Get the free Form 8865: A complete Guide for U.S. Persons with ...

Get, Create, Make and Sign form 8865 a complete

How to edit form 8865 a complete online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8865 a complete

How to fill out form 8865 a complete

Who needs form 8865 a complete?

How to Complete Form 8865: A Comprehensive Guide

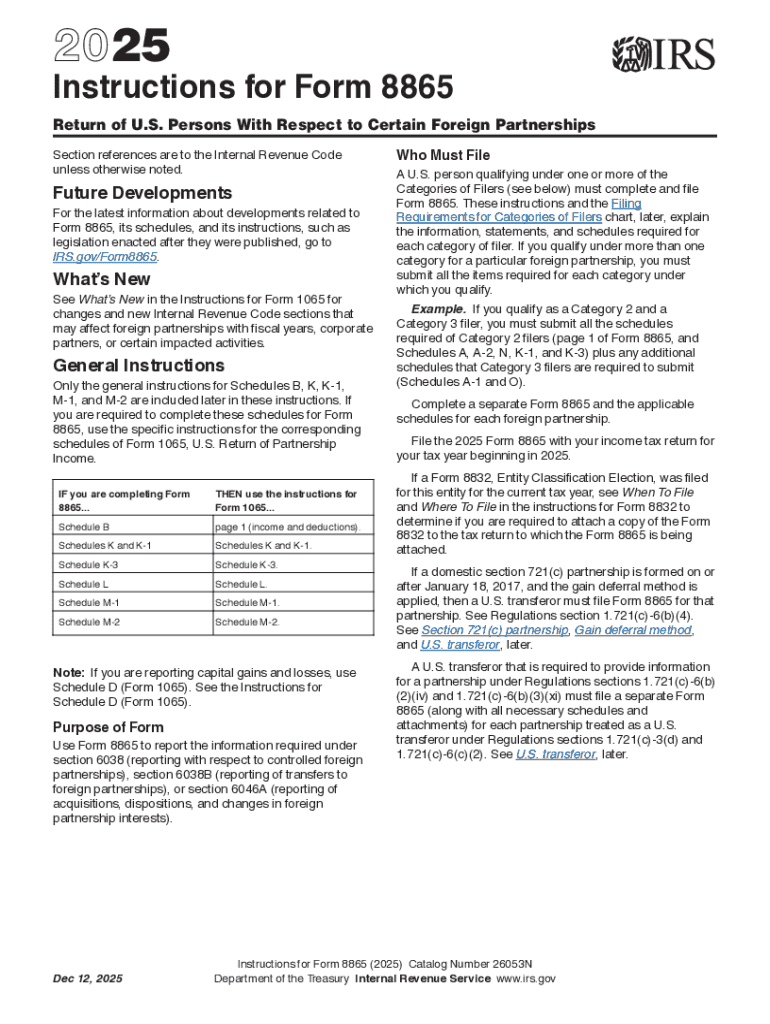

Understanding Form 8865

Form 8865 is a crucial document for U.S. taxpayers with interests in certain foreign partnerships. This tax form is essential for reporting a taxpayer's share of the partnership income, deductions, and credits to the IRS. Understanding Form 8865's purpose is vital not only for compliance but also for preventing potential penalties associated with underreporting.

Filing Form 8865 demonstrates a taxpayer's adherence to IRS mandates regarding foreign partnerships, a subject of increasing scrutiny. Its importance cannot be overstated, as failure to file Form 8865 correctly can lead to substantial financial repercussions. This guide aims to streamline the process of filling out Form 8865, ensuring clarity for individuals managing these complex tax regulations.

When is Form 8865 required?

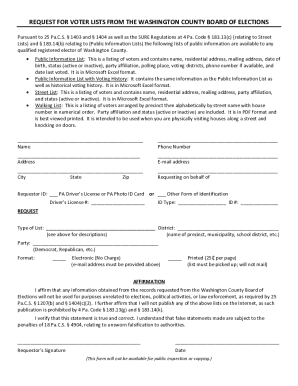

You are required to file Form 8865 in several scenarios. Primarily, if you are a U.S. person with a stake in a foreign partnership, the obligation arises. The IRS defines specific categories of filers based on ownership and transactions within these partnerships.

Categories of Form 8865 filers

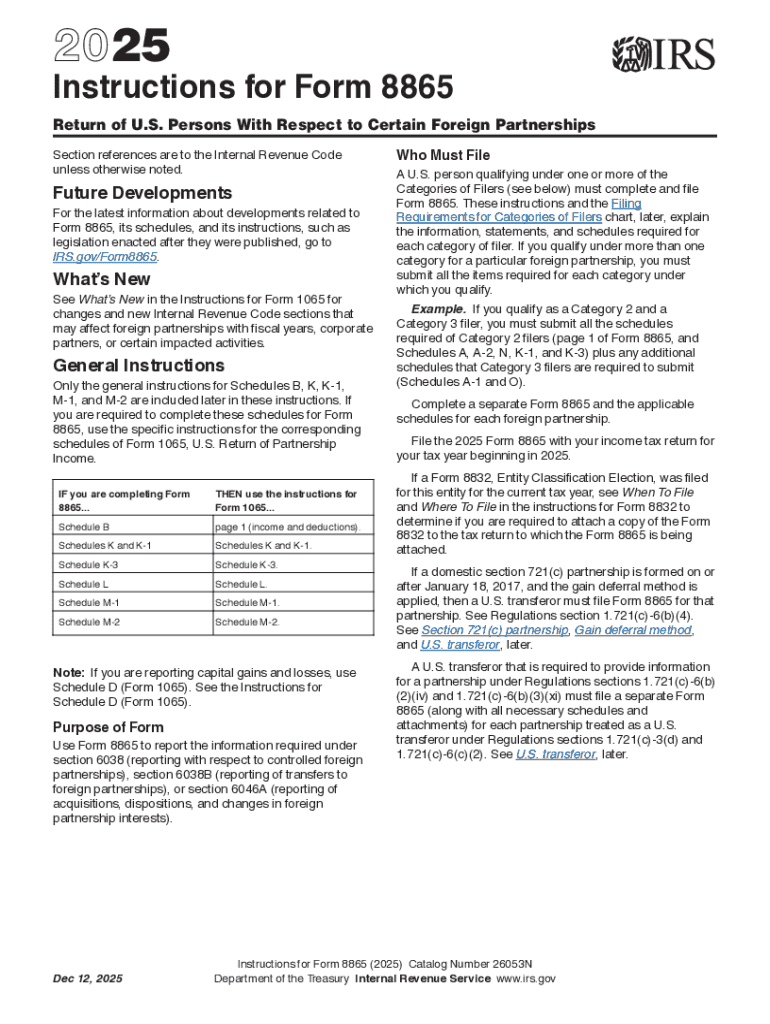

Form 8865 is divided into four distinct categories, each with its own requirements. Understanding these categories is essential for determining whether you must file and what information is needed. Below, we explore each category in detail.

Each category has unique criteria. For instance, those in Category 1 must show ownership percentages and reporting requirements, while Category 2 focuses on partners with actual control in the partnership. Clarifying which category you fall under is pivotal for compliance.

Filing requirements for Form 8865

Understanding who needs to file Form 8865 is paramount for compliance. Generally, anyone with a substantial financial stake in a foreign partnership must file this form. This obligation is not limited to individuals; partnerships that meet ownership criteria must also adhere to filing regulations.

Filing deadlines are critical to avoid penalties. Form 8865 typically aligns with the taxpayer's return, and it can be filed alongside the individual or partnership return. Missing deadlines can result in significant penalties, underscoring the need for meticulous attention to the filing timeline.

Detailed instructions for completing Form 8865

Filling out Form 8865 requires careful attention to detail. The form is broken down into several sections, each collecting important information that serves specific reporting needs. Here's a step-by-step guide through each part of the form.

Part : Identifying information

This section gathers identifying details about the taxpayer and the foreign partnership. Ensure that you provide accurate names, EINs, addresses, and ownership percentages. Documentation that corroborates this information, like partnership agreements, should be kept on hand.

Part : Information about the partner

In this section, report details about each partner's interest in the partnership. This section should present a correct and thorough account, highlighting individual contributions and ownership stakes. Use the correct partner identification format as per IRS guidelines to avoid complications.

Part : Information about the partnership

Provide an overview of the partnership, including its business activities and formation date. Clear descriptions and accurate reporting here are critical, as they represent the partnership's business structure and compliance stance.

Part : Schedule K-1 information

Schedule K-1 provides essential information about each partner's share of the partnership. Make sure to report allocations appropriately to ensure everything aligns with the IRS expectations. A well-prepared Schedule K-1 can simplify the reporting process significantly.

Common mistakes can hinder the filing process. Typical errors include misinformation about partner stakes, neglected supporting information, and submitting data in an incorrect format. Vigilance during preparation can avoid these pitfalls.

Tools and resources for Form 8865

Utilizing the right tools can vastly improve your experience when completing Form 8865. pdfFiller simplifies editing and signing processes, integrating seamlessly with the form format, allowing for intuitive adjustments and real-time collaboration among users.

Interactive features provided by pdfFiller also support document management, ensuring that all necessary information is easily accessible and editable. It’s designed to contribute significantly to user efficiency, allowing for timely compliance and improved documentation practices.

Additional resources

The IRS provides extensive guidelines dedicated to Form 8865, detailing its instructions and filing requirements. Use these official resources as a reference point for definitions and clarifications on completing the form accurately.

Consider exploring other useful tools or services that assist in document management and provide enhanced features for filing compliance. Leveraging technology not only saves time but can greatly reduce the likelihood of errors.

Insights into tax compliance and resolution

Accurate reporting on Form 8865 is vital for maintaining compliance with tax regulations. Mishandling this form can lead to penalties that may include hefty fines or increased scrutiny from the IRS. Failure to report foreign partnerships correctly can trigger audits and even legal implications.

To ensure compliance, maintain systematic records of Partnership agreements, transactions, and partner contributions. This detailed record-keeping supports diligent reporting and smooth audits should they occur.

Key takeaways for maintaining compliance

To avoid unforeseen penalties associated with Form 8865, adhere to best practices: Always file on time, ensure accuracy in reporting, and check for thorough documentation. Educate yourself on the evolving tax laws relevant to foreign partnerships, as this knowledge aids compliance.

FAQ section about Form 8865

Questions frequently arise regarding Form 8865. Let's explore some common queries and expert replies that address key concerns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 8865 a complete without leaving Google Drive?

How do I edit form 8865 a complete on an iOS device?

Can I edit form 8865 a complete on an Android device?

What is form 8865 a complete?

Who is required to file form 8865 a complete?

How to fill out form 8865 a complete?

What is the purpose of form 8865 a complete?

What information must be reported on form 8865 a complete?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.