Get the free Clean Energy Tax Credit Changes under the One Big ...

Get, Create, Make and Sign clean energy tax credit

How to edit clean energy tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out clean energy tax credit

How to fill out clean energy tax credit

Who needs clean energy tax credit?

Clean Energy Tax Credit Form: How-to Guide

Understanding clean energy tax credits

Clean energy tax credits are incentives provided by the government to encourage individuals and businesses to adopt renewable energy sources and energy-efficient appliances. These credits can significantly reduce the overall cost of making eco-friendly upgrades in homes and commercial buildings, ultimately promoting environmental sustainability.

The importance of clean energy tax credits extends beyond just financial savings. They play a pivotal role in reducing carbon emissions, lowering energy costs, and fostering a culture of energy efficiency. Available incentives vary, with federal credits often complemented by state-specific programs that further support local homeowners and businesses in their journey toward renewable energy.

Eligibility for clean energy tax credits

Determining eligibility for clean energy tax credits is crucial and varies depending on individual circumstances and type of property. Generally, both homeowners and businesses can qualify for these incentives, but they must fulfill certain criteria. For instance, income limits may apply, affecting the amount of credit that can be claimed.

Moreover, the property type plays a significant role in eligibility. Credits are primarily designated for primary residences, but second homes and rental properties may also qualify under specific conditions. Understanding which upgrades are eligible can help maximize tax benefits.

Relevant forms for claiming clean energy tax credits

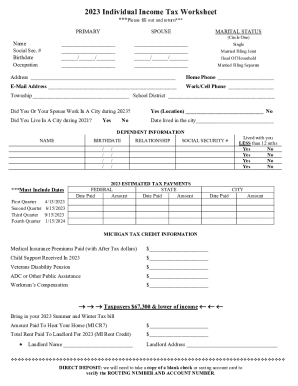

Claiming clean energy tax credits requires the right documentation. The necessary forms for most individuals include Form 5695, which specifically addresses Residential Energy Credits. In addition to this, Form 1040, the U.S. Individual Income Tax Return, will also be needed to submit your overall tax information.

Both forms are accessible through the IRS website. It's essential to ensure that all information is accurate and complete, which can help prevent potential delays or issues with your credit claim.

Step-by-step guide to filling out the clean energy tax credit form

Filling out the clean energy tax credit form can seem daunting, but following a structured approach simplifies the process. Start with Section A of Form 5695, which pertains to the Residential Energy Property Credit. Fill in the details of energy-efficient improvements made in the tax year.

Next, proceed to Section B, which covers Non-Business Energy Property. Here, you need to understand various eligibility categories to ensure all claimed improvements comply with IRS guidelines. Familiarize yourself with common pitfalls, like incorrect calculations or failing to include supporting documentation, which can lead to claim denials.

Interactive tools for assistance

To enhance the process of managing your clean energy tax credit forms, consider utilizing platforms like pdfFiller. This cloud-based tool allows for easy editing and management of forms, making it simpler to fill out and sign your documents digitally. You can upload your forms, make necessary edits, and send them directly to your tax professional without printing.

The collaborative features make pdfFiller especially useful for teams working on tax credits together. Each member can contribute, edit documents in real-time, and track submissions and updates, ensuring compliance and accuracy in all submitted forms.

Strategies to maximize your benefits

A strategic approach can significantly enhance your savings when claiming clean energy tax credits. Consider combining federal and state credits to maximize your benefits fully. Tax planning prior to making energy-efficient upgrades ensures that you capitalize on available incentives.

Moreover, documenting expenses accurately is vital. Keep all receipts and contracts as they serve as proof of purchases and installation. This documentation is not only crucial for credit claims but also helps avoid disputes in case of audits by government organizations.

Case studies: Real examples of tax savings

Examining real-world examples paints a clear picture of the potential savings offered by clean energy tax credits. A homeowner in California installed solar panels, which not only reduced their energy costs but also qualified them for a significant tax credit, allowing them to recuperate a major portion of their investment.

In another example, a business in New York upgraded its HVAC system to a high-efficiency model. This upgrade not only improved comfort and energy efficiency but also resulted in tax savings that offset installation costs. Families that revamped their home insulation and windows frequently report substantial energy savings, accompanied by tax credits that reward their investments in energy efficiency.

Common questions and troubleshooting

Navigating the clean energy tax credit process may raise various questions. It's common to wonder about what steps to take if your claim is denied. In such cases, reviewing the IRS guidelines for potential discrepancies in your application can help identify the issue.

Seeking assistance through a qualified tax professional or contact government organizations can provide clarity and solutions for any challenges encountered. Understanding common mistakes can alleviate future issues during the claiming process.

Insights into future changes in tax credits

As environmental concerns grow, legislation surrounding clean energy tax credits may evolve. Potential shifts reflect ongoing efforts by the government to boost renewable energy adoption in the United States, possibly leading to expanded benefits or altered eligibility criteria.

Monitoring trends in energy efficiency incentives ensures that individuals and businesses remain informed about available credits and can adapt strategies accordingly. Utilizing resources like pdfFiller helps in staying updated about upcoming changes or new requirements.

Conclusion: Empowering your tax journey with pdfFiller

Navigating the clean energy tax credit form can be simplified using effective tools like pdfFiller. This platform not only streamlines the process of editing and signing documents but also provides features to manage and collaborate on important tax forms seamlessly.

Empowering yourself with these tools can lead to greater efficiency in managing your clean energy tax credits, ensuring you capture all potential savings while maintaining compliance with government regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify clean energy tax credit without leaving Google Drive?

How do I make edits in clean energy tax credit without leaving Chrome?

Can I create an eSignature for the clean energy tax credit in Gmail?

What is clean energy tax credit?

Who is required to file clean energy tax credit?

How to fill out clean energy tax credit?

What is the purpose of clean energy tax credit?

What information must be reported on clean energy tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.