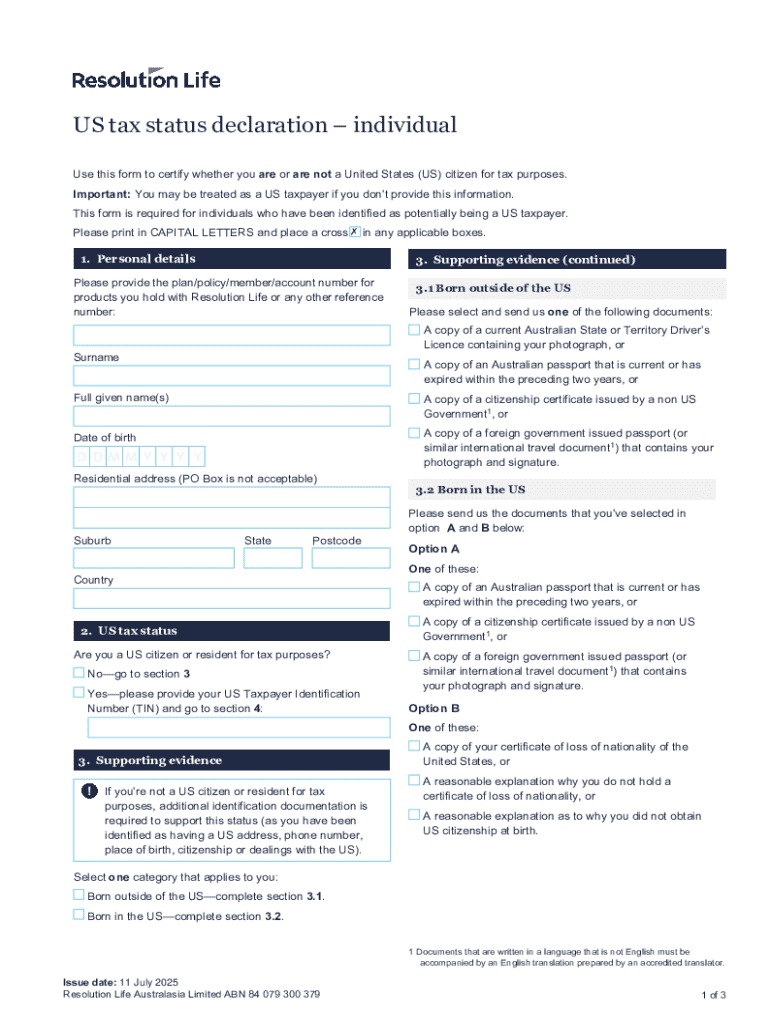

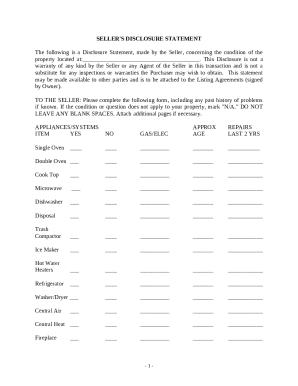

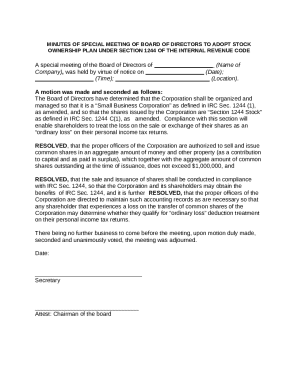

Get the free Form to show IRS no US residency for federal taxes

Get, Create, Make and Sign form to show irs

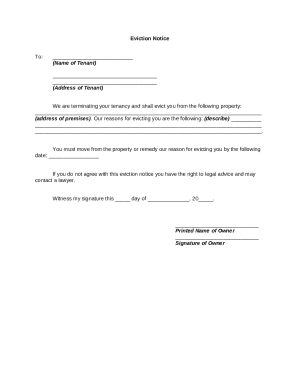

Editing form to show irs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form to show irs

How to fill out form to show irs

Who needs form to show irs?

Form to Show IRS Form: A Comprehensive Guide

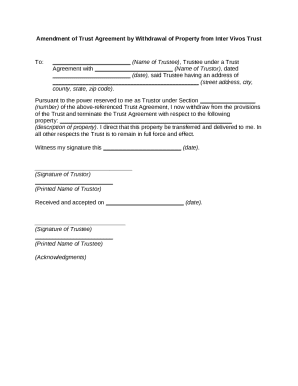

Understanding the importance of IRS forms

IRS forms are fundamental in the tax filing process for individuals and businesses. These documents not only facilitate tax reporting but also ensure compliance with the Internal Revenue Service. Accurate completion of these forms is paramount, as mistakes can lead to issues such as delayed refunds or even audits.

Common IRS forms include the U.S. Individual Tax Return (Form 1040), Employee's Withholding Allowance Certificate (Form W-4), and Wage and Tax Statement (Form W-2). Each of these plays a crucial role in a taxpayer's annual requirements and has specific legal implications regarding deductions and earnings. Underreporting income or miscalculating expenses can have serious repercussions, emphasizing the importance of accuracy.

Step-by-step guide to accessing IRS forms

Accessing IRS forms has been made easier through the IRS website. Navigate the site by visiting IRS.gov and clicking on the 'Forms & Instructions' section. Here, you can find various forms categorized by type, making it convenient to locate what you need.

Furthermore, pdfFiller offers a robust resource for accessing these forms. With its extensive library, users can quickly find, fill out, and manage IRS forms without any hassle. Whether you prefer PDF forms or online fillable formats, pdfFiller caters to both, allowing for a seamless user experience.

Essential IRS forms explained

One of the most widely used forms is the U.S. Individual Tax Return, commonly known as Form 1040. This form requires individuals to report their gross income, claim deductions, and determine tax liability. It's essential to pay attention to sections related to exemptions and deductions to minimize taxable income effectively.

Another critical document is the Employee's Withholding Allowance Certificate, or Form W-4. This form helps employers establish how much tax to withhold from employees' paychecks, directly impacting take-home pay. Correctly completing this form by reviewing personal financial situations, such as dependents or filing status, ensures that employees are neither over- nor under-withheld.

Then there’s Form W-2, essential for employees, which outlines wages earned and taxes withheld during the year. The information reported on the W-2 is crucial for preparing accurate tax returns, making understanding this form vital.

Filling out IRS forms with confidence

Accurate form filling is essential to avoid penalties or delays in tax processing. Start by gathering all necessary documents, including income statements, prior year returns, and receipts for deductions. Create a checklist of information required for each form to ensure that nothing is overlooked.

Common mistakes to avoid include miscalculating income, neglecting to sign forms, and failing to update personal information on W-4s. Using tools like pdfFiller allows users to double-check entries, employ interactive editing features, and incorporate eSignature capabilities to ensure forms are completed accurately and professionally.

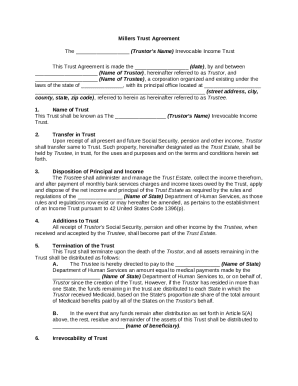

Managing IRS forms efficiently

Keeping track of IRS forms can be overwhelming, especially for individuals with multiple income sources. Best practices include maintaining a dedicated folder for tax documents and utilizing digital tools like pdfFiller for seamless organization. Categorize documents by type, such as income forms, deduction records, and previous returns, to streamline access when filing.

Moreover, pdfFiller enables users to share forms with team members or tax professionals effortlessly. This enhances collaboration and reduces errors by allowing multiple parties to review and suggest changes in real-time, ensuring completeness and accuracy.

Collaborating on IRS forms

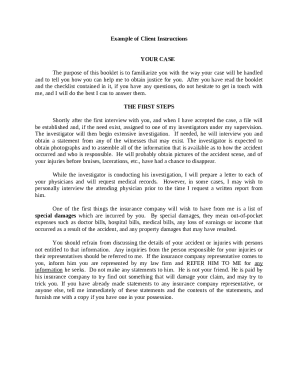

Collaboration is key when filling out IRS forms, especially for businesses. pdfFiller offers tools that allow team members and advisors to provide feedback and check documents before submission. Real-time collaboration features make it easy to edit and adjust forms based on input from peers or accountants.

Utilizing commenting tools ensures everyone involved can communicate effectively regarding potential changes or clarifications, leading to higher accuracy and a more thorough understanding of the tax obligations at hand.

Navigating IRS form submissions

Once IRS forms are completed, the next step is submission. Taxpayers can choose to e-file through tax software or mail in a paper copy to the IRS. The e-filing process is often quicker and provides instant confirmation, whereas mailing requires tracking to ensure forms are received.

It is crucial to adhere to submission deadlines to avoid penalties. Utilize pdfFiller’s tracking tools to monitor the submission status and ensure all documents are sent and received correctly, fostering peace of mind during the tax season.

What to do after submission

After submitting your forms, it's essential to know how to handle any potential inquiries from the IRS. Keeping thorough records of all submitted forms is critical for reference purposes, particularly if an audit arises. pdfFiller's features help securely store documents, ensuring they are retrievable when needed.

In the event of an audit, being organized and having access to all relevant documents will streamline the process and mitigate any stress involved. Leveraging pdfFiller’s organized digital storage can provide real-time access to historical tax documents, helping taxpayers stay prepared and informed.

Frequently asked questions about IRS forms

Taxpayers often have questions regarding the specifics of IRS forms. Common concerns include the correct forms needed, deadlines, and how to address errors on filed forms. Many taxpayers are also unsure of how to navigate the online resources offered by the IRS or pdfFiller.

For further clarification, the IRS provides extensive resources, including a detailed FAQ section on their website. Additionally, tools like pdfFiller feature comprehensive guides and customer support to answer any specific inquiries about form issues.

Maximizing the benefits of using pdfFiller for IRS forms

pdfFiller not only simplifies the process of finding and filling out IRS forms but also offers unique features designed to enhance document management. Features such as interactive editing, a library of templates, and eSigning capabilities make it an ideal solution for efficient tax form completion.

Numerous success stories highlight how businesses and individuals have effectively streamlined their document processes with pdfFiller. From facilitating collaborative editing with tax professionals to maintaining organized records, the platform empowers users to submit their forms confidently and accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form to show irs directly from Gmail?

How do I edit form to show irs straight from my smartphone?

How do I fill out the form to show irs form on my smartphone?

What is form to show irs?

Who is required to file form to show irs?

How to fill out form to show irs?

What is the purpose of form to show irs?

What information must be reported on form to show irs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.