Independent auditor's report on form: A comprehensive guide

Understanding the independent auditor's report

An independent auditor's report is a formal statement presented by an external auditor after reviewing an organization's financial statements. Its primary purpose is to provide assurance to stakeholders about the accuracy and fairness of the financial representations made by management. This report is essential for upholding financial transparency and accountability within an organization, serving as a foundation for building trust with investors, creditors, and the public.

The report's credibility stems from its independence, meaning the auditor does not have any conflicts of interest regarding the company being audited. This impartiality is vital for fostering confidence in the financial disclosures presented in the management report. Furthermore, independent auditor reports contribute to the integrity of the financial reporting process, allowing organizations to enhance their reputation in the marketplace.

An independent perspective, free from management influence.

Confidence for stakeholders regarding the accuracy of financial information.

A structured evaluation of compliance with applicable laws and regulations.

The structure of an independent auditor's report

An independent auditor's report typically follows a structured format that enhances clarity and comprehension. It begins with a clear title that typically states 'Independent Auditor’s Report', followed by the name of the entity being audited. Proper addressing is crucial, as it establishes who the report is directed to—often the board of management or shareholders. This establishes the relationship between the auditor and the stakeholders involved.

The introduction paragraph clarifies the context and scope of the audit, giving readers insights into what the auditor examined. Next, the report outlines management's responsibility, emphasizing that management is accountable for the preparation of the financial statements and establishing adequate internal controls. This sets the stage for understanding the auditor's own responsibilities, which include conducting an audit in accordance with established auditing standards to express an opinion on the financial statements.

Title and addressee – Identifying the report's audience.

Introduction paragraph – Contextualizing the audit.

Management's responsibility – Highlighting accountability.

Auditor’s responsibility – Detailing the auditing process.

Opinion paragraph – Offering a clear opinion on financial statements.

Basis for opinion – Justifications backing the auditor's conclusion.

Key audit matters – Discussing significant issues encountered during the audit.

The audit process leading to the report

The audit process is a thorough undertaking that comprises several key stages. Initially, planning the audit is critical, where auditors define the overall scope, objectives, and timelines while assessing risks that could impact financial reporting. A well-defined plan ensures that the audit efficiently addresses the most relevant concerns and aligns the auditing procedures with the needs of stakeholders.

Once the planning phase is established, conducting fieldwork is the next step, during which auditors gather substantive evidence related to the financial statements. This may include analyzing financial records, performing tests, and reviewing controls to understand how management has reported financial performance. The collected evidence supports the auditor's conclusions and aids in evaluating the overall fairness of the management report.

Planning the audit – Setting objectives and assessing risks.

Conducting fieldwork – Gathering evidence and performing tests.

Gathering evidence – Collecting documentation and information.

Evaluating findings – Analyzing data to form conclusions.

Regulatory and legal requirements

Independent auditors must adhere to specific regulations and legal requirements that guide the auditing process. These requirements can vary based on jurisdiction and include compliance with established auditing standards such as the International Standards on Auditing (ISA) or local frameworks pertinent to the company’s operations. Understanding these legal mandates ensures that the audit is conducted in accordance with the law, thereby enhancing the credibility of the auditor's report.

In the European Union, for example, auditors must comply with the EU Audit Regulation, which sets forth requirements that aim to bolster the transparency and quality of the audit process. Moreover, these regulations mandate specific disclosures concerning the auditor's independence, remuneration, and audit practices, contributing to robust public trust in reported financial information.

Legal frameworks guiding independent audits (e.g., ISA, local standards).

Importance of compliance with legal requirements.

Risks associated with failure to comply with regulations.

Common challenges in drafting the auditor's report

Drafting an independent auditor's report comes with its own set of challenges. One major difficulty lies in identifying key audit matters that are significant enough to warrant discussion in the report. Effective communication of these audit matters is crucial for ensuring that stakeholders grasp the risk areas that may impact the financial statements. Selecting these areas involves careful judgment and adherence to relevant guidelines.

Another challenge is articulating the auditor's opinion with clarity and precision to avoid confusion. The opinion should not only reflect the auditor's findings but also be comprehensible to the intended audience. Coupled with the need for clear expression is the requirement for maintaining objectivity throughout the auditing and reporting process to ensure the report’s integrity and credibility.

Identifying key audit matters for effective reporting.

Clarity in articulating the auditor’s opinion.

Ways to ensure objectivity and reduce bias.

Best practices for using the independent auditor's report

Effectively communicating the findings of the independent auditor's report to stakeholders is paramount for fostering trust and facilitating informed decision-making. Organizations should ensure that the report is presented interactively and straightforwardly, breaking down complex financial jargon into understandable terms for non-financial stakeholders. This transparency can promote a stronger relationship between management and stakeholders, enhancing the organization's credibility.

Furthermore, leveraging insights gleaned from the auditor's report can guide strategic planning and risk management decisions. The assessment of financial performance, including areas identified as risks, can help organizations adapt their operational strategies to enhance overall performance. Finally, it is crucial to integrate feedback received from the auditor’s report into future audits, establishing a cycle of continuous improvement that aims to bolster the quality of financial reporting over time.

Communicating effectively with stakeholders about the report.

Leveraging insights for strategic decision-making.

Integrating auditor feedback into future audits.

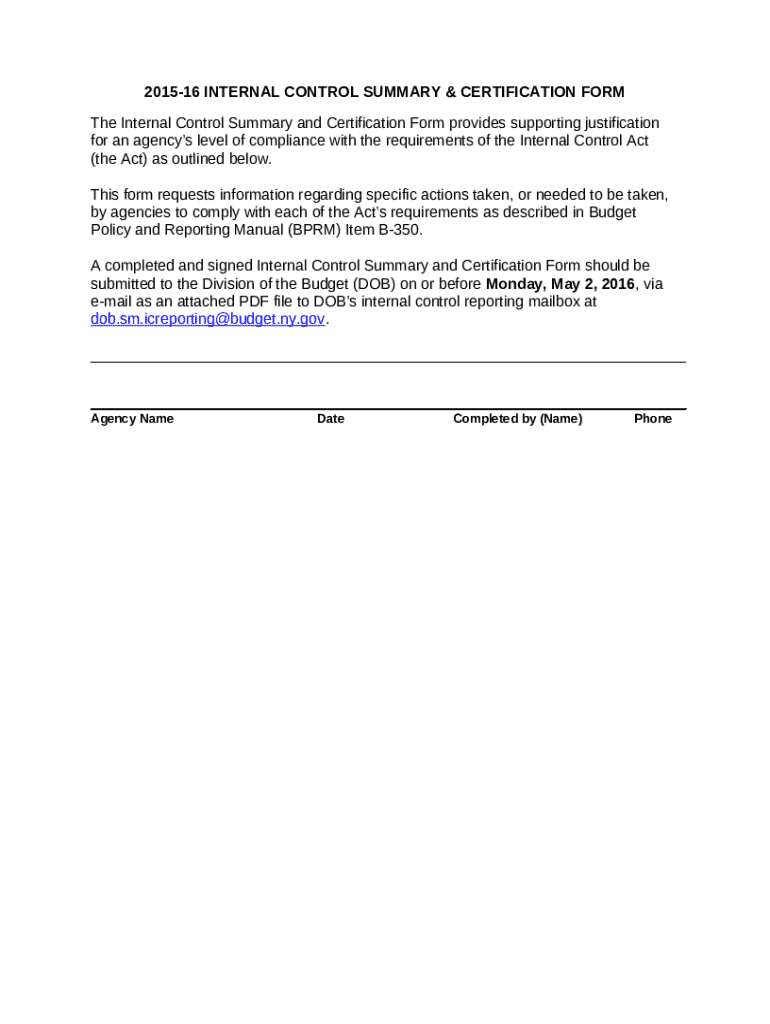

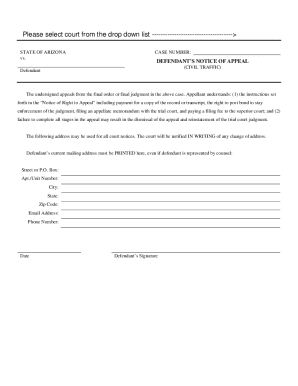

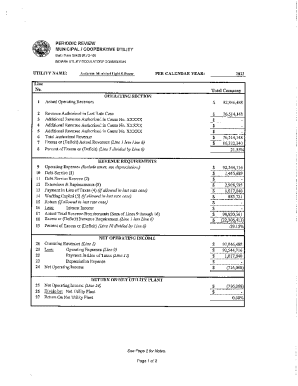

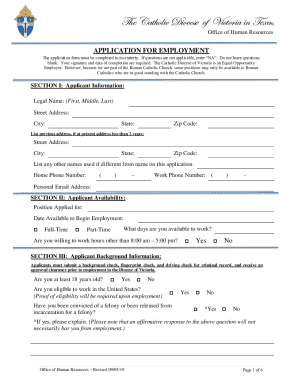

How to access and manage your auditor's report with pdfFiller

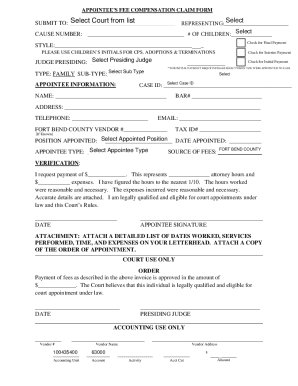

Accessing and managing your independent auditor's report efficiently can be achieved with pdfFiller, a cloud-based document management platform. Users can create and edit their auditor's report using a range of templates specifically designed for auditor documentation. The step-by-step guide for utilizing pdfFiller allows users to seamlessly navigate the process of filling out the report, ensuring that every essential section is accurately represented, from management's responsibilities to key audit matters.

Moreover, pdfFiller facilitates e-signature capabilities and team collaboration, enabling auditors and management to work together on document revisions efficiently. The cloud storage options offered by pdfFiller provide the advantage of easily storing, accessing, and tracking changes to auditor's reports, ensuring that documents are secure and readily available for review whenever needed.

Creating reports using user-friendly templates.

Editing the report collaboratively with team members.

Storing and accessing documents securely in the cloud.

Frequently asked questions (FAQs) about independent auditor's reports

Readers often have queries regarding independent auditor's reports, especially regarding timelines and potential disagreements. Typical turnaround times for receiving an auditor's report can vary based on the scope of the audit but generally range from a few weeks to several months. Organizations should communicate schedules effectively to align expectations with stakeholders.

If discrepancies arise between the auditor's report and management's statements, it is vital to address these issues head-on. Open dialogue can help determine the causes of the discrepancies, allowing management to respond to the auditor’s concerns with context. In cases where management disagrees with the auditor's opinion, it is essential to document differing perspectives and take steps to resolve conflicts professionally.

What are the typical turnaround times for auditor reports?

How should discrepancies between the auditor's report and management's statements be handled?

What should I do if I disagree with the auditor's opinion?