Get the free 3rd Quarter Maintenance for HVA

Get, Create, Make and Sign 3rd quarter maintenance for

Editing 3rd quarter maintenance for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 3rd quarter maintenance for

How to fill out 3rd quarter maintenance for

Who needs 3rd quarter maintenance for?

3rd quarter maintenance for form: A how-to guide

Understanding the importance of 3rd quarter maintenance for forms

Quarterly maintenance is crucial for keeping your forms accurate, relevant, and efficient. Regular evaluation helps organizations avoid common pitfalls related to form management, such as outdated information, compliance issues, and inefficient processes. Without a reliable maintenance schedule, forms can become cluttered, leading to errors that may affect the business's image and operations.

Regular updates and maintenance of forms have far-reaching benefits. They ensure that forms reflect the latest regulatory requirements, thus minimizing penalties and interest associated with non-compliance. Furthermore, updated forms can significantly improve user experience by streamlining processes, reducing the time and effort needed to complete tasks, and enhancing data accuracy.

Preparing for maintenance

Effective preparation is key to successful quarterly maintenance. Begin by creating an inventory of forms that need to be reviewed. This inventory should include all forms currently in use, ensuring nothing is overlooked during the maintenance process. Take note of how often each form is completed to prioritize the review process.

Next, set up a maintenance schedule. A structured timeline can help maintain consistency in reviewing forms throughout the year. Include specific dates for reviews, edits, and follow-ups. Additionally, assign responsibilities to team members. This delegation helps to clarify roles and ensure accountability, making the maintenance process more efficient.

Key components of 3rd quarter maintenance

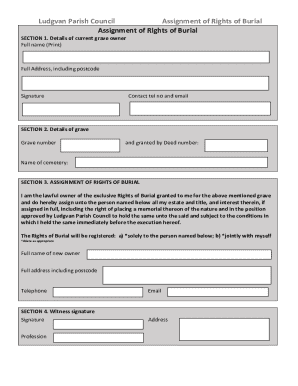

Form review and assessment

The first key component is form review and assessment, which involves evaluating the relevance of each form against current needs. Assess whether each form meets its intended purpose or requires updates to reflect organizational changes or regulatory updates.

Identify forms that need updates. This can include correcting outdated terminology, incorporating new licensing requirements, or eliminating redundant questions. Ensuring that forms align with recent developments in your organization, such as changes to tax accounts and exemptions, helps uphold your business's image.

Data accuracy verification

Data accuracy verification ensures that all information included in forms is correct and up-to-date. Check for outdated information by cross-referencing data with recent updates from tax portals and other relevant sources. This step is crucial for filing business tax returns accurately, as outdated forms can lead to errors in penalties and interest.

Correcting inaccuracies enhances the credibility of your forms and ultimately improves decision-making. Regular data checks help identify recurring issues, allowing for better long-term management strategies.

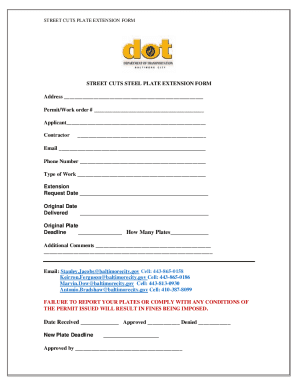

Editing and updating forms

Editing and updating forms can be simplified using pdfFiller's intuitive tools. Begin by accessing the editing tools and opening the specific form you wish to edit. Familiarize yourself with the available options, including text modifications and formatting capabilities, to make the process seamless.

When making changes to forms, ensure you are clear about what needs to be edited, whether that's changing existing text or adding/removing fields. Best practices for form version control include adopting consistent naming conventions for each version of a form and keeping a log of changes made. This helps track updates and ensures everyone is using the latest version.

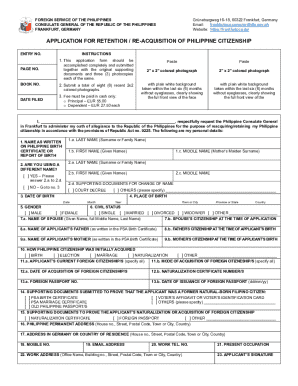

Ensuring compliance and security

Compliance is a critical aspect of form management. Ensuring that your forms adhere to regulatory requirements protects your organization from potential penalties. As you review and update your forms, verify that all licensing and tax-related information is correct and complies with current laws.

Utilize pdfFiller's security features to safeguard sensitive data within your forms. Conduct a compliance audit of existing forms, focusing on identifying any areas where updates might be necessary. This proactive approach can help mitigate risks associated with compliance lapses.

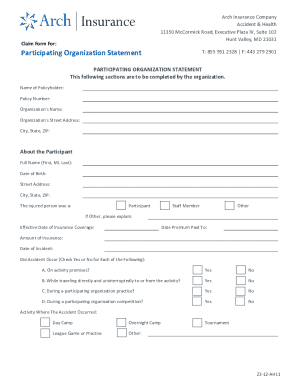

Digital signing and collaboration

Digital signing has become an essential part of the document lifecycle, and pdfFiller facilitates easy eSignature collection for updated forms. This not only streamlines the process but also ensures that all agreements are signed quickly and stored securely.

Utilizing pdfFiller's collaboration tools enhances teamwork by allowing stakeholders to provide input and feedback easily. You can track changes and comments efficiently, which simplifies communication and ensures that everyone is on the same page during the editing process.

Managing and storing forms

Proper management and storage of forms are vital for maintaining efficiency. Organize your forms in digital folders using pdfFiller’s organizational tools, which allow for easy retrieval and secure storage of documents.

Creating templates for future use can also streamline the process going forward, thus minimizing repetitive work. Furthermore, ensure that outdated forms are archived safely to prevent confusion while maintaining necessary records for compliance reasons.

Interactive tools and features of pdfFiller

Leverage interactive features within pdfFiller that enhance form usability. Consider incorporating user guides and tips directly into forms to assist users in completing them correctly. Customizing the user experience with interactive elements, such as auto-fill options or conditional questions, can improve both efficiency and user satisfaction.

These enhancements also help address potential questions or confusion at the point of data entry, reducing the need for follow-up communications and improving overall form completion rates.

Conclusion: maximizing efficiency with effective maintenance practices

As we've explored, 3rd quarter maintenance for forms is essential for maintaining accuracy, compliance, and efficiency in your organization. Committing to an ongoing maintenance schedule not only optimizes workflows but also safeguards your business against potential risks.

Utilizing the capabilities of pdfFiller can significantly enhance your form management practices. By organizing, updating, and maintaining your forms effectively, you create a streamlined process that fosters greater productivity and collaboration.

Appendix

Frequently asked questions about 3rd quarter maintenance will help clarify any uncertainties related to this topic. Troubleshooting common issues can also provide helpful insights into typical pitfalls encountered during form maintenance.

Moreover, familiarize yourself with essential glossary terms related to form management and editing to better navigate the complexities of this process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 3rd quarter maintenance for directly from Gmail?

How can I get 3rd quarter maintenance for?

How do I make changes in 3rd quarter maintenance for?

What is 3rd quarter maintenance for?

Who is required to file 3rd quarter maintenance for?

How to fill out 3rd quarter maintenance for?

What is the purpose of 3rd quarter maintenance for?

What information must be reported on 3rd quarter maintenance for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.