Get the free About Form 8878, IRS e-file Signature Authorization ...

Get, Create, Make and Sign about form 8878 irs

How to edit about form 8878 irs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out about form 8878 irs

How to fill out about form 8878 irs

Who needs about form 8878 irs?

About Form 8878 IRS Form: A Complete Guide

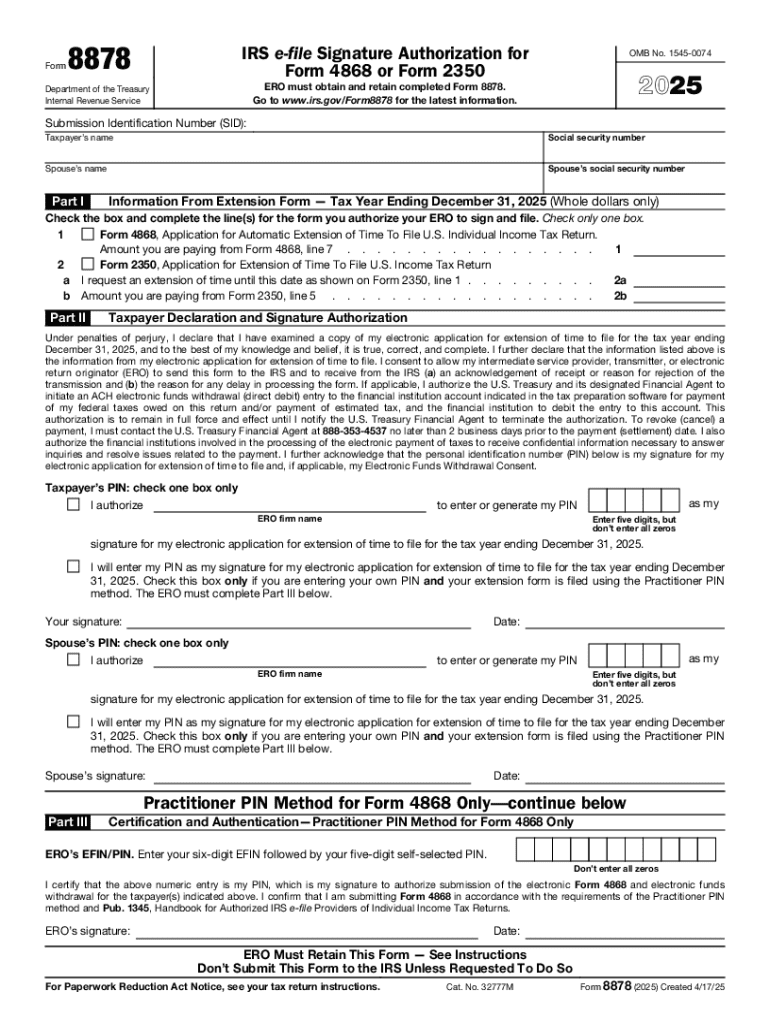

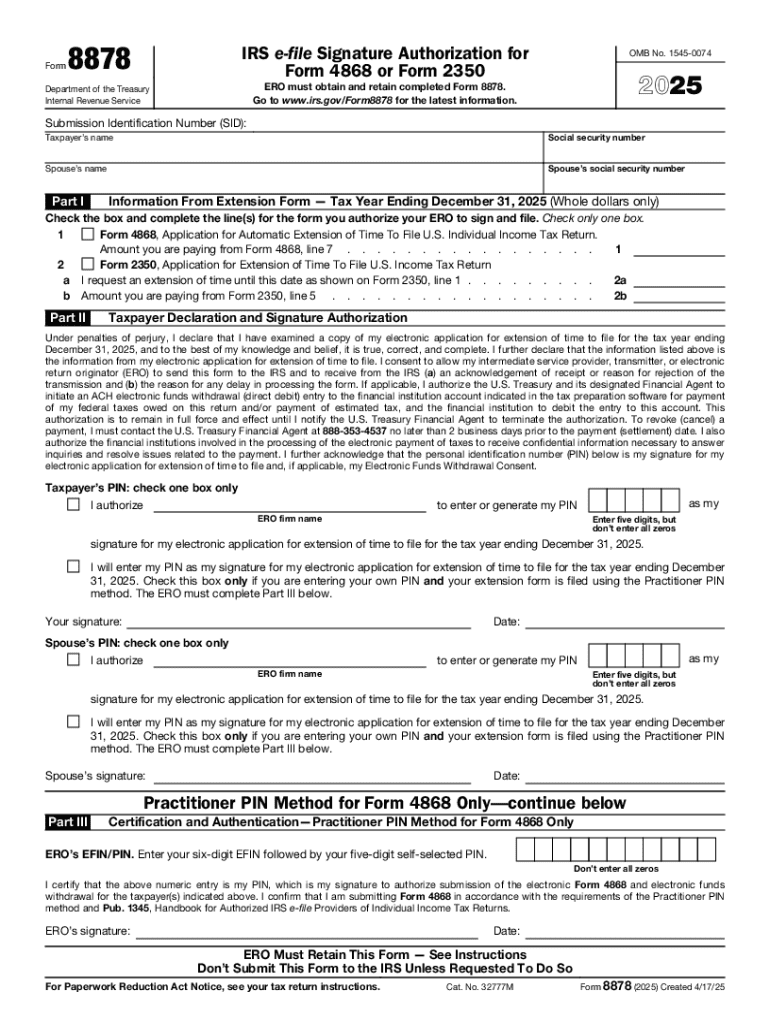

Overview of IRS Form 8878

IRS Form 8878, officially known as the "IRS e-file Signature Authorization," plays a critical role in the electronic filing process for income tax returns. This form allows taxpayers to authorize their tax return preparers to e-file their federal income tax returns on their behalf, thereby facilitating a smoother and faster filing process. For both individual taxpayers and tax professional agents, understanding the function and utility of Form 8878 is vital in the digital tax landscape.

Purpose and importance of Form 8878

The primary purpose of Form 8878 is to serve as a declaration, permitting tax return preparers to transmit tax returns electronically. By leveraging this form, taxpayers can experience significant benefits, like expediting the processing of their tax returns and speeding up potential refunds. The use of this signature authorization streamlines the e-filing procedure, ensuring it meets IRS requirements for secure and efficient data submission.

Who needs to file Form 8878?

Form 8878 must be filed by any taxpayer who wishes to authorize a tax return preparer to e-file their federal income tax returns. This is crucial for taxpayers who use the services of an Electronic Return Originator (ERO) to file their returns. Specifically, individuals and couples filing jointly, as well as certain businesses and trusts, may find themselves in situations that necessitate the completion of Form 8878. If a taxpayer is filing a tax return extension request or has a spouse as a joint filer, both should explore the requirements of this form.

Detailed instructions on completing IRS Form 8878

Completing Form 8878 requires specific information and a series of straightforward steps to ensure an accurate submission. The required information typically includes personal details such as the taxpayer's name, Social Security number (SSN), and the tax year in question. Additionally, the form requires the tax return preparer's EFIN and PIN numbers.

Required information

To complete Form 8878, gather the following:

Step-by-step filling process

Here’s how to fill out Form 8878 systematically:

Common mistakes to avoid when filling out Form 8878

Filing errors on Form 8878 can lead to delays in the e-filing process, causing unnecessary stress and complications. Some common mistakes include inaccuracies in personal identification details, such as mismatched names or incorrect SSNs, and failing to provide the EFIN or PIN for the tax preparer. It's also common for taxpayers to neglect to sign and date the form, making it invalid for submission.

To mitigate these issues, double-check all entries before submission and ensure that the information is consistent with prior tax documents. Taking these precautions can help ensure that your Form 8878 is processed without delay.

Requirements for tax return preparers

Tax return preparers must meet specific qualifications when submitting Form 8878 on behalf of their clients. Essential requirements include being registered as an ERO with the IRS, possessing a valid EFIN, and obtaining a unique PIN for electronic filing. Professional tax preparers should also adhere to best practices, including maintaining up-to-date knowledge about tax law changes and delivering accurate, timely submissions for their clients’ tax returns.

Additionally, tax professionals must ensure compliance by verifying all information provided by the taxpayer to prevent complications during the filing process. This diligence protects both the preparer and the taxpayer from potential audits or discrepancies.

Tools and resources for managing IRS Form 8878

pdfFiller interactive tools

pdfFiller offers a robust platform for creating, managing, and filing IRS Form 8878 seamlessly. Users can take advantage of interactive tools that enable easy form completion and submission, ensuring that all information is accurately captured and authorized.

Editing and signing features

With pdfFiller, users can efficiently edit, sign, and share Form 8878 digitally. This ability to modify forms directly in the platform not only saves time but also minimizes the risk of errors. Users can electronically sign their forms, ensuring they fulfill all IRS requirements for e-filing while enjoying the convenience of remote document management.

Frequently asked questions about IRS Form 8878

Several common questions arise concerning IRS Form 8878, particularly about filing deadlines and the use of electronic signatures. Taxpayers often ask about the timeline to submit the form after their tax preparer has prepared their return, as well as what to do in case the form is completed incorrectly.

Understanding these issues is crucial for a smooth filing experience. Taxpayers should note that Form 8878 must be submitted with their e-filed return and electronic signatures are permissible as long as the preparer follows the IRS guidelines.

Related tax forms and articles

IRS Form 8944 instructions

IRS Form 8944, known as the "Preparer e-file Hardship Waiver Request," is an essential form related to Form 8878. While Form 8878 is utilized for e-filing authorization, Form 8944 is for those preparers who may face hardship in e-filing their clients’ returns. Understanding both forms can help taxpayers ensure they follow the correct procedures.

IRS Form 9325 instructions

IRS Form 9325 serves as a confirmation of e-filed tax returns, providing critical information about the submission status. This form complements Form 8878, as it confirms that the return has indeed been filed electronically. Taxpayers should familiarize themselves with the requirements for both forms to avoid confusion during the e-filing process.

Video walkthrough of IRS Form 8878 completion

For those who prefer visual aids in understanding the completion of IRS Form 8878, there are numerous instructional videos available online. These videos provide step-by-step guides that help users navigate the form more efficiently, showcasing practical tips for accurately filling out the form and ensuring its successful submission.

Where to find IRS Form 8878

IRS Form 8878 can be easily accessed through the official IRS website or other reliable tax resource platforms. For added convenience, pdfFiller users can utilize the platform to access, fill out, and submit Form 8878 directly. This comprehensive approach guarantees that all necessary guidelines are followed while enhancing user experience with cloud-based features.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my about form 8878 irs directly from Gmail?

Can I create an electronic signature for signing my about form 8878 irs in Gmail?

How can I fill out about form 8878 irs on an iOS device?

What is about form 8878 irs?

Who is required to file about form 8878 irs?

How to fill out about form 8878 irs?

What is the purpose of about form 8878 irs?

What information must be reported on about form 8878 irs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.