Get the free INSURANCE REGULATORY AND ... - irdai gov

Get, Create, Make and Sign insurance regulatory and

How to edit insurance regulatory and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance regulatory and

How to fill out insurance regulatory and

Who needs insurance regulatory and?

Insurance regulatory and form how-to guide

Understanding insurance regulatory frameworks

Insurance regulations serve as crucial guidelines that maintain order in the insurance industry, ensuring the protection of consumers and the financial viability of insurers. These regulations define the responsibilities of various stakeholders within the industry, from insurers to policyholders, and are essential for fostering transparency, fairness, and reliability in insurance practices.

Key regulatory bodies, which vary by region, oversee compliance and enforce these regulations. In the United States, the National Association of Insurance Commissioners (NAIC) plays a pivotal role, working alongside state departments of insurance to establish standards and practices. Similarly, in the European Union, the European Insurance and Occupational Pensions Authority (EIOPA) governs insurance policies and practices across member states.

Types of insurance entities

The insurance sector encompasses various entities, each with its own regulatory framework and compliance requirements. This includes primary insurers, which directly provide policies to consumers, and reinsurers that offer insurance to insurers, mitigating risk for primary insurers. Captive insurers represent a unique segment, providing insurance to their parent companies to manage financial risk effectively.

Additionally, health insurers and Health Maintenance Organizations (HMOs) operate under strict regulations to ensure compliance with healthcare laws, while life insurers and property & casualty insurers offer products to help individuals manage risks associated with life events and property loss. Meanwhile, surplus lines insurers provide coverage for risks that traditional insurers may not cover, often subject to different regulatory standards.

Forms and filings: crucial components of compliance

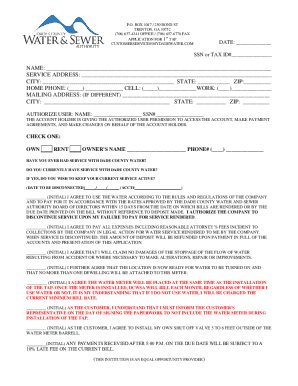

Regulatory forms are essential in maintaining compliance within the insurance industry, acting as vital documentation that ensures transparency and accountability. Each form serves a specific purpose, providing regulatory bodies with the information necessary to oversee entities effectively. Furthermore, they play a pivotal role in standardizing data collection across insurers.

Common regulatory forms include rate filing forms, annual financial statements, and various licensing applications. For instance, insurers must routinely file their financial statements to demonstrate financial responsibility and ensure funds are available to settle claims. Health insurers may need to submit forms related to network adequacy or consumer complaints related to service delivery.

Key form categories

Insurance regulatory forms can be categorized mainly as follows:

Essential steps for completing regulatory forms

Completing regulatory forms can be a daunting task, but by following a structured approach, the process can become manageable. The first step is to gather all necessary information and documents. This includes previous filings, a list of stakeholders, and financial data. Familiarizing yourself with the instructions for each specific form is equally important to ensure accurate completion.

Once prepared, the step-by-step process for filling out these forms should include:

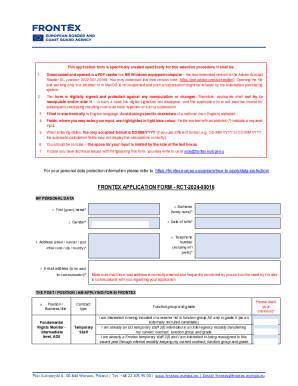

Best practices for managing insurance forms digitally

Managing regulatory forms digitally can streamline the process significantly. Cloud-based solutions like pdfFiller empower users to complete forms, store documents securely, and access files from anywhere. The benefits of using such platforms include improved collaboration among teams and reduced reliance on physical documentation, which can slow down the workflow.

pdfFiller offers various features that enhance user experience, such as eSigning capabilities, allowing users to sign documents electronically, and collaboration tools that enable multiple stakeholders to work on a document simultaneously. These features facilitate efficient communication, essential for meeting deadlines and ensuring that forms are submitted promptly.

Tips for ensuring compliance with state and federal regulations

To effectively manage compliance, it's crucial to stay informed about regulatory changes at both the state and national levels. Subscribing to regulatory newsletters and following industry updates will help ensure you never miss important announcements that can affect your filings. Additionally, maintaining secure document handling practices safeguards sensitive information and protects against data breaches, which can have severe repercussions for insurers.

Interactive tools for form management

Utilizing interactive forms presents several advantages, particularly in the world of insurance regulatory compliance. These modern forms come equipped with dynamic fields that can change based on user inputs, ensuring that the correct information is captured properly. Automated calculations within these forms save time and minimize errors, making the whole experience user-friendly.

Interactive forms often integrate well with existing management systems, offering a seamless workflow for users. Through APIs, businesses can enhance their operational functionality, linking various forms and documents together for easier access and insight. This interconnectedness leads to improved efficiency and data collection accuracy.

Collaborating with teams on regulatory compliance

Collaboration within teams is integral to ensuring regulatory compliance across all forms and processes. Clearly defined roles, such as who oversees submissions and who handles revisions, can streamline the compliance process. This division of responsibilities allows tasks to be completed faster and with greater accuracy.

Best practices for team collaboration in form management include:

Managing changes and updates to forms

Change is inevitable in insurance regulations, and having a robust process for revising and resubmitting forms is crucial. Common scenarios that may require revisions include changes in regulatory requirements, feedback from regulatory bodies, or internal adjustments to policies. It's essential to notify regulatory authorities when such changes occur, as this maintains transparency and accountability.

To stay updated on regulatory requirements, consider the following approaches:

Frequently asked questions (FAQs) related to insurance regulatory forms

Addressing common inquiries about regulatory forms can demystify the process for many insurers. A common concern often arises around what to do if a form is rejected. In these instances, reviewing the feedback provided by regulators can highlight areas needing adjustment, and rerouting your efforts towards rectifying these issues can facilitate resubmission.

Another typical question pertains to handling common mistakes made during the form completion process. Developing a checklist prior to form submission can help identify potential pitfalls and correct them accordingly. Regular training and refresher courses for involved team members can also mitigate errors.

Additional clarifications

Forms are periodically updated to reflect the evolving nature of insurance regulations. Staying informed on how frequently these updates occur is crucial for compliance, as it can vary by form and regulatory body. Regularly checking official announcements or engaging with industry networks will provide clarity and help ensure you remain compliant with the latest standards.

Case studies: successful management of regulatory forms

Real-life examples of organizations effectively managing regulatory forms shed light on best practices. For instance, a prominent health insurer implemented a digital document management system that reduced their filing turnaround time by 40%. By offering their team the ability to collaborate seamlessly in a cloud environment, they ensured that compliance was faster and more accurate.

Lessons learned from the challenges faced by insurers often revolve around the need for proactive compliance measures. Organizations that anticipate changes and prepare for them, such as by engaging in reserve assessments and stress testing, find themselves better equipped to handle regulatory demands and maintain a competitive edge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my insurance regulatory and in Gmail?

Can I sign the insurance regulatory and electronically in Chrome?

Can I edit insurance regulatory and on an iOS device?

What is insurance regulatory and?

Who is required to file insurance regulatory and?

How to fill out insurance regulatory and?

What is the purpose of insurance regulatory and?

What information must be reported on insurance regulatory and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.