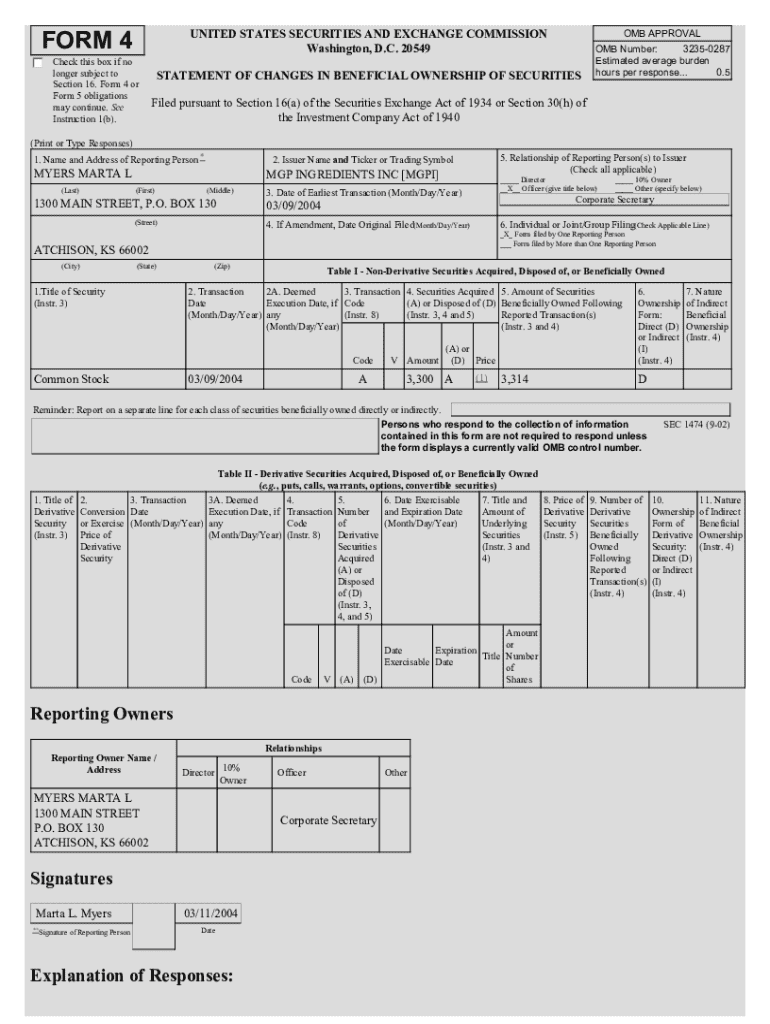

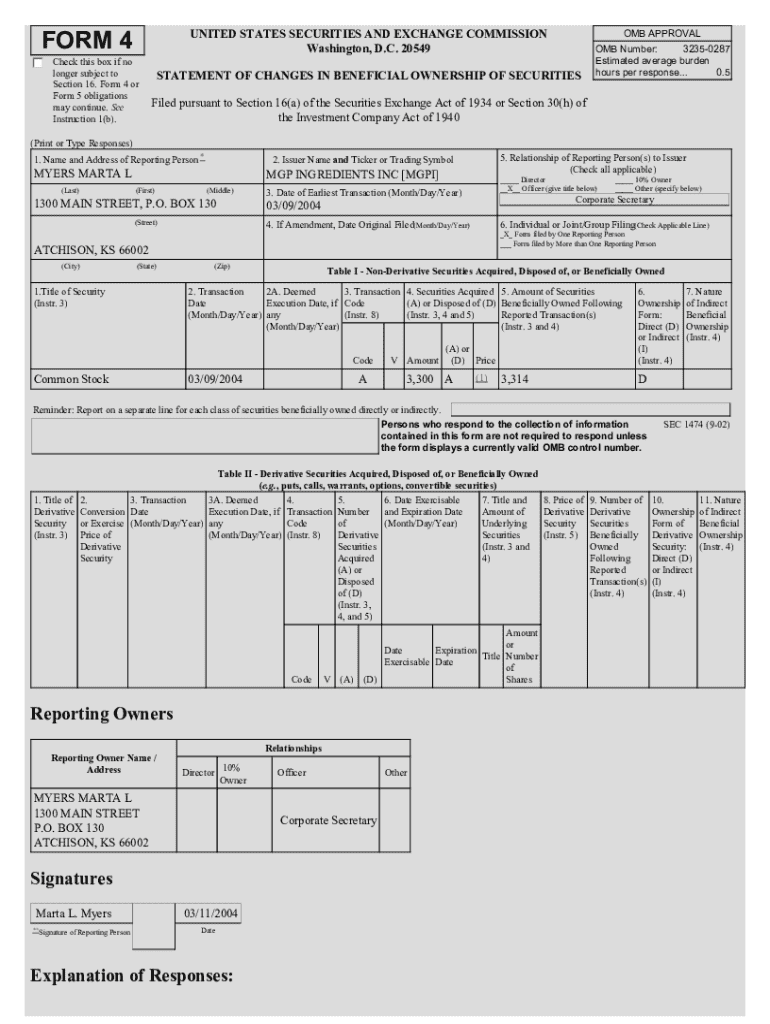

Get the free 3,300 A

Get, Create, Make and Sign 3300 a

Editing 3300 a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 3300 a

How to fill out 3300 a

Who needs 3300 a?

The Ultimate Guide to the 3300 Form: Fill, Sign, and Manage with Ease

Understanding the 3300 Form

The 3300 Form is a critical document utilized across various sectors to facilitate financial transactions and legal agreements. Primarily, it serves official purposes—be it government-related transactions or private sector dealings—ensuring standardized information collection.

The importance of the 3300 Form cannot be understated. It acts as a formal record of agreements, protects parties involved, and provides a means for traceability in transactions. Whether you're applying for a loan, settling a real estate deal, or even managing personal finances, familiarity with this form is imperative.

Preparing to fill out the 3300 Form

Before you dive into filling out the 3300 Form, it's essential to gather all the necessary documentation and information. Make sure you have all personal identification details, including social security numbers, addresses, and the specific purpose of the form.

Financial information is another crucial component. You should have your latest bank statements, income proof, or investment details ready for reference. Depending on the form's purpose, additional documents such as tax returns or proof of employment might also be required.

Common mistakes to avoid during this preparation phase include leaving signatures blank or providing incorrect information. Always ensure that everything is accurate before submission to prevent delays.

Step-by-step instructions for completing the 3300 Form

Accessing the 3300 Form is straightforward. You can obtain it online through mainstream pdf tools or through your local government office. You may also find it available in print at specific service points.

Filling out the form requires attention to detail. Here's a detailed walkthrough for each section:

If you need to make corrections on the form after filling it out, tools like pdfFiller provide user-friendly editing capabilities to help you avoid errors and confusion.

Signing the 3300 Form

Signing the 3300 Form is a vital step; your signature confirms that you agree to the terms outlined. It bears legal significance and can impact the enforcement of any agreements made.

With pdfFiller, eSigning becomes seamless. Simply upload the filled form, utilize the eSignature tool, and follow the provided steps to electronically sign. This method also ensures that your signature is secure and legally valid, streamlining the submission process.

Submitting the 3300 Form

Now that your form is completed and signed, submitting it is the next crucial step. You may choose to submit the 3300 Form via mail, email, or online depending on the guidelines specified for your particular form.

Ensuring successful submission is vital. You can track the status of your submission through various channels, including confirmation emails or official tracking numbers provided upon submission.

Managing your 3300 Form post-submission

Once submitted, it's wise to store a copy of the 3300 Form securely. Utilizing cloud-based storage solutions like pdfFiller provides an avenue for safe storage, making access easy when needed.

Should your circumstances change—be it a change in financial status or personal details—learn how to edit your form even after submission. You might need to contact the relevant authorities to make official updates or changes to the records.

Troubleshooting common issues

In rare cases, your form may be rejected. Common reasons for this include unfilled fields, incorrect information, or failure to meet submission guidelines. Understanding these reasons can help you address and rectify issues swiftly.

If you encounter challenges, pdfFiller offers customer support options. Users can engage through various channels such as email, chat, or community forums to seek assistance and rapid resolution of issues.

Unique use cases for the 3300 Form

The versatility of the 3300 Form is evident in its applications across different industries. For instance, in finance, it could be utilized for securing loans, while in real estate, it may serve as a document for property transfers and agreements.

Real-world examples showcase successful completion and submission, illustrating the form's role in facilitating seamless transactions. This understanding serves to bolster user confidence in managing the form effectively.

Interactive tools offered by pdfFiller

pdfFiller enhances the form completion experience with several collaborative features. Teams can work together on document preparation, which is especially beneficial when multiple approvals or insights are required.

Real-time editing and feedback tools elevate the process's efficiency. Users can collectively view changes, add comments, and finalize the document with streamlined communication, ensuring that everyone is on the same page.

Frequently asked questions (FAQs)

Queries related to the 3300 Form often revolve around its proper usage, the necessary documents required for submission, and the best practices for ensuring security. Addressing these FAQs with precise insights can enhance user understanding.

Utilizing pdfFiller's resources and tools can offer clarity, making the form management process smoother. Whether you're seeking answers about digital security measures or tips for ensuring efficient completion, leveraging these resources can elevate the overall experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 3300 a?

How do I edit 3300 a in Chrome?

How do I edit 3300 a straight from my smartphone?

What is 3300 a?

Who is required to file 3300 a?

How to fill out 3300 a?

What is the purpose of 3300 a?

What information must be reported on 3300 a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.