Get the free Using Form 4684 to report casualty and theft losses

Get, Create, Make and Sign using form 4684 to

How to edit using form 4684 to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out using form 4684 to

How to fill out using form 4684 to

Who needs using form 4684 to?

How-to Guide for Using Form 4684: Comprehensive Insights and Instructions

Understanding IRS Form 4684: A deep dive

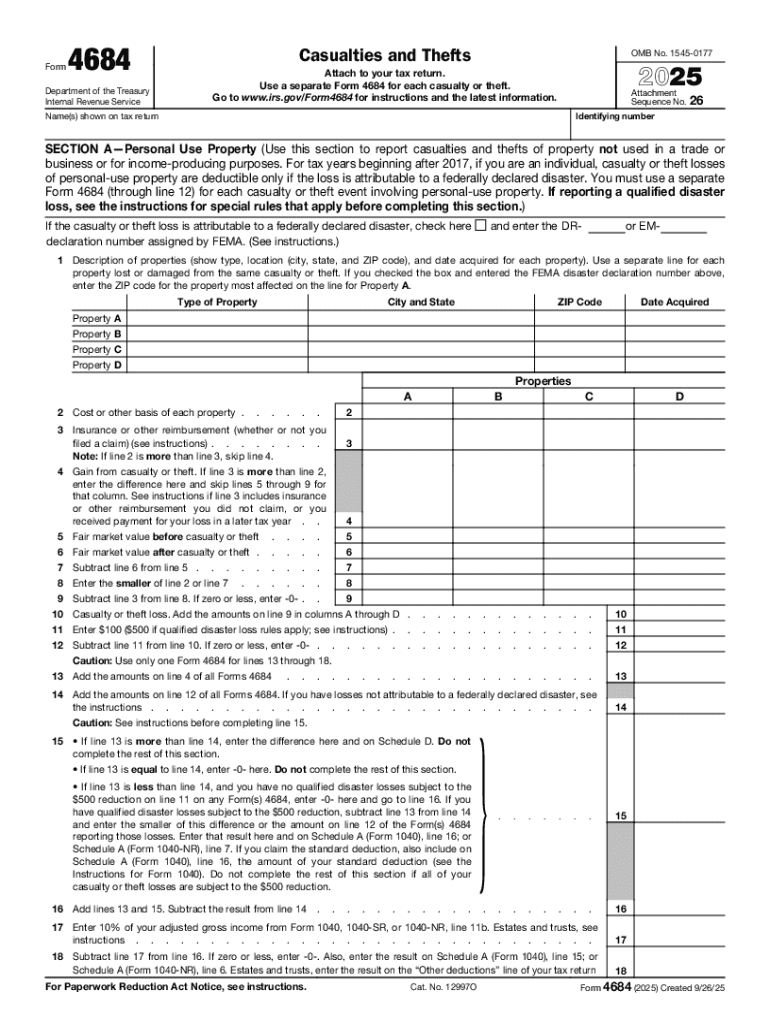

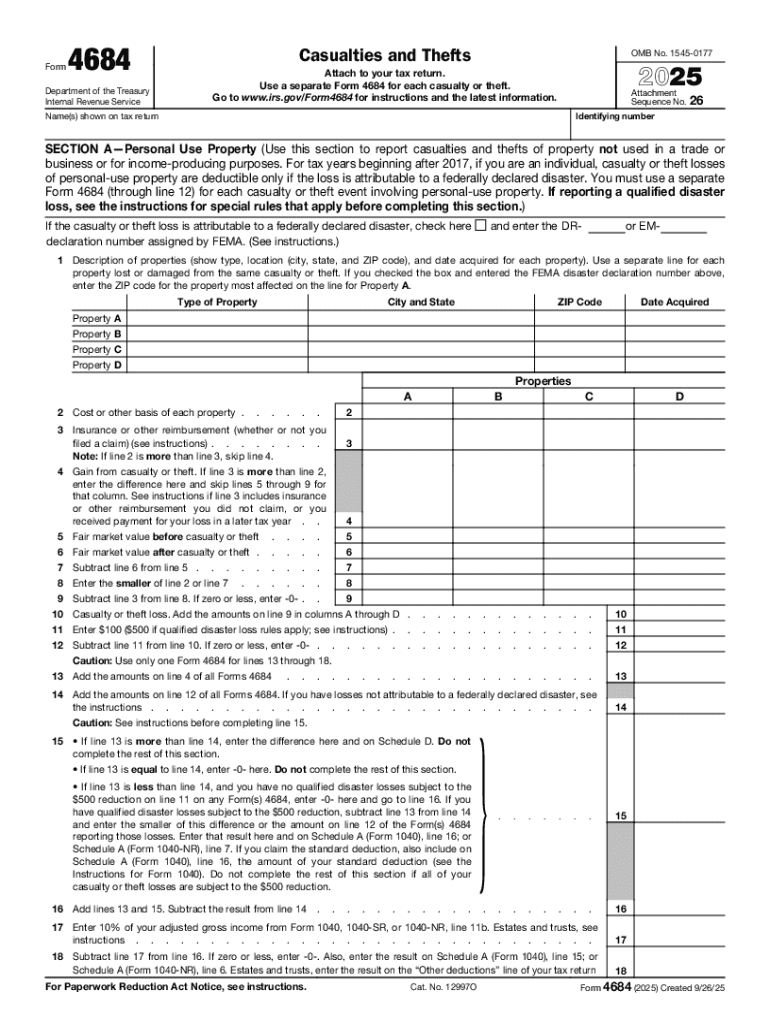

IRS Form 4684 is instrumental for taxpayers who experience casualty or theft losses. This form allows individuals and businesses to report losses incurred due to unforeseen disasters such as storms, fires, or vandalism, enabling them to claim tax deductions that may alleviate their financial burden.

The primary purpose of Form 4684 is to formalize claims for losses which can significantly impact taxable income. Taxpayers who report legitimate losses can deduct specific amounts from their gross income, reducing their overall tax liability. This form, therefore, serves as both a reporting mechanism and a pathway to financial recovery for those affected by property damage or theft.

Who needs to use Form 4684?

Understanding the criteria for using Form 4684 is crucial. Both individuals and businesses may need to file this form if they’ve encountered qualifying losses resulting from disasters. This includes homeowners, renters, and business owners who have suffered damage to personal or real property.

Common scenarios requiring this form include extensive property damage due to natural disasters such as hurricanes or earthquakes, theft of valuable items, or any instance where losses exceed a minimal threshold set by the IRS. Taxpayers should be vigilant about documenting any such incidents to substantiate their claims.

Key tax implications of filing Form 4684

Filing Form 4684 can have significant implications on your tax return. When properly executed, it allows taxpayers to claim deductions for their property losses. Eligible deductions may include the cost of replacements, repairs necessary to restore the property, or even losses from theft of business inventory.

It is essential to recognize that while claiming losses can lead to immediate tax benefits, they may also affect your future tax obligations. For example, if a deduction was claimed for a casualty loss, it may be subject to scrutiny in future audits, especially if losses continue or recur in subsequent years.

Essential documents needed before filing

Before initiating the filing process for Form 4684, it’s critical to gather all required documents. Key documentation includes insurance statements, recording loss valuation, and before-and-after photos of the damaged property, which provide concrete evidence of the losses incurred.

Organizing financial records and supporting evidence streams the process of accurately reflecting losses. Ensure that everything is clear and detailed — including police reports in cases of theft, and repair estimates for damaged property — to substantiate your claims and prevent delays.

Filing deadlines for Form 4684

Being cognizant of filing deadlines for Form 4684 is essential for adherence to IRS regulations. Generally, taxpayers must report casualty and theft losses on their tax return for the year in which the loss occurred, using Form 4684 within that same timeframe. Late submissions can lead to denial of deduction claims and additional penalties.

However, taxpayers may seek extensions under certain conditions. For example, victims of federally declared disasters may have additional time to file. Keeping track of these dates is crucial to uphold your eligibility for deductions and avoid unnecessary complications.

How to fill out IRS Form 4684: detailed instructions

Filling out IRS Form 4684 requires attention to detail and understanding of its structure. The form is organized into sections that guide the taxpayer through the information required accurately. Begin by gathering personal information before moving on to reporting losses in the relevant sections — casualty loss or theft loss.

Each section must be filled out meticulously. For instance, in the casualty loss section, detail specific events, including descriptions of damage, types of losses suffered, and values lost. Follow this by calculating net losses according to IRS guidelines.

Common mistakes to avoid when completing Form 4684

Taxpayers often make errors in completing Form 4684 that can jeopardize deductible claims. Common mistakes include overlooking documentation, failing to account for all losses, or misunderstanding the rules governing what qualifies as deductible losses. Each entry must be double-checked against IRS guidelines to ensure accuracy.

Additionally, tools like pdfFiller can aid in minimizing filing mistakes by allowing users to edit and manage their documents more effectively. Checklists or templates can streamline the completion process. Utilizing these tools can enhance accuracy and reduce the chances of errors.

What happens after you file Form 4684?

Once Form 4684 is submitted, the IRS begins their review process, which may involve verifying the accuracy of the information provided. Taxpayers should be prepared for possible follow-up requests or inquiries as the IRS may require additional information to validate the claims made on their form.

It's also essential for taxpayers to track their filing status. Retaining copies of all submitted documents and correspondence with the IRS can help in resolving any potential issues or disputes should they arise post-filing.

Utilizing pdfFiller for managing your Form 4684 needs

pdfFiller provides an invaluable resource for managing Form 4684 needs. With its capabilities, users can harness unique features like PDF editing, eSigning, and real-time collaboration to ensure that their forms are accurately completed and submitted without unnecessary delays.

Additionally, pdfFiller’s interactive tools simplify the completion process, equipping users to fill out Form 4684 in a user-friendly environment. Whether working individually or as part of a team, pdfFiller enhances the workflow surrounding document management, promoting efficiency and accuracy.

FAQs about Form 4684 and filing processes

Taxpayers frequently have questions about Form 4684, from eligibility requirements to the specifics surrounding filing processes. One common inquiry is regarding what constitutes a qualified loss. It's essential to clarify that losses resulting from federally declared disasters or the theft of property are typically eligible for deductions when properly documented.

It's advisable for taxpayers to be informed of nuances surrounding the form. Consultation with a tax professional can provide tailored advice and assurance that the form is file correctly while maximizing potential deductions. Understanding the intricacies of thoughtful planning can yield significant benefits in filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my using form 4684 to in Gmail?

How do I execute using form 4684 to online?

How do I fill out using form 4684 to using my mobile device?

What is using form 4684 to?

Who is required to file using form 4684 to?

How to fill out using form 4684 to?

What is the purpose of using form 4684 to?

What information must be reported on using form 4684 to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.