Get the free Form 15G for EPF WithdrawalA Complete Guide

Get, Create, Make and Sign form 15g for epf

Editing form 15g for epf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 15g for epf

How to fill out form 15g for epf

Who needs form 15g for epf?

How to Fill Out Form 15G for EPF

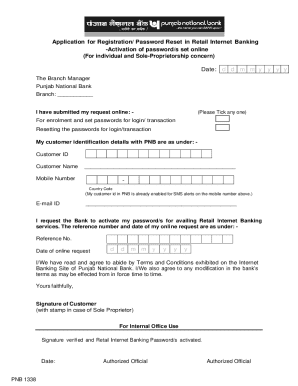

Understanding Form 15G for EPF

Form 15G is a vital document for individuals wishing to withdraw their Employees' Provident Fund (EPF). It allows account holders to declare that their total income is less than the taxable limit, thus potentially avoiding tax deductions at source (TDS). This is particularly important during EPF withdrawal because if you don’t provide this form, your EPF balance may be subject to TDS, which can affect the amount you receive.

The importance of Form 15G lies in its ability to facilitate smooth transactions and ensure individuals retain a greater portion of their EPF savings. It essentially signals to the employer or EPF authority that the individual is not liable for tax, allowing for a more efficient withdrawal process.

Who needs to submit Form 15G?

Individuals who are eligible to submit Form 15G are generally those whose total taxable income for the financial year is below the basic exemption limit. This includes students, unemployed individuals, and those with a limited income like pensioners. Situations where Form 15G is applicable include EPF withdrawals for individuals leaving service or those who have reached retirement age.

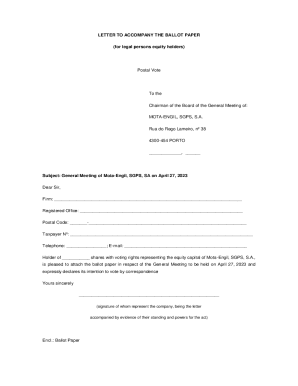

Key components of Form 15G

Form 15G consists of several components. It's structured to ensure that all relevant personal and tax information is captured efficiently. The first section focuses on personal details, where you’ll include your name, address, and PAN number. This is crucial for identification purposes to avoid any fraud or mismatches.

The tax information section requires you to specify the assessment year—this helps authorities understand which financial year the form pertains to. Lastly, the declaration component is your acknowledgment of the information provided, affirming its accuracy. Paying attention to these details is key.

Common mistakes include incorrect PAN details, mismatched assessment years, and leaving sections blank. Double-check all entered information to avoid delays in processing.

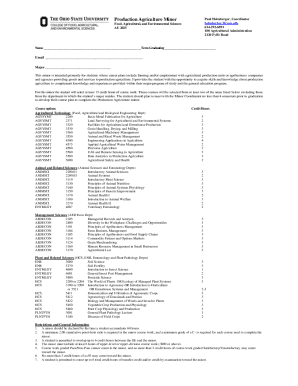

Step-by-step guide to filling out the form 15G

Filling out Form 15G is a straightforward process, but attention to detail is crucial. Here’s a step-by-step guide.

Following these steps ensures that your EPF withdrawal can proceed without unnecessary hurdles. If you prefer, utilizing platforms like pdfFiller can streamline this process, allowing for easy editing, signing, and document management.

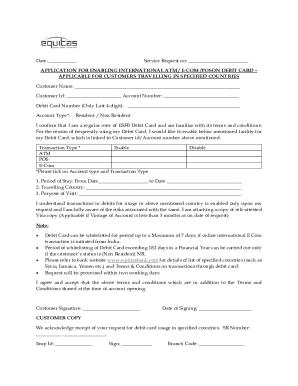

Using pdfFiller to fill out Form 15G

Utilizing pdfFiller for Form 15G offers various benefits that enhance user experience. PdfFiller is a cloud-based platform that allows you to access your forms from anywhere, eliminating the hassle of physical document management.

The platform's collaboration tools facilitate teamwork, allowing multiple users to edit and manage documents collectively. Interactive guides for document creation and completion are also readily available, ensuring users can navigate the process easily.

PdfFiller's user-friendly interface and simplified procedures make it an ideal choice for those looking to manage their documentation in an efficient manner.

Frequently asked questions (FAQs) about Form 15G

Inquiries regarding Form 15G often arise, particularly relating to its eligibility and submission processes. Here are some common FAQs that many individuals ask.

Clarifications on tax benefits indicate that submitting Form 15G can help you avoid unnecessary tax deductions while maximizing your EPF withdrawal. It's crucial to be informed and proactive about your tax obligations.

Other forms related to EPF withdrawals

In addition to Form 15G, there are other relevant forms that you may need to familiarize yourself with, particularly Form 15CA. This form is necessary for remittance of money outside the country and is critical if you plan to receive your EPF amount while residing abroad.

Understanding these forms ensures a seamless and efficient withdrawal process, safeguarding your financial interests.

Additional considerations

It is important to be aware of the tax implications of EPF withdrawals. If incorrectly filled, Form 15G could lead to potential tax liabilities, hence accuracy is paramount. Moreover, always maintain records of submitted forms as proof of your declarations.

Keeping copies helps in resolving disputes or in cases where income authorities may seek verification. This practice also promotes better financial management.

Conclusion

In summary, the process of filling out Form 15G for EPF is crucial for avoiding unnecessary tax deductions during your withdrawal. Emphasizing accuracy while going through this process cannot be overstated, as it directly affects your finances. Utilizing tools like pdfFiller enhances your experience, allowing for simple and effective document management.

Mastering Form 15G is an essential skill for anyone wanting to navigate their EPF benefits efficiently and ensuring that they maximize their entitlements without facing tax-related hassles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 15g for epf without leaving Google Drive?

Where do I find form 15g for epf?

How do I execute form 15g for epf online?

What is form 15g for epf?

Who is required to file form 15g for epf?

How to fill out form 15g for epf?

What is the purpose of form 15g for epf?

What information must be reported on form 15g for epf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.