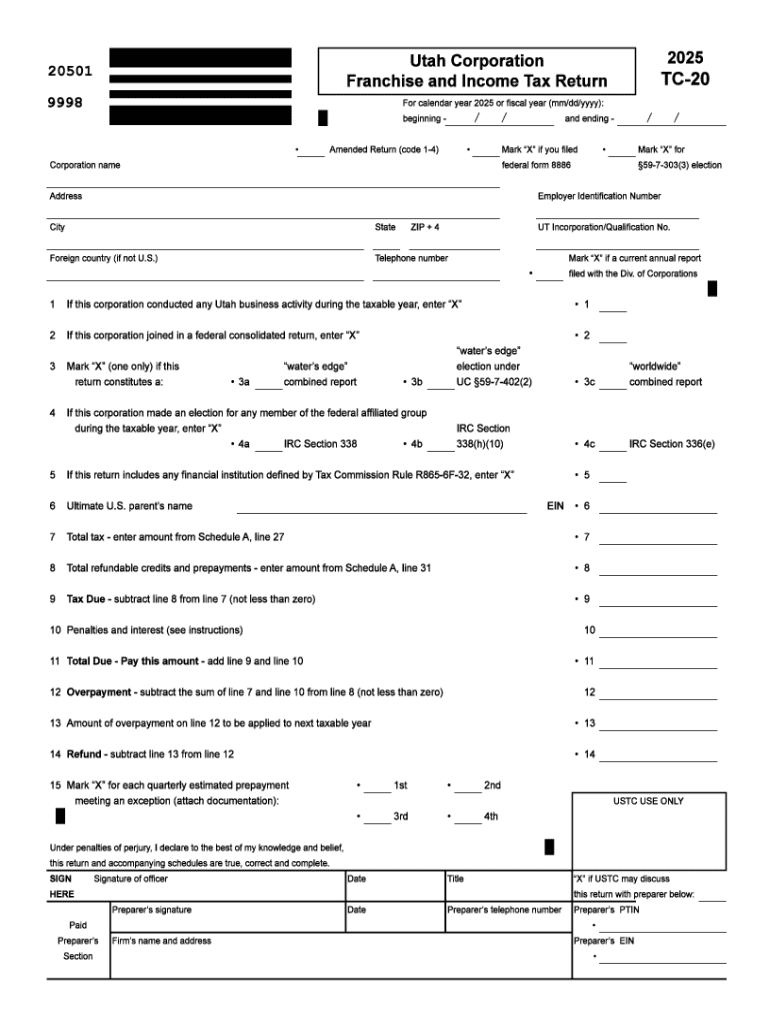

The TC-20 Utah Corporation Franchise Form is a crucial document that corporations in Utah must file annually to report their franchise tax obligations to the state. This form serves as an official record of a corporation's financial performance and tax liabilities within the relevant fiscal year. Every corporation operating in Utah is mandated to submit this form, regardless of whether they have generated profits or incurred losses.

For Utah corporations, the TC-20 form is not just a routine requirement; it plays a vital role in maintaining transparency with state tax authorities. The information provided on this form helps the state ensure compliance with tax laws, allocate resources effectively, and manage the overall economic health of the business environment in Utah.

Prerequisites for filling out the TC-20 form

Before beginning the TC-20 form, it is essential to confirm that your corporation meets the eligibility criteria set forth by the Utah State Tax Commission. Only corporations that are registered and doing business within the state can file this form. This includes both for-profit and nonprofit corporations established in Utah.

Gathering the required documentation is a critical step in ensuring a smooth filing process. Here is a list of the necessary information:

Step-by-step guide to completing the TC-20 form

The TC-20 form is divided into several sections, each designed to collect specific information necessary for calculating your corporation's franchise tax. Below is a detailed breakdown of how to navigate through the TC-20 form to ensure accurate completion.

Section 1: Basic Corporate Information involves providing the name and address of the corporation, as well as selecting the entity type. It's vital to ensure that the spelling and details match the records at the state level.

Section 2 focuses on franchise tax calculations. Here, you need to understand the applicable tax rates and thresholds depending on your corporation's income. For example, Utah employs a flat tax rate system for certain income levels while using graduated rates for higher earnings.

Section 3 details reporting and deductions. You will report your annual income, followed by a list of eligible deductions and exemptions, which can help in reducing the overall taxable income.

Lastly, in Section 4, you will find additional information and elective taxes. It is crucial to report any optional taxes that may be relevant to your corporation and provide any necessary supplementary statements.

Common errors and how to avoid them

Filing the TC-20 form can be straightforward, yet several common errors may hinder the process. Many corporations misreport their corporate structure by incorrectly categorizing the entity type, which can lead to complications with tax authorities.

Another frequent mistake is making incorrect financial calculations. It's essential to double-check your numbers and ensure that figures accurately reflect your financial tables. Missing signatures and dates on the form can also result in your submission being deemed incomplete, so make sure every signature is properly affixed before submission.

How to submit the TC-20 form

Corporations can submit the TC-20 form electronically or via mail. The electronic filing process is often more efficient and allows corporations to quickly manage their submissions. To file electronically, access Utah's online tax filing system through the Utah State Tax Commission website. Ensure you have all login credentials and necessary details prepared in advance.

For those opting for paper submission, it's essential to send the completed form to the correct address provided on the form's first page. Pay attention to important deadlines to avoid penalties. Note that certain state holidays may affect processing times, so plan accordingly.

Managing your TC-20 form after submission

Once you have submitted your TC-20 form, tracking its submission status can provide peace of mind. Utilize the Utah State Tax Commission’s resources to follow up on your submission. If there are any underlying issues or questions related to your filing, you can reach out to their customer service for guidance.

In case amendments or corrections are necessary post-submission, it's advisable to act swiftly to rectify any discrepancies. The state allows for amendments, but strict timelines must be adhered to in order to be compliant with regulatory requirements.

Filing fees and payment options

Filing the TC-20 form typically incurs associated fees which vary based on the corporation's income level. It is crucial to be aware of these filing fees to avoid any surprises during submission. Failure to include the appropriate fee can lead to delays and potential penalties.

Payment methods are flexible, with options often including credit card payments, bank transfers, and checks. Ensure all payments are submitted in a timely manner to prevent penalties, which could adversely affect your corporation's standing with the Utah State Tax Commission.

Related forms and resources for Utah corporations

In addition to the TC-20 form, Utah corporations may encounter a variety of other relevant forms. For instance, the Utah Income Tax Return (UT-1) is essential for reporting personal income earned by shareholders. Additionally, a Business Personal Property Tax Return is necessary for corporations owning property in Utah.

It is always wise to consult official resources from the Utah State Tax Commission, which offers comprehensive publications and guidance designed specifically for corporations filing taxes. Leveraging these resources can help businesses stay informed and compliant with all necessary regulations.

Interactive tools and resources for document management

Utilizing tools such as pdfFiller can streamline the process of filling out and managing the TC-20 form. With pdfFiller, users can easily edit and eSign PDF documents directly from their devices, making it a great choice for corporations seeking efficiency.

With its collaboration features, pdfFiller allows teams to work together on document completions in real-time, regardless of location. The cloud-based solution means forms can be accessed and managed anywhere, anytime, empowering users to maintain control over their documents even while on the move.

Frequently asked questions (FAQs) about the TC-20 form

As with any official form, questions frequently arise regarding the TC-20. Common inquiries relate to eligibility, what constitutes reportable income, and understanding the various deductions available. For example, many corporations want guidance on navigating more complex situations involving multi-state operations.

To best navigate these concerns, it’s advisable to reach out with specific questions to the Utah State Tax Commission or consult official guidance provided on their website. Having clarity on these points can greatly facilitate the successful filing of the TC-20 form.

Final considerations when filing the TC-20 form

Maintaining accurate and thorough records is essential not just during the filing process, but also for future compliance. When storing these important documents, leveraging tools like pdfFiller can be invaluable for future filings, ensuring a smooth and organized approach. Having a well-documented record can provide insights into your corporation's tax history and assist in easily referencing information when required.

Ultimately, inform yourself completely about the requirements and expectations surrounding the TC-20 Utah Corporation Franchise Form. A proactive approach to tax filings will benefit your corporation in securing its standing with state authorities and avoiding unnecessary issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tc-20 utah corporation franchise for eSignature?

Can I create an electronic signature for signing my tc-20 utah corporation franchise in Gmail?

How do I complete tc-20 utah corporation franchise on an iOS device?

What is tc-20 utah corporation franchise?

Who is required to file tc-20 utah corporation franchise?

How to fill out tc-20 utah corporation franchise?

What is the purpose of tc-20 utah corporation franchise?

What information must be reported on tc-20 utah corporation franchise?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.