Get the free Leg. Finance - House 6c Senat SB 332 cont., 340, 341, 342 ...

Get, Create, Make and Sign leg finance - house

Editing leg finance - house online

Uncompromising security for your PDF editing and eSignature needs

How to fill out leg finance - house

How to fill out leg finance - house

Who needs leg finance - house?

Leg finance - house form: A comprehensive guide

Understanding leg finance and its importance

Leg finance refers to the legal and financial processes involved in securing funding for housing, encompassing various aspects from loan applications to title transfers. Understanding leg finance, specifically for house forms, is critical because it ensures that individuals navigate the complex legalities and financial requirements efficiently. A well-prepared house form can significantly expedite the financing process.

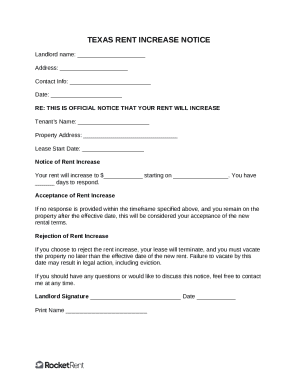

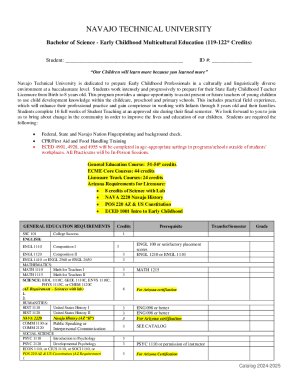

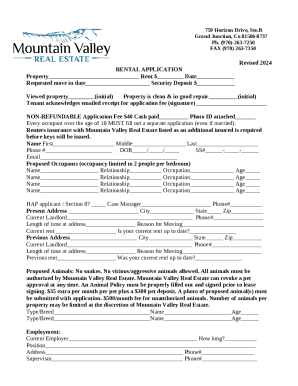

Overview of the house form

The house form acts as a comprehensive document that gathers necessary information to assess an individual's eligibility for financing a home. This form typically solicits a range of details about the borrower and the property in question. The accuracy of the information provided is paramount; discrepancies might lead to delays or outright denial of loan applications.

Completing the house form accurately not only fosters trust but also expedites review processes by financial institutions. Missing or erroneous information can complicate the approval timeline, causing frustration for applicants.

Interactive tools for efficient house form management

Utilizing interactive tools, such as those available on pdfFiller, simplifies the complexities of managing your house form. These tools offer features that make form completion intuitive and efficient, enabling users to access templates, fill them out electronically, and store documents securely.

These tools are equipped with features designed for ease of use, allowing users to navigate the house form effortlessly and ensure compliance with financial regulations.

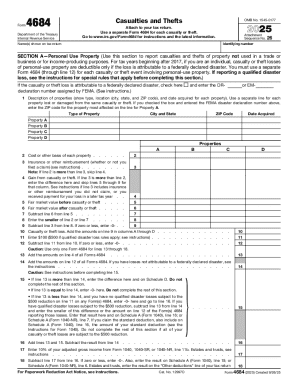

Step-by-step instructions for completing the house form

Preparing your documents is a critical first step in completing the house form. Assembling the necessary supporting documents beforehand, such as proof of income, tax returns, and bank statements, not only makes filling out the form easier but also enhances accuracy.

Ensuring your information is organized can prevent confusion later in the process, making it essential to maintain clear records of finances.

Filling out the house form demands attention to detail. Start by completing the sections methodically, ensuring that each field is accurately filled out. If you're unsure about a section, consulting a financial advisor can provide clarity.

Common pitfalls to avoid include inaccuracies in financial disclosures and neglecting to double-check the required signatures. It's vital to ensure the form adheres to all legal standards before finalization.

Collaborating on the house form

Sharing the house form with interested stakeholders, such as financial advisors or family members, can provide additional perspectives. By inviting collaborators to review the house form, feedback might highlight areas for improvement that you may have overlooked.

PdfFiller’s features allow you to track changes and comments made by collaborators, ensuring that everyone's input is taken into account.

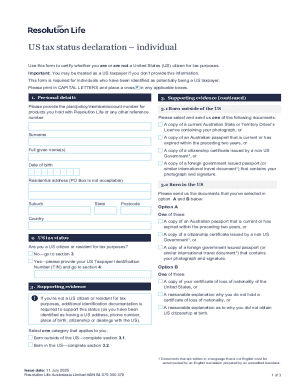

Once satisfied with the details, utilizing the eSignature feature on pdfFiller ensures that your house form is legally binding. Understanding the eSignature process is crucial, as these signatures must meet specific legal standards to be valid.

Managing your completed house form

After completing the house form, safeguarding the document is paramount. Utilizing secure storage options on pdfFiller allows you to archive your completed house form whilst maintaining accessibility for future references. The platform's encryption protocols ensure your sensitive information remains protected.

Moreover, pdfFiller provides the flexibility of accessing forms from anywhere, making it easy to retrieve documents when needed. This feature is particularly beneficial for individuals with busy schedules or those frequently on the go.

Troubleshooting common issues

Despite careful planning, challenges may arise when submitting the house form. Common issues include discrepancies in personal information or incomplete sections. Addressing these problems proactively can prevent setbacks in your financing journey.

Referencing an FAQ section specific to house form challenges can provide quick resolutions, and pdfFiller offers extensive support resources tailored to assist users at every turn.

Should the need arise, contacting customer support through pdfFiller will yield immediate assistance, ensuring that your questions about the house form are addressed quickly.

Future steps after completing the house form

Once your house form has been submitted, understanding the subsequent steps is crucial. The financing process can involve additional requests for information by lenders or a notification of your application's approval or denial. Staying informed about these developments is key to a successful financing outcome.

Keeping track of important deadlines related to your application is another critical facet. Many lenders provide timelines that indicate when to expect updates, thus enhancing your preparation and response times.

Case studies and real-life examples

Exploring success stories of individuals navigating the house form process showcases the importance of thorough preparation and engagement with tools like pdfFiller. For instance, a couple seeking to buy their first home found that using pdfFiller's interactive forms drastically reduced errors, speeding up the approval process.

Conversely, other individuals encountered challenges due to incomplete documentation and delays in the approval process. Learning from these experiences can provide actionable insights for future applicants, reinforcing the significance of utilizing comprehensive platforms.

Real-life examples underline how critical it is to stay informed, organized, and equipped with the right resources during your leg finance journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my leg finance - house in Gmail?

Can I create an electronic signature for the leg finance - house in Chrome?

Can I create an electronic signature for signing my leg finance - house in Gmail?

What is leg finance - house?

Who is required to file leg finance - house?

How to fill out leg finance - house?

What is the purpose of leg finance - house?

What information must be reported on leg finance - house?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.