Get the free Form 5471 Guide: U.S. Shareholders of Foreign Corporations

Get, Create, Make and Sign form 5471 guide us

How to edit form 5471 guide us online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5471 guide us

How to fill out form 5471 guide us

Who needs form 5471 guide us?

Form 5471 Guide - US Form

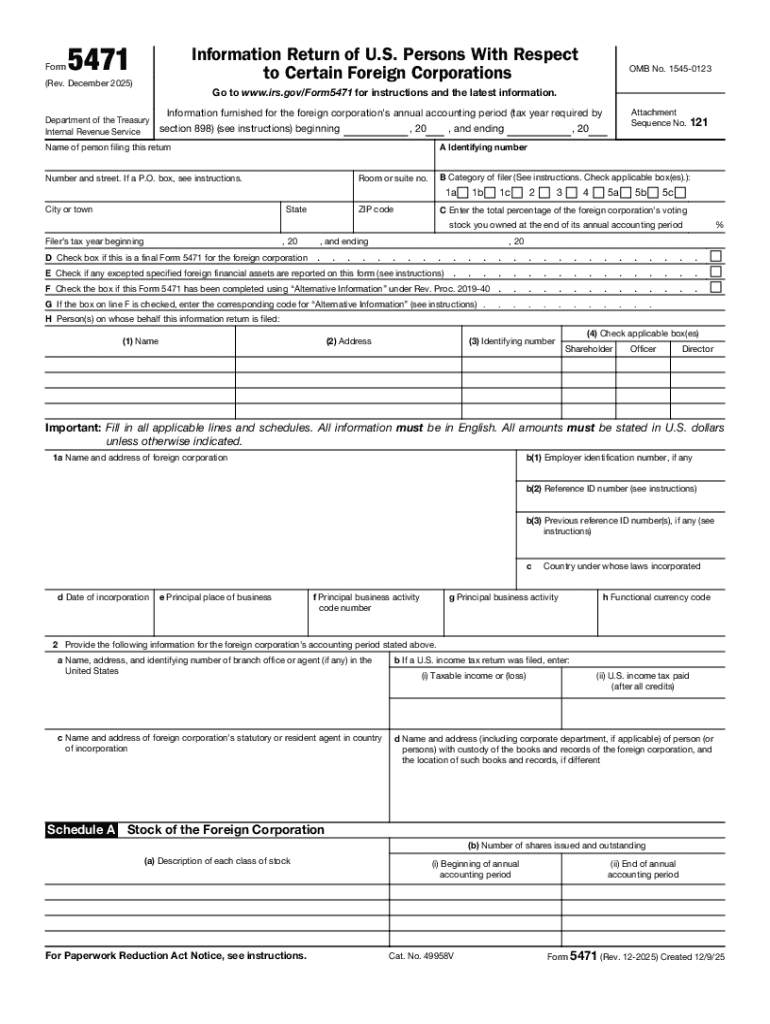

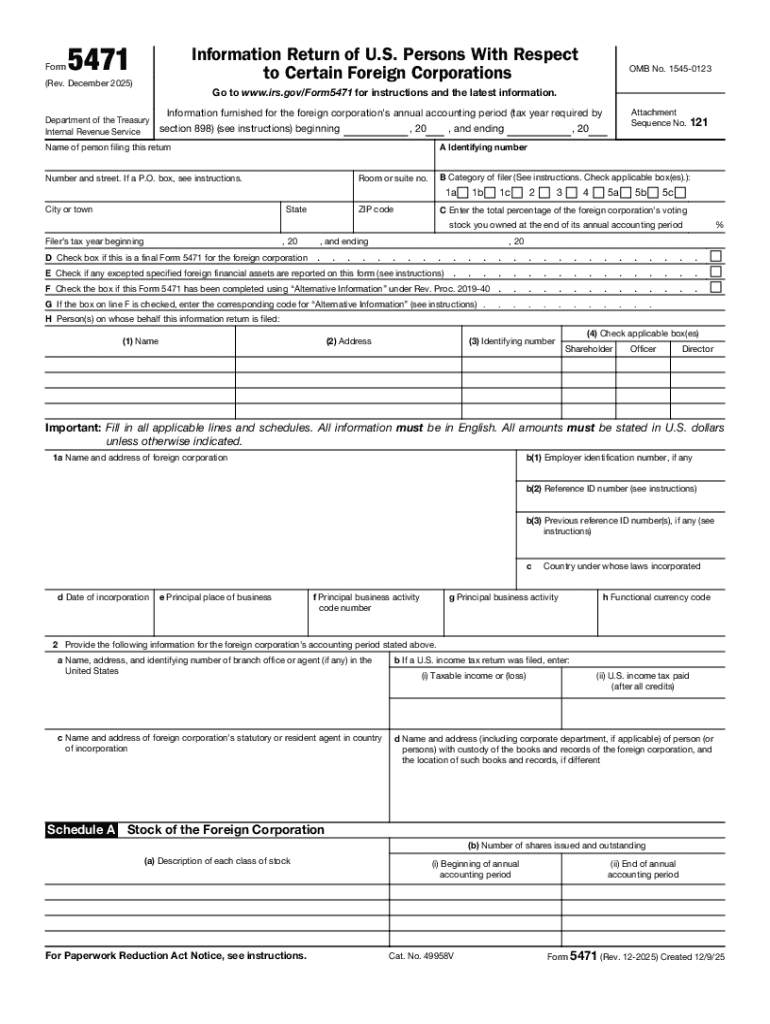

Understanding Form 5471

Form 5471 is a crucial document for U.S. citizens and residents who are involved with certain foreign corporations. This form is primarily used to report information about these foreign corporations to the Internal Revenue Service (IRS). It plays a vital role in ensuring compliance with U.S. tax laws, particularly for those who may otherwise underreport their foreign income. The importance of Form 5471 stems not just from its mandatory nature, but also from its implications for tax liability and compliance.

A clear understanding of the terms related to Form 5471, such as 'controlled foreign corporation' (CFC) or 'U.S. person,' is necessary for proper compliance. Also, taxpayers must be aware of the penalties for failing to file or for incorrect information submission. Awareness of these definitions and terminology contributes to accurate reporting and helps in navigating the complexities of U.S. tax regulations.

Who is required to file Form 5471?

Filing obligations for Form 5471 are mainly placed on U.S. persons who have certain ownership interests in foreign corporations. This obligation extends to U.S. citizens and residents, as well as entities like corporations and partnerships. Understanding your filing requirement hinges largely on your status and financial involvement with the foreign corporation.

There are specific categories of filers, delineated by the IRS, that determine who needs to file Form 5471. Those categories focus on U.S. persons who own shares in controlled foreign corporations (CFC). It’s critical to evaluate your situation against IRS guidelines to ensure compliance and avoid penalties.

Key components of Form 5471

The structure of Form 5471 includes multiple schedules, each designed to capture specific information about both the taxpayer and the foreign corporation. Understanding these schedules is crucial for accurate filing and compliance with U.S. tax regulations.

Each schedule serves a distinct purpose, detailing critical financial and operational information. For instance, Schedule A captures information about the foreign corporation itself, while Schedule B focuses on stock ownership information, reflecting how the U.S. person is involved with the CFC. The income statement and balance sheet provided in Schedules C and D, respectively, portray the corporation's financial health, which has direct implications for tax calculations.

Additionally, Subpart F income reported on Form 5471 has profound implications. It can affect the overall tax liability of U.S. shareholders, as this income is subject to U.S. taxation even if it is not distributed. By understanding the nuances of this income category, filers can better navigate their tax obligations.

Constructive ownership explained

Constructive ownership plays a critical role in determining whether U.S. persons must file Form 5471. This concept involves scenarios where individuals or entities may not directly own shares but are nonetheless deemed to possess an ownership interest due to relationships with other shareholders or certain family members.

Determining constructive ownership typically involves assessing relationships and indirect stakes in the corporation. For instance, if a U.S. person owns shares in a corporation, their family members might contribute to the total ownership that triggers filing obligations. Understanding how to calculate and assess constructive ownership is vital for compliance and avoiding penalties.

Special rules and considerations

Filers of Form 5471 should be aware of certain special rules that can impact their reporting, particularly concerning Subpart F income. One critical consideration is the de minimis rule, which allows for exclusion of some amounts from U.S. taxation under specific conditions.

The Subpart F de minimis rule comes into play when CFCs have minimal Subpart F income across a given tax year. Understanding these nuances is essential, as failing to grasp these provisions can lead to overstated tax liabilities or unnecessary reporting, adding to the complexity of tax data workflows.

Step-by-step instructions for filing Form 5471

Filing Form 5471 requires meticulous preparation and detailed documentation. The first step involves gathering all necessary documentation, including financial statements from the foreign corporation and records of U.S. ownership. This foundational groundwork contributes significantly to the accuracy and timeliness of your filing.

Next, complete the required schedules based on the information collected. Each section should be filled out based on the instructions provided, ensuring all data is accurate and complete. Common mistakes include omitting amounts or incorrectly categorizing income, which can result in penalties. Therefore, reviewing the filled form for accuracy before submission is crucial.

Filing and submission procedures

When it comes to filing Form 5471, knowing where and how to submit it is essential for compliance. The form must be filed with the U.S. tax return, typically attached to Form 1040, 1120, or the appropriate partnership tax return. Specific guidelines apply to electronic submissions, so understanding these can enhance efficiency and compliance.

Importantly, the deadlines for filing are strict, with penalties often imposed for late submissions. Knowing the due dates can prevent costly fines and ensure timely compliance with IRS regulations. Keeping a calendar of important filing dates will help maintain awareness throughout the year.

Managing your documentation

Effective document management is vital for professionals tasked with filing Form 5471. Properly organizing records and using efficient digital tools can streamline the process and facilitate easier access to necessary documentation. This is particularly important in cases where multiple team members or professionals are involved in the filing process.

Utilizing pdfFiller capabilities can significantly enhance document management efficiency. With pdfFiller, users can edit, sign, and collaborate on forms seamlessly, ensuring that all parties have access to up-to-date information. Implementing these practices leads to smoother tax data workflows, less risk of error, and ultimately better compliance.

FAQs about Form 5471

Navigating the complexities of Form 5471 often leads to numerous questions. Common inquiries include who specifically needs to file, what the potential penalties are for non-compliance, and how to interpret Subpart F income. Addressing these questions and understanding the details of Form 5471 is essential for U.S. persons who have dealings with foreign corporations.

Simple troubleshooting tips can also assist filers in resolving common issues, such as correcting filled forms or determining specific filing requirements. It’s important to seek out clear information and reliable guidance when needed to minimize confusion and comply with IRS regulations.

Leveraging pdfFiller’s features for Form 5471

pdfFiller offers a suite of interactive tools that simplify the completion of Form 5471. Users can utilize these features to enhance the filling experience, ensuring all necessary fields are completed accurately and efficiently. The platform's cloud-based nature allows for easy access from multiple devices, making it ideal for individuals or teams who need to edit documents on the go.

Beyond mere completion, pdfFiller’s eSign and collaboration capabilities significantly streamline workflows. Users can invite team members to review documents or make changes, enhancing communication and reducing the likelihood of errors. These tools empower users to manage their documentation effectively while working within a consistent and secure cloud environment.

Staying updated on tax regulations

Keeping informed about changes in tax law is essential for anyone dealing with Form 5471. The IRS regularly updates its regulations and guidelines, making continuous education vital for compliance. Both individuals and tax professionals need to stay updated to effectively navigate the complexities of foreign corporation taxation and filing requirements.

Numerous resources are available to aid in this education, including IRS updates, online seminars, and tax advisory newsletters. Consistently engaging with these materials will empower filers with the knowledge necessary to adapt efficiently to any changes that may impact their obligations regarding Form 5471.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 5471 guide us to be eSigned by others?

Can I sign the form 5471 guide us electronically in Chrome?

How do I complete form 5471 guide us on an Android device?

What is form 5471 guide us?

Who is required to file form 5471 guide us?

How to fill out form 5471 guide us?

What is the purpose of form 5471 guide us?

What information must be reported on form 5471 guide us?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.