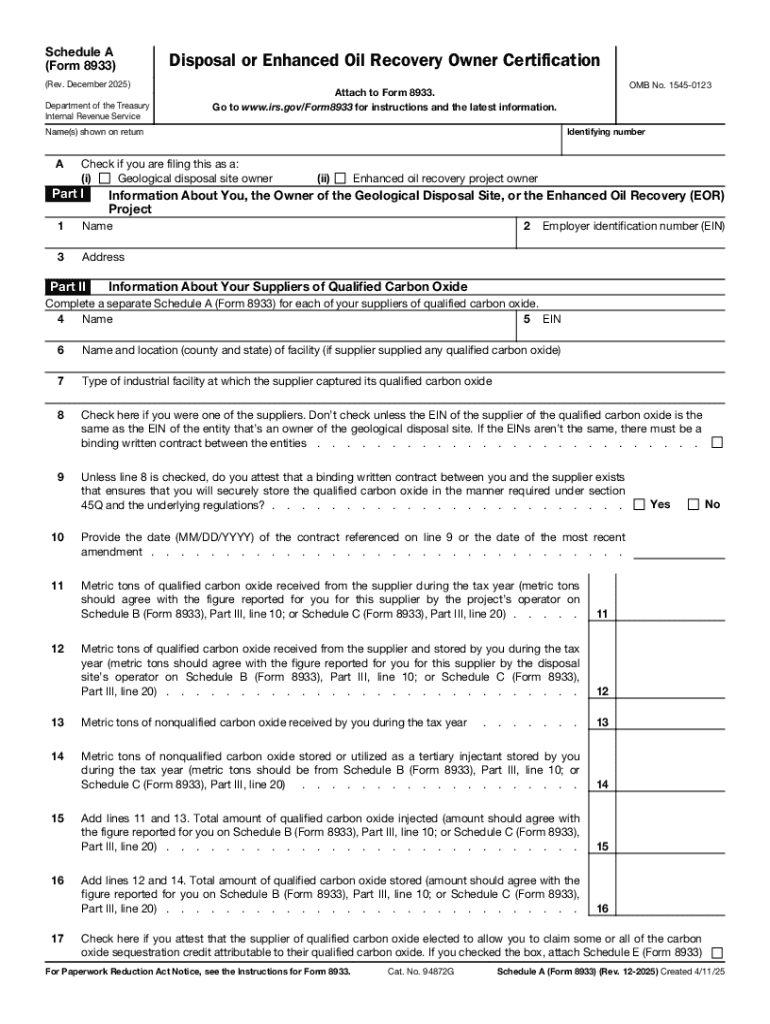

Get the free Form 8933 (Schedule A)

Get, Create, Make and Sign form 8933 schedule a

Editing form 8933 schedule a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8933 schedule a

How to fill out form 8933 schedule a

Who needs form 8933 schedule a?

A comprehensive guide to form 8933: Schedule A

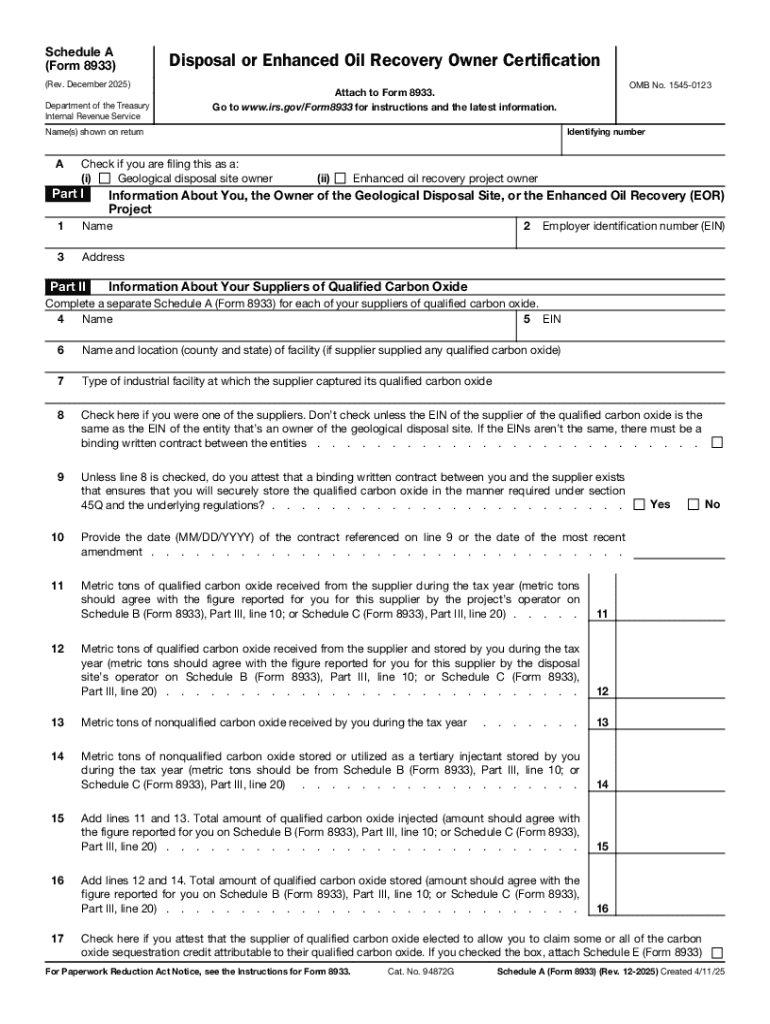

Understanding Form 8933: Schedule A overview

Form 8933: Schedule A is a crucial document for businesses and entities seeking to claim tax credits under Section 45Q of the Internal Revenue Code. This form is specifically designed for taxpayers who capture and store carbon oxides. By submitting Schedule A, these entities can potentially reduce their tax liability significantly. The importance of this form lies in its direct connection to the federal government’s initiative to encourage carbon capture and storage, which is a vital strategy in combating climate change.

Importance of Schedule A in the 45Q tax credit process

Understanding the Section 45Q tax credit is critical for any organization involved in carbon capture and storage. This tax incentive aims to spur investment in technologies that prevent carbon emissions from entering the atmosphere. For entities completing Form 8933: Schedule A, claiming these credits offers significant financial benefits. Not only can they offset substantial tax burdens, but they can also support compliance with environmental regulations.

Step-by-step instructions for completing form 8933: Schedule A

Before diving into the form, gather all necessary information. Identifying your taxpayer information, including your Employer Identification Number (EIN), is a fundamental first step. It's equally important to compile details related to the carbon capture technology you've implemented, which is essential for the completion of Schedule A.

When you start filling out Form 8933: Schedule A, pay careful attention to each section. Section A asks for information about the qualifying entities involved in the carbon capture project. Section B requires you to indicate the method of credit calculation, ensuring your calculations adhere to IRS guidelines. Finally, Section C focuses on reporting compliance obligations, detailing what is required for each type of taxpayer.

Tools and resources for managing your Schedule A submission

Utilizing interactive tools can streamline your experience with Form 8933: Schedule A. Platforms like pdfFiller offer built-in editing tools, allowing easy modifications to the form as required. Crucially, eSignature capabilities mean you can rapidly process submissions without the traditional delays associated with paper forms.

Cloud-based solutions for document management, such as those offered by pdfFiller, allow you to access documents from anywhere. This is particularly beneficial for teams who collaborate on tax submissions, as they can work together seamlessly, regardless of location.

Frequently asked questions (FAQs) about Form 8933: Schedule A

Missing the filing deadline for Form 8933 can lead to significant penalties, so it’s critical to stay aware of deadlines. If you need to amend a submitted Schedule A, the process involves filling out a new form and marking it as an amended return, which helps clarify your intentions to the IRS.

For disputes or inquiries regarding your filing, direct communication with the IRS is essential. Prepare supporting documents to substantiate your claims or any discrepancies they bring to your attention. Should your entity's eligibility change during the year—for instance, if you expand operations or alter your carbon capture methods—you must adjust your claim for any subsequent submissions.

Tips for maximizing your 45Q tax credits through efficient use of Schedule A

Accurate reporting is essential when submitting Form 8933: Schedule A. Consider all available deductions and ensure all calculations align with IRS expectations. Understanding the intricacies of the tax credit forms is vital for maximizing potential benefits. Staying informed about changes to tax regulations can also help you leverage new opportunities, ensuring your filings reflect the current legal landscape.

Best practices for document retention include organizing filing records meticulously, as this facilitates a smoother IRS review process. Maintain clarity in your inventory of supporting documents related to carbon storage pathways and compliance to bolster your claims and significantly improve your audit readiness.

Case studies: Successful utilization of Form 8933: Schedule A

Examining case studies from various organizations provides insight into the effective utilization of Form 8933: Schedule A. For instance, a small energy firm reduced its tax liability significantly by strategically claiming credits associated with its carbon capture technology. These real-life examples not only highlight the financial benefits of successful submissions but also emphasize the critical steps taken during the process.

Organizations that optimize their use of Schedule A often share similar attributes—capable teams that actively engage with regulatory changes, maintain thorough documentation, and seek ongoing professional advice. The lessons learned from these case studies underline the importance of diligence and precise reporting in maximizing tax advantages.

Final thoughts on using Form 8933: Schedule A for your tax needs

Accurate and diligent filing of Form 8933: Schedule A cannot be overstated. Engaging with tools from pdfFiller can enhance your experience, enabling effective document management and collaboration. As regulations evolve and the importance of carbon capture grows, being prepared and informed will equip you to optimize your financial positioning significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8933 schedule a to be eSigned by others?

How do I complete form 8933 schedule a online?

How do I make changes in form 8933 schedule a?

What is form 8933 schedule a?

Who is required to file form 8933 schedule a?

How to fill out form 8933 schedule a?

What is the purpose of form 8933 schedule a?

What information must be reported on form 8933 schedule a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.