Tax Identification Numbers (TIN) Form: A Comprehensive Guide

Understanding tax identification numbers (TIN)

A Tax Identification Number (TIN) is a unique identification number assigned to individuals and businesses for tax purposes. It acts as a critical identifier within the financial system, allowing the IRS and other tax agencies to effectively track tax obligations and compliance. TINs are necessary for various financial transactions that require reporting, ensuring that all entities operate under state and federal tax laws.

The importance of TIN in personal and business finances cannot be overstated. For individuals, it may be required for job applications, tax filings, and obtaining loans. Businesses must have a TIN for reporting employee wages, filing tax returns, and even opening a business bank account. Without a TIN, individuals and organizations may face difficulties with legal and financial processes.

Social Security Number (SSN): Primarily used by individuals for tax purposes.

Employer Identification Number (EIN): Assigned to businesses, including corporations and partnerships, for tax identification.

Individual Taxpayer Identification Number (ITIN): A number provided to individuals who are not eligible for an SSN, often used by non-resident aliens.

Who needs a TIN?

TINs are required for various groups. Individuals who are self-employed or operate their own businesses need a TIN to report their income accurately. Self-employed individuals may also require it to estimate their taxes quarterly. Additionally, students applying for financial aid may need it to complete their applications and secure funding.

Businesses, including corporations and partnerships, need a TIN for tax reporting and to comply with laws governing employee wages. Non-profit organizations also require a TIN to operate within compliance of the Internal Revenue Service. It's important to note that there are exceptions, such as non-resident aliens who may not have an SSN but need an ITIN to fulfill their tax obligations.

Self-employed individuals must secure a TIN to report their earnings.

Students applying for financial aid often need to provide their TIN.

Corporations, partnerships, and non-profit entities require a TIN for compliance.

Non-resident aliens may need an ITIN for tax filing without an SSN.

Minors and dependents can receive TINs but typically through a parent's or guardian's application.

The importance of accurately completing the TIN form

Filling out the TIN form accurately is vital because errors can lead to serious financial and legal implications. An incorrect TIN can cause delays in tax refunds, processing issues, and even audits by tax agencies. Such mistakes could result in penalties that can impact an individual or business's financial integrity.

Common mistakes include misspellings, incorrect social security numbers, and missing signatures. Understanding the form's requirements and reviewing entries before submission can help prevent these errors, ensuring that processes remain efficient and compliant. Therefore, taking the time to fill out the TIN form correctly can save significant headaches later.

Step-by-step guide to filling out the TIN form

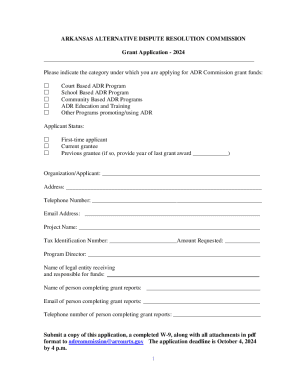

Before diving into the filling out of the TIN form, it's critical to prepare adequately. Start by gathering the necessary documentation, which might include proof of identity and any past tax information. Understanding the various sections of the form is essential so that each piece of information is entered accurately.

The typical TIN form consists of several key sections: personal information, reason for applying, and signature requirements. In the personal information section, provide accurate names and addresses, as discrepancies can lead to future complications. When detailing the reason for applying, ensure it aligns with your circumstances. Lastly, signatures must match your name as presented on the form.

Gather all pertinent documentation before starting the form.

Fill out personal information accurately, ensuring all names and addresses match.

Clearly state the reason for applying; clarity here is crucial.

Review your completed form for accuracy, ensuring everything is filled out correctly.

Alternatives and associated forms

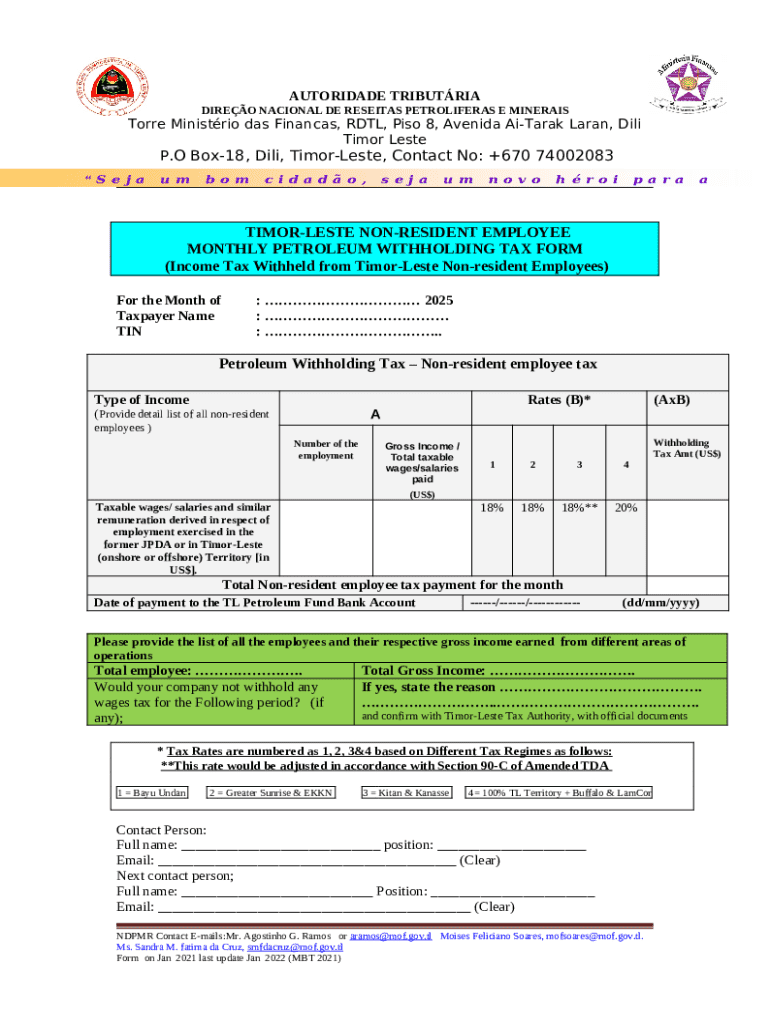

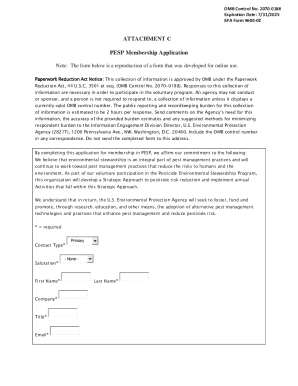

In certain scenarios, individuals or businesses may find themselves in need of alternative forms to the standard TIN application form. For example, the IRS Form W-9 is commonly used when a payee needs to provide their TIN to a business or individual for tax reporting purposes. Similarly, Form W-8 is typically required for foreign individuals or businesses conducting certain transactions, ensuring appropriate tax compliance.

Each alternative form has specific instructions that must be followed precisely. For instance, if using the W-9, ensure you complete all fields, including your TIN, which could be either an SSN or an EIN, depending on your tax situation. Some common scenarios requiring these forms include receiving payments, filing tax documentation, and satisfying IRS compliance.

Use Form W-9 when providing your TIN to a payor for tax reporting.

Form W-8 may be necessary for foreign individuals and entities.

Understand the context in which to use each form to ensure tax compliance.

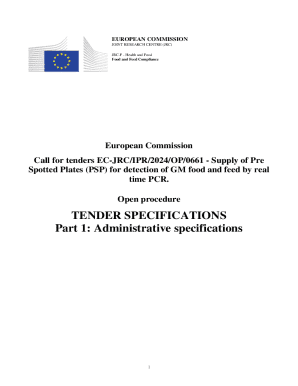

Managing and submitting your TIN form

After filling out the TIN form, carefully review your submission for accuracy, ensuring no fields are left empty and that all information aligns with your documentation. There are several options for submitting the TIN form, including online submissions through secure portals or by mailing a hard copy to the relevant tax authorities.

When opting for an online submission, ensure that you have a reliable internet connection and a fully completed digital version of your form. If mailing, verify that the correct address is used, as submission to the wrong agency can cause additional delays. Expect a processing timeline that may vary, but often takes several weeks depending on peak tax seasons.

Review your form thoroughly before submitting.

Choose between online submission or mailing, based on convenience.

Be aware of the expected processing timeline for your TIN form.

Compliance and penalties

As a TIN holder, legal responsibilities include ensuring that your information is kept up to date and that you provide accurate data whenever required. Failure to comply with TIN regulations can lead to potential penalties, including fines and fees that may accumulate over time.

Moreover, compliance issues can negatively impact your ability to file accurate tax returns, possibly leading to audits or scrutiny from tax authorities. Ensuring accuracy in both application and ongoing reporting is crucial to maintaining compliance and avoiding significant financial repercussions.

Stay informed about your legal responsibilities as a TIN holder.

Implement systems to keep your information current and accurate.

Understand the potential implications of non-compliance on your tax returns.

Best practices for maintaining your TIN

Safeguarding your TIN against identity theft is paramount. Store documents containing your TIN securely, and avoid sharing your number unless absolutely necessary. Keep track of who has access to your TIN and be vigilant about monitoring your financial and tax records for irregularities.

Additionally, keeping your information updated is essential for compliance. Changes in your personal or business status, such as changes of address or name, should be reported immediately to the relevant authorities. Utilize resources available for ongoing compliance checks to ensure your information remains correct and that you are aware of any potential updates to the tax laws or filing requirements.

Store your TIN securely to protect against identity theft.

Update your information promptly if there are any changes.

Utilize compliance resources to stay informed about obligations.

Frequently asked questions (FAQs)

Occasionally, individuals may forget their TINs. In such cases, it’s advisable to check prior tax documents or contact the IRS or relevant tax authority for assistance in recovering it. Keeping a record of your TIN in secured digital formats helps prevent such dilemmas.

If mistakes are made after submission, a correction process is often available, albeit it may take additional time. Do not hesitate to reach out to the responsible agency for guidance on how to correct any errors made during the submission. Sharing your TIN requires caution; always verify the legitimacy of the entity requesting it to avoid identity theft. Finally, the IRS allows online TIN applications, making acquiring one more accessible.

Check prior documents or contact authorities if you forget your TIN.

Reach out to authorities to correct mistakes post-submission.

Verify legitimacy before sharing your TIN with others.

Online applications for TINs are available for convenience.

Interactive tools and resources

To facilitate understanding and management of your TIN, interactive tools can be invaluable. Online platforms provide forms with guided assistance, making the application process smoother. Additionally, downloadable templates and checklists from platforms like pdfFiller can help ensure no important elements are overlooked, making the process of obtaining a TIN efficient and user-friendly.

Utilize interactive TIN application forms for simplified processes.

Access downloadable templates and checklists to stay organized.

Engage with platform tools for ongoing document management.

Understanding privacy considerations

Your TIN is a critical piece of personal information that needs to be handled with care. Understanding how your TIN is used in various financial contexts helps you make informed decisions about its security. Always inquire with agencies and organizations requesting your TIN how it will be utilized and safeguarded, ensuring proper data protection measures are in place.

Safeguarding personal information associated with your TIN is essential in preventing identity theft. Implementing best practices such as not sharing your TIN casually and storing documents securely will help ensure your personal data remains confidential. Regularly reviewing your financial statements can also alert you to unauthorized activities promptly.

Understand how your TIN is used to better protect yourself.

Inquire about data protection measures when sharing your TIN.

Regularly review your financial records for unauthorized activities.

Collaboration and support services

Utilizing cloud-based platforms for document management can enhance efficiency in organizing your financial data. Collaborative tools allow teams to access, edit, and manage tax-related documents seamlessly, reducing the chances of errors related to TIN management. Additionally, seeking out community forums or support services can provide valuable insight and advice based on shared experiences.

Engaging with such platforms ensures that all relevant parties are well-informed about updates regarding TINs and compliance requirements. These collaborative efforts can minimize mistakes while streamlining the process of managing important documents.

Utilize cloud-based platforms for effective document management.

Engage with community forums for shared experiences and advice.

Ensure all team members are informed about TIN updates and compliance.