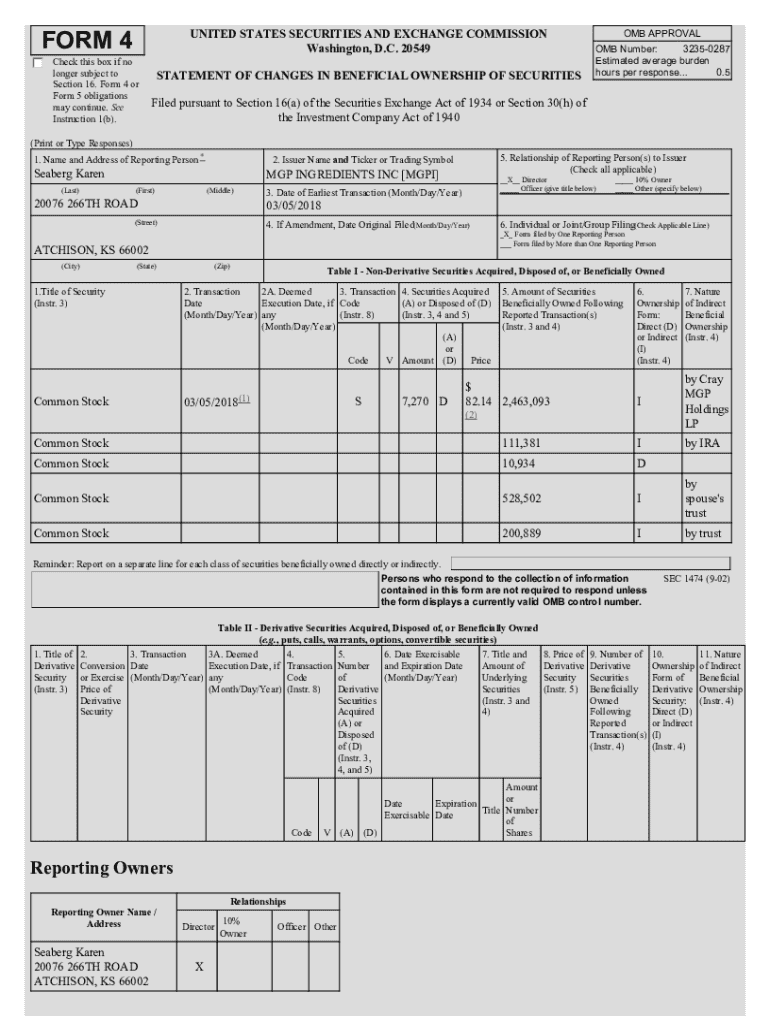

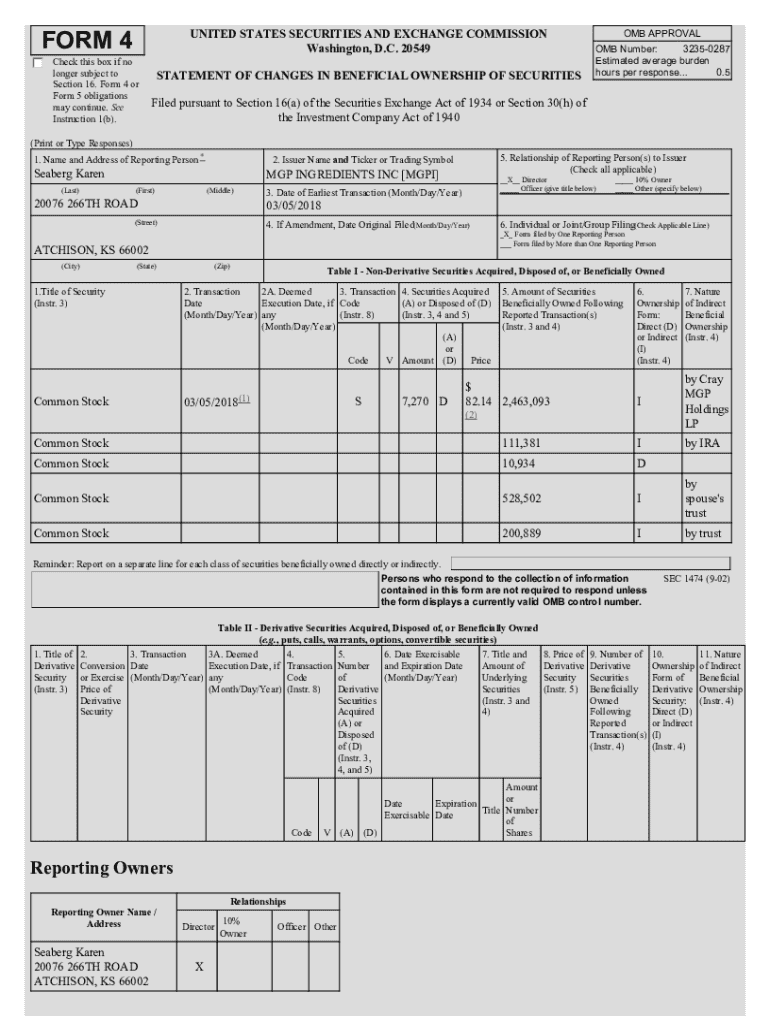

Get the free 7,270 D

Get, Create, Make and Sign 7270 d

How to edit 7270 d online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 7270 d

How to fill out 7270 d

Who needs 7270 d?

An In-Depth Guide to the 7270 Form

Understanding the 7270 Form

The 7270 D Form is a crucial document used in various legal and administrative proceedings, particularly focusing on fee administration in cases, as well as disaster relief. Its primary purpose is to document and manage claims that relate to specific tax reliefs or other administrative contexts. This form is often applicable during periods of state emergencies, such as natural disasters, to ensure that individuals and businesses receive the necessary support and financial relief.

It is vital for individuals and organizations who have suffered losses due to disasters to understand when and how to use this form to expedite their claim processing. Whether it’s for obtaining state of emergency tax relief or handling use tax law matters, the 7270 D Form serves as a structured approach to documenting these claims.

Compliance with using the 7270 D Form is critically significant; improper use or failure to submit this form can lead to legal complications or loss of eligibility for relief programs. Understanding its use is essential for effective navigation of bureaucratic processes during crises.

Key features of the 7270 Form

The 7270 D Form is divided into specific sections, each crucial for capturing necessary information for administrative review. Typically, it consists of three main sections: personal information, claim details, and certification. These sections help ensure that the information submitted is complete and actionable.

Commonly required data points include your personal identification details such as name, address, and contact information, along with detailed descriptions of the claim related to disaster or fee administration. Effectively filling out these sections ensures that your claim can be accurately assessed and addressed correctly.

Eligibility to use the 7270 D Form is generally limited to those directly affected by declared disasters or those who meet specific qualifications outlined within the form guidelines. Determining your eligibility is crucial before attempting to submit the form.

Step-by-step guide: How to fill out the 7270 Form

Before filling out the 7270 D Form, preparation is key. Gather all necessary documents such as identification proof, evidence of your losses, and any prior correspondence related to your claim. Ensuring you have everything ready minimizes the chance of missing essential information that could delay your submission.

Filling out the form involves accurate detailing in each section. Let’s break it down specifically:

Section 1: Personal Information

Include your full name, address, phone number, and any relevant identification numbers. Common mistakes include omitting critical contact information or misspelling names. Accuracy is paramount here.

Section 2: Claim Details

Describe the nature of your claim clearly and provide all necessary evidence. This includes outlining the losses you have encountered due to disasters or other emergencies that prompted your application. Ensure there are no gaps in information, as this could trigger requests for clarification.

Section 3: Certification

To ensure the legal binding nature of your form, sign and date the certification section. Consider having a witness if your jurisdiction requires it. This final step asserts your statement's truthfulness, which is essential for maintaining the integrity of the submission.

Always double-check your work before submission. The importance of reviewing your form can’t be overstated and may save you from unnecessary delays or complications.

Electronic versus paper submission

Submitting the 7270 D Form electronically offers various advantages such as speed and efficiency. Many users find that electronic submissions lead to faster processing times, eliminating potential postal delays, which is vital during disaster response initiatives. Tools like pdfFiller enable seamless electronic submission, allowing you to complete, sign, and send the form all in one place.

If you opt for paper submission, ensure you follow traditional methods correctly. Fill out a hard copy of the form, and send it via registered mail to ensure it reaches the intended department. Pay attention to the exact address listed on the form instructions, as failing to send it to the correct department can result in delays.

Editing and managing your 7270 Form with pdfFiller

Accessing the 7270 D Form through pdfFiller allows for easy editing and collaboration. The platform provides user-friendly editing features such as highlighting, commenting, and digitally signing the document. These tools help you tailor the form precisely how it needs to be submitted.

Collaboration is another strong suit of pdfFiller. Teams can work together on the form, tracking changes and ensuring everyone is on the same page regarding submissions. These collaborative tools make managing the 7270 D Form much more effective, streamlining the process from start to finish.

Troubleshooting common issues

While filling out the 7270 D Form, it's easy to make mistakes. Common pitfalls include incorrect personal information, missing claim details, or errors in the certification. Avoiding these mistakes by closely following instructions and checking for errors can save a lot of time.

If your form is rejected, don't panic. First, carefully read the rejection notice to understand the reasons. Correct the noted issues, and be sure to adhere to the resubmission guidelines. Contact point information is generally provided in the notice, which can be helpful for further assistance.

Frequently asked questions (FAQs) about the 7270 Form

Many users often have questions regarding the submission of the 7270 D Form. A common query is whether it's possible to submit the form without all required documents. Generally, it’s advised against this, as missing documents can delay processing times.

Another significant concern is what to do if you miss the submission deadline. Typically, you may have options for late submission, but this is highly dependent on local regulations, so always refer to the form’s issuing body.

Lastly, how often does the form change? Regular updates may occur, particularly in response to evolving policies concerning disaster relief, so always refer to the official source for the latest version.

Real-world examples of the 7270 Form in use

Understanding real-world applications of the 7270 D Form can provide clarity. Take for instance a natural disaster scenario, where a community experiences flooding. Residents can use this form to report their losses and claim necessary relief. Testimonials from users indicate that those who understood the submission process and requirements could navigate effectively through their claims.

In these cases, testimonials highlight how prompt submission via pdfFiller directly impacted their relief timeframes, emphasizing the importance of both familiarity with the form and access to efficient tools for submission.

Next steps after submission

After submitting the 7270 D Form, tracking your submission is essential. Organizations typically provide tracking numbers or other mechanisms to monitor the status of your application. Keeping an eye on your application's progress ensures that you can respond quickly if additional information is requested.

It's also vital to understand the review process. Typically, reviews occur in a set timeline, but it can vary based on claim complexity. Preparing to respond to any follow-up requests promptly can assist in minimizing further delays.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the 7270 d form on my smartphone?

Can I edit 7270 d on an iOS device?

How do I complete 7270 d on an Android device?

What is 7270 d?

Who is required to file 7270 d?

How to fill out 7270 d?

What is the purpose of 7270 d?

What information must be reported on 7270 d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.