Get the free About Form 8612, Return of Excise Tax on Undistributed ...

Get, Create, Make and Sign about form 8612 return

Editing about form 8612 return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out about form 8612 return

How to fill out about form 8612 return

Who needs about form 8612 return?

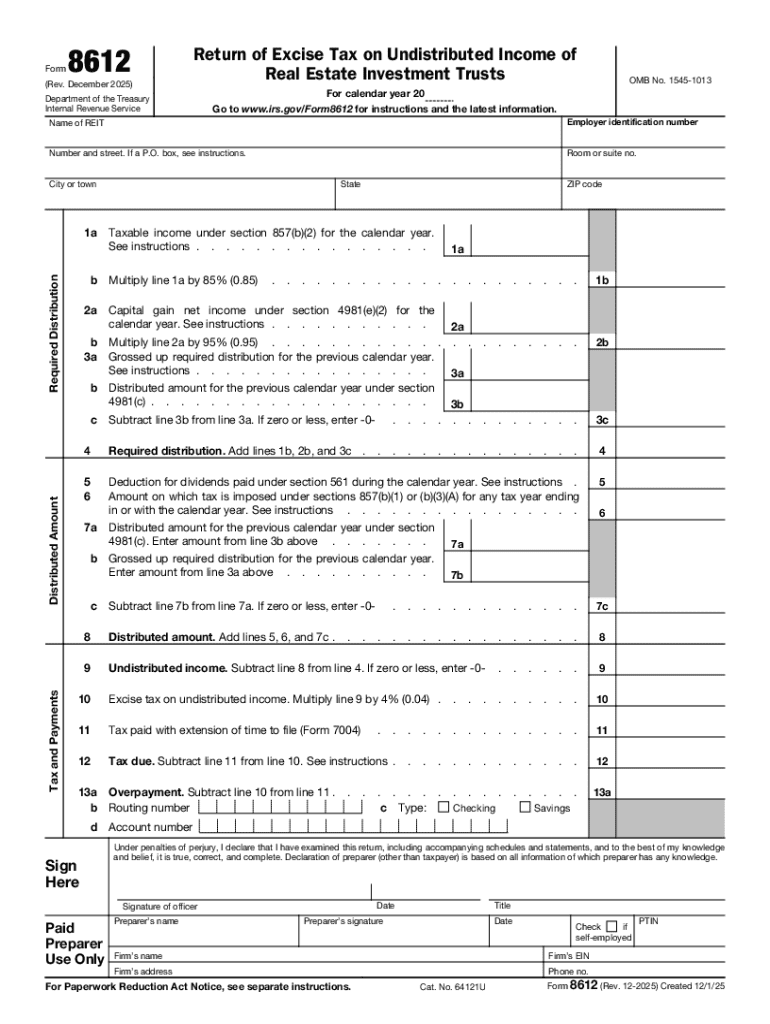

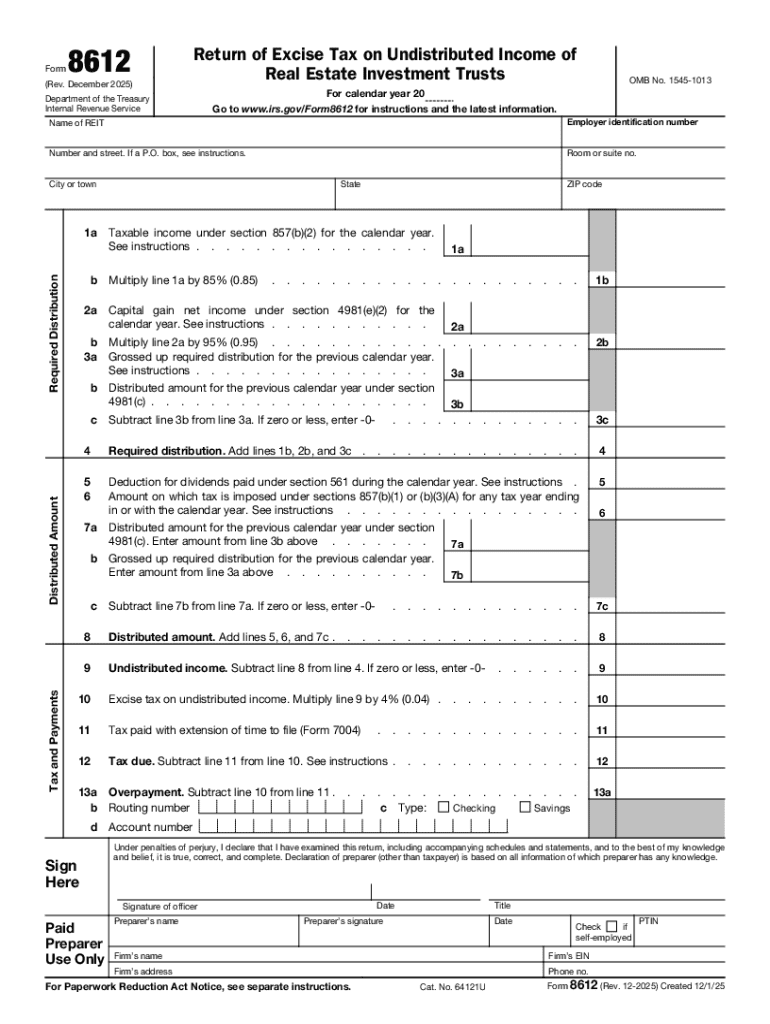

About Form 8612 Return Form

Understanding Form 8612: The Essentials

Form 8612 is an important tax document used for reporting certain excise taxes and distributions related to deficiencies in deficiency dividends. Specifically, it caters to specific corporations, partnerships, and estates that must report any excise tax due on undistributed net income in these scenarios. The form serves not only to fulfill regulatory compliance but also to provide a record of these financial transactions to the IRS. Its primary purpose is to ensure accurate reporting of distributions and to establish the corporation’s compliance with tax laws.

Individuals and entities that find themselves in situations involving throwback elections or special distributions often need to file this form. This includes firms handling investments in distributions that affect liquidity tools or involve income levels that exceed certain thresholds. Understanding when and why to use this form is crucial for avoiding shortfall penalties and ensuring accurate tax reporting.

Key terminology explained

Within Form 8612, specific terminology is frequently encountered. Here are some key definitions:

Who needs Form 8612?

Eligible filers of Form 8612 encompass a wide range of individuals and teams, mainly corporations and partnerships involved in specific financial operations. These entities should complete the form if they are subject to excise tax obligations stemming from their income distributions or deficiencies therein. Understanding the criteria for filing is essential to avoid complications during tax evaluation.

Any firm that manages liquidation or entities reporting excessive dividend distributions must be particularly vigilant. The importance of compliance with the IRS becomes evident as failing to file Form 8612 accurately can lead to substantial penalties, including monetary fines and interest charges. Filing this form is not merely an administrative requirement; it protects against legal repercussions associated with inaccurate tax reporting.

Step-by-step guide for completing Form 8612

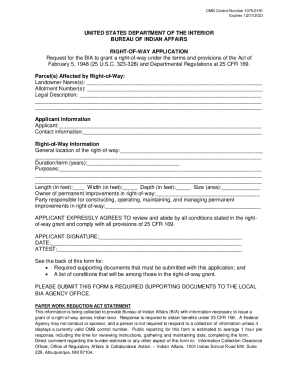

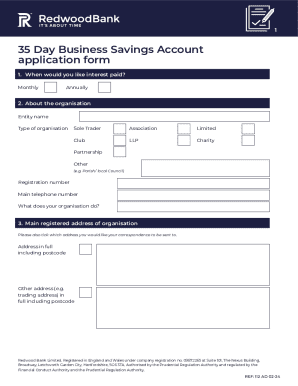

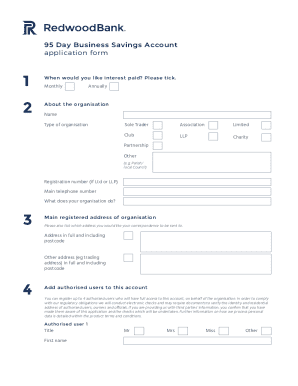

Filling out Form 8612 can seem daunting, but with the correct information and organized approach, it becomes manageable. Start by gathering all necessary documents such as previous tax returns, financial statements, and any records related to deficiencies or distributions.

Gathering required information

Detailed instructions for each section

Section A: Personal Information

Input your entity's name, tax identification number, and address. Ensure accuracy here, as incorrect information can lead to processing delays.

Section B: Income and Deductions

List all applicable income sources and deductions, including appropriations of deficiency dividends. Avoid common pitfalls such as misreporting passive income or misunderstanding the inclusivity of certain deductions.

Section : Tax Calculations

Accurately compute your excise tax duty here. Pay attention to the applicable rates, which can fluctuate based on income levels and filing categories.

Section : Signature and Date

Signing and dating your return is not just a formality but a legal declaration of the accuracy of your filing. Use the eSignature feature on pdfFiller to simplify this process.

Key computation techniques for Form 8612

Calculating taxable income on Form 8612 requires precise attention to detail. Start with gross income, then sequentially subtract allowable deductions to reach your taxable income. Maintaining accurate documentation throughout the year simplifies this calculation greatly.

Common mistakes include miscalculating deductions or overlooking certain types of income. To mitigate these risks, it’s imperative to consult tax professionals or employ detailed accounting practices. Utilizing technology solutions, like pdfFiller, can help verify accuracy and consistency in your forms.

Important timing rules

Form 8612 has specific filing deadlines that all eligible entities must adhere to. Generally, this form is due on the same date as your income tax return, which typically falls on the 15th of the fourth month following the end of your tax year. For corporations that operate on a calendar year, this means it is usually due by April 15.

Failure to file on time can result in penalties accumulating based on the unpaid excise tax. It's wise to proactively address any potential delays by organizing your documentation early and utilizing platforms like pdfFiller to streamline the process.

Documentation and controls

Retaining accurate records is critical when preparing Form 8612. Essential records include past returns, financial statements, and correspondence with the IRS pertaining to deficiencies or distributions. Regular audits of these documents can substantially assist in maintaining compliance.

Organizing your documentation not only aids compliance but also facilitates easier filing. Best practices involve creating a systematic filing approach, such as utilizing digital folders and employing tags for quick retrieval, ensuring you can access needed files promptly when required.

Enhancing your filing experience with pdfFiller

pdfFiller provides an exceptional platform for populating and managing Form 8612. Its seamless PDF editing capabilities allow users to fill out the form effortlessly. Users can directly input data into the form, ensuring that everything is neatly organized and easily readable.

eSignature features enhance the user experience, enabling the legal signing of your tax return electronically, avoiding the hassle of printing and resubmitting. This not only saves time but also acts as a security feature, keeping all information contained within one accessible platform.

For teams, pdfFiller fosters collaboration by allowing multiple users to work on the same document effortlessly, making it ideal for firms that wish to enhance their tax reporting capabilities while maintaining organizational clarity.

FAQs about Form 8612

Many questions arise surrounding Form 8612, particularly around its applicability and filing nuances. Common inquiries include eligibility criteria, specific filing steps, and what to do if you realize you've made a mistake post-filing. Seeking clarity on these points can save time and mitigate stress during tax season.

For those in need of additional help, the IRS provides resources, while tax professionals can assist in navigating the complexities of tax documents, ensuring that users fulfill their obligations without unnecessary complications.

Enhancing compliance: leveraging technology

Utilizing cloud-based platforms like pdfFiller can drastically improve the management of tax documents. Benefits include the ease of access from anywhere, which is particularly valuable in today's remote work environment, and the incorporation of features designed specifically for tax compliance.

However, security also plays a crucial role. Ensuring that your tax information remains protected while utilizing digital resources should always be a priority. Take advantage of security features, including data encryption and authentication checks, to safeguard your sensitive financial information as you file.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute about form 8612 return online?

How do I fill out the about form 8612 return form on my smartphone?

How do I complete about form 8612 return on an Android device?

What is about form 8612 return?

Who is required to file about form 8612 return?

How to fill out about form 8612 return?

What is the purpose of about form 8612 return?

What information must be reported on about form 8612 return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.