Get the free 2025 Instructions for Schedules K-2 and K-3 (Form 8865)

Get, Create, Make and Sign 2025 instructions for schedules

Editing 2025 instructions for schedules online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 instructions for schedules

How to fill out 2025 instructions for schedules

Who needs 2025 instructions for schedules?

2025 Instructions for Schedules Form: Your Comprehensive Guide

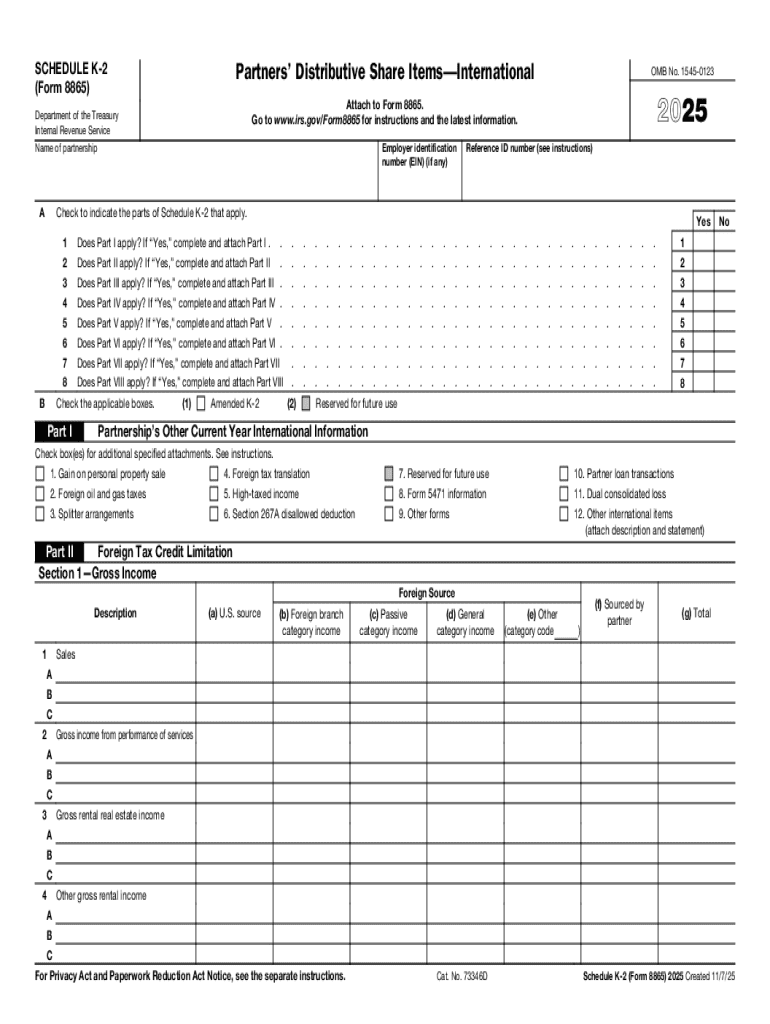

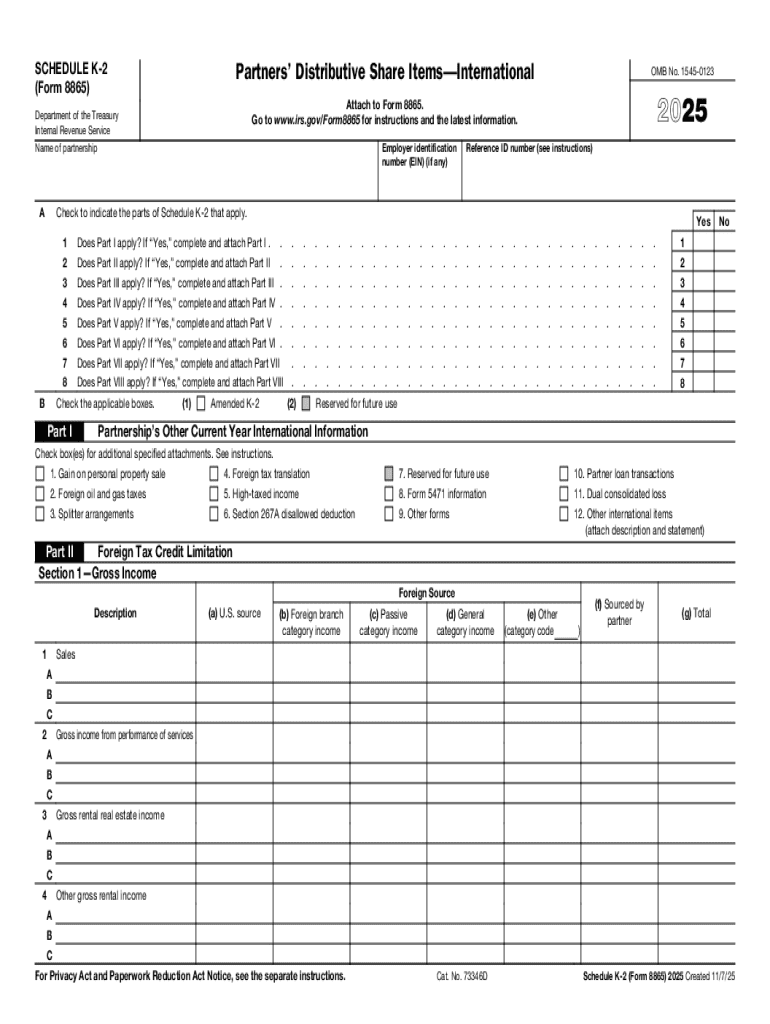

Overview of the 2025 schedules form

The 2025 schedules form is a crucial document for taxpayers that provides detailed reporting options for various types of income, deductions, and credits. Its primary purpose is to help individuals and businesses accurately report their tax obligations while maximizing potential benefits. Completing this form correctly ensures compliance with tax laws and helps avoid costly errors.

Accurate completion of the schedules form is essential, as incorrect information can lead to penalties or delayed refunds. For the 2025 tax year, several key changes may affect how you approach this task. These updates include modifications that streamline data entry and introduce new sections designed to capture evolving financial scenarios.

Understanding the structure of the schedules form

The structure of the 2025 schedules form is divided into clear sections that guide taxpayers through the process of reporting. Each section corresponds to different tax scenarios and provides specific lines for inputting data. Understanding the main components is vital for effective navigation.

Common terms and definitions used within the form help clarify responsibilities. Knowing what constitutes qualifying income or eligible deductions can significantly impact your tax report. Additionally, many online platforms like pdfFiller offer interactive tools that enhance navigation and allow users to fill out forms easily.

Step-by-step instructions for completing the 2025 schedules form

To efficiently complete the 2025 schedules form, it’s advisable to follow a step-by-step process. Begin by gathering all necessary information. This includes your income documents, receipts for deductions, and any relevant tax credits. Having everything at hand simplifies the process and minimizes the risk of errors.

Avoiding common mistakes is pivotal. Double-check entries to prevent misinformation, especially with numerical data. Consider utilizing pdfFiller’s comprehensive editing features to ensure syntax accuracy and, when working in teams, use its collaboration tools to gather input from various stakeholders.

Electronic signatures and submissions

In 2025, the importance of electronic signatures (eSigning) becomes even more pronounced. Electronic signatures offer a convenient, secure way to authenticate your documents. They save time by minimizing physical paperwork and simplify the submission process, ensuring that your submitted forms remain compliant with regulations.

The eSigning process in pdfFiller is straightforward and user-friendly. Users can easily follow the steps to create an electronic signature, ensuring that all necessary forms get submitted on time. This method holds the same legal weight as traditional signatures, provided they meet the necessary criteria.

Managing and storing your schedules form

Effective management and storage of your completed schedules form are essential for future reference and audits. Using pdfFiller's secure storage options, you can store your documents safely in the cloud, ensuring easy access and protection against data loss.

The benefits of cloud storage are significant. Not only does it allow access from anywhere at any time, but features like version control ensure that you can track changes and revert to previous versions if necessary. This is particularly useful for teams collaborating on complex tax preparations.

Troubleshooting common issues

While completing the 2025 schedules form, common issues may arise, impacting the accuracy and efficiency of your tax filing process. These can range from missing information to calculation errors that may pose significant challenges.

To mitigate these issues, utilize pdfFiller’s suite of support tools. If you experience difficulties, take advantage of their live chat feature or access the user community resources that provide helpful guides and troubleshooting tips.

Additional tips for maximizing pdfFiller’s capabilities

pdfFiller not only simplifies the 2025 instructions for schedules form process but also offers functionalities to prepare for future years. Leveraging templates can help streamline your form-filling tasks, especially as tax regulations evolve or new forms are introduced.

To stay ahead of changes in tax regulations, keep updated with pdfFiller’s integrated features with other document management tools, ensuring a seamless workflow and comprehensive tax preparation strategy.

Success stories and case studies

The value of the 2025 schedules form becomes clearer through success stories from individuals and teams who have effectively navigated their tax obligations. These examples illustrate how accurate reporting can lead to significant tax savings and reduced audits. Utilizing pdfFiller has empowered many users to enhance their document management practices and achieve greater financial clarity each tax season.

Testimonials highlight the ease of use, efficiency, and improved accuracy that come with using pdfFiller for document management, proving that robust tools can dramatically improve the tax filing experience.

FAQs on the 2025 schedules form

As you work through the process of completing the 2025 schedules form, several frequently asked questions may arise. Understanding common queries can expedite the process significantly and alleviate potential confusion. For instance, what specific documents are needed to begin? Or how can I make sure I’ve utilized all possible deductions?

pdfFiller’s help center is an excellent resource for navigating these questions, featuring a wealth of information to support users as they fill out their forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 2025 instructions for schedules without leaving Chrome?

Can I sign the 2025 instructions for schedules electronically in Chrome?

How do I fill out 2025 instructions for schedules using my mobile device?

What is 2025 instructions for schedules?

Who is required to file 2025 instructions for schedules?

How to fill out 2025 instructions for schedules?

What is the purpose of 2025 instructions for schedules?

What information must be reported on 2025 instructions for schedules?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.